In late January 2024, we followed up on Avolta with a publication called Cheap For No Reason (OTCPK:DUFRY). After analyzing the Q4 results released on March 7th and listening to the CEO outlook, we remain overweight on Avolta as we believe the pace of sales recovery is underappreciated. Our investment thesis is intact, and the company’s latest presentation supports our buy rating rationale (Fig 1). In detail, our equity story is backed by 1) global passenger growth consistently outperforms GDP growth, 2) compared to airlines, the company is less vulnerable to unrest in specific destinations and serves in 73 countries with diversified concession (Airports and Motorways – Fig 2), and 3) Avolta still trades at a significant discount compared to its historical average. We believe the dividend reinstatement is also a positive catalyst.

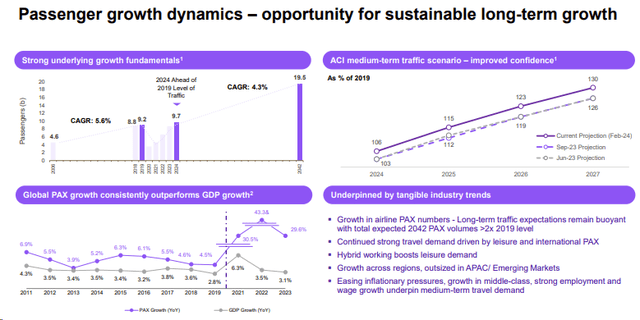

Passenger growth estimates

Source: Avolta Q4 and FY results presentation – Fig 1

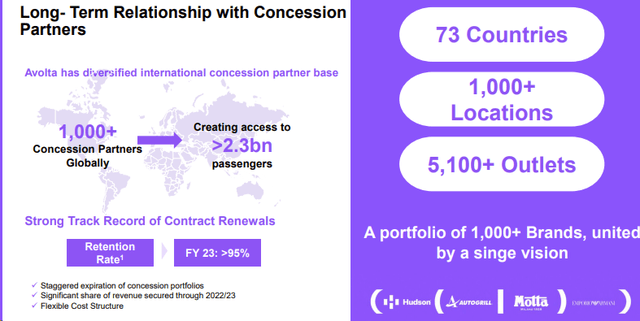

Avolta Worldwide Concession

Fig 2

Q4 Results

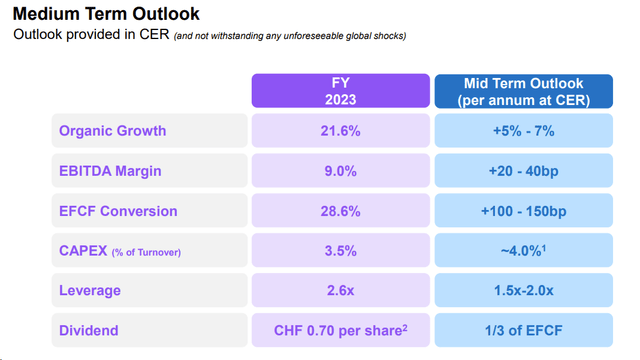

Here at the Lab, we believe the press release title is very effective and describes the current positive take: “Avolta takes off.” In addition, we positively report the following words: “Strong performance continues into the new year, and management remains confident in long-term growth.” That’s music to our ears. Before moving on with our upside, we reported Avolta earnings. The company delivered 2023 core organic top-line sales of CHF 12.53 billion, with a plus 21.6% on a yearly basis. Regarding the P&L, Avolta’s EBITDA reached CHF 1.13 billion with a margin uplift of 30 basis points. The company achieved a margin of 9% and delivered an EBITDA increase of +20% year-on-year. On a quarterly basis, the Q4 core sales signed a plus 7.3% with actual FX and a plus 13.1% at constant FX. The Equity Free Cash Flow reached CHF 323 million, and the company further de-leverage. Avolta’s net debt reached CHF 2.69 billion, with a ratio of 2.6x on the EBITDA.

Why Are We Positive?

Firstly, Avolta beats Wall Street consensus estimates on sales and EBITDA. In detail, the most noteworthy results were achieved at the EBITDA level (CHF 1.13 billion vs. an average estimate of CHF 1.05 billion). Thirty basis points of higher EBITDA might seem irrelevant; however, for a low-margin business, this is material.

In addition, we tend to like companies that do not overpromise. Avolta previously guided an EBITDA margin between 8.5% and 8.7% range. We positively view the 9% EBITDA margin achievement. More importantly, the Equity Free Cash Flow was significantly up compared to the consensus.

All geographical regions contributed soundly to organic growth generation, with a gross margin up by 50 basis points. This reflects limited promotion activities and shows the company’s ability on pricing power. This is a key positive.

According to the management team, year-to-date sales (February) were up 7% in a constant currency FX. Strong passenger growth trends drove this.

Avolta Guidance

Our previous analysis forecasted 2023 sales of CHF 12.6 billion with an adjusted EBITDA of CHF 1.08 billion with a margin of 8.5%. Looking ahead, we now estimate sales growth of 6% (mid-point of Avolta guidance) with an EBITDA margin unchanged at 9.4%. For this reason, our EBITDA forecast is now set at CHF 1.24 billion. Considering the dividend payment and the EFCF evolution, this also supports at least a CHF 300 million yearly deleverage.

Avolta’s medium-term sales targets are supportive, but we note a better-than-expected conversion ratio. This should suggest a 2024 EFCF estimate between CHF 350 and 375 million.

Looking at the Wall Street estimates, sell-side analysts should increase Avolta’s EBITDA by a low single-digit upside, while EFCF should grow by double digits. This might provide a positive stock price reaction in the short term.

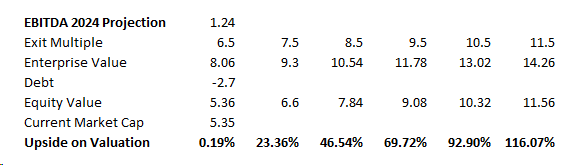

Valuation and Risks

In our upside investment thesis, valuation plays a key role. Avolta trades on 2024 estimates at 6.5x EV/EBITDA, compared to a median pre-pandemic level of >10x. Even if it is unnecessary (the company is safer than the pre-COVID-19 level with Autogrill integration), we applied a 15% discount to Avolta EV/EBITDA median multiples. Therefore, we confirm our valuation set at CHF 50 per share. However, below, we provide a recap of where Avolta could land if it were priced before the pandemic outbreak. The company’s upside could exceed 100%.

Mare Internal Analysis

Downside risks include geopolitical and natural events, which might negatively affect the international traffic market. The company is also exposed to emerging markets, which might result in high earnings volatility. Intense competition exists for airport concessions, and authorities might demand higher fees. The company is also exposed to FX risks. In the longer term, regulators could affect top-line sales for wine and tobacco products.

Conclusion

There is downside protection thanks to a dividend reinstatement and deleveraging in progress. The company was able to pass price increases and is more protected with Autogrill business combination. The company is still cheap, and we confirm our strong buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply