Archer-Daniels-Midland (NYSE:ADM) is a company I have mentioned at various times over my 10 years writing on Seeking Alpha. The most bullish stories were posted after the pandemic selloff, represented by this March 2020 effort here. As explained in my articles, right on cue – extraordinary money printing by the Federal Reserve (and central banks globally) almost immediately led to a sharp rise in grain prices. Since ADM is one of the primary grain storage enterprises, processors, refiners, and transporters to the world (specifically the U.S. market), predicting a substantial future rise in sales and income was not rocket science after the Fed announced “Unlimited QE.”

A new bullish argument during October 2023 has appeared. Buying ADM after a period of weakness in grains (over 12 months) could be a great contrarian decision for your portfolio. Why? My answer is mainly a function of the stock’s vastly improved valuation.

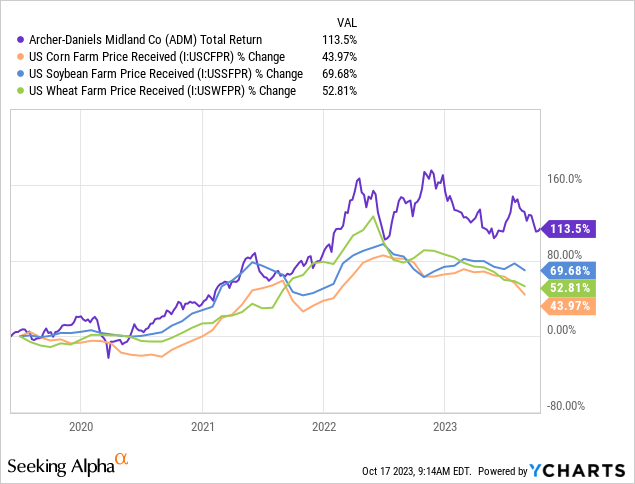

YCharts – ADM Total Return vs. Grain Prices, 4 Years of Change

Today’s setup for investors is showing some similarities to late 2019, where any new scheme by central banks to offset a looming recession should support grain prices and ADM in particular by late 2024. The company makes a regular margin for its services, buying/selling grains and related manufactured/processed commodity products. The good news is a better-than-average trailing valuation is now available for investors, where any “unexpected” improvement in operations next year is not priced into shares.

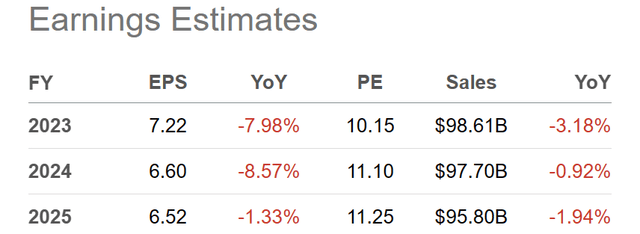

The upside proposition is food inflation continues next year, and ADM easily beats bearish Wall Street analyst predictions currently. The consensus view seems to be betting a possible cycle peak in grain prices during 2022 will translate into flat to lower ADM results for a number of years.

Seeking Alpha Table – ADM, Analyst Estimates for 2023-25, Made October 16th, 2023

Better Valuation Than You Think

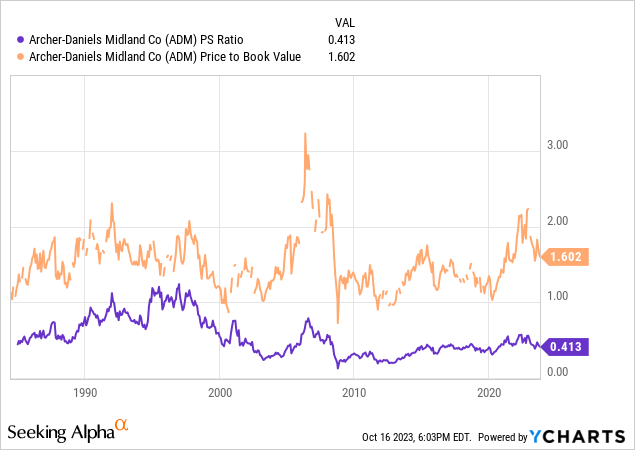

When we review price to trailing annual sales and book value back to 1986, we find ADM is actually fairly valued to slightly undervalued by Wall Street today. In fact, valuations on sales (0.41x) have been relatively depressed since the Great Recession in 2008-09. Without question, shares are definitely a smarter deal at $75 for new capital than the highs last year around $100 per share.

YCharts – ADM, Price to Sales & Book Value, Since 1986

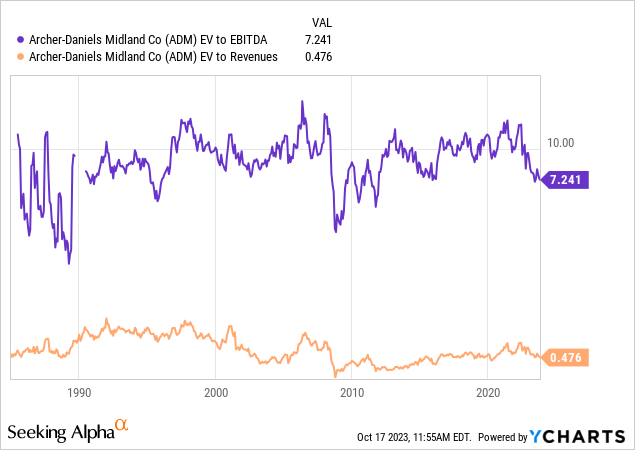

When we include changing debt and cash levels over the decades, ADM’s more liquid setup today appears to be closer to a bargain for new capital allocators. Enterprise valuations on core cash EBITDA (7.2x) or revenues (0.48x) are close to multi-year lows in October 2023. Another 10% drop in the share quote into the end of the year might produce the best EV multiples since 2012.

YCharts – ADM, Enterprise Valuations, Since 1986

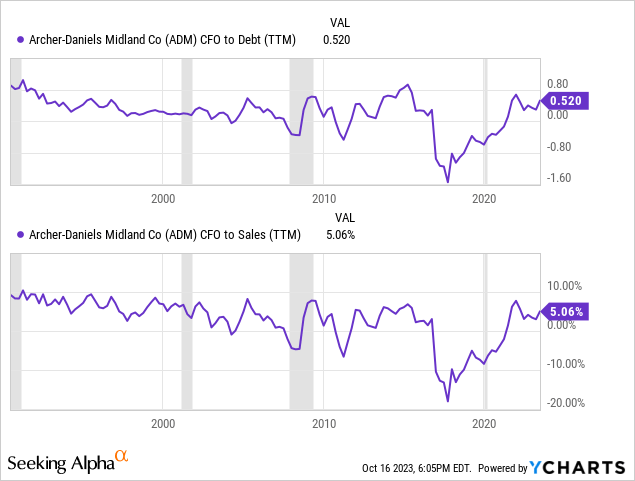

Improving financial results since 2018 may also argue for a higher-than-normal valuation. For example, cash flow to debt and sales are running near 6-year highs and above 20-year averages. (You will notice on the graph below, cash flow each year is relatively recession-proof. A defensive-position excuse to like ADM is based on stable grain trading and operating business metrics.)

YCharts – ADM, Cash Flow to Debt & Sales, Since 1990

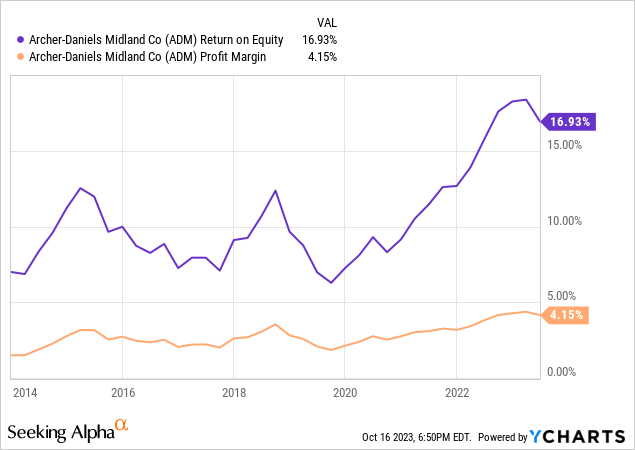

For sure, returns on equity of 17%-18% and profit margins on sales of 4%+ are looking far stronger than before the pandemic, with both sitting at decade highs in 2023.

YCharts – ADM, Return on Equity, Final Profit Margin, 10 Years

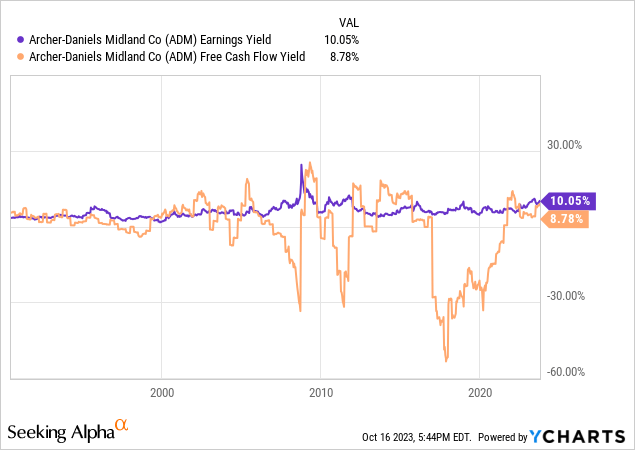

Plus, the excessive capital spend on building out ethanol plants (and other business reinvestment ideas) since 2008 may have finally ended. Management has publicly stated interest in paring back its more cyclical ethanol biofuel exposure for years (since 2016), and several plants have been sold. You will notice this direction change in capital investment into the operating business below. Free cash flow numbers have approached the regular reported earnings total since late 2021, meaning management has been less aggressive in developing new ventures.

YCharts – ADM, Earnings vs. Free Cash Flow Yields, Since 1990

Timing Your Buy

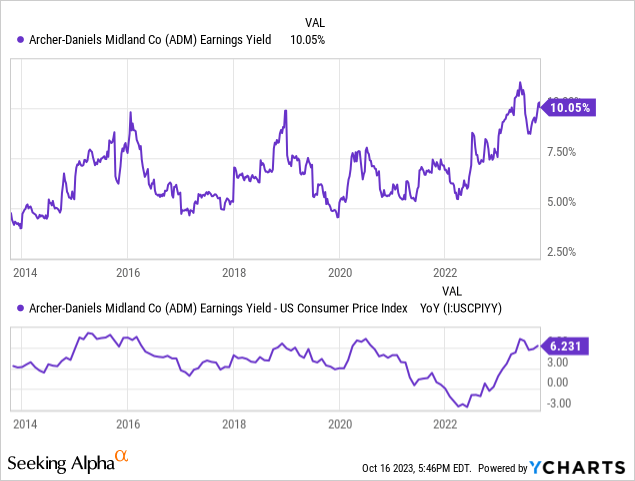

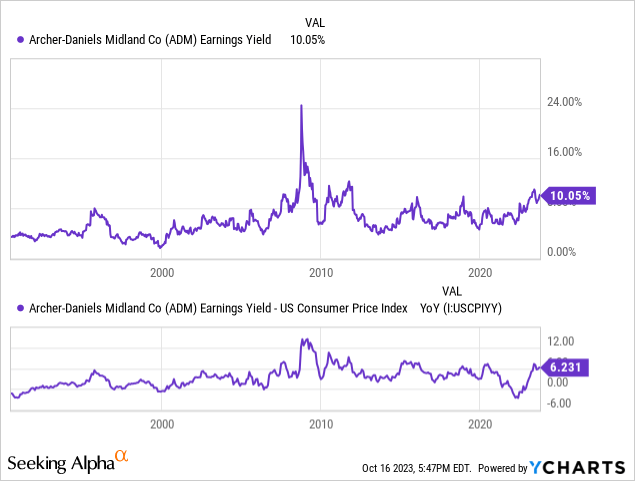

My main excuse for writing this article revolves around the current earnings yield, a quite high 10%+ number for new investors. The selloff in ADM shares over the last 12 months, alongside income levels remaining strong, means the theoretical earnings yield on your investment is very desirable.

What’s just as appetizing is ADM’s earnings yield vs. the prevailing CPI inflation rate. I often talk about buying companies delivering earnings (or free cash flow) yields in excess of cost-of-living changes. The whole reason to look at owning any business is its ability to provide high income returns, with even better results years down the road on improving business economics and/or inflation gains (sales growth if you will). The inflation-adjusted 6.2% income yield available today from ADM is far, far greater than the vast majority of equities trading in America. For example, the S&P 500 company-average relative rate is under 1% on a trailing basis, with a potential recession likely sending this calculation into negative territory soon. For ADM, only 2008-12 witnessed a higher than 10% earnings yield over the last 40 years!

YCharts – ADM, Earnings Yield vs. U.S. CPI Rate, 10 Years

YCharts – ADM, Earnings Yield vs. U.S. CPI Rate, Since 1990

When we combine the ideas of high earnings yield with a robust income return on investment vs. inflation, previous setups like today have proven to be terrific areas to buy the stock.

Reviewing the historical periods when both were very high, using an earnings yield approaching or better than 10% combined with an adjusted yield to CPI beyond 6%, a variety of important trading bottoms in ADM shares were outlined. Since 1986, just five earnings yield buy signals appeared previously, similar to the middle of 2023.

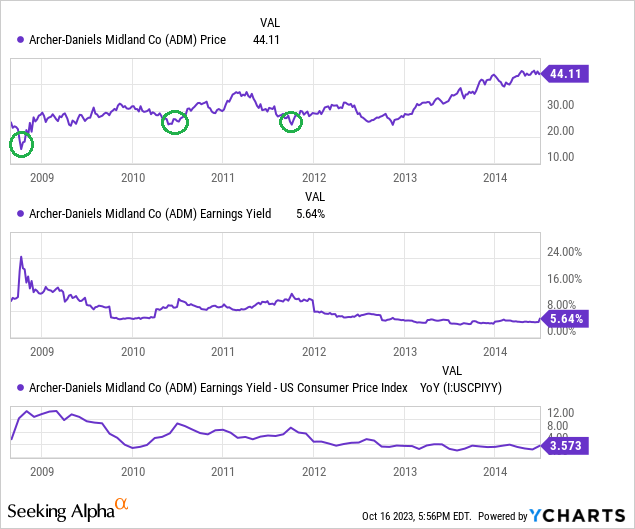

2008-2011

The first instance came in late 2008, during the height of Great Recession stock market selling. Believe it or not, financial market pessimism about the future of the economy, plus ultra-high grain prices catapulted the trailing earnings yield to a modern record 25% over several trading sessions (circled in green below). The split-adjusted stock price low of $15 would quickly be followed by a rise to $32 in late 2009, about a year later.

Again, in the summer of 2010 and the autumn of 2011 (also circled in green), high earnings yields above 10% combined with inflation-adjusted yields better than 6%. Both proved smart buy areas for 6-9 month swings higher in the share price.

YCharts – ADM, Price Changes, Earnings Yield vs. U.S. CPI Rate, 2008-14, Author Reference Points

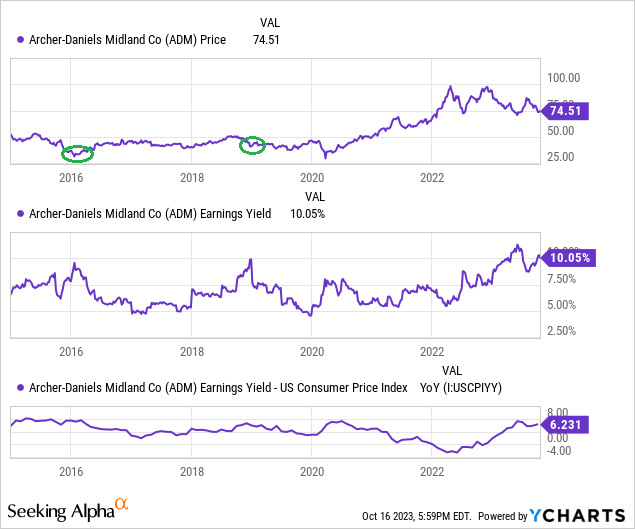

2016 and 2019

The last two instances appearing since 1986 are drawn below, with green circles to identify the buy points. Early 2016 and early 2019 proved decent times to purchase an ADM position. Each witnessed higher ADM quotes 12 months later, with the 2020 pandemic forcing central bank money-printing and supply-chain shortage issues. A combination of factors pushed share pricing dramatically higher by early 2022.

YCharts – ADM, Price Changes, Earnings Yield vs. U.S. CPI Rate, 2015-Present, Author Reference Points

Final Thoughts

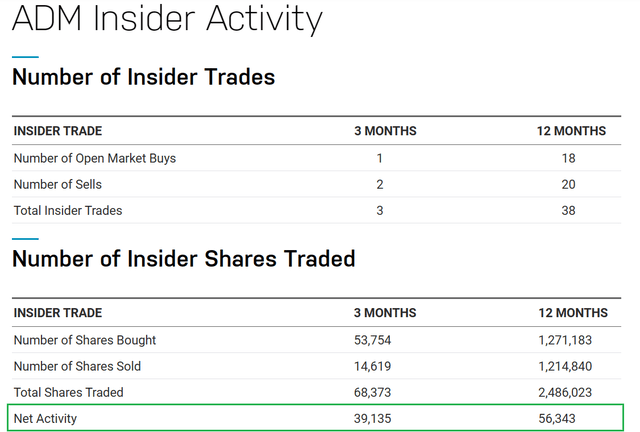

Insider trading over the last year highlights a slight bullish bias by managers at the company (net-net boxed in green on the table below). I have talked about the increasing level of insider selling at Big Tech names since early summer in previous articles. However, ADM has experienced no such rush to the exits in 2023. I take this as a clue the operating business is running well at the present time.

Nasdaq.com – ADM, Insider Trading, 12 Months, Author Reference Point

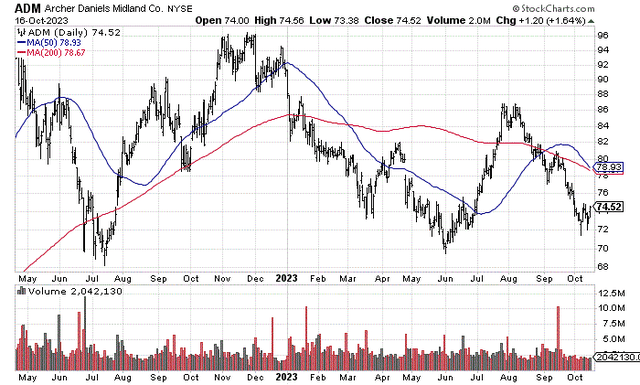

The technical trading chart is sending mixed signals on momentum, using my proprietary sorting formulas. This pick is more focused on the sound valuation available. Yet, it does look like the $68 to $70 price area may provide solid support, as long as grain quotes and the stock market generally do not dive lower anytime soon.

StockCharts.com – ADM, 18 Months of Daily Price & Volume Changes

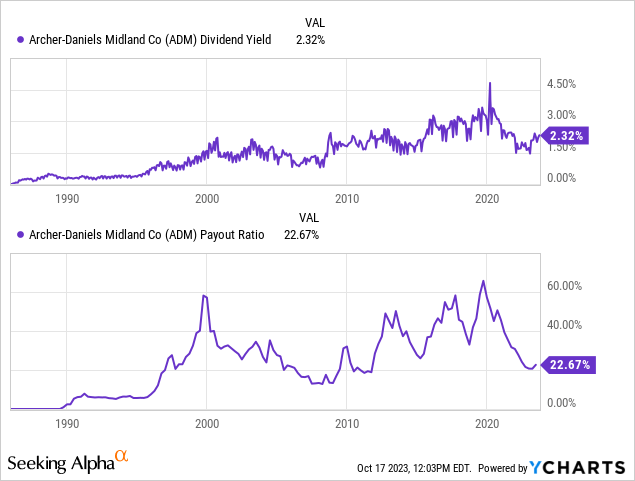

Perhaps the most bullish argument of all to consider ADM is the dividend story. Cash distribution yields have steadily grown over the decades, especially for the buy-and-hold crowd getting dividend payout raises on a regular basis. The trailing 2.3% yield is far above the S&P 500 average of 1.5%, with Big Tech and smaller company averages under 1.0%.

Even better news is the payout ratio as a percentage of earnings is running at a conservative rate of only 23%. If management desired, ADM’s payout could easily double (bringing a 4.6% cash yield annually), and still be inside its typical payout percentage range since 1999. In addition, this potential cash yield approaching 5% would be very close to prevailing short-term savings rates and the pace of inflation. Income investors dream of such a yield, while holding a leading, economically critical blue-chip business. If ADM continues to grow sales and income faster than inflation, like it has over the decades, future dividend payments will be incredibly attractive. I am thinking dividend raises from ADM over the next 2-3 years will be top tier vs. other large capitalization names.

YCharts – ADM, Trailing Dividend Yield vs. Payout/Earnings, Since 1986

What are the major risks owning ADM? Downside risk #1 (and conversely the opportunity) in my mind is the direction of grain prices. Since the company takes a small margin on the current grain price, lower commodity prices will negatively affect company performance, plain and simple. Assuming you have a bearish outlook on grains for 2024, I understand if you want to pass on ADM ownership.

Risk #2 revolves around equity pricing on Wall Street generally. Rising interest rates and a recession will affect the market averages and could exert some bearish influence on ADM’s trading, at least over the short term. All told, a major stock market dive could pull shares under $68 in coming months.

In the end, I rate shares a Buy and own a small position. My plan is to purchase additional shares on weakness, if it appears. Given a sharp drop to $65 or even $60 (which would almost surely be correlated with a huge equity market tank in America), all other variables remaining the same, I would likely move my rating to Strong Buy. A severe equity market setback may directly lead to another round of Federal Reserve money printing, with sharp grain advances again the background situation pulling ADM to new all-time highs over $100 per share during 2024-25.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Read the full article here

Leave a Reply