ARK Innovation ETF (NYSEARCA:ARKK) has gained massive traction in the past couple of years, especially during its explosive growth in 2021 where the fund soared to over $150 a share. Today, the same ETF trades at about a quarter of its all-time high, and investors are fleeing from the volatile ETF to rotate into safer options like the SPDR S&P 500 ETF (SPY) and Invesco QQQ ETF (QQQ) which still provide exposure to growing industries. In this article, I explain exactly why ARK Innovation ETF may not be a wise investment at the moment.

ARK Innovation ETF

Just as described in its name, ARKK ETF’s main goal is to invest in companies that have demonstrated innovation through their services and products. The selection of stocks for ARKK ETF’s portfolio is based on a vision of investing in the future.

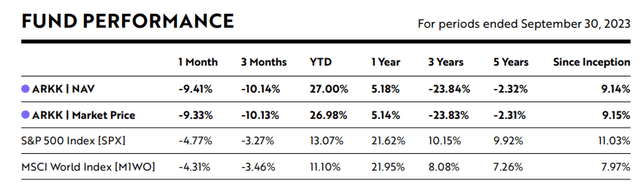

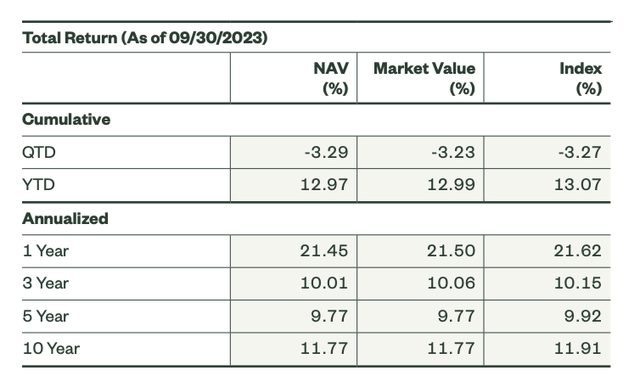

Fund performance

ARKK ETF Fund Performance (Ark Funds)

We first observe that ARKK ETF has done 9.15% annualized returns since its inception in late 2014, though the fund has lost an annualized 2.31% in the past 5 years. In comparison, the popular S&P 500 index, which tracks the top 500 listed U.S. companies, has done 11.03% annualized returns since inception and 9.92% annualized returns in the past 5 years. If we were to calculate the returns of the S&P 500 index from ARKK ETF’s inception date, the index’s annualized returns would be even higher at about 11.7%. All in all, the ETF has failed to outperform the market despite a larger concentration in companies with high potential growth.

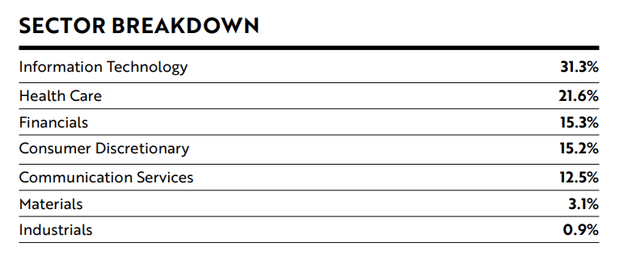

Sector breakdown

ARKK ETF Sector Breakdown (Ark Funds)

ARKK ETF Technology Breakdown (Ark Funds)

Upon observing the sector and technological breakdown of ARKK ETF, we see that the portfolio is largely focused on AI and biotechnology. I must concede that these are indeed promising sectors which may reap massive returns in the long run as we see more technological breakthroughs. It’s completely in line with ARKK ETF’s strategy to catch promising innovative companies that will hit a home run in the long term.

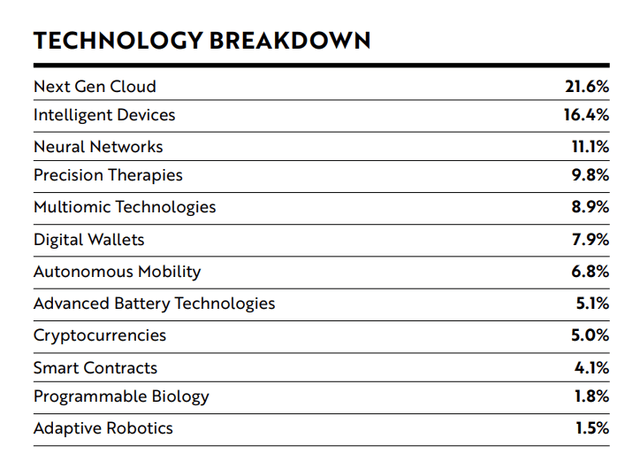

Portfolio analysis

ARKK ETF Top 10 Holdings (Ark Funds)

We see that the top 10 holdings of ARKK ETF make up more than half of the ETF’s entire portfolio. While these companies are all big names many of us retail investors have likely heard of, I do have my reservations with regard to some of the companies in this list.

Let’s take a deeper dive.

A quick search on each company’s financials reveals that as of 2022, 8 in 10 of ARKK ETF’s top 10 holdings returned a negative net income, with Tesla, Inc. (TSLA) and Zoom Video Communications, Inc. (ZM) being the only exceptions. In particular, DraftKings Inc. (DKNG), UiPath Inc. (PATH), Twilio Inc. (TWLO) and Unity Software (U) Inc have had a negative net income since 2019, which is a pretty concerning trend considering a company’s bottom line is a good indicator of its profitability. While we may have to account for market conditions like interest rate hikes, and uncontrollable wars that may have impacted the price and profitability of companies in general, to be consistently at a net loss for the past 4 to 5 years is not negligible, especially if these companies make up almost half of ARKK ETF’s top 10 holdings. One may argue that this is a tradeoff for future growth, but as an investor, one must truly evaluate the risk-to-reward ratio of investing in an ETF.

Expense ratio

Being an actively managed ETF, ARKK ETF’s expense ratio is 0.75%, about 8 times that of the SPDR S&P 500 ETF’s expense ratio. While this is far from an apple-to-apple comparison, the truth stands that in the same period (since ARKK ETF’s inception), SPY ETF has returned an annualized 2.5% higher than ARKK ETF despite being more passively managed. In theory, investing in a fund with a high expense ratio that comes as a result of constant portfolio rebalancing and high market activity would only make sense for an investor if the fund has proven to beat the market, or fulfil other investment goals like lower volatility or consistently high distribution through company dividends or option strategies like writing covered calls. However, at a beta of about 1.65 and a dividend yield of about 1.9%, ARKK ETF fulfils neither of the criteria, and the main justification for investing in ARKK ETF would be to price in the potential growth of its constituent companies.

Better options

For investors who want to invest in growth, there are other ETFs out there that provide this exposure at a lower risk and more reliable past performance.

Schwab U.S. Large-Cap Growth ETF

One possible candidate would be the Schwab U.S. Large-Cap Growth ETF, or SCHG ETF (SCHG), whose portfolio consists of mainly large cap growth stocks that have proven to be consistently profitable over the years. The underlying index is the Dow Jones U.S. Large-Cap Growth Index.

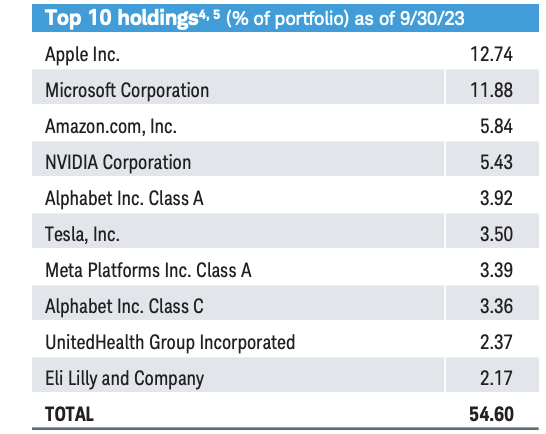

SCHG ETF Top 10 Holdings (Charles Schwab Asset Management)

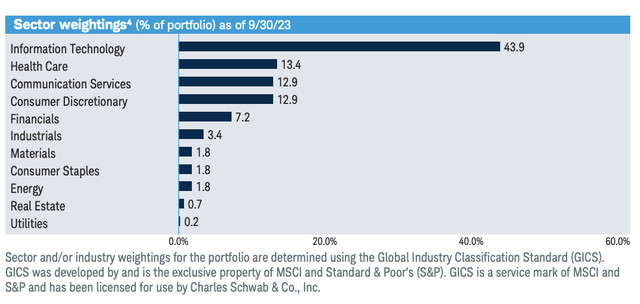

SCHG ETF Sector Allocation (Charles Schwab Asset Management)

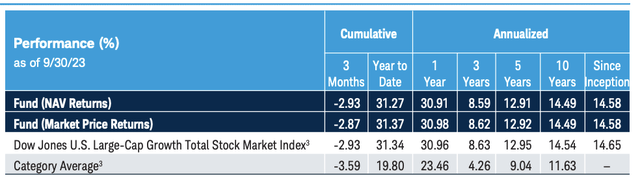

SCHG ETF Fund Performance (Charles Schwab Asset Management)

We observe a similar exposure to growing industries, most notably in information technology and healthcare. We also see many familiar names in SCHG ETF’s top 10 holdings which have proven to be profitable over the last decade. Most importantly, we see that the fund has achieved an annualized return of 14.49% in the past 10 years, over 5 percentage points higher than that of ARKK ETF. SCHG ETF also boasts a very low expense ratio of 0.04%, compared to ARKK ETF’s 0.75%.

SPDR S&P 500 ETF

Another possible candidate would be the popular SPDR S&P 500 ETF, or more commonly known as the SPY ETF. This ETF tracks the S&P 500 index, which comprises of the 500 largest listed U.S. companies in the stock market.

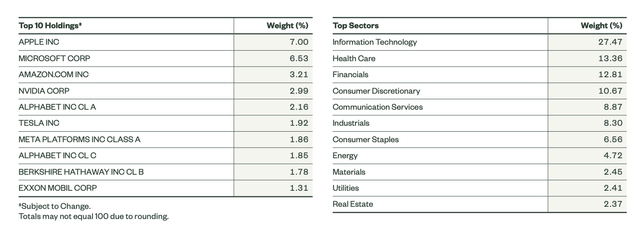

SPY ETF Sector Allocation and Top 10 Holdings (S&P Global)

SPY ETF Fund Performance (S&P Global)

Once again, we see that at a lower expense ratio of 0.09%, SPY ETF does also offer exposure to industries with strong growth potential, most notably in information technology and healthcare. The fund itself has also returned an impressive annualized 11.91% in the past 10 years, clearly outperforming ARKK ETF.

Is ARKK ETF terrible?

With all things considered, I wouldn’t go as far as to say that ARKK ETF is a terrible investment. After all, an annualized return of just over 9% since inception is still better than many other funds out there. However, the company’s heavy investments in companies that have been struggling to be profitable for the past few years is definitely something I wouldn’t overlook. The high volatility of the ETF is also not ideal for investors with lower risk appetites or shorter investment horizons. Considering these factors, along with the fact that there are other options in the market which provide exposure to growth at a lower risk and better historical return, I simply would not recommend ARKK ETF unless you’re an investor who particularly believes in the ETF’s constituent companies.

My bottom line

When we put money in the stock market, my bottom line is that the investment has to make sense. I can understand why some investors may like ARKK ETF due to its investments in innovative, forward-thinking companies. However, the risk-to-reward ratio just isn’t right for me. Most of the company’s top 10 holdings do not seem to be in a very favourable financial position, and historical returns have proven that despite the exponential growth of the industries in which ARKK ETF is invested in since its inception, passively managed index ETFs have still emerged superior. As such, I issue a ‘Sell’ rating on ARKK ETF.

Read the full article here

Leave a Reply