AT&T (NYSE:T) has been a battleground since I started contributing to Seeking Alpha. No matter what, I have remained bullish as I believed there was light at the end of a very long tunnel. While my bullishness has varied from very bullish to just bullish, I am upgrading my stance back to very bullish after AT&T delivered strong Q3 earnings. AT&T has not been a good investment as shares have declined by -46.11% over the last decade, and the only aspect that has softened the blow has been the dividend. For years, the bear case has played out, leaving the remaining long-term shareholders of AT&T frustrated as nothing that AT&T has done changed Mr. Market’s perception. AT&T released its Q3 earnings before the open on Thursday, and the stock was up over 6.5% on the day. After spinning off WarnerMedia and focusing on its bread-and-butter communications business, AT&T looks as if it’s firing on all cylinders and is once again a cash cow. I am upgrading my stance to very bullish as I believe the road back to $20 is being forged, and AT&T will turn the corner in 2024.

Seeking Alpha

Following up on my previous article

In my last article about AT&T (can be read here), I discussed how I thought a bottoming process was occurring, my rationale for sticking with AT&T as a long-term investment, their financials, and how AT&T was a broken stock, not a broken company. The market was down on AT&T due to their lackluster free cash flow (FCF) in the first half of 2023, and some questioned whether AT&T would hit their $16 billion FCF goal for 2023. As a long-term shareholder and AT&T contributor, I wanted to follow up with this article as Q3 earnings were released yesterday. For investors who can get through the negative stigma that has been placed on AT&T, I think there is a solid investment lying in the rubble.

AT&T just decimated what remained of the bear case

In Q1 of 2023, AT&T generated $1 billion in FCF, and then in Q2, they generated $4.2 billion in FCF. AT&T didn’t leave a great impression on the market after Q1 earnings as revenue missed estimates by -$80 million, subscriber growth slowed, and FCF came in at $1 billion, significantly lower than the analyst estimates of $2.6 billion. Senior leadership had addressed the huge FCF miss on the earnings call and explained that their capital investments of $6.4 billion, device payments, and incentive compensation all peaked in Q1, which impacted its FCF, but they remained confident that AT&T’s full-year outlook of generating in excess of $16 billion FCF was still intact. The market didn’t put much faith in AT&T and focused on the miss and its debt pile rather than taking management at face value, which looks like a mistake after Q3 earnings.

Steven Fiorillo, AT&T

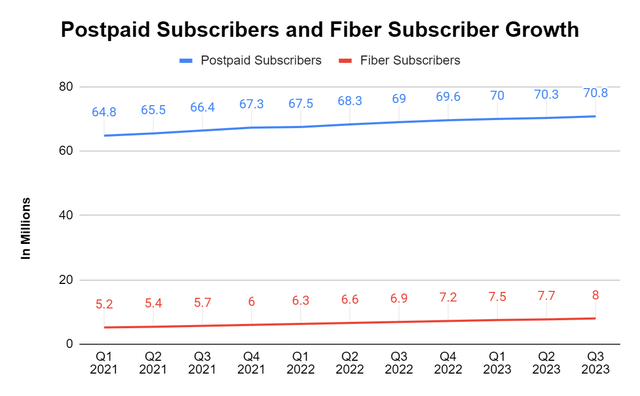

For the past 10 consecutive quarters, AT&T has increased its number of postpaid subscribers within the mobility business and the number of subscribers utilizing AT&T fiber. This led to a top and bottom line beat for AT&T, delivering $30.35 billion in revenue ($110 million beat) and $0.64 in EPS ($0.02 beat). The continued subscriber growth led to a 1.98% YoY increase in cash from operations to $10.3 billion and a 31.58% YoY increase in FCF to $5.2 billion from $3.8 billion YoY in Q3. In Q3, wireless revenue grew $571 million, which was a 3.7% increase YoY, while the average revenue per unit increased 0.6% to $55.99. The amount of EBITDA generated from mobility in Q3 increased 7.6% to $8.9 billion as AT&T added roughly 468,000 net additions throughout the mobility segment.

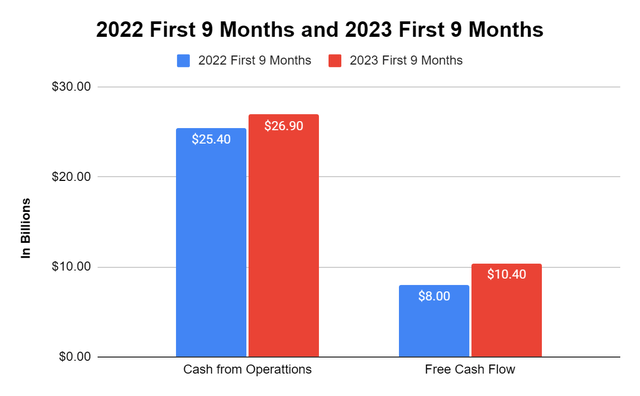

Much of the bear case surrounding AT&T was based on whether they could deliver their FCF guidance, as this was correlated to their ability to service and reduce debt. The major scare in Q1 left the first half of 2023 unstable, as only $5.2 billion of FCF was generated from AT&T’s operations. This meant that AT&T would need to generate at least $10.8 billion or $5.4 billion in Q3 and Q4 to reach their guidance of $16 billion. AT&T came in with $5.2 billion of FCF in Q3 as its cash from operations increased $1.5 billion or 5.91% in the first nine months of 2023 while their total free cash flow increased 30% YoY in the first nine months of 2023 to $10.4 billion. AT&T came out with a raised guidance for its FCF as earnings were released and now expects to generate roughly $16.5 billion in FCF for 2023.

Steven Fiorillo, AT&T

While it’s been a difficult decade, 2023 hasn’t been good for shareholders of AT&T as shares have declined -17.8%. In addition to AT&T being a legacy company that isn’t grabbing headlines, an ongoing negative stigma about its debt has continued to grow. The bottom line is that AT&T is wildly profitable, critical to our way of life, and growing its customer base. AT&T is positioned to pay down its debt, reduce its leverage, and offer a long-term value proposition for shareholders. Q3 may be a turning point as many questions have been answered about AT&T’s ability to generate FCF, and I will discuss the value proposition in the following section.

Seeking Alpha

An updated look at AT&T’s debt profile and why the fear of debt is overblown

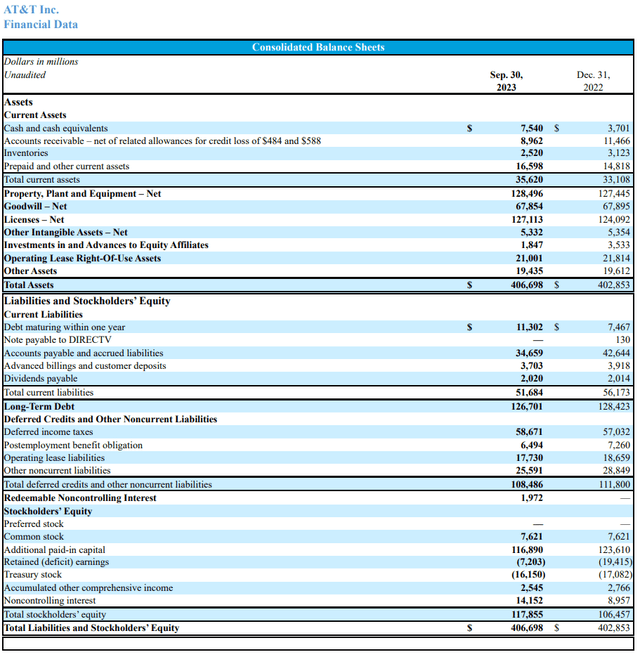

AT&T raised guidance on its FCF to $16.5 billion, so I am going to be conservative and use $16 billion as the baseline. AT&T currently has $7.54 billion in cash on hand, with $2.02 billion in dividends payable for Q3, $11.3 billion in debt maturing in the next year, and $126.7 billion in long-term debt. Using $16 billion in FCF provides AT&T with $4 billion in FCF quarterly, which they retain roughly $1.98 billion after dividends are paid.

AT&T

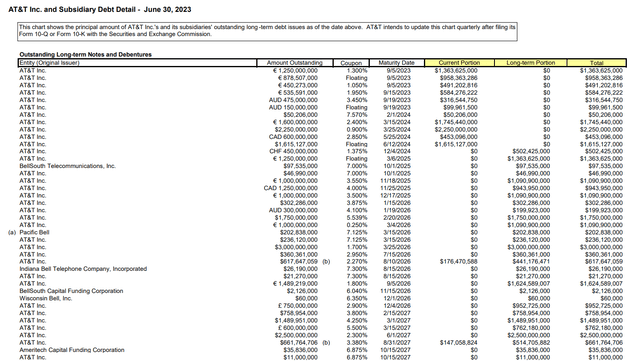

AT&T has not updated their debt details and the debt profile is still as of June 30. What we know is that the debt maturing within one year is $11.3 billion, and there is $126.7 billion on their balance sheet in long-term debt. AT&T has $7.54 billion in cash on hand and is retaining $1.98 billion in FCF after dividends. Here is what AT&T’s debt profile looks like over the next several years:

- 10/1/23 – 9/30/24 $11.3 billion

- 10/1/24 – 9/30/25 $1.87 billion

- 10/1/25 – 9/30/26 $12.7 billion

- 10/1/26 – 9/30/27 $6.98 billion

While AT&T has a large amount of debt on the balance sheet, it is absolutely manageable without refinancing due to AT&T’s FCF. I am going to walk through a blueprint for the next $32.85 billion of debt due through 9/30/27.

From 10/1/23 – 9/30/24, $11.3 billion of debt is due per AT&T’s balance sheet. There is $7.54 billion in cash, and AT&T will retain $7.92 billion in FCF over the next 12 months, placing their pool of capital to repay debt at $15.46 billion. AT&T can eliminate the next year’s debt and roll into the next year with $4.16 billion in cash.

From 10/1/24 to 9/30/25, AT&T has $1.87 billion of long-term debt coming due. They can pay for that with cash on hand and still have $2.29 billion in cash. AT&T will generate another $7.92 billion in retained FCF during this year, placing their cash at $10.21 billion.

AT&T’s largest amount of debt coming due comes in the 10/1/25 – 9/30/26 year, with $12.7 billion in long-term debt maturing. AT&T could start this period with 80.39% of their maturing debt sitting in cash based on the debt repayment plan I have outlined above. Between the $10.21 billion in cash and the $7.92 billion in retained FCF, AT&T could eliminate this mountain of debt and finish this period with $5.43 billion in cash.

In the 10/1/26 – 9/30/27 year, AT&T has $6.98 billion of debt coming due. They could start the year with $5.43 billion, and after factoring in the $7.92 billion retained FCF, they could eliminate this period’s debt and finish the year with $6.37 billion in cash.

AT&T

For far too long, people have used AT&T’s debt profile as their bear thesis. AT&T is a capital-intensive business that needs to tap the debt markets. Debt is only a problem if it can’t be serviced or repaid. AT&T has built a cash cow that generates tens of billions in profits. Based on the simple plan I outlined above, AT&T can continue spending the same amount on CapEx and paying the dividend while eliminating $32.85 billion of its debt. Over the next four years, AT&T will have $32.85 billion in debt coming due, and they have $7.54 billion cash on hand while having the ability to retain $31.68 billion in FCF after dividends. Based on AT&T’s debt profile, there is never a point where AT&T would be in a position where the debt isn’t manageable as long as they continue generating $16 billion of FCF annually.

A strong point that could be overlooked is that from 10/1/24 – 9/30/25, AT&T only has $1.87 billion in debt due, which they can pay directly from their cash on hand. There is an opportunity for AT&T to either rebuy debt with their retained FCF throughout the year at a discounted price or invest that capital at higher rates from risk-free assets to generate hundreds of millions in interest income. AT&T’s debt is overblown, and over the next four years, AT&T has the ability to reduce its debt load from $138 billion to $105 billion. This would cause their debt-to-EBITDA ratio to go from 3.08x ($138 billion debt / $44.86 billion EBITDA TTM) to 2.34x ($105.15 billion debt / $44.86 billion current EBITDA TTM) over the next four years.

Conclusion

I am upgrading my stance on AT&T, and while a dark cloud may still surround it, this cash cow is turning the corner. I think the biggest misconception is AT&T’s ability to repay its debt because people look at the debt owed rather than the schedule of debt in relation to AT&T’s continuing operations. In the TTM, AT&T has generated $44.86 billion in EBITDA, and in the past nine months, they have produced $10.3 billion in FCF. As long as management keeps everything boring and doesn’t go off on any tangents, they have the ability to win the long game. Investing in AT&T is going to take time to play out, but I believe the road to $20 has been forged with AT&T’s increased guidance, and there is a road being paved back to $30 over the next several years if management can follow a similar debt reduction plan as to the one I provided above. AT&T could have less than $100 billion in debt in several years and get back to growing the dividend. AT&T is a cash machine that is being undervalued because people aren’t taking the time to understand their debt profile.

Read the full article here

Leave a Reply