AvalonBay Communities (NYSE:AVB) is a major apartment REIT with properties located in legacy markets on the East and West Coast. The REIT focuses on higher-end rental units with an average monthly rent of about $2,500 and has historically delivered very solid double-digit returns to investors.

Last time I covered the stock was in May, when I issued a HOLD rating at $180 per share. I liked the way in which AVB was positioned and didn’t mind the legacy market exposure, but I couldn’t see a clear way to 10%+ returns. Since then, the stock has been quite volatile, reaching as high as $200, only to settle around $180 again. More importantly, the company has also released very good Q2 2023 results. Today’s article is meant to update my thesis based on Q2 numbers and to give investors some insights of what to look for in Q3 earnings, which will be released on October 26th.

Supply and demand

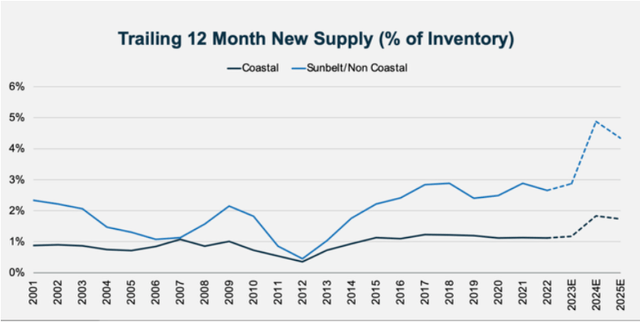

I’ve touched on the topic of new supply in my original article. Here I want to provide a little bit more of an insight.

It’s no secret, that a large number of people and jobs moved to the South during and after the pandemic. This has resulted in a spike in construction activity in the region to about 4-5% of new supply each year. At the same time, new supply in the coastal regions has remained relatively stable at 1.5% per year.

EQR Presentation

Over the past 24 months or so, the Sunbelt region has seen unprecedented growth, as confirmed by double-digit FFO increases of Mid-America Apartment Communities (MAA). But now things seem to be slowly changing, and legacy markets are starting to catch up. This will be clearly illustrated by very high rent growth in AVB’s markets, but the point is that demand is strong, while supply remains at relatively normal levels compared to history (certainly the growth in new supply post-pandemic has been much lower in Costal markets than in the Sunbelt. With strong demand and stable supply, I see the risk of oversupply as minimal. For this reason, I actually slightly prefer the Coastal markets over the Sunbelt at this time.

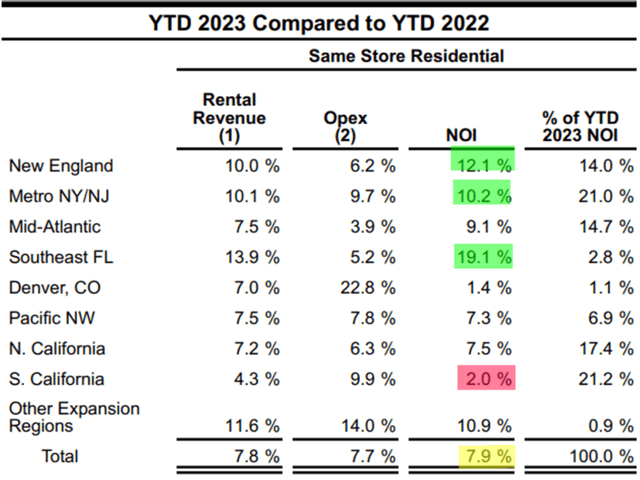

AvalonBay

I think that one of the best ways to determine how a REIT is doing is to look at their ability to raise rents, which is especially important in a high inflation environment like the one we have today.

Over the first six months of the year, AVB has done remarkably well on this front by increasing their same-store NOI by 7.9% YoY. It’s notable, that the increases weren’t uniform across the portfolio. Florida has seen the fastest levels of growth, but since this region accounts for less than 3% of the overall NOI, it didn’t contribute meaningfully to AVB’s bottom line. The Northeast, on the hand, has a high weighting and saw very high double-digit growth of 10-12%, suggesting that demand is coming back to cities such as NYC or Boston. On the other side of the country, California (and especially Southern California) has struggled with low rent increases of only 2% YoY.

AVB

Right now, management’s full year guidance calls for a 7% YoY increase in NOI. When Q3 earnings come out, one of the first things I’ll want to see will be rent increases across various regions to confirm my thesis that demand is indeed coming back to Coastal markets. If management hits their target, FFO per share will reach $10.50.

Last year, Sunbelt REITs experienced double-digit rent-growth, but that seems to be thing of the past as MAA’s growth guidance for this year is largely in line with AVB’s.

Management didn’t provide any insight on what growth will be like in 2024 and 2025. The general consensus seems to be for 5% same store NOI growth. On top of that, the REIT will be able to grow by adding new properties to their portfolio. Currently, there are 3,600 units scheduled for completion until the end of next year, which (if leased) will contribute another 4-5% to growth. As a result of these two factors, I expect AVB to deliver 6-8% annual NOI growth until 2025. This is largely in line with the expected growth for AVB’s closest peer Equity Residential (EQR) and actually above the expected growth for MAA (and most other Sunbelt peers) which are likely to experience a temporary slowdown in rent growth due to a large spike in new supply.

There are relatively few things that could derail this. AVB has an A- rated balance sheet with low leverage of only 4x EBITDA and the vast majority (92%) of debt fixed-rate. Moreover, near term maturities are low and can easily be repaid from rental revenue if refinancing terms are not favorable.

With that said, higher interest rates for a long period of time will hurt the stock price in the short-term as the market re-rates to adjust to higher interest rate expectations. But what’s important is that even with high interest rates, cash flow is likely to grow as rent growth will most likely out-weigh interest expense increase. For this reason, I see AVB as quite well positioned for a higher for longer scenario – this would be supported by the fact that it is one of only seven REITs with an A- or better rating.

The main risk to my thesis is that the tick up in rent growth in the Northeast will be short-lived, and growth rates will decline as soon as Q3. This would negatively impact future growth expectations and therefore the stock price. In fact, I see Q3 earnings as the breaking-point which will decide whether Coastal markets are actually coming back strong or not. This will, to a large extent, be determined by rent and NOI growth.

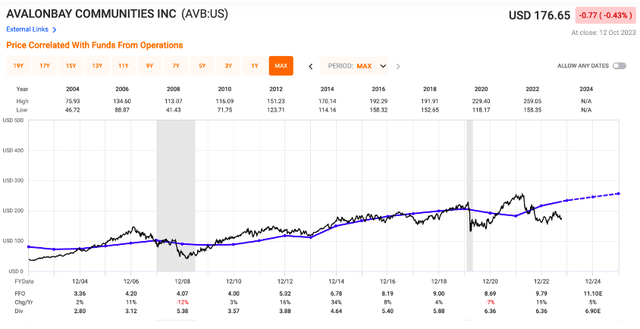

Valuation

A share price of $176 today puts the stock at a forward P/FFO of 16.8x, which is slightly below where the stock traded last time, thanks to increased growth guidance for this year. The long-term average for AVB stands around 22x FFO. But I don’t really expect meaningful multiple expansion, until rates come down.

Until then, investors will continue to receive a 4% dividend yield and are likely to see cash flow increase by 6-8% per year. That’s a slight improvement compared to my last article, as a result of very strong rent growth in Q2. I will be watching Q3 results closely and if strong rent growth persists, I will initiate a position, for now I reiterate my HOLD rating for AVB.

FastGraphs

If you really like AVB, though, it might be prudent to initiate a small position before earnings come out, because I suspect that if strong NOI growth persists, the stock price will move substantially higher on the announcement.

Read the full article here

Leave a Reply