Investment Thesis

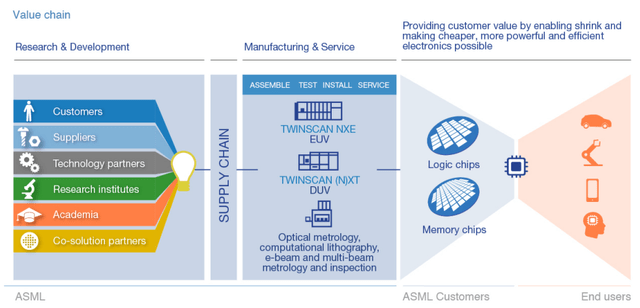

ASML Holding N.V. (NASDAQ:ASML) (OTCPK:ASMLF), is an industry-leading company at the forefront of semiconductor lithography technology. ASML has established itself as a pivotal player in the semiconductor manufacturing ecosystem. Their cutting-edge photolithography equipment plays a vital role in enabling the production of the world’s most advanced microchips, driving the digital revolution. With a commitment to innovation and precision, ASML has secured a near-monopoly position in Extreme Ultraviolet lithography, a transformative technology in the semiconductor industry. Their relentless pursuit of technological excellence, coupled with a unique market position, positions ASML as a global powerhouse poised to shape the future of microelectronics.

Value Chain (ASML Website)

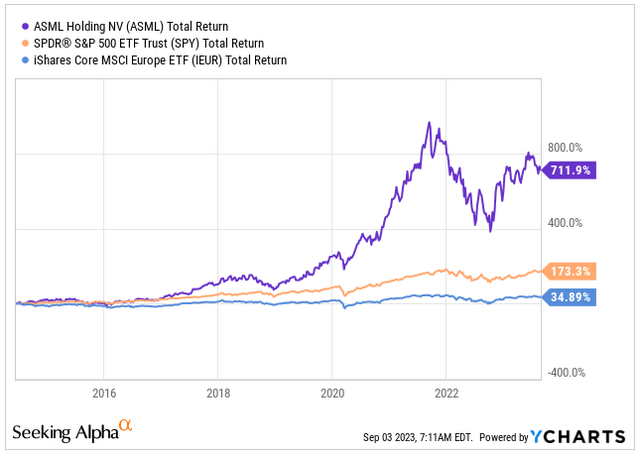

ASML’s performance over the past decade has been truly impressive, consistently outpacing the total returns of both the S&P 500 and MSCI Europe. While the company has slightly trailed its competitors like Applied Materials (AMAT) and Lam Research (LRCX) in recent times, this dynamic is poised for change in the coming decade. ASML currently holds a near-monopoly position in EUV technology, with no competitors even close to challenging its dominance.

In its most recent financial report, ASML continued to shine, achieving a remarkable 27% YoY growth in revenue and raising its full-year 2023 guidance from an initial 25% to an even more impressive 30%.

With a backlog that’s completely booked and operations running at full capacity in the DUV equipment segment, coupled with the construction of new fabs in the United States and Europe, my expectations are high. I anticipate ASML will not only meet but exceed the upper end of its guidance over the next seven years, solidifying its position as an industry leader and driving further growth.

Total Return (Seeking Alpha / YCHARTS)

Impressive Financial Performance and Expanding Profitability

ASML’s Q2 results, continued to exceed expectations, showcasing the company’s resilience in the face of market dynamics. Their Q2 revenue reached €6.9 billion, falling within the guided range of €6.5 billion to €7 billion but surpassing analyst predictions of €6.74 billion. This achievement reflects an impressive YoY growth rate of 27%.

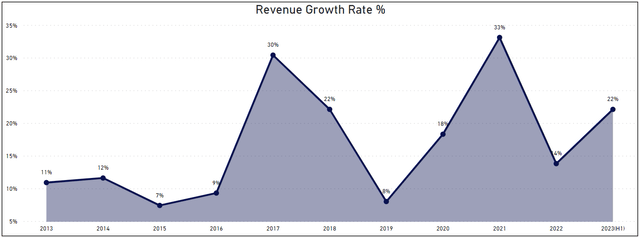

While a top-line growth of 27% YoY is indeed impressive, ASML has proven capable of achieving even greater expansion. In the last decade, ASML achieved its highest revenue growth rate of 33% in 2021, driven by the surging chip demand prompting companies to scale up production capacities. Throughout this decade-long period, the company has consistently delivered robust growth, boasting CAGR of 17.3%.

Revenue Growth Rate (Author’s Graph (Data ASML IR))

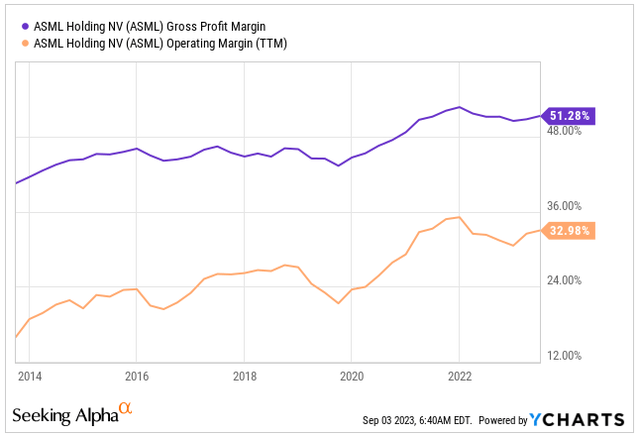

Turning to the bottom-line financial performance, ASML continues to impress with its margin growth. In Q2, the gross margin expanded to 51.3%, marking an increase from 50.6% in Q1 and 49% compared to the same period last year. The positive gross margin development also translated into a stronger operating margin of almost 33%, further propelling the EPS to €4.93. In the last decade, the company has consistently boosted its profitability, primarily fueled by the advantages of economies of scale, its near-monopoly status granting them edge in pricing, and advancements in technology.

Gross & Operating Margin (Seeking Alpha / YCHARTS)

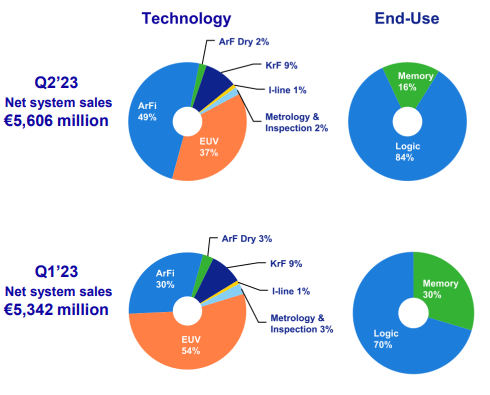

During the quarter, ASML shipped 107 new systems, marking a substantial 29% increase compared to the previous year. This surge in shipments was primarily propelled by robust demand for DUV machines. ASML finds itself in a situation where demand for DUV machines outpaces its production capacity, underscoring the exceptional strength of this market segment. Consequently, ASML anticipates faster growth in the DUV sector for the current year, surpassing earlier expectations.

Nonetheless, the performance of ASML’s advanced and higher-priced EUV machines has shown some disappointment, dropping from 54% of net system sales in Q1 to 37% in Q2 2023. This can be attributed to the challenges faced in establishing new fabs in the United States and Europe, where major players like TSMC (TSM), Intel (INTC), and Samsung (OTCPK:SSNLF) are grappling with a range of issues, including a shortage of skilled workers, leading to delays in the commencement of production. As a result, EUV sales have been impacted, as these fabs are not yet in a state of readiness to receive and deploy the machines. In my view, these delays may persist for couple more quarters, however it’s important to emphasize that this setback is not a consequence of insufficient demand or operational problems on ASML’s part. Instead, it stems from ASML’s necessity to postpone the recognition of revenue due to a shift in the timing of demand as ASML can only recognize revenue once the machine has been successfully delivered to the customer.

Sales Breakdown (ASML IR)

Strong Growth Prospects Despite China Export Restrictions

One of the standout qualities of ASML as a company is their clear and dependable guidance, which offers a straightforward view of their business outlook. Their ability to effectively manage a significant backlog provides us with a strong sense of what the company is likely to earn in the years ahead.

In their recent earnings call, ASML revealed their projection for year-end net sales growth, targeting an impressive 30%. This surpasses their previous estimate of over 25% and exceeds the 27% growth reported for the first half of 2023. This remarkable growth is primarily driven by a surge in DUV revenue, although it’s expected to be somewhat offset by lower expectations for EUV and installed base management. Additionally, ASML holds an optimistic view of a slight improvement in gross margin compared to 2022. They attribute this optimism to the positive margin impact of increased DUV immersion revenue, which is expected to counterbalance the dilution resulting from reduced upgrade revenue in 2023.

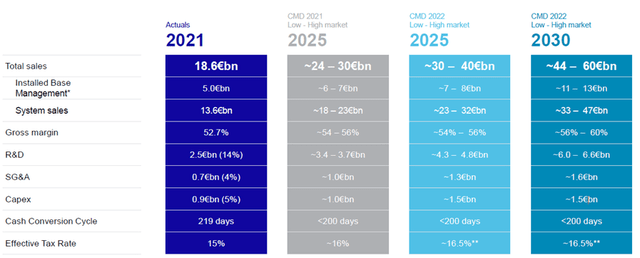

During ASML’s Capital Market Day in 2022, the company unveiled a revised financial model for 2025 and 2030. According to this model, they anticipate achieving sales ranging from €24-30 billion in 2025 to a substantial €44-60 billion in 2030. If they successfully reach the €60 billion sales mark in 2030, it would signify an impressive compound annual growth rate of 14% from their 2022 revenue. While slightly below the past decade’s CAGR of 17.3%, this growth trajectory is nonetheless exceptional.

ASML Guidance (ASML IR)

ASML’s anticipated growth is set to significantly outpace the industry average, which is expected to hover around CAGR of 7.4% from 2023 to 2033. The primary reason for this disparity is ASML’s notable lead over its competitors, driven by substantial investments in R&D. These investments have yielded substantial technological advancements and have positioned ASML at the forefront of EUV technology. This technological edge is expected to become increasingly critical in the upcoming decade.

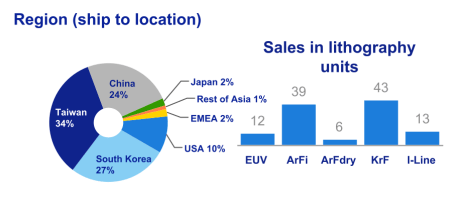

From my standpoint, one area of concern within the business landscape is the growing restrictions surrounding the shipment of DUV machines to China. The situation is more severe for EUV machines, which are entirely banned from export to China. These restrictions on DUV exports to China continue to expand.

Compounding the issue, delays in the construction and deployment of new fabs in the United States and Europe have led to a postponement of revenue from these regions. In contrast, China has played a pivotal role in driving revenue during Q2.

In Q1 2023, revenue from China constituted a mere 8% of the total, a portion that could have been readily replaced by the demand for DUV and EUV machines from the United States and Europe. However, in Q2, revenue from China surged, contributing a substantial 24% of the total. As the year-end approaches, ASML will need to navigate the process of obtaining export licenses for shipments to China, which could potentially impact top-line growth.

While I maintain confidence that these challenges should not pose significant long-term hurdles for ASML, in the short term, we might witness slightly lower revenue growth than initially projected. This outcome hinges on whether there are further delays in the deployment of new fabs in the United States and Europe.

Sales by Region (ASML IR)

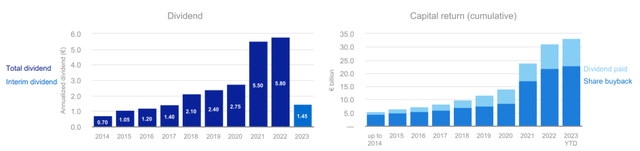

Return to Shareholders

ASML’s return to its shareholders has been truly remarkable. Over the past nine years, the company has consistently increased its dividend at a impressive CAGR of 26.5%. Although the dividend yield currently stands at a relatively modest 0.95%, the payout ratio remains low at just 24.42%. This leaves significant room for future growth in dividends, particularly when considering the expected earnings growth in the years ahead.

Dividend & Share Buybacks (ASML IR)

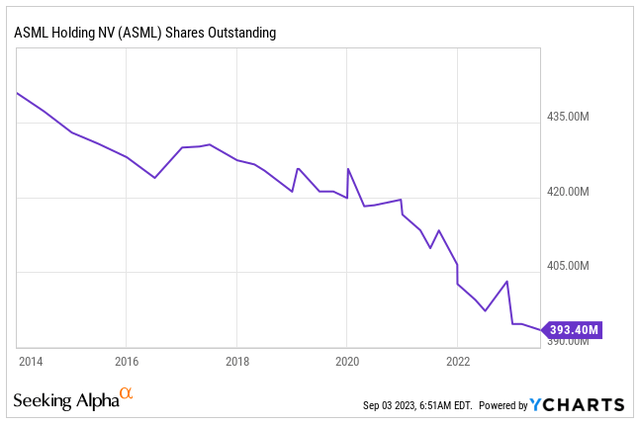

Beyond the remarkable dividend growth, ASML is also actively participating in share buybacks. Interestingly, the company has actually allocated more funds to the share buyback program than to dividends in absolute terms. While years like 2020 and 2021 weren’t ideal for buybacks due to the stock’s soaring prices, 2022 and 2023 have provided favorable conditions as the company’s stock traded below its estimated fair value. Since 2013, ASML has successfully bought back approximately 10.8% of its outstanding shares.

Shares Outstanding (Seeking Alpha / YCHARTS)

Valuation

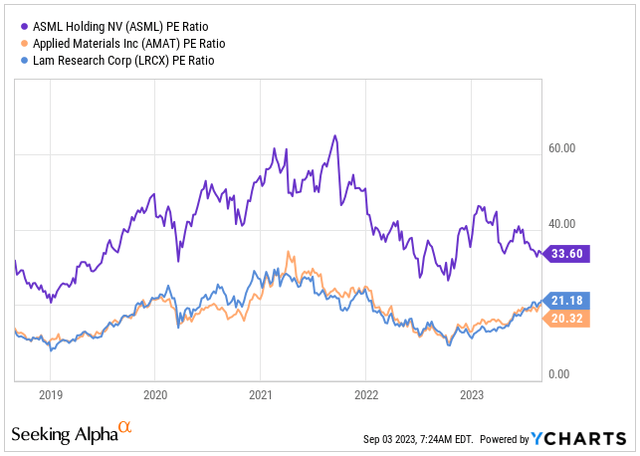

In terms of valuation, ASML doesn’t appear to be cheap by any means; instead, it carries a significant premium compared to its competitors like Applied Materials and Lam Research. Currently, ASML is trading at a PE ratio of 33.60x for this year, while Applied Materials trades at 20.32x and Lam Research at 21.18x. This translates to a premium of more than 60%.

From my perspective, the rationale behind this premium is rather straightforward. ASML enjoys an exceptional market position, particularly in its monopoly-like status in EUV technology. The company is well-positioned to capitalize on this advantage in the years ahead. While it’s true that advancements in competitors’ technology could potentially challenge this unique positioning, the high cost of research and development and formidable barriers to entry make me believe that ASML is in a favorable position, even with its premium valuation relative to its peers.

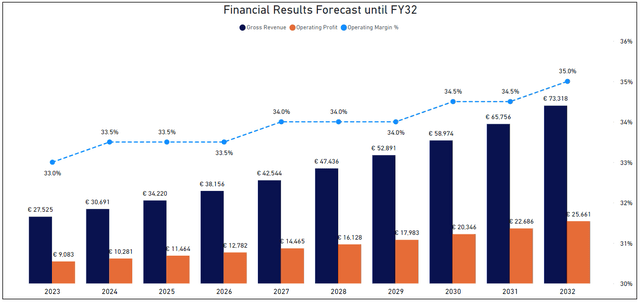

PE Ratio vs. Peers (Seeking Alpha / YCHARTS)

To calculate ASML’s Fair Value, I’m using DCF Model. In constructing the Financial Projection for the next decade, I’m adopting the upper end of management’s revenue guidance, envisioning that sales will reach approximately €58.9 billion by the end of 2030. This projection reflects a Compound Annual Growth Rate of 13.5% from 2022 sales, coupled with a slight expansion in Operating Margin, growing from today’s 33.0% to 34.5%, aligning with the management’s expectations. Furthermore, I anticipate that the operating margin will continue to expand, reaching at least 35% by 2032. Concurrently, I foresee a slowing in the sales growth to a CAGR of 10% beyond 2030.

Financial Projection (Author’s Graph (Data ASML IR))

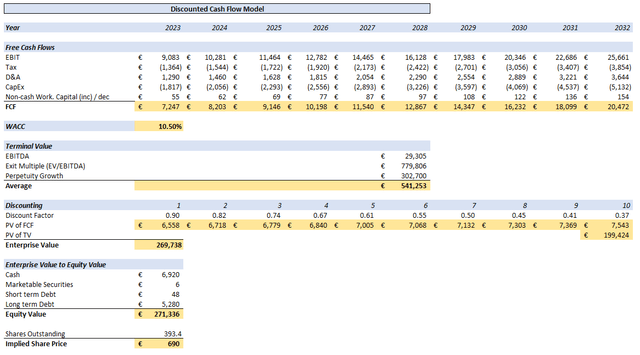

In addition to the growth assumptions mentioned above, I’m using WACC of 10.50%, a Tax Rate of 15.02%, and a Terminal Growth Rate of 3.5%, which tends to be on the more conservative side. Drawing insights from historical data, I’ve estimated that Depreciation & Amortization and CAPEX are likely to fall within the approximate range of 14.2% and 20%, respectively, relative to EBIT.

Moreover, I’m applying an EV/EBITDA ratio of 26.61 to calculate the Average Terminal Value. After discounting these values over the next 10 years, the PV of FCF amounts to approximately €70.3 billion, while the PV of TV reaches nearly €200 billion. Consequently, the total Enterprise Value is estimated at €270 billion. Following adjustments for Cash, Marketable Securities, Short & Long-term debt, the resulting Equity Value is assessed at €271 billion.

DCF Model (Author’s Graph (Data ASML IR))

My calculation suggests that the Fair Value of the company stands at €690 ($745 for the ADR), indicating an undervaluation of 11.5% when compared to today’s price of €612 ($663 for the ADR).

Conclusion

ASML has once again delivered an impressive financial performance in Q2, achieving a remarkable 27% YoY revenue growth. Notably, the company has revised its full-year 2023 guidance upward from the initial 25% to a more robust 30%.

ASML’s exceptional position in its well-established DUV business, complemented by its near-monopoly status in the EUV sector, places it in a prime position to capitalize on the burgeoning demand in the years ahead. Anticipating nothing less than a CAGR of 14% over the next seven years, ASML’s growth prospects remain promising.

Although delays in the construction and deployment of new fabs in both the United States and Europe have exerted pressure on EUV equipment sales, the DUV segment has admirably compensated for this. However, the expanding list of restricted DUV machines earmarked for export to China by the end of 2023 may result in a short-term slowdown in top-line growth. Nevertheless, the long-term narrative appears to be intact.

Based on my calculations, if the upper end of the management’s guidance materializes, I believe the company is currently undervalued by at least 11.5%. Therefore, I rate ASML stock as a BUY.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply