Investors in Arista Networks, Inc. (NYSE:ANET) were likely very happy after the market closed on October 30. This is because shares of the company shot up around 8% after management reported financial results for the third quarter of the company’s 2023 fiscal year. When the market actually opened on October 31, this gain grew to 12%. Revenue and profits comfortably exceeded expectations and it is clear that the business continues to do well even in a rather difficult environment. In the long run, the company does make for an interesting prospect. It’s almost guaranteed to continue growing. And frankly, I for one have had a history of underestimating it. While I still believe that the stock is pricey and I would prefer to focus my capital on something more value-oriented, I do think that some additional upside from here is not unlikely. Because of this, I have decided to upgrade the company from a ‘hold’ to a ‘buy’.

It’s okay to be bullish about Arista Networks

One of the greatest challenges that value investors like myself face is that we tend to underestimate growth prospects. Companies that look pricey can be a big turn-off for us. But this doesn’t necessarily mean that the firms in question are bad prospects. Many of them are overpaid for. But those that can demonstrate continued robust growth can grow into their valuation and beyond. During my time writing about Arista Networks, I considered it a great business, but I did not give enough flexibility when it came to how much upside the stock might ultimately have. And this has come at a rather painful cost in the form of missed opportunity. Since I first wrote about the company in February of this year, shares have jumped 24.2% compared to the 0.5% increase seen by the S&P 500. And even since my most recent article on the company in early August, the stock has dropped only 4% while the S&P 500 has plunged 8.5%. This does not factor in the new move higher that shares experienced on October 31.

Author – SEC EDGAR Data

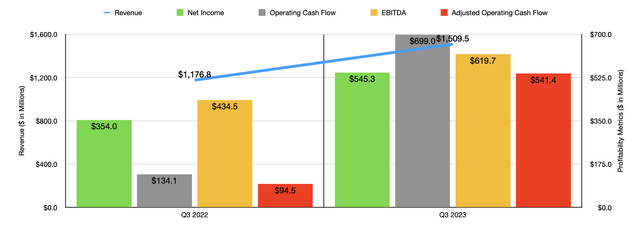

In my very first article on the company, which I already linked above, I dug into exactly what the company is and what it does. So I will save you from a rehash of that. Instead, it might be best to just dig in. For the third quarter that management just reported, revenue came in at $1.51 billion. In addition to coming in 28.3% higher than the $1.18 billion generated in the third quarter of 2022, it was also about $30 million above what analysts had forecasted. According to management, services and subscription software were responsible for 16.8% of revenue in the third quarter. This was up from the 15.2% of sales reported in the second quarter. This is a rather significant change in such a short window of time.

This kind of growth might seem odd given recent industry conditions. You see, at the end of the day, Arista Networks is a company that benefits from the growth of the cloud computing industry. So any growth in that space will almost certainly prove bullish for it. But we have seen some mixed results as far as that industry goes. At this time, the three largest cloud companies on the planet are Amazon (AMZN) with its AWS, Microsoft (MSFT) with Azure, and Google parent Alphabet (GOOG) (GOOGL). But for the third quarter of the 2023 fiscal year, the only one of these players that performed exceptionally well was Microsoft. As the second largest player in the space, it still managed to grow its revenue by 29%. By comparison, both Alphabet and Amazon fared worse, with sales growth of 22% and 12% year over year, respectively.

The fact of the matter is that the market is cautious when it comes to making investments because of high interest rates and inflationary pressures. But as a whole, the spaces in which Arista Networks operates seem to be doing well and management expects that trend to continue. The company should continue to especially benefit from Facebook parent Meta Platforms (META). That particular firm accounts for roughly 26% of overall revenue for Arista Networks. And with Meta Platforms expected to spend between $27 billion and $29 billion on capital expenditures this year, followed by between $30 billion and $35 billion next year, much will be focused on investments in servers, as well as AI and AI hardware (both of which will feed demand for data centers), I don’t doubt that this revenue trend will persist.

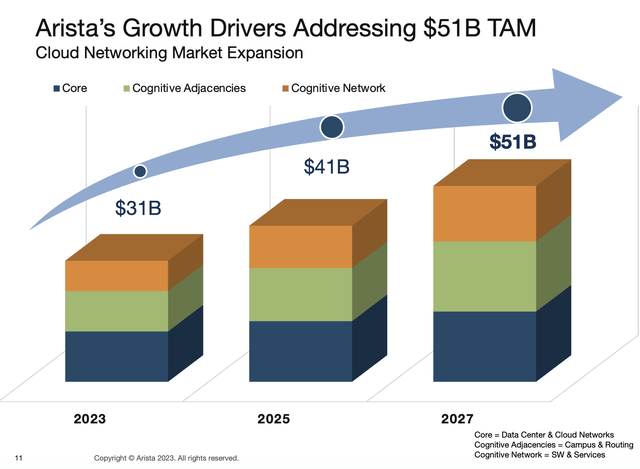

Arista Networks

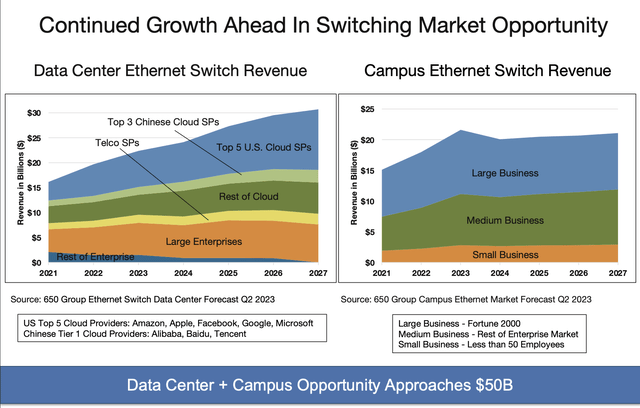

In fact, over the next few years, management believes that the markets in which it plays in will grow at a rather nice clip. For 2023, the total addressable market for cloud networking is estimated to be worth $31 billion. That should grow to $51 billion by 2027. The data center Ethernet switch market should expand from just over $20 billion to more than $30 billion over the same window of time, with that growth largely driven by the top five largest cloud providers and other large enterprises. Meanwhile, the campus Ethernet switch market should remain more or less flat around $20 billion.

Arista Networks

The growth in revenue that the company has experienced has been instrumental in pushing up profits as well. Earnings per share came in at $1.72. In addition to dwarfing the $1.13 reported the same time last year, it also came in $0.28 per share above what analysts had anticipated. As a result of this, net income shot up from $354 million in the third quarter of 2022 to $545.3 million the same time this year. Other profitability metrics followed suit. Operating cash flow, for instance, grew from $134.1 million to $699 million. If we adjust for changes in working capital, we get an increase from $94.5 million to $541.4 million. And finally, EBITDA for the company grew from $434.5 million to $619.7 million.

Author – SEC EDGAR Data

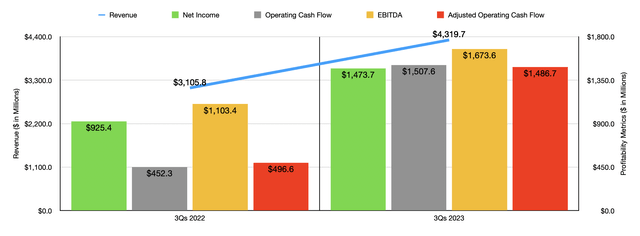

As you can see in the chart above, the third quarter was not a blip on the radar. Financial results for the first nine months of 2023 came in significantly higher than what we saw in 2022. We don’t really have too much to go with when it comes to guidance here. If we annualize results experienced so far, we would expect net profits of $2.15 billion, adjusted operating cash flow of $4.15 billion, and EBITDA of $2.41 billion.

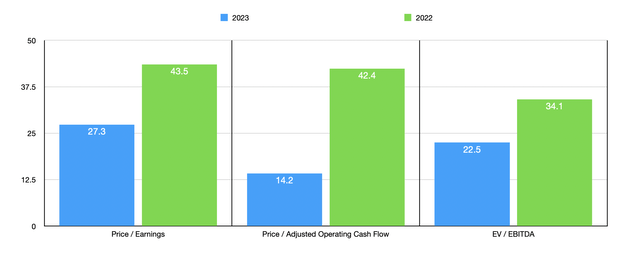

Author – SEC EDGAR Data

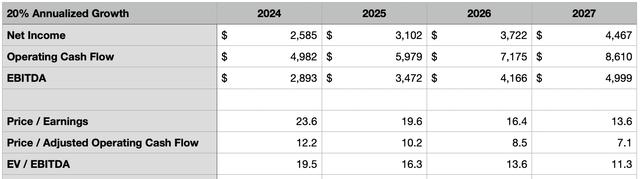

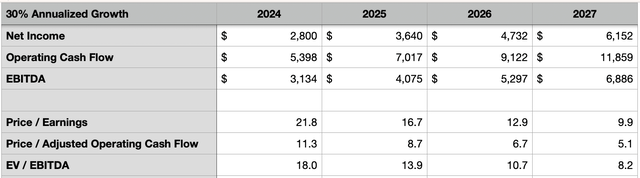

Taking the aforementioned figures, I then created the chart above. In it, you can see how shares are priced using data from 2022 and estimates for 2023. Shares look significantly cheaper on a forward basis. With the exception of the price to operating cash flow approach, the stock does look quite expensive. But again, we are dealing with rather significant growth. In the first table below, I decided to conduct a little experiment. In it, you can see how the pricing of the stock changes as time goes on if we assume that profits and cash flows will continue to grow at a 20% rate per annum for the next few years. In the table below that, you can see what the company looks like if growth averages 30% per annum. Assuming that growth does come to fruition, it doesn’t take terribly long before shares go from being pricey to being reasonably priced.

Author – SEC EDGAR Data

Author – SEC EDGAR Data

It seems as though I am not the only one that has turned bullish on Arista Networks. In response to the company’s financial results for the third quarter, Morgan Stanley (MS) decided to upgrade the company. Like me, they previously had a more neutral rating on the company because of how pricey shares were. But they see this earnings beat as a net positive for shareholders and the start of better times to come. In particular, they pointed out that while InfiniBand connectivity has so far been the winner in AI, the eventual winner is likely to be Ethernet. The fact of the matter is that InfiniBand has enjoyed an early lead when it comes to buildouts at data centers focused on AI because of low latencies. But at the end of the day, Ethernet is superior because not only can it handle 800Gbps (something InfiniBand seems incapable of doing for another two years), but because it is also far more popular globally, with 600 million ports shipped annually.

This does not mean that Arista Networks is a guaranteed winner though. Morgan Stanley accurately pointed out that there is some risk as data centers transition from 400G switches to 800G switches. The good news is that, late last year, Arista Networks introduced the 7050X4 Series and in announced the expansion of the 7060X5 Series with the addition of 800G to double the capacity that is craved by the largest players in the data center industry. And given how much of the firm’s revenue comes from just its two largest customers, both of whom are big players in the market with rapid growth ambitions, these product introductions are very sensible. But of course, the deployment of any new technology aimed at replacing an old one, or at least an updated technology to replace an outdated one, is bound to have some risk. And so far, financial results have not been harmed as a result of that process.

Takeaway

In the past, I feel as though I have been overly harsh when it comes to Arista Networks and its potential. I have always known that it is a high-quality company. But I have underestimated just how strong growth would be. When you factor in that this is a very long-term market opportunity and that management is comfortably exceeding forecasts when it comes to financial results, I do think perhaps an upgrade from a ‘hold’ to a soft ‘buy’ makes sense at this time.

Read the full article here

Leave a Reply