Investment thesis

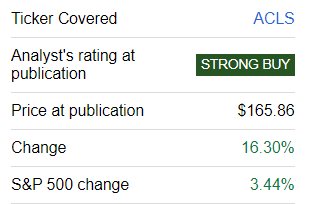

My initial bullish thesis about Axcelis Technologies (NASDAQ:ACLS), which I shared last quarter, worked out well. The stock significantly outperformed the broad market with a 16.3% rally since June 21.

Seeking Alpha

Today, I would like to reiterate my “Strong Buy” rating given how the recent developments unfolded. The company demonstrates strong revenue momentum, which is impressive amid the temporary mild crisis in the wafer fabrication equipment market. The backlog is strong and the company’s product line is well exposed to the hottest end markets right now. The near-term outlook is robust amid the current weak environment. It is also crucial that, according to my valuation analysis, the stock is still substantially undervalued.

Recent developments

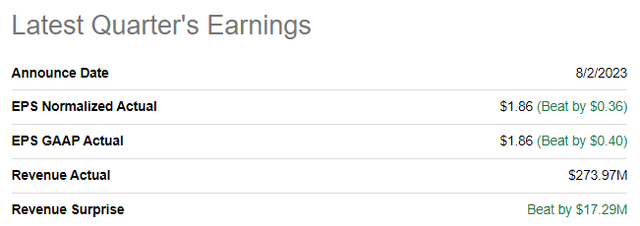

ACLS released its latest quarterly earnings on August 2, when the company confidently topped consensus estimates. Revenue demonstrated stellar growth momentum with almost 24% YoY growth. The adjusted EPS followed the top line and expanded significantly, from $1.32 to $1.86.

Seeking Alpha

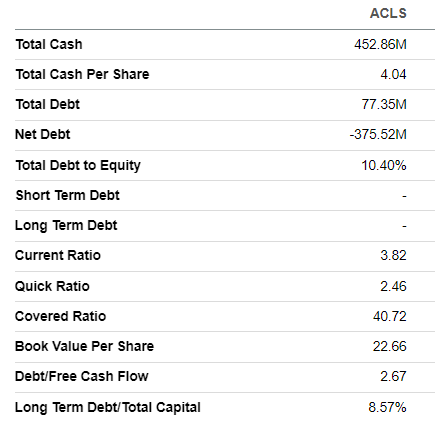

Profitability metrics are stable, which is solid in the current challenging environment. This enables the company to increase its free cash flow [FCF], which rose seven-fold YoY and means ACL is able to sustain its consistent share buybacks program. Solid FCF allows the company to balance between keeping shareholders happy with buybacks, sustaining the healthy balance sheet, and reinvesting to fuel future growth with about a 9% R&D to revenue ratio.

Seeking Alpha

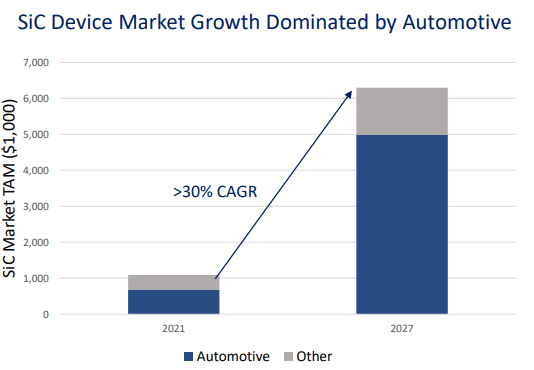

If we look forward now, we can see that the near-term prospects are bright. According to the latest earnings call, the backlog is high at $1.2 billion. This looks very high compared to TTM revenue of slightly above $1 billion. It is also crucial to mention that according to the company’s CFO, Kevin Brewer, ACLS is already taking orders for the year 2025. That said, the full-year 2024 capacity is almost sold out, which is good for investors and makes the next year’s revenue predictable. The company’s family of products is exposed to the hottest markets like AI, EV, 5G, and IoT. The impressive diversification of end markets also makes the company well-positioned to benefit from various secular tailwinds. The company bets big on its Purion family of products, and it pays off. It makes the company well-positioned in the booming EV industry, where SiC Device is expected to be in high demand in the next five years.

ACLS’s latest investor presentation

The upcoming quarter’s earnings release is scheduled for November 3. Consensus estimates expect the company to sustain robust growth momentum with a 22.2% YoY revenue growth. The adjusted EPS is forecasted to demonstrate notable expansion from $1.21 to $1.73.

Seeking Alpha

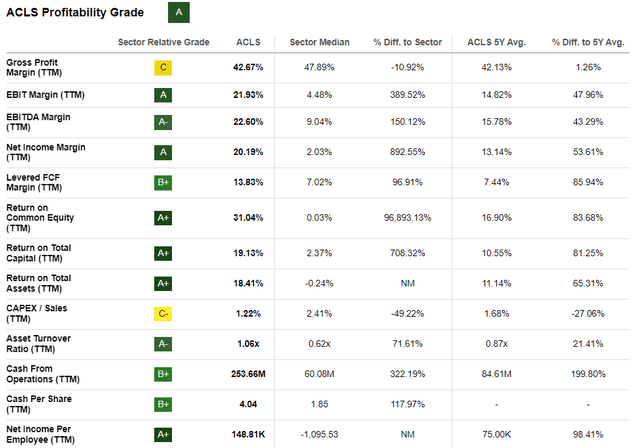

For the full fiscal year, the management projects revenue to exceed $1.1 billion, which represents a 20% YoY growth. The full-year guidance was upgraded by $70 million during the latest earnings call. The company’s expected revenue growth this year looks very strong compared to the overall wafer fabrication equipment [WFE] market temporary softness. According to counterpointsearch.com, the WFE market’s revenue is expected to decline about 10% this year. This is a strong, bullish sign to me. I also like that the company sustains stable profitability metrics in the recent tough high-inflation environment. The company has an “A” profitability grade from Seeking Alpha Quant and it is crucial that ACLS’s profitability metrics are not only higher than the sector median but also much stronger than five-year averages across the board.

Seeking Alpha

The company has a good chance to continue profitability metrics expansion while the top line enjoys strong growth moment. ACLS has a solid track record of widening margin expansion while the business expanded in the past. This gives me a high conviction that the management can sustain profitability metrics improvement while the business continues scaling up.

Valuation update

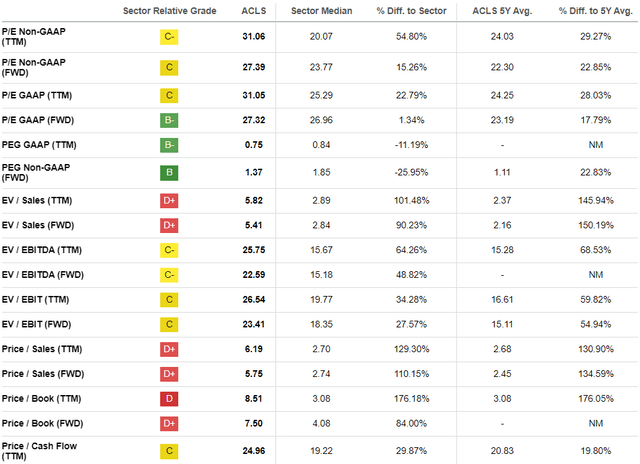

The stock has rallied 146% year-to-date, significantly outpacing the broader U.S. market. Seeking Alpha Quant assigns the stock a low “D+” valuation grade since ACLS’s valuation multiples are substantially higher than the sector median and historical average. That said, from the multiples point of view, the stock is overvalued.

Seeking Alpha

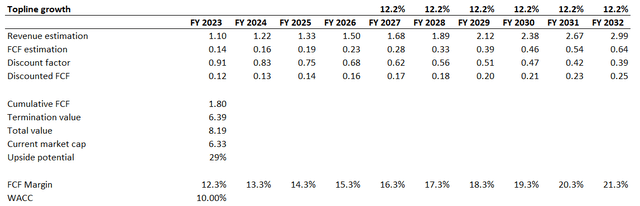

To cross-check multiple analyses, I would like to run a discounted cash flow [DCF] simulation. I use the same 10% WACC as I did initially. Revenue consensus estimates are available up to FY 2026. For the years beyond, I implement a 12.2% CAGR, in line with the forecast for the whole semiconductor industry. For the base year, I use a TTM 12.3% FCF margin and expect it to expand by one percentage point yearly.

Seeking Alpha

The company’s fair value is at about $8.2 billion, which is 29% higher than the current market cap. That said, the stock is substantially undervalued even after this year’s massive rally.

Risks update

As a growth company, ACLS needs to meet its ambitious revenue growth expectations and profitability expansion pace. If the company fails to do so, investors will be disappointed, and a massive stock sell-off is likely. It is also crucial to mention, that aggressive growth stocks like ACLS are vulnerable to even insignificant short-term underperformance compared to consensus estimates or slight near-term earnings outlook downgrades. That said, potential investors should be ready to tolerate the short-term volatility and be long-term-minded when investing in ACLS.

Operating in a semiconductor industry also means the company is vulnerable to the broader economic condition. We are currently experiencing a highly uncertain environment, which is unfavorable for growth companies: high interest rates, escalating geopolitical tensions, and volatile oil prices, which significantly affect inflation. That said, the global economic slowdown is probable and we already see that some of the major economies are already falling into recession. While the U.S. economy demonstrates impressive resilience, in the current weak global environment, the “black swan” might come suddenly. In uncertain times, I believe that dollar averaging would be the best strategy to mitigate the high level of uncertainty.

It is also crucial to underline that the company generated more than half of its revenue in China in Q2. Having such substantial exposure in China is extremely risky in the current environment of escalated geopolitical tensions between the U.S. and China. We are now in the middle of the so-called “Chip War” between the two largest global economies. While the risk of Axcelis’ products being banned for sale to Chinese companies is remote, the potential adverse effect will be massive.

Bottom line

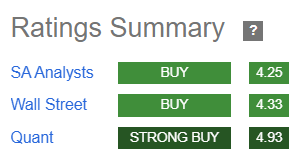

To conclude, I agree with Seeking Alpha Quant rankings, which assign ACLS a “Strong Buy” rating.

Seeking Alpha

The company demonstrates excellent execution amid booming demand for its Purion product family while the overall WFE market experiences temporary headwinds. The near-term outlook is favorable for the company, and it is bullish that the management has raised the full-year guidance. Long-term forecasts for the semiconductor industry are also bright. The company’s strong track record of success gives me a high level of conviction that it will be able to absorb long-term industry tailwinds. Most importantly, the stock is still about 30% undervalued, even after a massive year-to-date rally.

Read the full article here

Leave a Reply