Overview

Ardmore Shipping Corporation (NYSE:ASC) provides transportation by sea for petroleum and other chemical products. Their fleet has a total of 26 ships with 22 being owned by the company and 4 Time Chartered-In. All of their ships fall in the MR or Medium Range Tanker Classification, and these ships are larger than handysized tankers and smaller than the gigantic VLCCs, Suezmaxs and Aframaxes. These ships are typically used for regional trade as their smaller Deadweight Tonnage (DWT) allows them to be able to use more ports and canals than their larger peers. ASC is pretty unique in that they are basically a pure MR play with no exposure to larger ships. This article will be an update to our previous article written in August of 2023. With ASC reaching our initial price target of $16, we believed an update was needed. We maintain a rating of Buy for ASC.

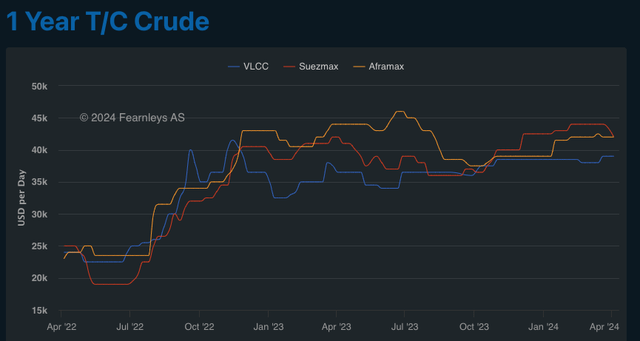

Fearnleys

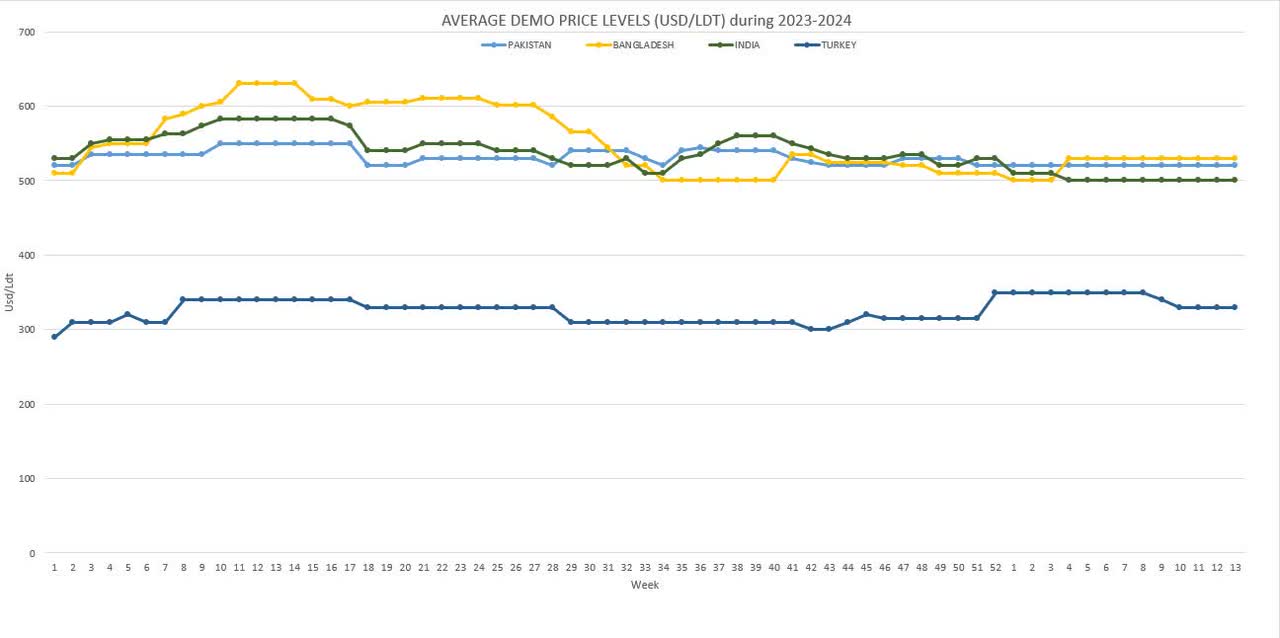

While the above Fearnleys’ chart does not have MR’s explicitly called out, we can use this as an analysis of the overall market. Since roughly the summer of 2022 rates have risen and stayed at elevated rates through 2023 and 2024. These elevated rates have allowed tanker holders to reconsolidate their balance sheets, pay off ships, return capital to investors and be in an overall stronger position than the 2010s.

We have covered this phenomenon in our other coverage of the industry: Euronav (EURN), Frontline (FRO), International Seaways (INSW), Scorpio (STNG), Teekay (TNK), and Nordic American Tankers (NAT)

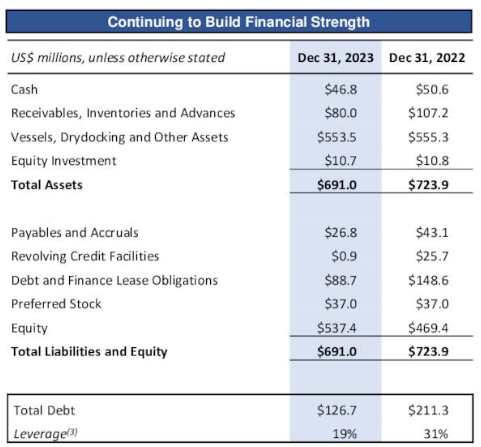

ASC is no different, having used the excess cash generated from these elevated rates, they have reduced their debt and their cash breakeven per day. As of Q4 2023, their cash breakeven per day was $13,900, down from $14,500 per day in Q4 2022. The lowering of costs by ~4.1% while fuel rates and insurance have been elevated is a promising sign of the structure of the business.

Lowering their debt during this period has also allowed them to better control leverage on the balance sheet and made them a less risky venture to lend to. While rates are still elevated, the drop in leverage from 31% in Q4 22 to 19% in Q4 23 allows them the ability to reinvest in their fleet, return capital to investors and allows them to be on better terms with lenders.

ASC

Market Overview

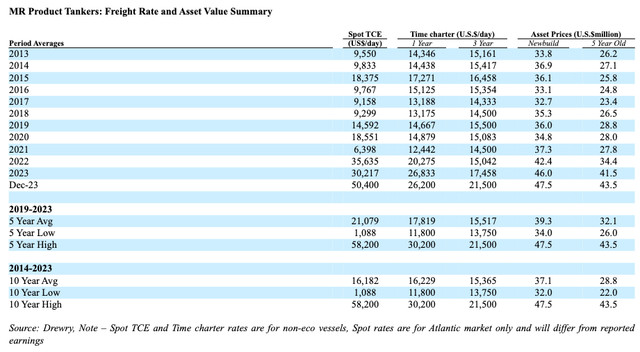

While tanker rates are cyclical in nature, we believe that the current market dynamics are inherently bullish. Following Covid, Spot TCE has remained elevated, and we see it staying that way as the market dynamics are favorable for low-leveraged, modern, and flexible fleets.

We believe tanker fleet dynamics are a factor of earnings, inherent scrap value and ship valuation. With rates being elevated it makes logical sense that ship prices (both new and used) would rise to reflect the income they can generate. With rates being elevated, so too is the secondary market for both MR and Chemical Tankers. We believe this trend of elevated rates and elevated ship prices is entrenched and likely to remain elevated due to the supply demand imbalance. We believe oil demand, geopolitical factors and the structure of the tanker market are also inherently bullish for not only ASC, but the entire tanker space.

Spot TCE (ASC)

Valuation

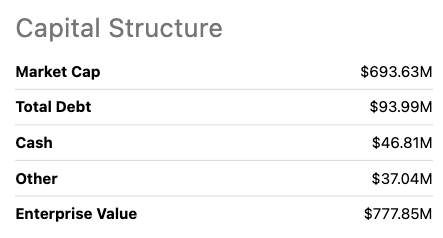

Seeking Alpha

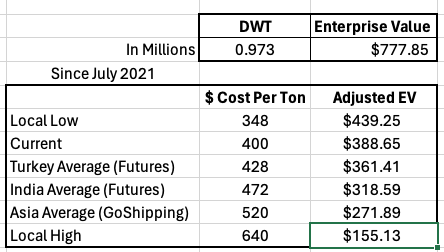

Since ship prices are directly linked to the earnings they generate we believe a nominal valuation is needed to offset the relative valuation associated with ship prices. With scrap values at nearly ~$400/ton and a DWT of 973,000 we can come up with a scrap value of the fleet of ~$390 Million. While $/ton is historically high we believe that macroeconomics and fiscal policy are likely to keep scrap value volatile, yet high.

Go Shipping

When analyzing ASC we are going to use a modified Enterprise Value that will give us an adjusted value for the company while taking out the scrap value of the ships. We believe that this will give us a solid floor from which to plan any entry or exit from the position. If enterprise value is the total value needed to purchase a company as a whole, we believe taking the enterprise value and subtracting the scrap value of the ships will give us a tangible asset valuation for the company. The lower this valuation is, the closer to scrap value the company is. This will give us a normalized valuation of the company vs a relative one from looking purely at aftermarket sales of ships.

The below table highlights this adjusted enterprise value as a function of today’s Scrap Value Per Ton, which at $400 translates to an adjusted EV of $388 Million.

Steel Scrap Values (Author, LME Futures Go Shipping)

While this method of valuation is far from perfect it allows us to better understand the premium above scrap value we are paying for earnings, as well as give us a way to compare from tanker company to tanker company.

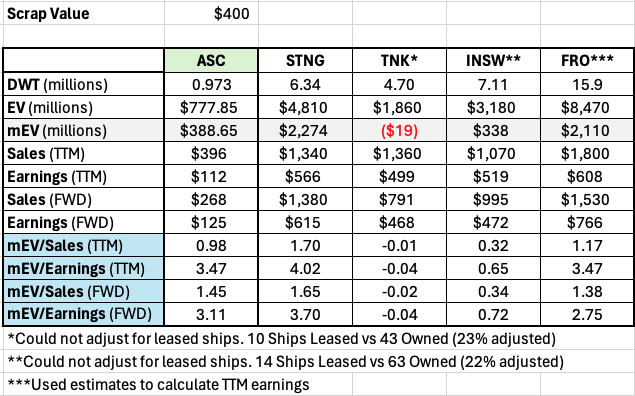

At today’s valuations this modified Enterprise Valuation (mEV) gives us the following valuations across the industry:

Modified Enterprise Value (EV – Scrap Value) (Author)

After accounting for the scrap value of the ships, not surprisingly we see significant drops to mEV with TNK having a near $0 net value, STNG having $2.7 Billion and ASC dropping to $388 Million.

On a per share basis taking the $388 Million in scrap value and dividing it by the share count, 41.53 Million we get a scrap valuation of $9.37/Share. While estimates for the industry see a decline in shipping rates in 2024. We believe rates are more likely to stay elevated closer to the last TTM.

With the adjustment we get an mEV/Sales (TTM) and mEV/Earnings (TTM) of .98 & 3.47 respectively. While not a major discount relative to TNK and INSW we still believe this metric simply provides a base value for the shares.

What we also enjoy about ASC is that management have a transparent capital return policy. Ever since restarting the dividend, they have targeted and executed a dividend policy of paying out 1/3 of their earnings to shareholders. At current share prices they seem to believe strengthening the balance sheet is more important than share buy backs and for ASC we agree. They are currently trading at a near 100% P/NAV and we believe that a lower P/NAV is needed in order to justify share buy backs.

Risks

Geopolitical issues and changing weather patterns are disrupting the normal trade routes and making voyages take longer. While it’s great for tanker demand and rates right now, the company knows it won’t last forever. Once things settle down and routes go back to normal, it could put a dent in their revenues.

There are also some questions about how long this strong tanker market will stick around. Management seems to see some similarities to previous multi-year boom times, but I believe they also know each cycle is a little different. If there’s a surprise drop in demand or a big economic meltdown, it could cut the good times short.

Another thing to keep an eye on is rising interest rates and the cost to borrow. The company’s worked on paying down debt to prepare for this, but higher debt costs would still be a drag, especially if tanker rates start sliding.

Looking further out, there’s still a lot of uncertainty about future environmental regulations and what kind of propulsion tech new ships will need. ASC is not currently leading the pack in that regard. This regulatory and tech uncertainty is keeping a lid on new orders for now, but not investing in the fleet could make it harder to update it down the line.

Insurance costs are also climbing, especially for ships going through dicey areas such as the Black and Red Seas. If global conflicts keep escalating, those voyage expenses could keep going up. So far, the company’s been disciplined about not going overboard with growing the fleet this up cycle. But if asset values keep rising, the sweet spot for renewing the fleet cost-effectively might start shrinking.

Even though the near-term market looks pretty solid, the economy goes in cycles and global dynamics are always evolving. So it’s tough to say for sure what the long game will look like. Management’s going to have to keep juggling current opportunities with being ready for an eventual market slump.

In addition to this, we believe it is important to keep an eye on share issuance. Shares have ticked up from 41 Million in December 2022 to 41.5 million in December 2023, roughly a 1% gain. While not extremely disruptive to equity holders, it is something to keep an eye on.

Conclusion

We believe ASC’s fleet justifies a scrap value of $9.37 a share and a fleet replacement value near $16 a share. While there is cyclicality to tankers we believe that now is still a good time to own tankers and specifically a great time to own ASC. We believe they have strength in their fleet, balance sheet and at current prices they are worth owning. We believe the capital return policy is straightforward and is beneficial for owners of ASC. We predict any significant weakness in share value from this point will only incentivize management to engage in share buy backs.

While they don’t offer a significant discount from scrap value alone relative to others in the space, we do believe that at current rates they are worth owning while still being defensive. We intend to sell July & October 2024 calls as well as cash covered puts if/when volatility ticks up for ASC. This will help us lower our cost basis and, in addition to the dividend, offer us some downside protection.

We are maintaining our rating of Buy.

Read the full article here

Leave a Reply