Television is a medium because anything well done is rare. – Fred Allen

Technology’s advancement and impact on our lives is a megatrend, independent of credit events. That train will not stop. What becomes more of the question is timing and risk management in investing in that future. The ARK Next Generation Internet ETF (ARKW) is a fund focused on investing in companies at the forefront of pioneering technologies, like cloud computing, blockchain, and artificial intelligence. On the surface, this seems like THE way to play the future. But as is usually the case, it’s never that simple.

ARKW is an actively managed Exchange Traded Fund that primarily invests in equity securities of companies that are instrumental in developing next-generation internet technologies. The fund aims to provide long-term capital growth by investing a significant portion (at least 80%) of its assets in both domestic and U.S. exchange-traded foreign equity securities of relevant companies that are focused on technology infrastructure to the cloud, enabling mobile, internet-based products and services, artificial intelligence, the Internet of Things, etc.

ARKW’s investment strategy is centered around the belief that we are living in a world driven by innovation, and investors need to be on the right side of change. The fund’s portfolio is actively managed, meaning ARKW’s investment team handpicks stocks based on their research and analysis. The firm places a strong emphasis on research, studying industries, technologies, and market trends to identify companies with high growth potential. This approach allows ARKW to focus on companies that are driving technological innovation and disrupting traditional industries.

ARKW: A Closer Look at the Holdings

The ARKW portfolio is diversified across several sectors that are expected to be at the forefront of technological advancements.

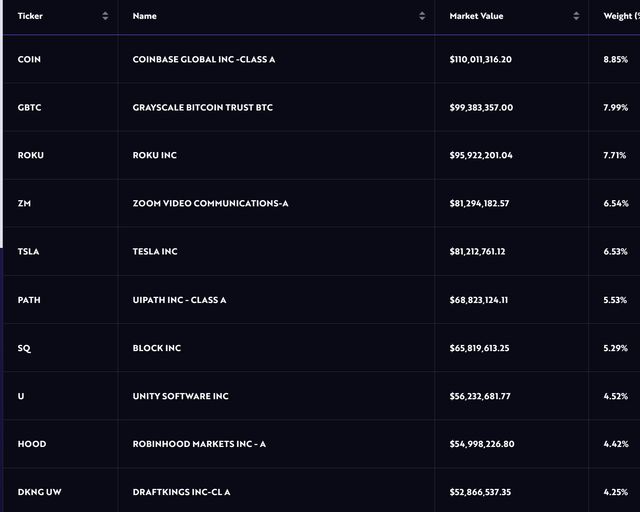

Some of the top investments in ARKW’s portfolio include:

- Tesla (TSLA): A global leader in electric vehicle manufacturing.

- Roku (ROKU): A renowned streaming media company.

- Coinbase Global (COIN): A prominent cryptocurrency exchange platform.

- Zoom Video Communications (ZM): A leading video conferencing service provider.

The holdings are subject to change based on the fund’s ongoing evaluation of market trends and potential investment opportunities. Note the holdings are fairly concentrated – not unexpected in a thematic fund, but one that should be considered for volatility potential nonetheless.

ark-funds.com

Navigating the Technology Breakdown

ARKW’s portfolio is diversified across multiple sectors, each playing a crucial role in the advancement of next-generation internet technologies. The largest allocation is towards cloud computing, which forms the backbone of most modern digital services. Blockchain & P2P technologies have also received significant attention due to their potential to revolutionize financial transactions and data security.

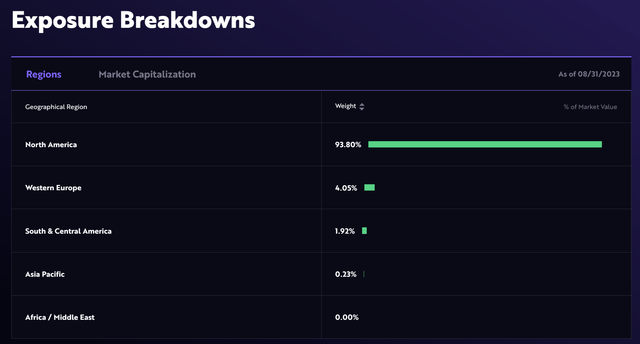

Geographically, ARKW’s investments are primarily focused on North America, followed by Western Europe, South & Central America, and the Asia Pacific. This global investment strategy enables the fund to capitalize on the growth of next-generation internet technologies worldwide.

ark-funds.com

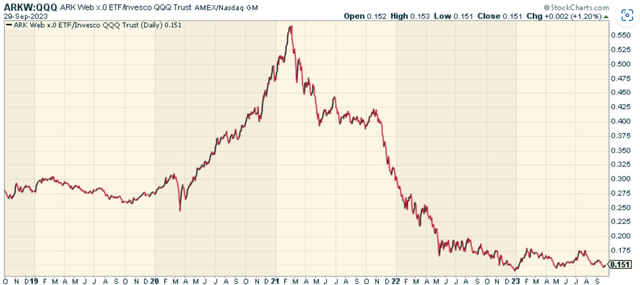

The Reality of Investing in ARKW

Investing in ARKW can be an exciting opportunity, but it’s essential to understand that if an investment thesis is obvious, it’s likely already reflected in stock price. ARKW focuses on disruptive technologies, which are often volatile and unpredictable. This means that while the fund has immense growth potential, it can also experience significant losses and is as prone to narrative shifts in the near-term as anything else. When we look at a chart of ARKW relative to the Qs (QQQ), it’s gone roundtrip in terms of giving back all of its outperformance. This isn’t necessarily a bad thing, but typically when a theme goes through this, it takes many years for relative strength to sustainably come back.

stockcharts.com

Conclusion

This is a good theme and an attractive fund to consider. Just be aware it’s a very long-term play, and that it can be highly volatile. Personally, I’d hold off on allocating here until somewhat cheaper prices, and then just weight this carefully in a portfolio.

Read the full article here

Leave a Reply