It’s been just over two months since I announced to the world that I was taking profits in Games Workshop Group PLC (OTCPK:GMWKF) in an article with the monumentally original title “Taking Profits in Games Workshop.” Since selling my shares, they’ve fallen about 20% against a loss of about 8% for the S&P 500 since. Although the company hasn’t yet reported financials again, I thought I’d review the name once more because, by definition, an investment trading at $118.50 is a less risky prospect than the same investment when it’s trading at $150.55. So, it’s time so decide whether or not it makes sense to buy back into this business. I’ll make that determination by looking at the current valuation, and comparing that to when I bought in September of last year. I’ll also make a comparison to the risk-free rate to see if investors are actually receiving positive compensation for investing in this equity. Before all of that, though, it’s time to demonstrate my immaturity once again by indulging in one of my favorite pastimes: self-congratulation.

Welcome to the “thesis statement” portion of the article, where I give you the gist of my thinking without exposing you to the elements that might induce excessive eye rolling, like the bragging I’m about to get up to. Although the shares are only about 7.5% cheaper than they were when I sold, the dividend yield has spiked nicely higher, and the risk premia has moved from a negative 110 basis points to a positive 30 basis points. That’s significant in my view, especially given what’s happened to the 10-Year Note since I last reviewed this name. Additionally, my local Dungeons & Dragons store also hosts Warhammer tables, and I’ve gotten to know some of these players over the past while. These people are very, very passionate about the hobby and have convinced me that there’s another growth spurt coming, especially from Japan. For that reason, I’m going to buy some of these shares back. The valuation isn’t as compelling as it was, and I hope the stock drops further from here, but I want to participate in any upside that we see from current levels. Finally, my bragging is not just a thinly disguised way for me to feed my very fragile ego, although that’s a huge positive, obviously. I want to remind investors that we should never simply buy and forget an investment. In my view, our results will be much better on a risk adjusted basis if we buy when the shares are cheap, and sell when they’re too dear.

Why I’m Skeptical of Passivity

I’ve always been of the view that the same investment can be “good” or “bad” depending upon the price paid for it. If you can acquire the future cash flows of a given business at a sufficient discount, it makes sense to buy. If the shares become too dear, the probability is high that they’ll fall in price, so in that circumstance it makes sense to sell, or at least eschew the shares. A corollary of this view is that to conclude that an investment is “good” or “bad”, and continue to hold that view regardless of what happens to price, will produce suboptimal results. I feel inclined to use Games Workshop to demonstrate the idea that it’s better to keep your eye on valuations, so I’m going to use Games Workshop to demonstrate the idea that it’s better to keep your eye on valuations.

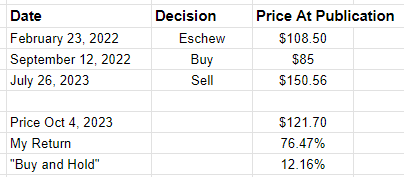

I’ve written three articles on Games Workshop, and the results of my efforts are outlined in the following table for your enjoyment and edification.

My Games Workshop Trade History (Author Calculations)

By avoiding the two drawdowns in price, and by purchasing when the market overreacted to the downside, I managed to do very well on this stock over time. In my view, the lesson from this specific instance can be generalized: never fall in proverbial (or literal!) love with an investment. Keep track of valuations, and when the market gets excessive, let it go. This need to keep ongoing track of investments is one of the reasons why a site like this one is so valuable to the retail investor.

Valuations

I’ve written it before, and I’m sure I’ll write it again. We don’t buy “companies.” We buy “stocks.” Stocks are a claim on the future cash flows of a given business, and so you’d expect that they would move up and down in line with the fortunes of the business for which they’re a supposed proxy. The problem is that they don’t. The company has done quite well, as was pointed out eloquently here, but the shares are down about 10% since this was published. The problem for the stock investor is that results are driven by a host of other variables than what’s going on with the stock. The stock may be impacted by the pronouncements of a central banker, what the market thinks a central banker might say, the price of oil, and a host of other variables too numerous to count. Given that, I think investors need to be mindful of the risk of stock investing, and the way that they can minimize their risk is by only buying when valuations make sense.

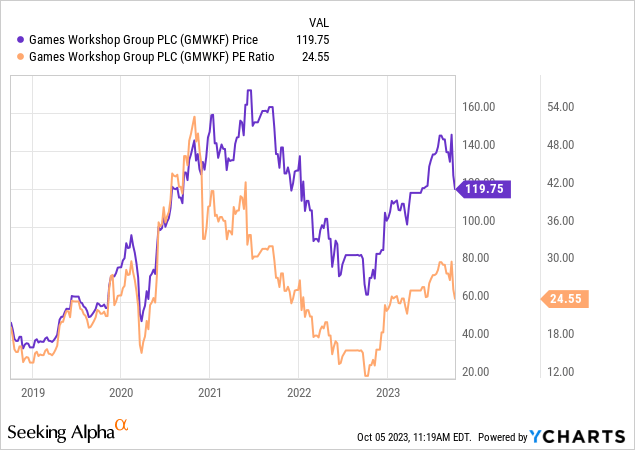

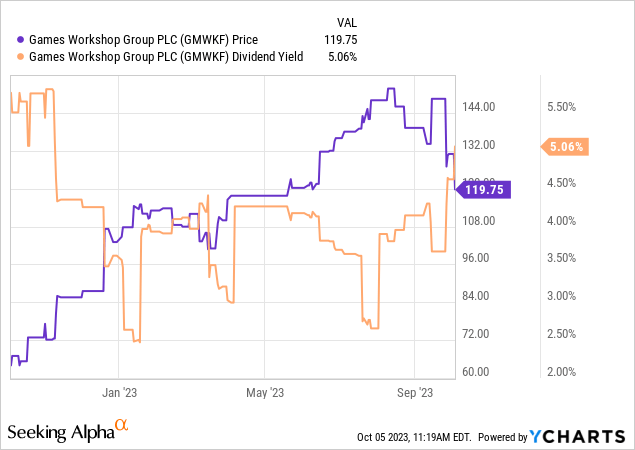

Writing of valuations, it’s time to see whether or not it makes sense to buy my shares back. In case you don’t have your “almanac of Doyle’s trades” in front of you, I’ll remind you that I bought these shares when they hit a PE of about 16.4 times. Also, at the time I became bullish, the dividend yield was about 4.3%, while the 10-year risk-free rate was only about 3.3%.

I then sold them when the PE hit 26.4 times, and the dividend yield had fallen to 2.77%. I think it’s important to note that at the time I sold the shares, the dividend yield was about 110 basis points lower than the 10-Year Treasury Bond.

At the moment, the shares are about 7.5% cheaper on a PE basis per the following, but the dividend yield has jumped to over 5%. This means that the current risk premium is about 30 basis points positive again.

I like the fact that people who buy at current prices are actually receiving a positive yield over and above the risk-free rate, but that premium is only about ⅓ of what it was when I turned very bullish on this name. Given the positive risk premium on offer at the moment, and given the growth potential at the firm over the next few years, I’m taking half a position in the stock, and will add on any weakness.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply