Arcturus Therapeutics (NASDAQ:ARCT) has made great progress in advancing its pipeline thus far. Especially, when you consider that it has a near-term catalyst for investors to look forward to. That’s because in the coming months [2nd half of 2023] it is expected that it will release results from the phase 2 study, which is using ARCT-810 for the treatment of patients with Ornithine-Transcarbamylase [OTC] deficiency. This is going to be a significant market opportunity in the coming years as I will explain below. Besides this advancement, there is another positive to note from another program in the pipeline. That is, Arcturus received clearance to begin phase 1b testing of its drug ARCT-032 for the treatment of patients with Cystic Fibrosis [CF]. This biotech has a huge chance here, because it is going to attempt to target all CF patients regardless of mutation type.

ARCT-810 Is Targeting A Growing Market

A program in the pipeline with great potential is ARCT-810, which is being advanced in a few studies. The one to make note of would be the phase 2 study, which is being done in the United Kingdom and in Europe. It is expected that this trial will enroll up to 24 adolescents and adults with OTC deficiency. This disorder is one by where it causes ammonia to build up in the blood. Ammonia at a normal level is okay, but if it reaches a high level than it becomes too toxic for patients.

With this being a rare disorder, it is not thought of being a blockbuster indication, which is true. However, this market is expected to grow over the next 7 years. It is expected that the Ornithine-Transcarbamylase Deficiency market is expected to reach $930.33 million by 2030. Investors won’t have to wait long to see data from this phase 2 study either. That’s because results from this trial, of ARCT-810 for OTC Deficiency, are expected to be released in the coming months. Not only that, but the company has already received Rare Pediatric Disease Designation from the FDA for ARCT-810, which means upon FDA approval, it would be eligible to receive a Priority Review Voucher which can be sold for $100 million+, or kept for itself to use to speed up review of another drug later on. On top of getting this designation it also got another, known as Fast Track Designation. Should this program deliver promising results, then this will be a huge victory for the company and its shareholders.

ARCT-032 Holds Ability To Challenge Market Leader In Cystic Fibrosis Space

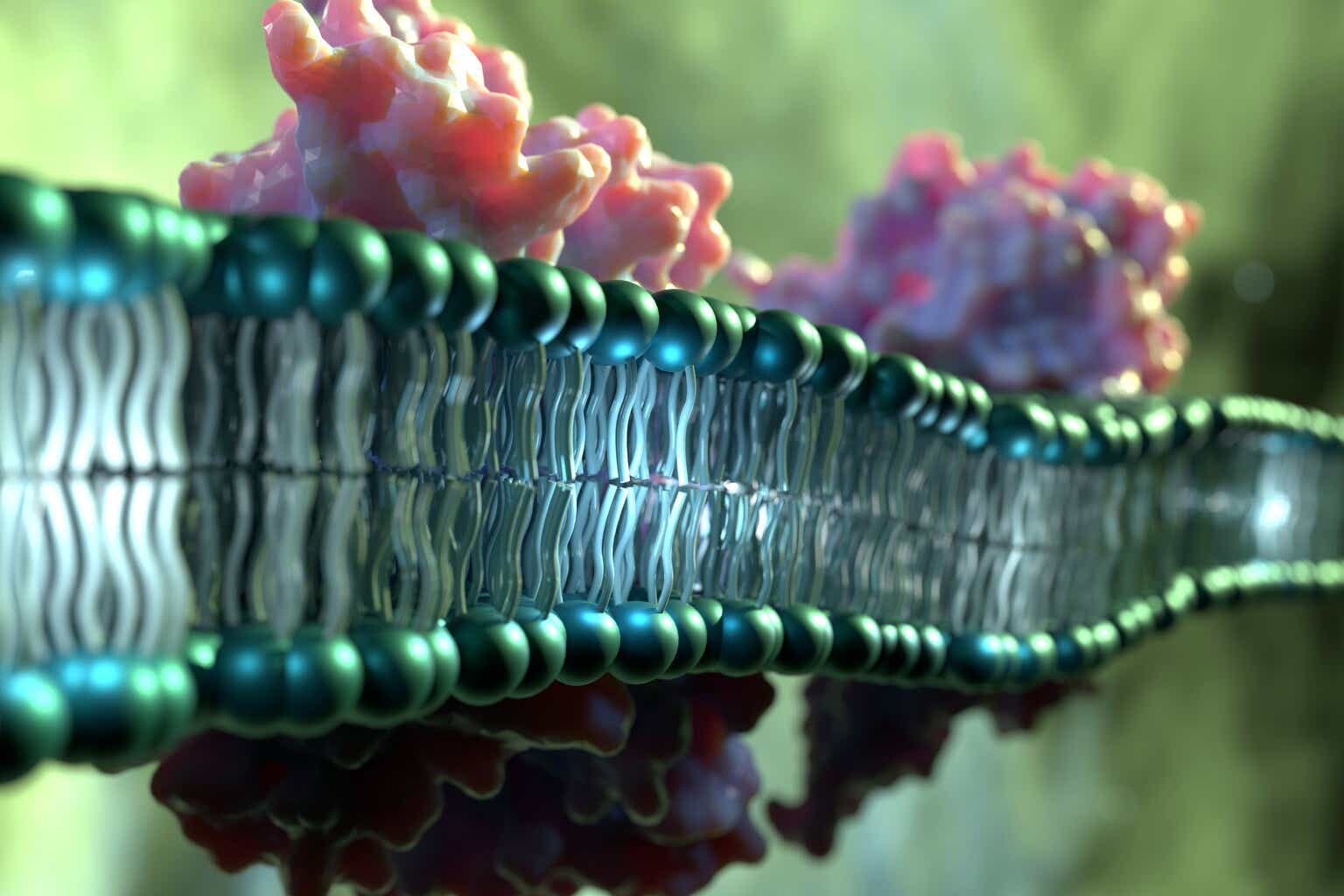

Another product in Arcturus’ pipeline with great promise would be the advancement of ARCT-032, which is being developed for the treatment of patients with Cystic Fibrosis. This is another large market opportunity for sure, because the global cystic fibrosis market is expected to reach $31.88 billion by 2027. The top biotech who has a huge hold in this space would be Vertex Pharmaceuticals (VRTX). Its CF franchise has been doing exceedingly well, so much so, that it has raised its full year guidance for 2023. It expects full-year sales of $9.55 billion to $9.7 billion. How does Arcturus hope to compete? Well, by doing something entirely different with its messenger RNA [mRNA] technology. It places a full-length CFTR mRNA molecule into an encapsulated lipid mediated delivery platform, generated by Arcturus, known as LUNAR. This type of treatment is nebulized [medication administered in mist form] into CF patients airways. From there, the molecule is delivered into epithelial cells, whereby mRNA produced a fully functional CFTR protein. What’s good about this is that this happens, regardless what mutation type the CF patient has. Thus, there are no FDA approved treatments that are able to treat all 2,000 CFTR mutation of CF at the moment. Should Arcturus succeed in its endeavors, then it could possibly become the first one to do so. It completed a phase 1 study in New Zealand and it also was able to receive regulatory approval to move on towards the testing of 8 adult CF patients in a phase 1b study. It expects to initiate enrollment of this phase 1b study in the 2nd half of 2023.

Financials

According to the 10-Q SEC Filing, Arcturus Therapeutics had cash, cash equivalents and restricted cash of $380.6 million as of June 30, 2023. It has been able to receive cash to date from CSL Seqirus. Matter of fact, it received $300 million as upfront payments and about $23.6 million under a manufacturing and supply agreement for ARCT-154. It will continue to receive future milestones from this company and such funds will be used to help fund the Covid and Flu programs in the pipeline. However, I wouldn’t worry about any cash raise in the near-term. That’s because it believes it has enough cash on hand to fund its operations through the beginning of 2026.

Risks To Business

There are several risks that investors should be aware of before investing in Arcturus Therapeutics. The first risk to consider would be with respect to ARCT-810 for the treatment of patients with Ornithine-Transcarbamylase [OTC] deficiency. That’s because this treatment is being explored in a phase 2 study and results from it are expected to be released in the coming months. There is no assurance that results from this study are going to be positive or that this program will continue. A second risk to consider would be with respect to the soon to be recruited phase 1b study, which is using ARCT-032 for the treatment of patients with CF.

First of all, it is only going to begin phase 1b testing soon and thus is still early in the clinical stage testing process. Secondly, there is no guarantee that the trial will ultimately end up being successful. The third risk to consider would be with respect to the Covid program. There is no assurance that the Marketing Authorization Application [MAA] for ARCT-154 for Covid will be given approval by the European Commission in 2024. The fourth and final risk to consider would be with respect to the Flu program that Arcturus is moving forward. There is no guarantee that this program will be moved toward regulatory approval and/or marketing.

Conclusion

Arcturus has done well to advance its pipeline. I believe it is good to look into, because it provides a key catalyst for investors to look forward to in the coming months. That is, it expects to release results from a phase study in U.K. and Europe, which is using ARCT-810 for the treatment of patient with Ornithine-Transcarbamylase [OTC] deficiency. As I explained above, this market is expected to grow over the next 7 years and any positive data released could provide some significant upside. Another factor to consider is that this company holds potential to be the first in treating all 2,000 CF patients regardless of mutation. With an impending catalyst in the coming months for ARCT-810, plus a well-established pipeline, I believe that investors might be able to capitalize on any gains.

Read the full article here

Leave a Reply