Editor’s note: Seeking Alpha is proud to welcome AP Investments as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

My Thesis

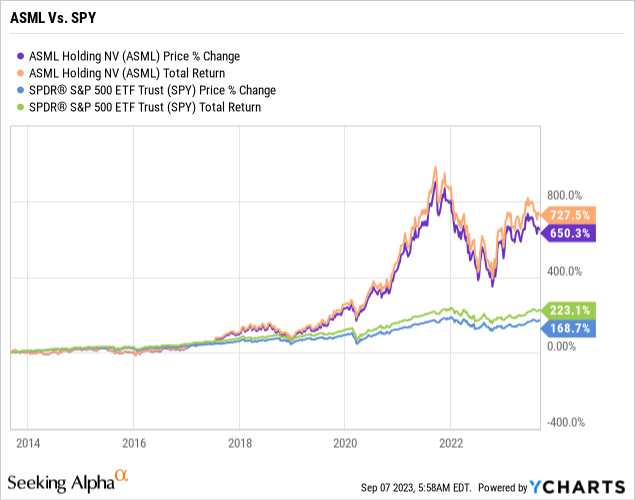

My outlook regarding the future of ASML (NASDAQ:ASML, OTCPK:ASMLF) is decidedly optimistic. The company occupies a distinctive and pivotal position within one of the most critical industries globally. Astute investors possessing a genuinely long-term investment horizon stand to derive substantial benefits from this unique positioning.

As we delve further into our analysis, it becomes evident that I hold a favorable view of the company, both in terms of its qualitative attributes and quantitative metrics. Furthermore, I find the current valuation to be within reasonable bounds. Let us now proceed with a detailed examination of these facets.

Let’s Start With A Little Bit Of History

Photolithography is a precise process in which light is directed onto a silicon wafer coated with specific chemicals to create conductive patterns. This groundbreaking technique, originally observed by physicist J. Lathrop, who inverted his microscope onto a chemical-coated wafer, has since become the cornerstone of chip manufacturing.

Over the years, this technology underwent significant advancements. In the 1980s, GCA initially controlled it, but due to mismanagement and political challenges, the company faltered, leading Japanese firms like Nikon and Canon to assume leadership. Concurrently, a Dutch company, ASML, emerged as a spin-off from Philips. The prevailing technology of the era was Deep Ultraviolet (DUV). Around the same time, Andy Grove and Intel embarked on developing Extreme Ultraviolet (EUV) technology, a significantly more precise method poised to revolutionize chip production.

Recognizing the immense potential and profitability of EUV technology, Intel decided to transfer its EUV technology to ASML, sparing ASML from the monumental resource investment required. This decision posed a formidable challenge for ASML, as EUV technology is exceptionally complex.

The machinery involved is intricate, comprising thousands of distinct components, including the world’s smoothest surface produced by the German firm Zeiss, in which ASML acquired a stake. Due to the colossal development costs, ASML remains the sole entity in the EUV market, controlling 100% of it. Any competitor endeavoring to produce a similar machine would need to invest billions and replicate the extensive engineering expertise developed over many years by ASML’s engineers.

Renowned author Chris Miller, in his book “Chip War,” asserts that it would take a decade for a competing company to develop comparable technology, underscoring the monumental barriers to entry. Even if China were to aggressively enter the market with substantial budgets, success would remain uncertain.

ASML’s advanced technology enables the production of the world’s most advanced chips, primarily serving three major customers: TSMC, Samsung, and Intel. Each of these machines carries a price tag of approximately $150 million, rendering them accessible only to large-scale manufacturers.

Notably, ASML consistently allocates over $3 billion annually to Research and Development (R&D) for further advancements in cutting-edge technologies.

EUV Machine (Phone Arena)

ASML’s Primary Revenue Sources

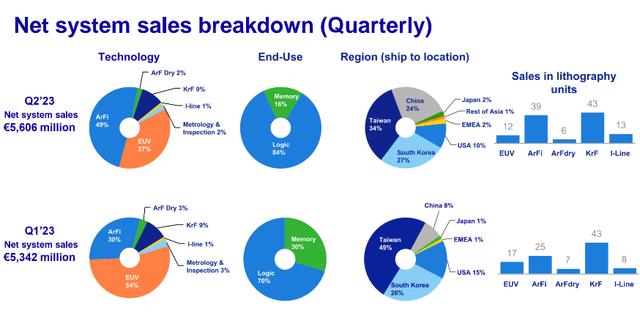

EUV systems comprise the cornerstone of ASML’s revenue stream, encompassing both the presently operational EUV 0.33 NA system and the EUV 0.55 NA (High-NA) system, which has already garnered customer orders.

Furthermore, DUV systems represent a significant source of revenue, as illustrated in the following chart:

ASML IR

As depicted in the chart provided, the majority of the revenue emanates from nations housing semiconductor fabrication facilities, including Taiwan, South Korea, China, and the United States. The substantial revenue derived from Taiwan also presents a noteworthy risk, as will be discussed in greater detail subsequently.

Now, Let’s Explore The Numbers And What The Future May Bring

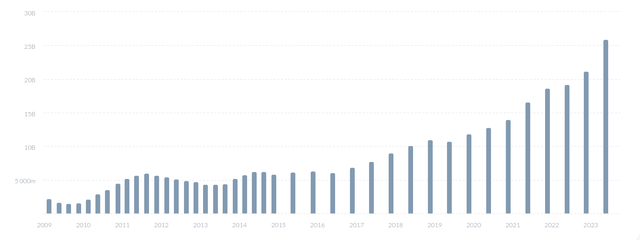

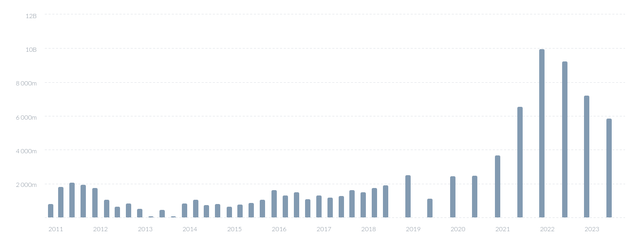

As of late, ASML has demonstrated remarkable revenue growth over the past five years, boasting a compounded

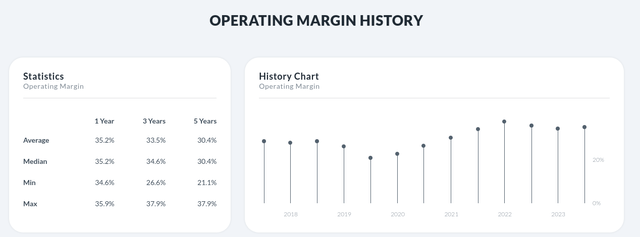

annual growth rate ((CAGR)) of 20%. Concurrently, the company has made substantial enhancements to its profit margins. Over the last half-decade, the gross margin has consistently averaged an impressive 48%, exhibiting a discernible upward trajectory, with the trailing twelve-month (TTM) margin currently standing at 50%. Similarly, the Earnings Before Interest and Taxes (EBIT) margin has maintained an average of 28%, and at present, the TTM EBIT margin registers at 32%.

In my opinion, it’s crucial to recognize that ASML holds significant pricing leverage due to its dominant position in the market. However, what sets them apart is their responsible exercise of this power. They seem committed to keeping pricing levels reasonable, possibly to deter customers from exploring alternative options.

The expansion of profit margins has translated into significant growth in the EBIT line, which has achieved an impressive CAGR of 26%.

Nevertheless, it is crucial to recognize that the intrinsic value of the company derives not solely from its historical performance but also from its future earnings potential. Anticipating the future, the burgeoning demand for advanced semiconductors is poised for further escalation, catalyzed by the AI boom. This upswing is set to complement the already substantial demand within the semiconductor industry, spanning applications such as smartphones, autonomous vehicles, supercomputers, and more.

Wall Street analysts estimate a robust annual top-line growth rate of 18% for the ensuing three years, a projection that appears reasonable but is susceptible to fluctuations contingent upon the cyclical nature of the semiconductor industry. Nonetheless, adopting a long-term perspective underscores the sustained and substantial demand anticipated for semiconductor chips.

operating margin growth (Alpha Spread)

revenue growth (Alpha Spread)

ASML demonstrates commendable returns on capital, factors that, from my perspective, hold paramount importance in the realm of long-term compounding investments. The company boasts an impressive 43% Return on Capital Employed (ROCE) and a commendable 29% Return on Invested Capital (ROIC). It is crucial to emphasize that both of these ratios are indispensable in fostering long-term success.

The combination of elevated returns on capital, coupled with robust growth prospects, engenders substantial value. In most instances, this value creation tends to outperform benchmark standards.

Upon scrutinizing the free cash flow, as one might anticipate, it exhibits a higher degree of volatility and susceptibility to industry cycles. Nevertheless, it is imperative to note that, from a broader perspective, it demonstrates a consistent upward trajectory.

FCF growth (Alpha Spread)

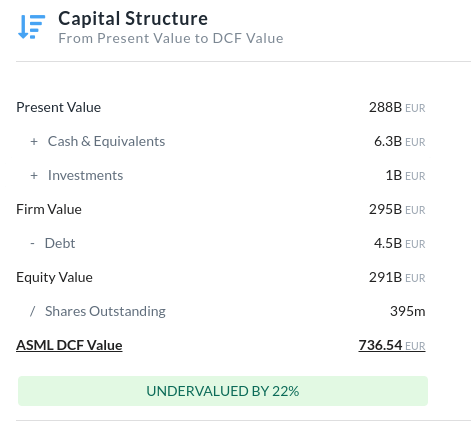

In my opinion, ASML’s financial position is quite impressive. With cash reserves amounting to $6.3 billion, surpassing their long-term debt of $4.5 billion, the company appears to be in a solid financial state. Moreover, their substantial free cash flow suggests they have the ability to easily meet their debt obligations within a year.

Annually, ASML allocates a substantial $3 billion towards Research and Development (R&D), a critical commitment to uphold Moore’s law. In my assessment, these investments represent prudent capital allocation, as they are poised to yield future returns through groundbreaking innovations within the industry.

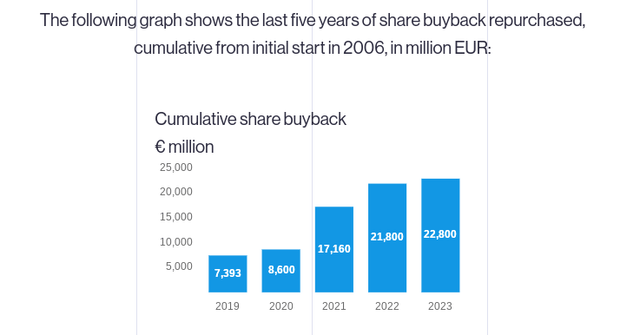

Moreover, ASML provides a dividend yield of just below 1%, alongside a continuous share buyback program. This effort aims to boost earnings per share (EPS), which in turn bolsters the company’s financial robustness and delivers value to shareholders.

ASML Cumulative share buyback (ASML investors relations)

Valuation

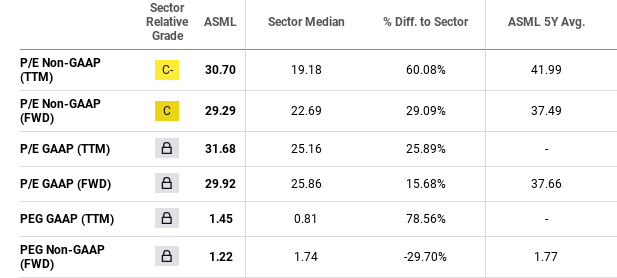

In my view, ASML holds a distinct position as a high-quality compounder, and as commonly recognized, such quality often comes with a premium. However, I believe that we are currently in a favorable moment where a justifiable valuation can be warranted. At present, the stock is trading at an earnings multiple of 33 (non-GAAP), which compares favorably to the 5-year historical average of 41. Similarly, forward earnings stand at 31, below the average of 37. As a result, based on earnings metrics, there is potential for multiple expansions, especially for those with a long-term investment perspective.

Valuation Multiples (Seeking Alpha)

For the calculation of Free Cash Flow (FCF) yield, I have considered the average 3-year cash flow, dividing it by the market capitalization. This calculation yields an FCF yield of 2.9%, surpassing the company’s historical average of 2.6%. While a higher ratio is often preferred, it is imperative to underscore that ASML deviates from conventional metrics, given its unique market position. This sentiment is mirrored across various ratios, such as PEG and EV/EBITDA, among others.

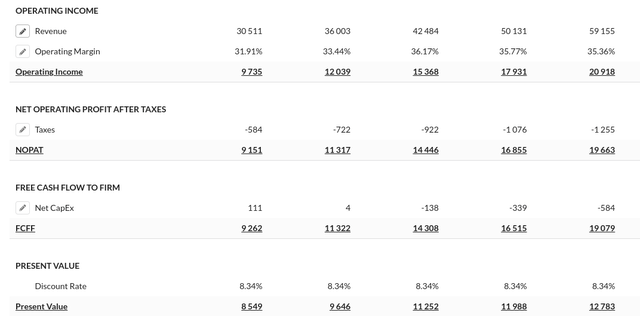

However, in contrast, the valuation picture is less sanguine within my Discounted Cash Flow (DCF) model. Herein, the margin of safety is not as ample as investors might desire. Under optimistic assumptions, with a terminal growth rate of 2%, I have incorporated a top-line growth rate of 18%, relying on analysts’ growth projections for the forthcoming three years. Utilizing a discount rate of 8.3%, as determined by the WACC calculation, Employing a projected EBIT margin of 34%, derived from last year’s margins. the derived stock price approximates EUR736, translating to a 22% margin of safety. It is imperative to recognize that these inputs embody bullish expectations, and the prevailing economic environment carries inherent uncertainties that could potentially impede growth. Therefore, the decision to acquire the stock at its present valuation necessitates a steadfast commitment to a long-term investment horizon.

The capital structure is derived from the Discounted Cash Flow (DCF) analysis. (Alpha spread)

My Inputs (Alpha Spread)

From a technical standpoint, although it falls outside my area of expertise, From a technical perspective, it is apparent that ASML is trading below its 200-day moving average, a situation that, in my view, could represent an advantageous opportunity to commence the accumulation of shares.

1 year chart (TradingView)

Risk Factors

China has expressed a keen interest in ASML, with a strong desire to explore the possibility of developing their own EUV (Extreme Ultraviolet) systems. This pursuit may potentially trigger heightened competition in the sector. Geopolitical tensions between the United States and China are on the rise, and this year, ASML made an announcement regarding the restriction of EUV technology to China.

In my opinion, insufficient inventory management represents a substantial risk, especially given the significant investment associated with each ASML system, which amounts to hundreds of billions of dollars. Ineffective management in this aspect could potentially lead to a decline in profit margins.

ASML may encounter difficulties in meeting the escalating demand for advanced chips anticipated in the future. Failure to address this demand adequately could result in substantial missed opportunities and revenue.

The ongoing tension between China and Taiwan warrants attention as TSMC, one of ASML’s major clients, could be severely impacted. In my view, such a scenario would have profound implications for all parties involved.

Another significant risk, in my assessment, pertains to valuation. My investment thesis relies on a multitude of assumptions, which, by and large, lean towards a bullish outlook. Nevertheless, there remains the possibility of multiple expansions or, in a less favorable scenario, multiple contractions.

Of course, it is imperative to conduct a thorough examination to uncover additional potential risks, and I strongly encourage you to do so.

In Conclusion

As an investor, I have a strong appreciation for ASML’s outstanding qualities. It’s a compounding investment with a remarkable track record in the semiconductor industry, particularly due to its leadership in Extreme Ultraviolet lithography technology.

In my opinion, ASML seems like an appealing choice for investors with a long-term perspective, considering its current valuation. Nevertheless, it’s important to recognize that market conditions can present opportunities to acquire top-quality stocks like ASML at more favorable prices down the road. Therefore, while ASML holds allure at the moment, it’s wise for investors to remain vigilant and watch for potential entry points that could offer even better value in the future.

Read the full article here

Leave a Reply