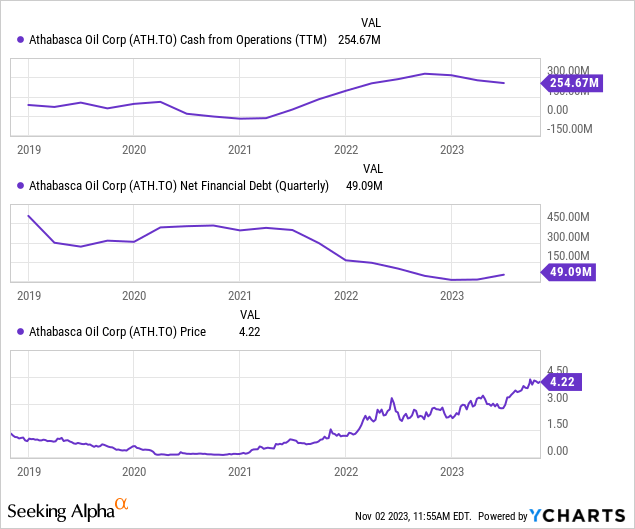

Athabasca Oil Corporation (TSX:ATH:CA) is a strong Canadian small cap oil company with great potential earnings in coming years. The company put out another strong set of results recently with their third-quarter earnings report. The stock is heavily levered to both heavy oil and trades at a discount due to its smaller size than Canadian oil majors. The key to the Athabasca thesis is the company continues to increase cash flow, pay down debt, and buy back a significant amount of the float. These buybacks should ramp up in 2024 allowing for a sizable capital appreciation opportunity, which is essential since ATH does not pay a dividend. The other benefit of Athabasca is the lack of exposure to natural gas, which continues to be under pressure due to heavy supply and strong production in North America.

Q3 excellence

Q3 earnings were strong for Athabasca with combined growth in both light oil and the larger thermal oil division. Total production has grown to 36,200 barrels per day with additional growth of at least 4,000 barrels expected by mid-2024. 10% growth is quite solid in the oil patch and reflects a conservative use of funds, with 75% of the remaining cash flows going to share repurchases. For Athabasca’s Q3 production, 31,691 barrels were from the thermal oil division which carries a low 1-9% royalty contribution at the moment. This is the main revenue and income driver for the company at over 90% of the operating income. The main two areas for ATH for thermal (heavy) oil are the Leismer and Hangingstone areas of Alberta, Canada. Royalty payouts will stay low from the Leismer area of Alberta until 2027, allowing significant additional cash flow for investors in the medium term. This area has proved and probable reserves of 698 million barrels – giving a large runway of production into the future. The company also expects significant investment in the area will mean a $5 per barrel margin improvement for Leismer, meaning significantly more cash flow from operations in coming years. This is due to a ramp-up of paired wells providing better economics per well. Per barrel netback (profit net of operating costs) for Leismer is $7 higher than Hangingstone already at $55.17/barrel in Q3, with Athabasca’s major focus on this area due to the strong well economics in the area.

Light oil barrels per day were 4,485 of which 55% were liquids. At just $31.50 netback and operating income of $13 million CAD, it is clear why the capital expenditures and focus are on the heavy oil portion of the business due to high profitability. This led to an operating income of $168 million CAD in Q3, up solidly over Q3 2022 at $140 million. Athabasca has $2.8 Billion CAD of tax pools from losses and exploration, making cash taxes low for the foreseeable future and also boosting cash generation. This is a large amount of value for a company trading at just $2.38 Billion market cap today with a net cash balance. The balance sheet is in excellent shape now, a far cry from a few years ago, with net cash now of $155 million. This gives the company the optionality to acquire additional production, although many investors are pushing for 100% of the cash back in the form of buybacks. This is due to the long life of Athabasca’s current asset base and strong cash flows already online.

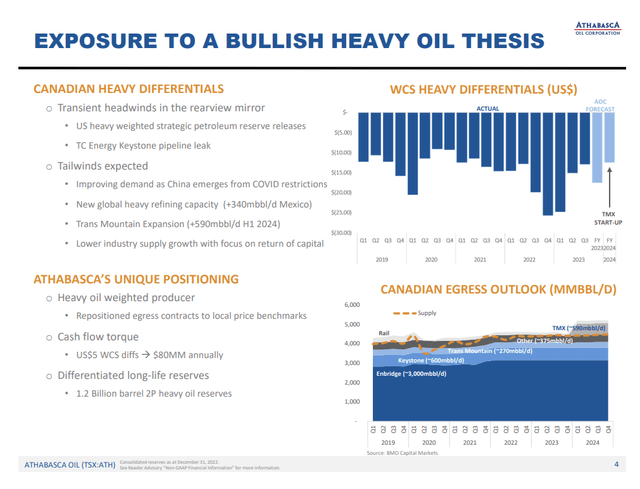

WCS differential (ATH IR Nov 2023)

Catalysts for coming months

One key catalyst for heavy oil producers in Canada is the TMX pipeline coming online in early 2024. This will provide around 590,000 barrels of additional capacity each day for heavy oil to refineries in the United States. This should help reduce the heavy oil differential from the $15-$20 level to close to $10 over time. Additional refinery capacity is coming online for heavy oil as well, as Dos Bocas Olmeca comes online in 2024 with 340,000 additional barrels of daily heavy refining. This helps increase demand in North America for heavy barrels which benefits the oil sands producers north of the border like Athabasca. Keep in mind the United States strategic petroleum reserve release was mostly heavy oil which also had downward pressure on the differential in the past year and a half. Now the setup is great for the Western Canadian Select differential to improve, benefitting the heavy oil players in Canada. Short-term seasonality with winter approaching is causing the differential to widen temporarily, but equities are shrugging this off due to the pipeline expansion around the corner.

2024 guidance will also be given in December and will provide another catalyst for ATH shares as the market is underestimating potential cash flow for 2024. It’s possible management could move to 100% cash flow going to share repurchases from the current 75%. That would give an additional boost to the share price and provide even greater stability in the stock. The stock has performed well with a gain of 46.7% for the past year versus 13.9% for the S&P 500 with significant potential upside in the coming years as well. The company can continue to grow both production and buyback 10% of the float in coming years, leading to significant share price increases. Longer term a dividend isn’t out of the question either, but Athabasca realizes its stock is mispriced and will focus on buybacks first to maximize gains for shareholders.

Conclusion – Strong buy on 2024 potential

Athabasca has some large inherent risks as an oil stock and a small cap company. Large shareholders can move the price significantly and quickly, plus oil prices will be a large portion of the stock’s movement over a long period. However, the fundamentals of the underlying business are undeniably very strong with net cash and strong production growth. A neutral view of oil in the $70-$90 range over the coming years is enough to be very bullish on ATH. Seasonality may put some pressure on oil in the short term, but spring 2024 is a very exciting time for the industry in Canada. Differentials and production improvements into 2024 will increase profitability significantly for ATH and make the stock a strong buy at $4.20 per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply