Introduction

Avidity (NASDAQ:RNA) is a biopharmaceutical firm specializing in a unique RNA therapy termed Antibody Oligonucleotide Conjugates (AOCs). This platform fuses the exactness of RNA therapeutics with monoclonal antibodies, targeting previously untreatable diseases. Currently, three AOC programs are undergoing clinical trials, focusing on various muscular dystrophies.

In a recent analysis, I concluded that Avidity offers a promising AOC platform targeting untreatable diseases. Their three clinical programs could lead to revolutionary treatments. The stock’s volatility stemmed from trial setbacks and the inherent risks of novel therapies. Upcoming trial data and FDA interactions are crucial. Their financial sustainability requires close monitoring, and given the uncertainties, I recommended a ‘Hold’ stance on their stock.

The following article discusses Avidity’s financial health, ongoing clinical trials, and its recent FDA interactions concerning AOC 1001, suggesting a “Hold” investment position.

Q2 Earnings Report

Looking at Avidity’s most recent earnings report, as of June 30, 2023, they held $576.5M in cash and equivalents, a decrease from $610.7M at the end of 2022. Collaboration revenue, largely from their partnership with Eli Lilly (LLY), amounted to $2.3M for Q2 2023, slightly up from $2.2M in Q2 2022. R&D expenses rose to $42.6M in Q2 2023 from $39.8M in Q2 2022, with the increase attributed to the advancement of specific research projects and expansion of overall capabilities. G&A expenses also increased to $12.3M in Q2 2023, up from $8.7M in Q2 2022, due to higher personnel and professional fees supporting expanded operations.

Cash Runway & Liquidity

Turning to Avidity’s balance sheet, as of June 30, 2023, the company has combined assets of $576.5M in ‘Cash and cash equivalents’ ($153.9M) and ‘Marketable securities’ ($422.6M). Over the span of six months ending June 30, 2023, the “Net cash used in operating activities” was $98.8M, leading to an estimated monthly cash burn of $16.5M. Given this rate, the company has a cash runway of approximately 34.9 months based on the combined assets. It’s important to note, however, that these values and estimates are grounded in past data, and their relevance to future performance is uncertain.

In assessing Avidity’s liquidity status, the significant presence of assets in the form of cash and marketable securities indicates a strong liquidity position, allowing them to cover their operational expenses for the foreseeable future. The company doesn’t appear to have significant debt. Given the company’s healthy liquidity position and the continued capability to raise capital through common stock issuances, as seen in recent history, it seems probable that Avidity could secure additional financing if required. These are my personal observations, and other analysts might interpret the data differently.

Valuation, Growth, & Momentum

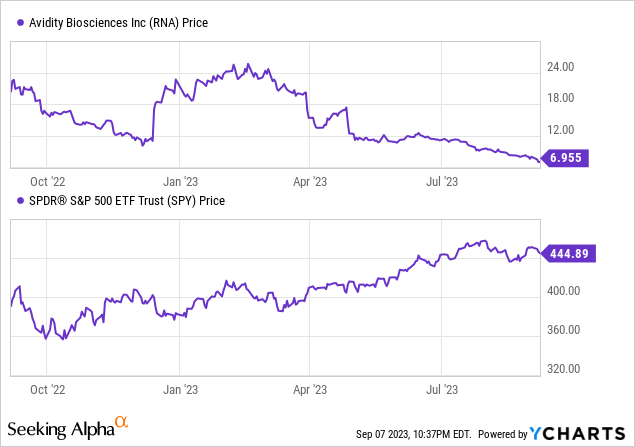

According to Seeking Alpha data, Avidity’s capital structure reveals a minimal debt relative to its market capitalization, with an enterprise value at -$52.76M. Valuation metrics are primarily not applicable due to the company’s developmental phase. Though the company is generating minimal revenue via collaborations, the growth prospects remain favorable given its yearly revenue growth and consistent 3-year compound annual growth rate (CAGR). Avidity’s stock momentum is significantly underperforming broader market indices.

Flexing Forward: Avidity’s Prowess in Muscle Disease Research

Avidity is making significant strides in the realm of rare muscle diseases, especially DM1, DMD, and FSHD. Their intensive research promises transformative treatments for these conditions.

In the Phase 1/2 MARINA trial, AOC 1001’s intravenous administration was evaluated for its safety and tolerability in adults with DM1. This involved a 3:1 randomized study of 38 participants. The results revealed directional improvements in multiple functional assessments. Myotonia, a DM1 hallmark, was assessed via video hand opening time (vHOT), strength was measured using the Quantitative Muscle Testing (QMT) total score from various muscle groups, and mobility was gauged through the 10-meter walk run test and the Timed Up and Go test. Importantly, these functional measurements are closely aligned with the ongoing END-DM1 natural history study.

Additionally, the study indicated substantial DMPK reduction and gene splicing changes with AOC 1001 treatment. Broad splicing improvements were observed across over a thousand genes linked to DM1, underscoring its nuclear activity. Furthermore, AOC 1001 exhibited a commendable safety and tolerability profile, with most adverse effects being mild to moderate.

Other milestones include the initiation of the AOC 1044 EXPLORE44 trial for Duchenne muscular dystrophy and the FDA’s easing of the partial clinical hold for AOC 1001.

My Analysis & Recommendation

Avidity, with its innovative AOC platform, has garnered attention in the biopharmaceutical domain, particularly for its potential to address diseases previously deemed untreatable. A key point of contemplation, however, remains the company’s current negative enterprise value of -$52.76M.

Factors warranting consideration include:

-

Biopharmaceutical Sector Dynamics: The biopharmaceutical field is replete with both risk and opportunity. The partial clinical hold in September 2022 by the FDA, due to a severe adverse event in the MARINA trial, underscored these challenges. It is pertinent to mention that subsequent investigations conducted by Avidity found no evident correlation between the event and the components of AOC 1001. By May 2023, the FDA eased this hold, indicating a cautiously optimistic trajectory for the drug.

-

Financial Health Evaluation: Avidity’s current monthly expenditure rate of $16.5M, in conjunction with their 34.9-month cash runway, suggests adequate liquidity in the near term. Nonetheless, as the company advances in its clinical trials, which tend to escalate in costs, this financial trajectory merits close monitoring.

-

Revenue Structures: Predominantly relying on collaborative revenues, exemplified by the partnership with Eli Lilly, Avidity’s revenue sources could benefit from diversification, especially as the AOC programs evolve.

-

Market Interpretations: A negative enterprise value often indicates market apprehension, contingent on both the perceivable risks and potential rewards of a company’s research efforts. Future clinical data and additional FDA rulings will be influential in determining market perceptions.

For investors, the upcoming period will be pivotal. The FDA’s recent easing of the clinical hold has permitted dose escalation from 2 mg/kg to 4 mg/kg for a subset of participants in the MARINA-OLE study. Hence, there’s a clear anticipation surrounding the safety and efficacy data resulting from this dose escalation. This data will provide valuable insights into the drug’s potential, and any positive outcomes could be a significant catalyst for Avidity’s stock.

Based on the present data and the evolving landscape, a “Hold” position on Avidity seems appropriate. The potential of their AOC platform is evident, but with pending milestones such as the dose-escalation safety and efficacy data, it’s prudent for investors to wait for more definitive evidence before revising their investment strategy.

Read the full article here

Leave a Reply