Arm Holdings plc (NASDAQ:ARM) is a company with possibly lucrative long-term prospects. I expect the company’s energy-efficient chip designs to continue to dominate the mobile space, and in the longer term, the company may grow into other verticals, such as laptops, data centers, and automotive. In the near term, however, I find the company’s valuation already discounts those expectations.

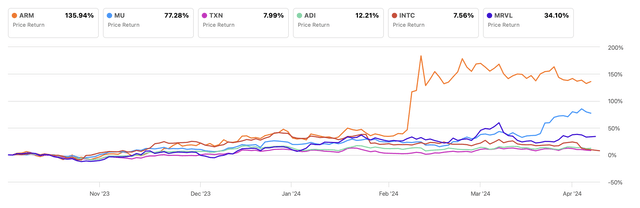

Stock Price Performance

In recent months, ARM stock has materially outperformed its peers, including Micron Technology, Inc. (MU), Texas Instruments Incorporated (TXN), Analog Devices, Inc. (ADI), Intel Corporation (INTC), and Marvell Technology, Inc. (MRVL), as this graph illustrates:

Seeking Alpha Premium Tool

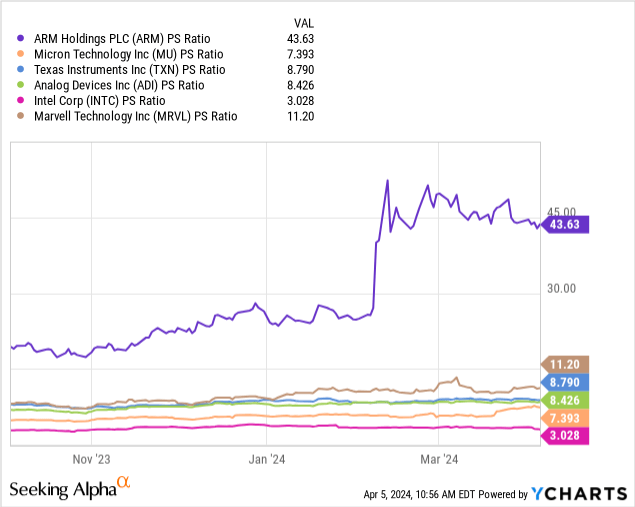

Because multiple companies in the peer group are not profitable or have little profits, a comparable company analysis based on the price-to-earnings ratios would not be informative, so I compared the group using price-to-sales ratios:

The above chart illustrates that ARM is valued in a different league than the rest of the pack, so let’s explore why market participants might believe ARM deserves a price-to-sales ratio that is 5x more expensive than its peer group’s median of 8.4x multiple, which is already quite high.

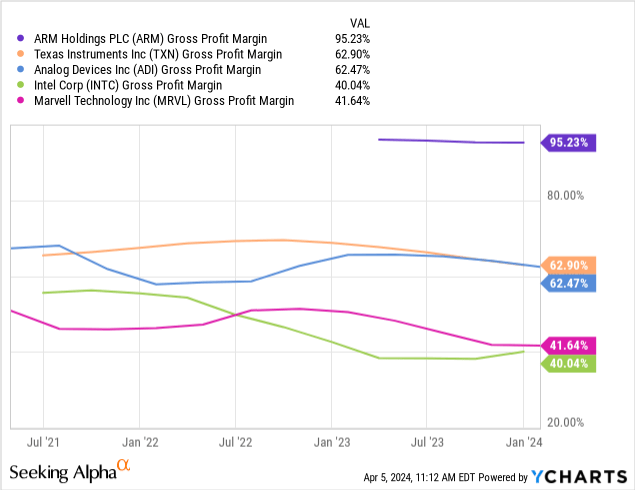

One reason why a company might deserve a higher price-to-sales multiple is that it can generate more profits with a given amount of sales, i.e. higher profit margins, so I wanted to see if this is the case for ARM. The following chart compares ARM’s gross profit margin to the rest of its peer group:

Did you notice that I left out Micron from the above graph? I did so because Micron has a negative gross profit margin, as I discussed in my article titled, Micron: Sell on Valuation, and I recommend reading it.

The above graph shows that ARM indeed has a much higher gross margin than its peer group; in fact, an exceptionally high gross margin of 95 percent!

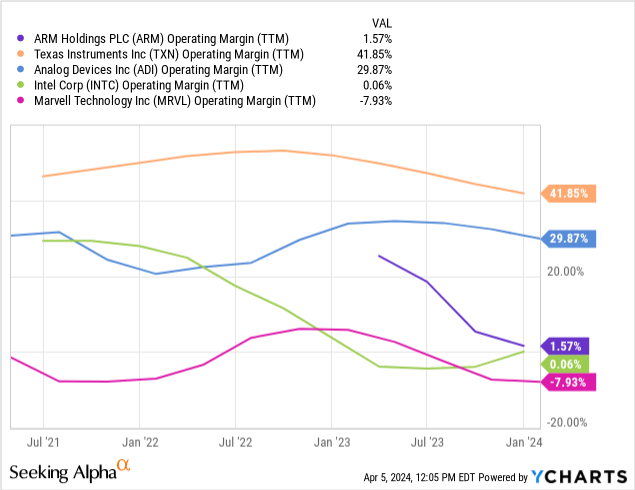

Arm’s IP-licensing business model and royalty-based revenues certainly help, as well as its chip designs’ scalability across multiple verticals, but one level deeper look into the group’s operating profit margin paints a different picture:

The above graph illustrates that ARM’s operating profit margin has declined since its IPO one year ago to near breakeven and materially lower than the bottom line profitability of Texas Instruments and Analog Devices, which I will explore in future articles, so let’s dig into one level further into ARM’s income statement to better understand the disconnect between the company’s gross profit margin and its operating profit margin.

Income Statement Analysis

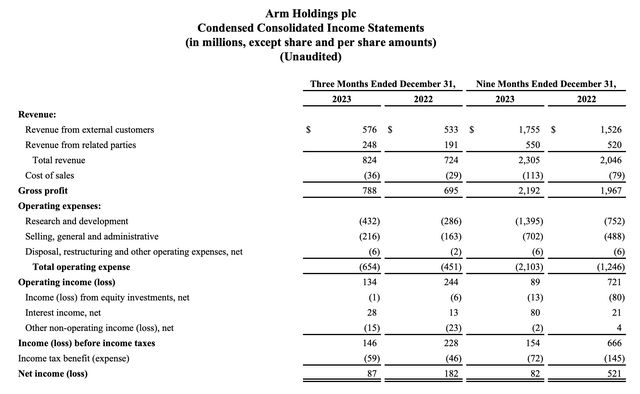

The following table presents ARM’s most recent income statement:

ARM Investor Relations

Based on my review of ARM’s income statements, I note three key points that ARM investors must consider:

- In the nine-month period ended December 31, 2023, 24 percent of ARM’s total revenue was generated from “related parties,” and this percentage reached as high as 30 percent in the most recent three-month period;

- The company’s Research and Development as well as Selling, General, and Administrative expenses grew year-over-year more than its Revenue growth rate, both on a three-month and nine-month basis, indicating that the business may not be benefiting from any operating leverage; and

- ARM’s operating and net income both dropped year-over-year, both on a three-month and nine-month basis.

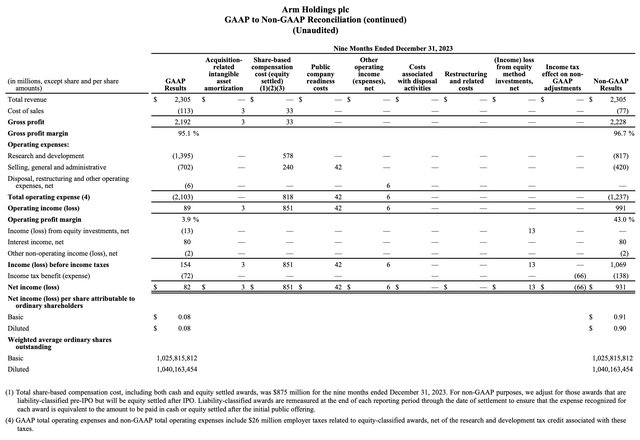

Further, throughout its earnings press release, the company discusses “non-GAAP” results, which primarily exclude stock-based compensation:

ARM Investor Relations

Generally, I review both GAAP and non-GAAP results, try to understand the adjustments between the two sets of results, and decide on a case-by-case basis, which set of results to weigh more in my forecasts and investment decisions. In this case, I decided to base my understanding of the company’s fundamentals on GAAP results because its stock-based compensation expense appears to scale with revenues rather than remain relatively constant to allow for some operating leverage that could lead to higher profit margins in the future.

Animal Spirits

I believe that the Artificial Intelligence theme is making its waves through various stocks, and I’ve been covering the sector in my recent articles and have discussed the red flags I see from extreme sentiment and recent insider selling at Nvidia to low margins and intensifying competitive threats at AMD, to elevated supplier and customer credit risks at Super Micro, to competition hitting fundamentals at Qualcomm.

I recommend reading those articles, too, for a full picture of my skepticism on the theme. If you have any feedback or would like to ask any questions, I’m active in the comments below my articles, and I’d love to learn from you.

Risks to My Analysis

If ARM can extend the dominance of its energy-efficient chip designs beyond the mobile space into other verticals in a profitable and scalable way, then the company could exceed my expectations of low bottom line profitability.

Further, the ongoing excitement around AI stock could deem historical results irrelevant and propel the world into uncharted territory of momentum, and in that scenario, the ARM stock could outperform my expectations.

If you think of other reasons why ARM stock will continue to push higher, please let me know in the comments below.

Conclusion

While ARM’s future potential and asset-light business model may attract certain investors, the disconnect between gross profit and operating profit margins is concerning. The company’s increasing expenses and declining bottom line profitability tell me Animal Spirits may be responsible for the company’s higher price-to-sales ratios rather than superior fundamentals. I rate the stock SELL and plan to update my analysis in future articles.

Read the full article here

Leave a Reply