Shares of Ares Capital (NASDAQ:ARCC) have slipped a bit since my previous article on August 1st (can be read here), as ARCC declined by -3.68%. Their dividend offset the slight price decline, which brought ARCC’s total return to 1.29% compared to the S&P 500’s decline of 7.76%. ARCC is the business development company [BDC] king, as its net assets of $10.36 billion and a market cap of $10.47 billion overshadow the rest of the sector. The Fed has been clear that we’re in a higher for longer rate environment, which I believe will benefit ARCC. As credit remains tight, banks will be less likely to service middle-market companies, allowing ARCC to continue lending at higher established rates. When the Fed finally pivots, the data indicates that rates will unlikely decline as fast as they increased, so any debt that ARCC issued at a floating rate will stay higher for longer as well. Rates are still at the highest point since the early 80s, and I expect ARCC to have added lucrative debt and equity investments throughout its portfolio in Q3. Going into earnings, I think ARCC is a buy as it trades at a slim premium to its net asset value [NAV], and from a long-term perspective, investors are getting a strong income-generating equity that can continue paying a large yield in a declining rate environment.

Seeking Alpha

Following up on my previous ARCC article

In my previous article on ARCC from August 1st (can be read here), I discussed how ARCC operates a large dividend margin between its net investment income [NII] and payable dividend, why I have ARCC in an income-producing portfolio rather than allocating that capital toward capital appreciation investments, and how ARCC compared to its BDC peers. I wanted to follow up going into earnings because a lot has changed in the macroeconomic environment that I feel benefits ARCC and why I am adding to my position going into Q3 earnings.

The higher for longer rate environment should benefit ARCC, and I am a buyer

In an environment with rising rates, the cost of capital increases, and lending becomes restrictive. Requirements get more demanding, and banks are more selective. Many middle-market companies are not able to secure funding from traditional banks and need to partner with BDCs. ARCC is the largest BDC with a portfolio valued at roughly $21.5 billion, spanning 23 industries with investments across 475 portfolio companies. Even in a lower rate environment with looser restrictions, middle market companies still seek out debt and equity investments from BDCs, which is ARCC’s specialty. ARCC invests in several types of debt, including first-lien senior secured and second-lien senior secured, while also taking equity positions in smaller companies.

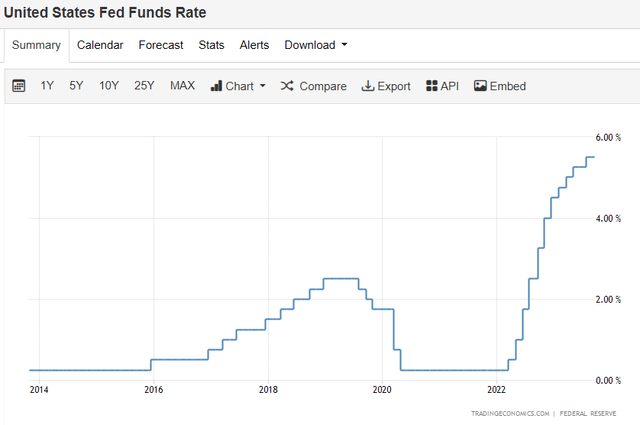

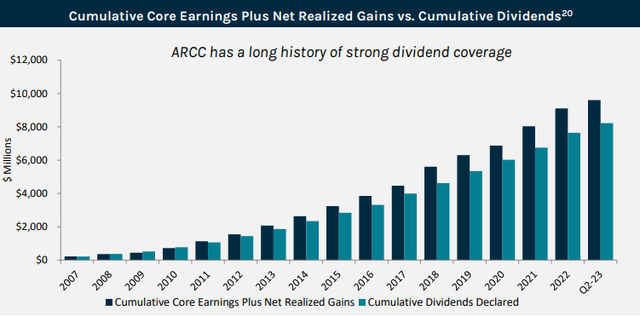

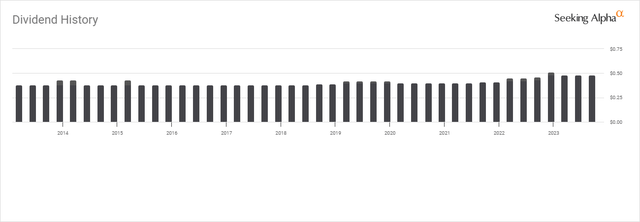

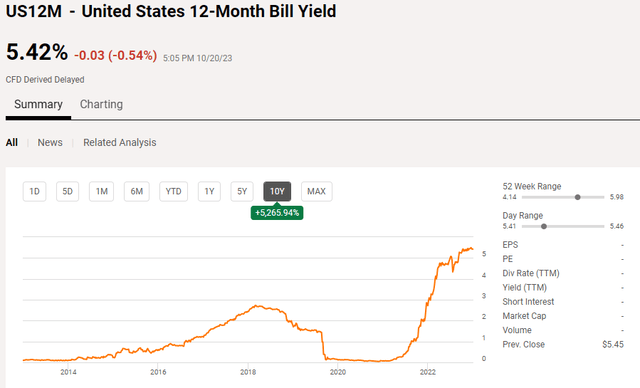

Until recently, rates have been historically low, falling under 1% prior to 2018 and again after the pandemic hit. It’s important to establish that ARCC has grown its core earnings and the amount of capital allocated to its dividend during both a lower and higher rate environment. Back in 2014 and 2015, when rates were basically nonexistent, ARCC paid a quarterly dividend of $0.38, which they grew to $0.40 in 2019 as rates increased a bit. During the pandemic, when rates fell to under 1%, ARCC maintained the quarterly dividend of $0.40 and even increased it to $0.41 in 2021. The higher rate environment has allowed ARCC to jumpstart the dividend payments as the quarterly dividend grew 3 times in 2022 from $0.41 to $0.48. It’s important to compare the two charts below as they are clear indications that even during periods of declining rates, ARCC has not only maintained the dividend but also grew its core earnings.

Trading Economics

Ares Capital

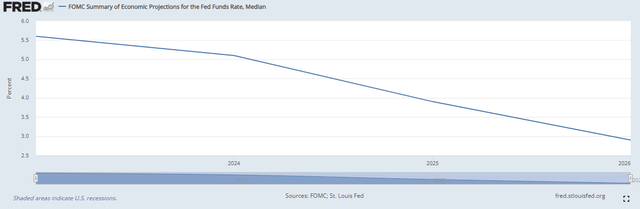

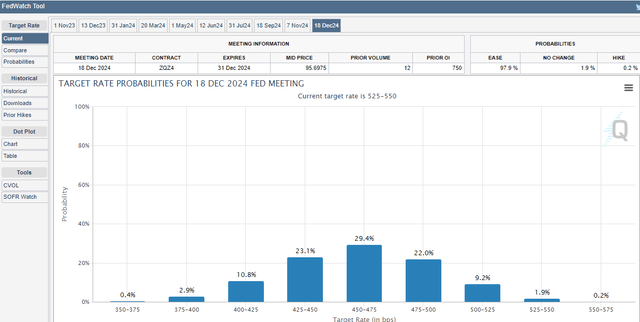

The St. Louis Fed is projecting that rates will be higher for longer, and the median interest rate will be 5.1% in 2024, 3.9% in 2025, and 2.9% in 2026. The CME Group FedWatch Tool is projecting that we finish 2024 with the highest probability of rates being 450-475 bps. The economic projections are showing us that the path forward is a Fed pivot, but rates are not going back to 2% anytime soon. We’re going to see years of rates above 3%, and rates probably won’t even have a 3 handle until sometime in 2025.

This is why I am more bullish on ARCC than ever. Based on the previous annualized data from ARCC, they were able to grow their core earnings, net realized gains, and cumulative dividends each year since inception. This includes a financial crisis, a mortgage crisis, higher rate and lower rate environments, and a pandemic. With rates at the highest level in over a decade, all ARCC’s investments in first-lien senior secured and second-lien senior secured debt are coming with higher yields that should help grow their future earnings, NII, and dividends. Jerome Powell has been hawkish in his last 2 speeches and left the door open for another hike while eliminating any hope of a pivot in the near future unless something drastic occurs. This should give ARCC an extended runway to issue extremely lucrative senior secured debt and further build its core portfolio. Even debt issued at a floating rate won’t fall too drastically based on the forward economic projections as rates will be higher for longer.

St Louis Fed

CME Group

ARCC has been a strong income play and I think there is good reason for investors to be excited about ARCC’s long-term ability to generate income

Going back to October 21st, 2013, shares of ARCC traded at $17.26. Since then, the quarterly dividend has never declined and has grown from $0.38 to $0.48 while paying 10 special dividends. Since the dividend was paid on 12/31/13 ARCC has paid $16.31 of dividend income to shareholders. If you had purchased shares a decade ago, you would have received 94.5% of your original investment in dividend income prior to the benefits of compounding from reinvesting the dividends. Your original investment would have also increased by 8.86% or $1.53 per share from $17.26 to $18.79.

If you had told me that I could have invested in a company a decade ago that would pay me 94.5% of my original investment in distributed income while appreciating 8.86% and still throwing off a 10.22% dividend yield, I would have purchased shares hand over fist. I think ARCC can do something similar over the next decade as it’s been building a portfolio at higher rates, and there is no reason why it can’t continue increasing earnings and dividends. The higher for longer rate environment should benefit ARCC and its shareholders, and I am expecting the dividend to increase slightly over the next several years. From an income perspective, shares of ARCC trade at $0.20 over book value, so you are buying its income-producing portfolio of assets at basically a 1:1 ratio, and the portfolio’s book value could increase over time.

Seeking Alpha

Why ARCC could gain a lot of traction over the next two years

We’re living through an environment where the risk-free rate of return has been extremely lucrative for income investors. They haven’t had to take on equity risk to generate meaningful income. Over the past year, investors looking for income have been able to build short-term CD or bond ladders with yields ranging between 4 – 5.75%. It’s estimated that over $5 trillion is piled up in money market accounts. I believe this is a key reason why many equities, including The Coca-Cola Company (KO), have lost their appeal. Why take on equity risk at a sub-4 % yield when you can build a ladder risk-free at over 5%?

I think this is very bullish for ARCC and several other high-yield investments. ARCC is the largest BDC and arguably the best managed. They have a track record of growing net earnings and dividends in high- and low-rate environments. Income investors will need to be incentivized for them to take on equity risk. It may not occur in the next 3-6 months, but eventually, when the Fed pivots and risk-free investments mature, income investors will either build new ladders or allocate capital back to equities. As long as rates remain over 4% while these risk-free assets mature, ARCC will be more compelling for investors who want to move capital back into the markets. ARCC will have either a high single-digit or low double-digit yield, which could act as a magnet for incoming capital. I think that shares of ARCC could be pushed higher in 2024 if capital flows back into income-producing equities.

Seeking Alpha

Conclusion

I think earnings will be strong for ARCC as they should have added lucrative debt investments at high yields throughout the quarter. This should help ARCC grow earnings and their NII going forward. As an anticipated Fed pivot in 2024 approaches, ARCC is still building a higher-yielding portfolio that should correlate to an attractive dividend as capital comes back into the market. ARCC has a long track history of paying an above-average yield, and I believe they can continue growing the dividend as the rate environment stays higher for longer. I see ARCC as a solid income investment that will become more attractive to investors in the following years as the risk-free rate of return declines.

Read the full article here

Leave a Reply