Investment Action

Based on my current outlook and analysis of Autodesk’s (NASDAQ:ADSK) 2Q23 earnings, I recommend a buy rating. I expect ADSK to continue growing in the low teens in the near term as it continues to leverage its pricing power and capture volume from growth in end-markets. While the uncertainty within its end-market deserves a discount in multiples, I think the upside is still attractive.

Basic Recap

ADSK is a market leader in 3D design, engineering, and entertainment software and services, providing customers with effective solutions for their businesses. Their flagship product, AutoCAD, is widely used in the construction industry by architects, engineers, and designers to conceptualize, draft, and prototype their ideas. As of FY23, the Americas contribute 42% of revenue, Europe and the Middle East 38%, and Asia-Pacific for the remaining.

Review

In my view, ADSK currently holds a dominant share of the market in the sector of cloud-based design and engineering software. In the realm of CAD, ADSK stands as the most widely favored choice. The collaborative workflows within the design and service ecosystem involve active participation from customers, vendors, owners, and other crucial stakeholders, all integrating ADSK’s products. Like other software suites providing extensive support for customer workflows, ADSK’s offerings can demand premium prices due to their prevailing market dominance. When juxtaposed with the overall expenses of a construction project, which might reach millions of dollars, the cost of these products remains relatively minor.

This leads me to believe that ADSK possesses ample opportunity to increase its pricing. Looking back the past few years, we can see that ARPU has been increasing:

“So you raised prices at the end of March, and I’m sure that’s all embedded in your guidance and it allows you to invest appropriately and get to the margins you want.” 1Q23 earnings call

“The uptick in the conversion rate was expected as our maintenance renewal prices increased by 20% in the second quarter, making it more cost-effective for customers to move to subscription.” 3Q2020 earnings

“Effective earlier this month, for all maintenance contracts up for renewal, the price to move to subscription increases 5%, and maintenance plan prices increase 10% if they choose to stay on maintenance.” 1Q19 earnings

Many employees were initially introduced to this software during their time in graduate school and have consistently used it since then. Shifting to a new vendor, even if one is open to learning new software and aligning existing processes, presents a significant inconvenience. Given the company’s strong competitive position and the loyalty it commands, I anticipate that ADSK will continue to have the ability to set prices, ultimately resulting in sustained high-profit margins over the long term.

ADSK’s 2Q24 total revenue was $1.34 billion, up 9% from 2Q23 and 12% on a constant currency basis. AEC’s 14% growth leads the way in terms of revenue growth, driven by EBA revenues and the ebb and flow dynamic of upfront revenues. Both the total RPO (at $5.2 billion) and the RPO (at $3.5 billion) are up significantly, at 11% and 12%, respectively. Non-GAAP EBIT was $489 million, with margins increasing by 200bps to 36%. The company’s FCF was $128 million, and its non-GAAP EPS was $1.91. Objectively, 2Q24 results should not be annualized as some customers’ overage billings have been moved from 2FH24 into 2Q24, allowing ADSK to report better-than-expected 2Q earnings and FCF. I view the shift of EBA (Enterprise Business Agreement) billings from 2FH24 to 2FQ24 as largely reflecting timing and de-risking FY24 guidance and also set up the stage for ADSK to beat FY24 guidance if 2H24 does better than expected. Leading indicators, such as increasing usage and record bid activity on BuildingConnected and cautious optimism from channel partners, were discussed during the 2FQ24 call, suggesting a good chance of a 2FH24 beat. Specifically, the robust performance of the group of EBAs expected to be renewed in the latter half of the year has notably elevated billings, free cash flow, and subscription revenue. This particular group of EBAs had previously been renewed three years ago, coinciding with the onset of the pandemic, and has consistently demonstrated robust acceptance and utilization since that time.

Since free cash flow is the most important operating metric for investors (and me), it’s encouraging to see that ADSK exceeded expectations in 2FQ24. This quarter’s free cash flow of $128 million can be attributed largely to the timing of EBAs. As anticipated, billings decreased by 8% in the second quarter as a result of the shift from upfront to annual billings for multi-year contracts. The total amount of revenue expected to be deferred rose by 14% to $4.2 billion, and management maintained its prior forecast that long-term deferred revenue would level off in the tens percentile. ADSK also saw some multi-year customers switch to annual contracts during 2Q, which was in line with expectations.

Overall, I think the results were very positive, and I feel comfortable about FY24 FCF guidance as 1H24 is already $842 million. However, I think the problem with ADSK comes with the nature of revenue growth. It seems to me that ADSK has been growing through price increases. This is effectively done by either an organic price increase, transitioning offline users to the cloud, or changing multi-year contracts to annual contracts. Although I believe ADSK has a lot of pricing power, there is an end to how much price you can increase before end users churn. The long-term growth driver must stem from volume, and in the near term, the ADSK end-market seems to be facing macro-economic headwinds (which are inherent due to the nature of ADSK end markets like manufacturing and commercial construction).

Valuation

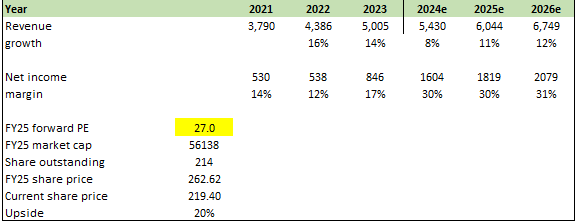

Author’s work

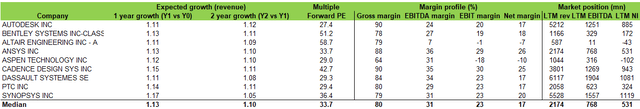

I believe ADSK can grow at low teens (my assumptions) moving forward (FY24 meets management guidance) given it is still seeing momentum in converting multi-year contracts to annual, which will be a tailwind to pricing (giving ADSK a reason to raise prices every year) and also capturing volume from growth in end-markets (should revenue as the economy recovers). I used consensus FY24/25/26 estimates for net margin, which I think will expand given that ADSK has very high gross margins, which should translate to high net margins as the business scales. When compared against peers, I would expect ADSK to trade in line with peers given its market position, similar growth profile, and much better margin profile (ADSK has the highest gross margin). However, I acknowledge the near-term concern with the cyclicality in end-markets, and as such, a discount is reasonable today. I assumed ADSK would continue trading at 27x forward PE, a discount to peers, which translates to 20% upside.

Author’s work

Risk & Final Thoughts

Aside the risk of pricing power diminishing, another risk to note is that ADSK might not be able to convert non-compliant users as fast as expected, which could lead to ADSK growing slower than expected.

I recommend a buy rating for ADSK. ADSK is likely to sustain growth in the low teens in the near term, leveraging pricing power and capturing volume from end-market growth. Despite the cyclicality in end-markets causing uncertainty, the potential upside remains attractive. ADSK is a market leader in 3D design software, notably with its flagship product AutoCAD widely used in construction. The company’s dominant market share, collaborative workflows, and ability to command premium prices indicate its strength.

Read the full article here

Leave a Reply