Badger Meter (NYSE:BMI) manufactures flow measurement and communication solutions worldwide. BMI recently announced solid Q3 FY23 results, and I will analyze the results in this report. Its price action is quite bearish, indicating a correction in the coming times, and I think the market has rewarded the company for its solid growth over the years. So, I don’t see any undervalued opportunity here. Hence, I assign a hold rating on BMI.

Financial Analysis

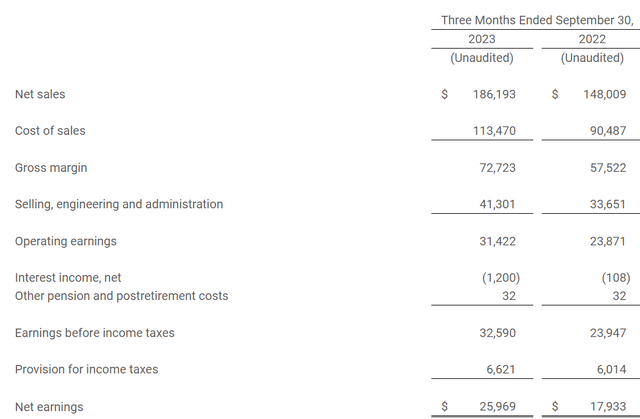

BMI recently announced Q3 FY23 results. The net sales for Q3 FY23 were $186.1 million, a significant rise of 25.8% compared to Q3 FY22. The increase was mainly due to a 31% rise in utility water product sales. In addition, higher demand for its flow instrumentation and pressure monitoring products contributed to its sales growth. The gross margin for Q3 FY23 was 39%, which was 38.8% in Q3 FY22. A structural positive revenue mix trend was the major reason behind the margin expansion.

BMI’s Investor Relations

The net earnings for Q3 FY23 were $25.9 million, a significant rise of 44.8% compared to Q3 FY22; apart from the increased sales, its net earnings also benefitted from the interest income the company earned from the increased cash. Another reason that helped them achieve solid results was the improvement in the supply chain, which helped them fulfill their customers’ strong demand. Looking at the balance sheet, its CFO increased by 32.1% in Q3 FY23 compared to Q3 FY22, and even after higher expenditures and dividend payments in this quarter, its cash rose to $21.1 million, which was $14.5 million in Q3 FY22. The liquidity and cash position of the company look strong. So not only its financials but its balance sheet also looks strong.

Technical Analysis

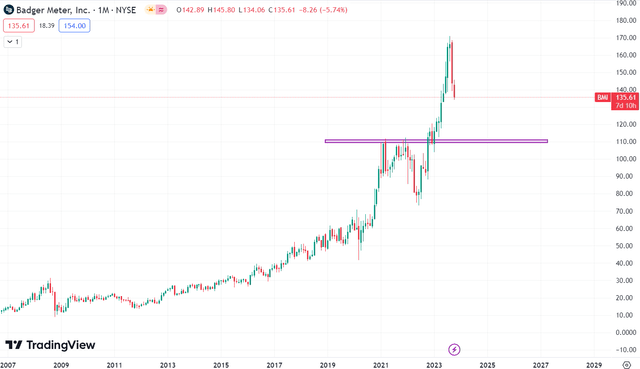

Trading View

BMI is trading at $136.9. Since June 2022, the stock price has increased by over 80%. The stock has given a solid run in the last 12 months, and not only the recent price action but historically, this stock has been very stable and rewarding. But looking at the recent price action, would I invest or suggest anyone to invest? The answer is a big no, and the reason for this is that the stock has created an evening star pattern, which is a bearish pattern. An evening star pattern suggests that the uptrend might end, and the stock might go into a downtrend. I believe the possibility of the reversal is quite high because the stock has made an evening star pattern at the very top, which is not a good sign. In addition, if we look at the price action from January 2023, we can see that the stock momentum is 90 degrees, which means that the stock has moved up without any correction, which I believe is not a good sign. Because whenever a stock moves up without a correction or consolidation, the ability of the stock to hold the upward momentum becomes weak. Hence, I am bearish on BMI because the price action is not looking good. Talking about buying opportunities, I think the $110 level will be a good buying level because it is a strong support zone for the stock, and looking at the price action, I believe it might reach $110 in the coming times. So, one can enter it once it reaches the $110 level.

Should One Invest In BMI?

First, look at BMI’s valuation. BMI has a P/E [FWD] ratio of 43.39x compared to the sector median of 24.19x. This might show that BMI is quite overvalued, but I don’t think so because of the solid growth the company has been showing over the last couple of years. Their revenue has grown from $425.5 million in FY20 to $565.5 million in FY22, and the estimated revenue of FY23 will be quite higher than FY22 revenue. So, the growth that they have shown has been impressive, and high-growth companies generally trade at a higher valuation. So, looking at the historical average might be a better option if we want to analyze its valuation. Its five-year average P/E [FWD] ratio is 44.69x, and it is trading around 43.39x. So, it is still trading below its historical averages.

But even after posting solid quarterly results, I don’t think it is a buying opportunity. Because I think the company is fairly rewarded by the market for its solid growth. The company is trading at higher valuations, and its stock price has risen well in the last 12 months. Since the market has already rewarded it, I don’t see any undervalued opportunities here. In addition, its price action is alarming because it is quite bearish and is indicating a correction in the coming times. So, considering all the aspects, I assign a hold rating on BMI.

Risk

They may be negatively impacted by the state of the global economy, an increase in interest rates, delays in government programs designed to boost the economy, and the impact of government budget cuts or partial shutdowns of governmental operations that affect their customers, which include independent distributors, large city utilities, public and private water companies, and numerous smaller water utilities. They are a supplier of products and software, most of which are to water utilities. These clients might put off capital projects, such as non-essential maintenance and upgrades, or they might not be able to approve and finance acquisitions in the event of a recession, unstable global markets, or an environment with increased borrowing rates. They also offer goods for other uses to lessen their reliance on the municipal water market. A large decline in this market could negatively impact sales and operating results. Therefore, a decline in the demand for their goods and services could negatively impact their business, operational results, and overall financial performance. Other potential risks include a downturn in the overall state of the economy, the municipal water market, rising interest rates, delays in the timing or amount of potential annual federal funding, government budget cuts or partial shutdowns of governmental operations, and the availability of funds to municipalities.

Bottom Line

BMI has shown solid growth, and it is continuing its growth. They posted solid quarterly results, and their balance sheet looks strong. But despite all these positive factors, I don’t think it is a good buying opportunity because I believe the company has already been awarded by the market with a high valuation. In addition, its price action is quite bearish, indicating a correction in the coming times. So, considering all these, I assign a hold rating on BMI.

Read the full article here

Leave a Reply