The future is a hundred thousand threads, but the past is a fabric that can never be rewoven.”― Orson Scott Card

Today, we put Avid Bioservices (NASDAQ:CDMO) in the spotlight. The stock has been cut in half so far here in 2023. This fiscal year looks like it will be a ‘transitional‘ one for the company as Avid shifts to a higher growth future. Time to buy the dip in the shares in front of coming improvements to the company’s fortunes? An analysis follows below.

Seeking Alpha

Company Overview

Avid Bioservices is a contract development and manufacturing organization or CDMO that is headquartered just outside of Santa Anna in Tustin, CA. The company offers various services to the healthcare industry in including clinical and commercial drug substance manufacturing, bulk packaging, release and stability testing, and regulatory submission and support. Avid Bioservices has three decades of experience in the biologics industry. The stock currently trades just under seven bucks a share and sports and approximate market capitalization of approximately $430 million. The company’s fiscal year ends on March 31st.

First Quarter Results:

The company posted first quarter numbers on September 7th. Avid Bioservices posted a GAAP net loss of $2.1 million or three cents a year, a penny worse than the consensus. The loss was primarily due to the costs of building and staffing a new facility (more on that in the next section). Revenues rose nearly three percent on a year-over-year basis to $37.7 million, which was $1.6 million above expectations. Despite mixed results, the stock has fallen over 40% since first quarter numbers came out.

The company’s revenue backlog expanded much faster than sales growth and came in at $189 million, 20% above 1Q 2023. Management reiterated its FY2024 sales guidance of $145 million to $165 million.

Analyst Commentary & Balance Sheet

Since Avid Bioservices posted second quarter results, both RBC Capital ($15 price target) and Craig-Hallum ($22 price target) have reiterated Buy ratings while William Blair Avid Bioservices as a Market Perform.

Just under nine percent of the outstanding float in the stock is currently held short. Numerous insiders have been consistent sellers of the shares in 2023 and have sold just under $2 million worth of shares collectively so far this year.

The company ended its latest quarter with approximately $25 million worth of cash and marketable securities on its balance sheet. Avid Bioservices burned through $13.6 million of cash during the quarter, primarily as a result of building out a new cell and gene therapy facility, that should be completed by the end of its third quarter (i.e., end of 2023). This could a potential game changer for Avid Bioservices as the new facility has revenue-generating capacity of up to $400 million annually according to management.

Avid Biologic Facility (Company Website)

Currently, Avid Bioservices has more than 20,000 liters of state-of-the-art capacity and a fully disposable platform. The company has just over $140 million of senior convertible notes on its balance sheet as well.

Verdict

Avid Bioservices made 10 cents a share in FY2023 on just over $149 million in revenue. The current analyst firm consensus has the company shifting to a loss of 11 cents a share in FY2024 as sales rise to nearly $155 million. Profits of 19 cents a share are projected in FY2025 as sales rise in the high teens as new capacity comes online.

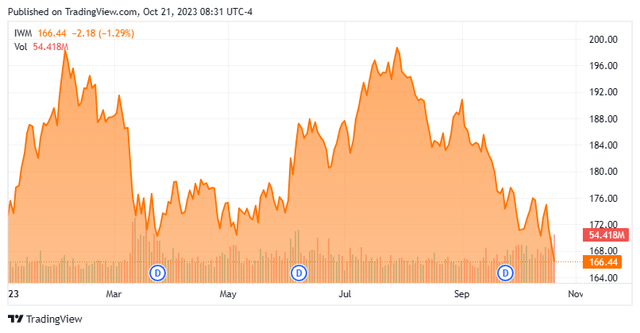

Avid Bioservices is building for the future and will post a loss this fiscal year before seeing accelerated sales growth and profits in FY2025. Unfortunately, the market has not been kind to small, unprofitable concerns since it last peaked in late July. In fact, the small cap Russell 2000 index recently turn negative for 2023 as well and is now down over three percent for the year, including dividends.

Seeking Alpha

The company is interesting story as its new capacity comes online. I do have some concerns on whether Avid will need to raise additional capital given its cash position and recent quarterly burn rate. This is a name I plan to circle back on once its new facility is completed and early indications are available to see how fast sales will grow due to this new capacity. Until then, I have no investment recommendation around Avid Bioservices given the uncertain market environment.

People are like dice. We throw ourselves in the direction of our own choosing.”― Jean-Paul Sartre

Read the full article here

Leave a Reply