Investment thesis

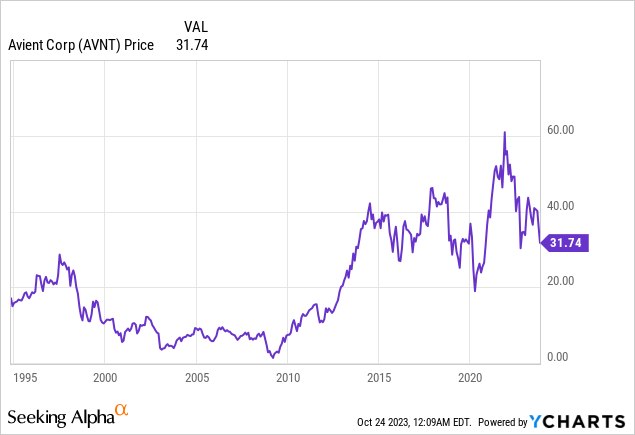

Avient Corporation (NYSE:AVNT) is expected to report Q3 2023 results on November 02, 2023, and given the recent high volatility experienced in recent quarters due to a very complex macroeconomic landscape, it is very important to assess the current situation, as well as what to expect, in order to decide wisely how to proceed as investors. The company has recently made significant restructuring efforts in order to focus on higher-margin businesses through acquisitions and divestitures, so stagnant sales have been offset, until now, by higher profit margins. Still, inflationary pressures and weakening volumes have impacted profit margins since the outbreak of the coronavirus pandemic in 2020 while consumers losing purchasing power and customer destocking are beginning to make themselves felt in sales at a time marked by higher debt exposure and significantly higher interest rates, which has lowered expectations of dividend growth investors used to dividend growth rates of around CAGR of 15%, so the share price has suffered a significant decline of 48% from all-time highs as a consequence.

Despite this, the company remains highly profitable, and high cash and equivalents should allow it to navigate current headwinds for some time even if they slightly intensify. High cash from operations derived from recent improvements in profit margins should allow for a slow deleveraging, especially once investments in newly acquired companies conclude, which should reduce the risk that increased interest rates pose for the company in the long term. Still, it is important not to discard a possible dividend cut as a consequence of the growing need to preserve as much cash as possible given the current complex macroeconomic landscape.

A brief overview of the company

Avient Corporation, previously known as PolyOne Corporation, is a global specialized and sustainable material solutions company that manufactures specialty-engineered materials, including performance fibers, advanced composites, color and additive systems, performance-enhancing additives, liquid colorants, and fluoropolymer and silicone colorants. The company, which was founded in 1885, serves a wide range of industries, including energy, defense, 4G and 5G, general industrials, building and construction, consumer products, packaging, health care, and others. Its market cap currently stands at $2.9 billion as it employs almost 10,000 workers worldwide.

Avient Corporation logo (Avient.com)

After the divestiture of the Distribution segment in November 2022, the company operates under two reportable segments: Color, Additives, and Inks, which provide 69% of the company’s total revenues (using 2022 as a reference), and Specialty Engineered Materials, which generated the rest. The company has a strong focus on capitalizing on trends towards a more sustainable production model and enjoys a strong geographical diversification as, using 2022 as a reference, 40% of the company’s total revenues are provided by operations within the United States and Canada, whereas 36% are in Europe, 19% in Asia, and 5% in Latin America.

Currently, shares are trading at $31.74, which represents a 48.36% decline from all-time highs of $61.46 reached in November 2021. Although sales have remained stagnant in recent years, investors saw how the restructuring process carried out helped improve the company’s profitability profile. Despite this, margins have recently suffered strong periods of volatility caused by inflationary pressures and weak volumes. Furthermore, a very significant increase in interest expenses as a consequence of higher debt exposure and interest rates have set off alarm bells at a time marked by growing concerns of a potential recession caused by recent interest rate hikes.

Recent acquisitions and divestitures

In recent years, Avient’s growth strategy has been characterized by an aggressive M&A activity, although this has also been accompanied by significant divestments as the company has focused on markets that offer higher profit margins. Here is a summary of the latest acquisitions.

In January 2018, the company acquired IQAP Masterbatch Group, a provider of specialty colorants and additives based in Spain with customers throughout Europe, for $74 million. Later, in June 2018, the company also acquired PlastiComp, an advanced engineered materials innovator and producer of specialty composites, for $44.3 million.

Half a year later, in January 2019, the company acquired Fiber-Line, a global leader in customized engineered fibers and composite materials, for $120 million, and in October 2019, it sold its Performance Products and Solutions business for $775 million.

In July 2020, the company acquired the color masterbatch businesses of Clariant (OTCPK:CLZNF), which includes 46 manufacturing operations and technology centers in 29 countries, for $1.44 billion, and a year later, in July 2021, the company also acquired Magna Colours, a market leader in sustainable, water-based inks technology for the textile screen printing industry, for $48 million.

Finally, in September 2022, the company acquired the protective materials business of DSM, $1.4 billion, and renamed it to Avient Protective Materials, and later, in November 2022, the company sold its Distribution business for ~$750 million, due to its lower margin profile, in order to pay down near-term maturing debt.

Revenues remain stagnant as recent acquisitions were focused on higher profit margins

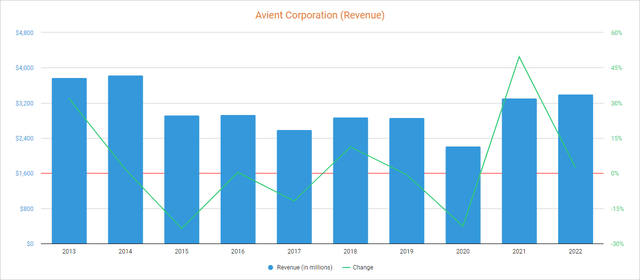

As a consequence of an M&A strategy more focused on achieving higher profitability rates and not so much on achieving revenue growth, sales have been stagnant in recent years. Although sales suffered a sharp decline of 22.63% in 2020 as a consequence of coronavirus-related disruptions, they recovered in 2021 and 2022 as they increased year over year by 49.69% and 2.46% respectively.

Avient Corporation (Revenues) (Avient.com)

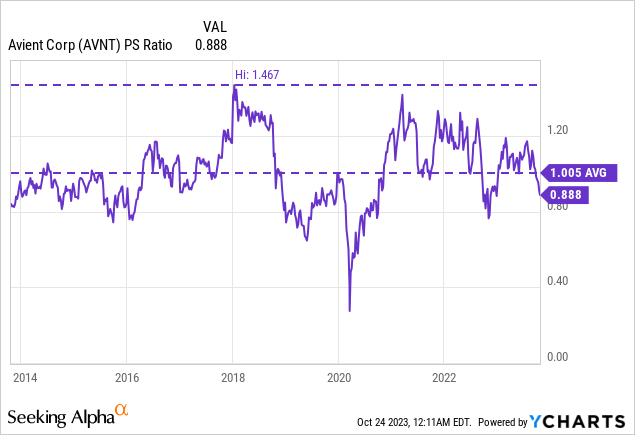

As for 2023, revenues decreased by 5.21% year over year during the first quarter and by 7.47% (also year over year) during the second quarter caused by a general slowdown in the industries served by Avient. Also, customers are reducing their inventories, which caused a decline in orders, and these headwinds are not expected to recover significantly in the foreseeable future. In this regard, revenues are expected to decrease by 4.12% in 2023 but to increase by 4.60% in 2024, which means revenues will likely remain stagnant for quite some time. As a consequence, the P/S ratio experienced a recent decline to 0.888, which means the company generates annual revenues of $1.13 for each dollar held in shares by investors.

This ratio is 11.64% lower than the average of the past 10 years and represents a 39.47% decline from the spike of 1.467 experienced at the beginning of 2018, which reflects current investors’ pessimism, which is largely explained by four main factors: declining volumes due to weaker consumer purchasing power and customer destocking, rising interest expenses, a growing perception of recessionary risks in the short and medium term, and higher margin volatility caused by unstable volumes and inflationary pressures.

Profit margins have recovered, but the macroeconomic landscape is still complex

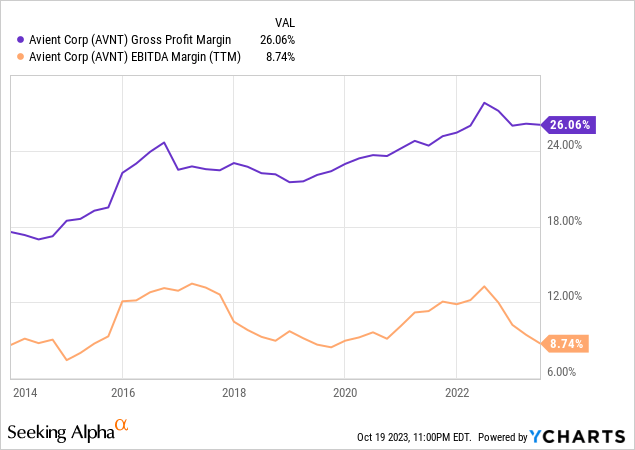

If we observe the evolution of profit margins in recent years, we can see that recent restructuring efforts have been accompanied by a subsequent improvement in the company’s profitability profile, especially in terms of gross profit margins. Despite this, increased production costs and raw material and wage inflation, as well as weaker volumes, have caused a significant contraction in the EBITDA margin in recent quarters as the trailing twelve months’ gross profit margin currently stands at 26.06% and the EBITDA margin at 8.74%.

However, the gross profit margin improved during the past two quarters to 29.20%, and the EBITDA margin to 13.31% thanks to improved raw material prices and cost reduction initiatives, which means profit margins have essentially recovered from recent headwinds. Still, it is still too early to claim victory as the current macroeconomic context is still marked by strong volatility and uncertainties, especially regarding inflationary pressures and demand, and sales are expected to continue to be weak in the second half of 2023 and in full 2024.

Furthermore, the company needs to generate more cash than before to cover interest expenses as debt begins to be a serious problem. Therefore, the improvement in profit margins has not been accompanied by an improvement in the company’s prospects as rising interest expenses have made it more susceptible to finding itself in serious problems in the event that a new headwind impacts profit margins again.

Debt is becoming a serious problem as interest expenses have skyrocketed

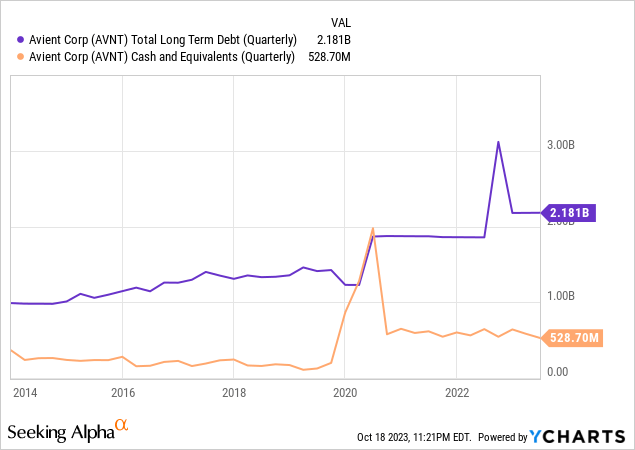

The company has been exposed to an increasing level of debt in recent years, and long-term debt is currently very high at $2.18 billion. On the other hand, cash and equivalents are also high at $529 million, which serves as a strong safety net.

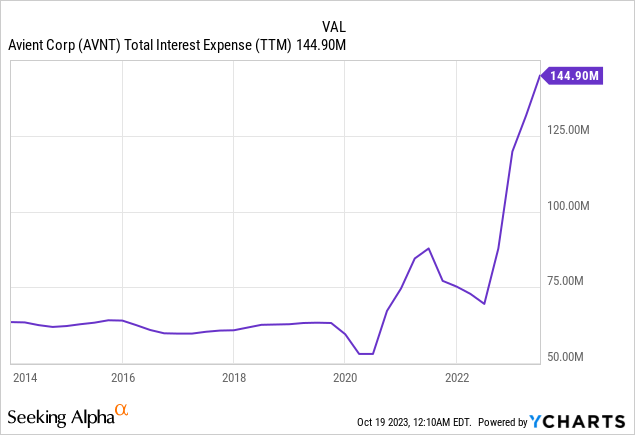

Due to the company’s great ability to generate cash from operations of over $200 million in a typical year, debt exposure had not been a problem until now as total interest expenses have historically been between $50 million and $75 million while profit margins were greatly improved thanks to acquisitions and divestitures. But now, higher debt levels and increasing interest rates have caused a dramatic increase in the trailing twelve months’ total interest expenses to $145 million, and therefore, interest expenses have practically doubled since the beginning of 2022.

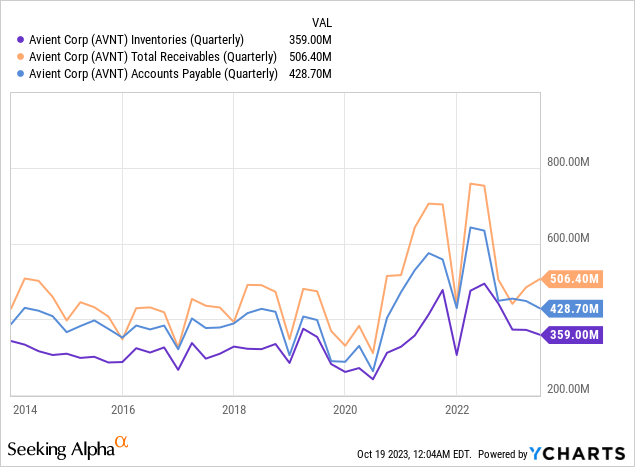

During the second quarter of 2023, the company reported interest expenses of $29.40 million, which means interest expenses are expected to be slightly lower than those paid in the last 12 months at around $120 million thanks to some deleverage boosted by the divestiture of the Distribution segment and a $135 million inventory reduction, although the difference is still not very significant. Luckily, the company has no maturities until 2025, but for it to significantly reduce these expenses, it must continue to reduce its debt levels. As a strong point, cash and equivalents of $529 million should help slightly reduce debt while accounts receivable of $506 million are higher than accounts payable of $429 million, although inventories of $359 no longer give as much margin to be converted into actual cash.

Therefore, my conclusion here is that the recent decline in the share price is largely caused by the recent increase in interest expenses, which will most likely put serious pressure on the company’s balance sheet in the foreseeable future, and in order to be reduced, the company must perform a significant reduction in debt exposure, which would ultimately unlock significant shareholder’s value in the long run. In this regard, the company will need to maintain a relatively low cash payout ratio in order to make this debt reduction possible, for which increased interest expenses will be a problem from now on.

Dividend growth will likely slow down as a result of higher cash payout ratios

The company initiated a dividend payment of $0.16 (divided into four quarters) in 2011 and it has been steadily raised since then at very acceptable rates. In October 2023, the company announced a 4.04% dividend increase to $1.03 per share and year, which represents the most recent raise, marking a CAGR growth of 15% since the dividend inception. Furthermore, the recent share price decline left potential investors with a current dividend yield of 3.24%.

Avient dividend growth (Avient.com/investor-center/news/avient-announces-thirteenth-consecutive-annual-dividend-increase)

Even so, dividend growth rates will likely get even lower as the cash payout ratio has been increasingly higher, and this ratio is poised to keep increasing caused by the recent spike in interest expenses. In the following table, I have calculated the sustainability of the dividend in recent years by calculating what percentage of the cash payout ratio has been dedicated each year to paying dividends and covering interest expenses.

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Cash from operations (in millions) | $208.4 | $240.3 | $227.6 | $202.4 | $253.7 | $300.8 | $221.6 | $233.8 | $398.4 |

| Dividends paid (in millions) | $29.9 | $35.7 | $40.2 | $44.1 | $56.1 | $60.3 | $71.3 | $77.7 | $86.8 |

| Interest expense (in millions) | $59.8 | $65.9 | $56.3 | $59.4 | $61.0 | $67.0 | $61.1 | $72.6 | $79.4 |

| Cash payout ratio | 43% | 42% | 42% | 51% | 46% | 42% | 60% | 64% | 42% |

As one can see, the cash payout ratio, although it has remained relatively low year after year, has increased significantly in 2020 and 2021 to above 60%, and although it has been only 42% in 2022, this is attributable to a higher than usual cash from operations boosted by a $66.9 million reduction in inventories and an increase in $24.9 million in accounts payable (while accounts receivable increased by just $0.7 million).

Currently, trailing twelve months’ cash from operations declined to $267.0 million (compared to $398.4 million reported in full 2022), and inventories declined by $135 million in the same period. Nevertheless, accounts receivable increased by $22 million and accounts payable decreased by $205.3 million, which shows that the company still has room to continue generating positive cash from operations and continue paying its debt gradually as it reported trailing twelve months’ net income of $576.2 million.

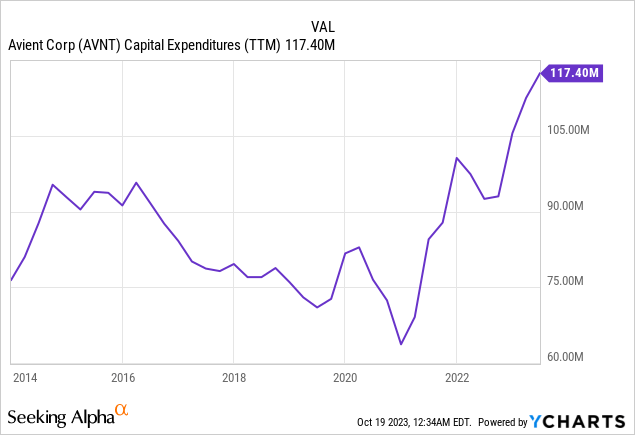

Still, we must not forget that capital expenditures are currently high at $117.4 million (trailing twelve months) as the company is making significant investments in the newly acquired businesses.

Still, the company reported lower capital expenditures in the second quarter of 2023 at $25.6 million, so at this rate they should be reduced to $102.4 million per year at the current pace. Furthermore, these investments should ultimately lead to slightly higher profit margins, although there are no guarantees for this to be a reality.

What to monitor once Q3 2023 results are released

Ultimately, and in my opinion, it will be the company’s ability to reduce current (net) debt levels during this quarter what would draw a more optimistic perception among shareholders, for which a drop in sales (year over year) lower than those of the second quarter, which was 7.47%, will be decisive in order to meet expectations of a lighter drop of 4.12% in sales for the whole of 2023 as orders from customers are expected to receive a slight boost thanks to more moderate inventories. This would allow a better use of labor while avoiding accumulating more inventories than necessary. Also, if the company reports profit margins similar to those of the second quarter of 2023, cash from operations should be very positive as could then continue reporting positive net income.

Risks worth mentioning

In the long term, I consider Avient Corporation’s risk profile to be relatively low, but still, there are certain risks that I would like to highlight in relation to the short and medium term.

- Recent interest rate hikes could trigger a global recession, which could have a significant impact on the company’s operations.

- If inflationary pressures intensify in the short and medium term, or if sales do not recover beyond 2024 due to a worsening macroeconomic context, cash from operations may not be sufficient to cover interest expenses, dividends paid, and capital expenditures.

- If the company encounters problems covering these expenses, it could opt to cut the dividend in order to free up some cash with which to pay down some debt and thus reduce interest expenses in the long term, which would improve the company’s long-term prospects at the cost of short and medium term shareholder damage.

- The company could also issue new shares in order to reduce current debt levels to more sustainable levels, which would lead to some share dilution.

- For more cautious investors, saving a bullet to invest after the next earnings release, in case of results falling short of expectations, could be a good way to reduce the risk of significant capital losses by allowing the strategy to reduce the average share purchase price in the event of further declines.

Conclusion

As a 48% drop in the share price suggests, Avient Corporation’s situation is anything but simple. Overall, operations are very healthy, with positive profit and EBITDA margins that make the company highly profitable. Certainly, the recent restructuring process has been a success from an operational point of view. The problem is that, given the current macroeconomic context marked by higher interest rates and weakened demand, the increase in interest expenses has been significant and the company’s profit margins are volatile.

As the current situation suggests, high interest rates should be a temporary headwind, although the company cannot rely on potential interest rate cuts as a strategy to stay afloat in the long term. For this reason, if demand does not accelerate enough in 2024 and beyond, the company could opt to divest lower-margin businesses, issue new shares, or cut the dividend in order to free up cash and pay down some debt, which would certainly have a significant impact on investors in the short-to-medium term.

Still, I strongly believe this represents a good opportunity for long-term dividend growth investors with enough patience to wait for the current situation to improve as the company remains profitable and cash and equivalents is very high. In exchange for said patience and potential short and medium-term shareholder damage, investors should be rewarded with a generous dividend yield on cost of 3.24%, in the long run, in a highly profitable company operating in key industries, but given the ongoing volatility in the markets and industries, I highly encourage those investors with more cautious approaches to average down in order to reduce share price volatility risks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply