Arbe Robotics Ltd. (NASDAQ:ARBE) develops 4D imaging radar technology for driver assistance systems and supports autonomous vehicles. ARBE’s technology looks reliable and safe, and a potential OEM contract could prove its real-world viability. However, as of today, ARBE remains largely pre-revenues. It’s also worth highlighting that ARBE’s tech can be useful for free space mapping and smart city infrastructure. For instance, it could have applications in traffic flow enhancement, real-time monitoring, security and surveillance, parking optimization, and lighting systems. Even heavy machinery could benefit from its real-time detection capabilities. Yet, until we see a tangible contract and revenue potential, I remain neutral on ARBE. For now, ARBE seems to be trading primarily on speculation about a potential contract we have limited details on, coupled with a relatively short cash runway. Therefore, I lean neutral on the stock and rate it a “Hold” until we have more concrete information about the contract and its revenue potential.

Autotech: Business Overview

Arbe Robotics is an autotech company founded in 2015 and based in Tel Aviv, Israel, with additional offices in China, Germany, and the US. ARBE specializes in 4D imaging radar solutions for the automotive industry, focusing on enhancing driver assistance and autonomous driving. ARBE’s product portfolio comprises software and hardware suites designed to optimize its radar technology, which is essential for current and next-generation vehicles with automated driving capabilities.

Source: ARBE Company Profile. Brochures 2024.

Therefore, ARBE provides vehicle safety tools for normal and challenging conditions. A central component is its sensor suite’s Phoenix Perception Radar. This radar delivers high-resolution imaging with long-range detection for identifying stationary and moving objects. The Phoenix radar offers redundant sensor technology, unlike optical sensors such as cameras and LiDAR. Redundancy is key because it ensures safety and reliability even in adverse conditions like fog, heavy rain, or low light. Theoretically, this positions ARBE favorably for adoption because consumers and regulators are understandably concerned with safety.

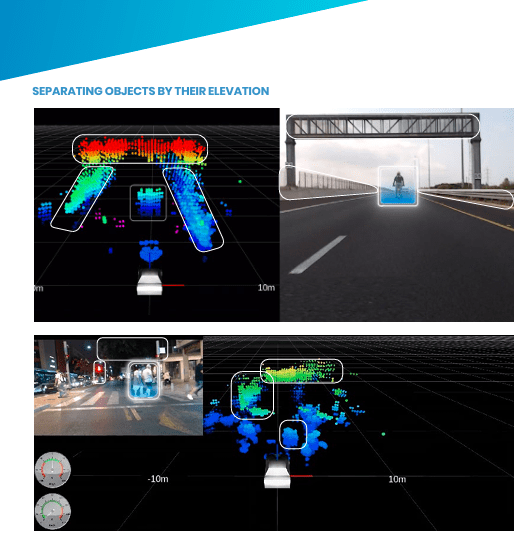

Interestingly, ARBE’s radar data is also comprehensive. It incorporates critical information such as depth to differentiate distances, velocity compared to other vehicles, object orientation, and long-range detection of distant objects. These details are crucial for the vehicle to understand its surroundings, make informed decisions, address current driver-assistance challenges, and advance autonomous vehicle operation technology.

Source: ARBE Company Profile. Brochures 2024.

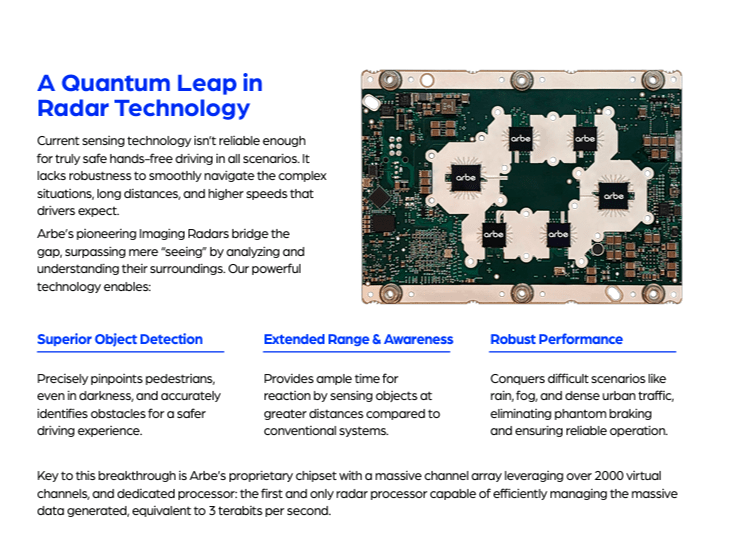

It’s worth mentioning that ARBE’s radar chipset can be acquired separately. This is an essential component of its Phoenix radar, which offers multiple transmission and reception channels. The chip can capture highly detailed images across multiple channels, making it ideal for enabling radar functioning in diverse environments. It can also distinguish objects more accurately, even when they are close to each other. Thus, the chipset reduces the likelihood of false object detection, which could lead to dangerous braking. Moreover, ARBE’s radar processor chip manages vast amounts of data and uses advanced signal processing. It has AI-based post-processing capabilities that enhance object detection and classification accuracy. This is key because it filters out noise, reduces false positives, and achieves precise object detection and classification.

Additionally, ARBE Perception provides tools for sensor fusion, object tracking, and scene understanding. The sensor fusion function combines data from various sensors, such as radar, cameras, and LiDAR. This way, it provides a complete, integrated understanding of the environment. It also has object tracking, which monitors the position and movement of objects around the vehicle. It can even predict vehicle paths, pedestrians, and obstacles for automated driving decisions. ARBE’s technology understands the scene’s context, including road signs, lanes, and diverse traffic scenarios.

Source: Free Space Mapping Brochure. 2024.

It’s worth highlighting that the company’s automotive applications extend beyond passenger vehicles. Essentially, its technology applications can be either dynamic or static. Dynamic applications involve constantly moving environments, such as space mapping in urban scenarios, trucking, industries using heavy machinery (e.g., construction and agriculture), robot shuttles, and aerial vehicles. On the other hand, static applications include stable environments, such as traffic monitoring, optimizing traffic flow, lighting controls, parking systems in smart cities, and safety and security tracking. What I like the most about the company’s IP is that its technology theoretically applies to current and future transportation demands, smart city infrastructure, and industrial processes.

The company’s latest investor presentation noted that by 2028, 30% of new vehicles will include hands-free driving capabilities. This will be driven by sensors like ARBE’s, which provide comprehensive surrounding perception. After all, this will only be possible if self-operating systems are capable of accurate and safe decision-making.

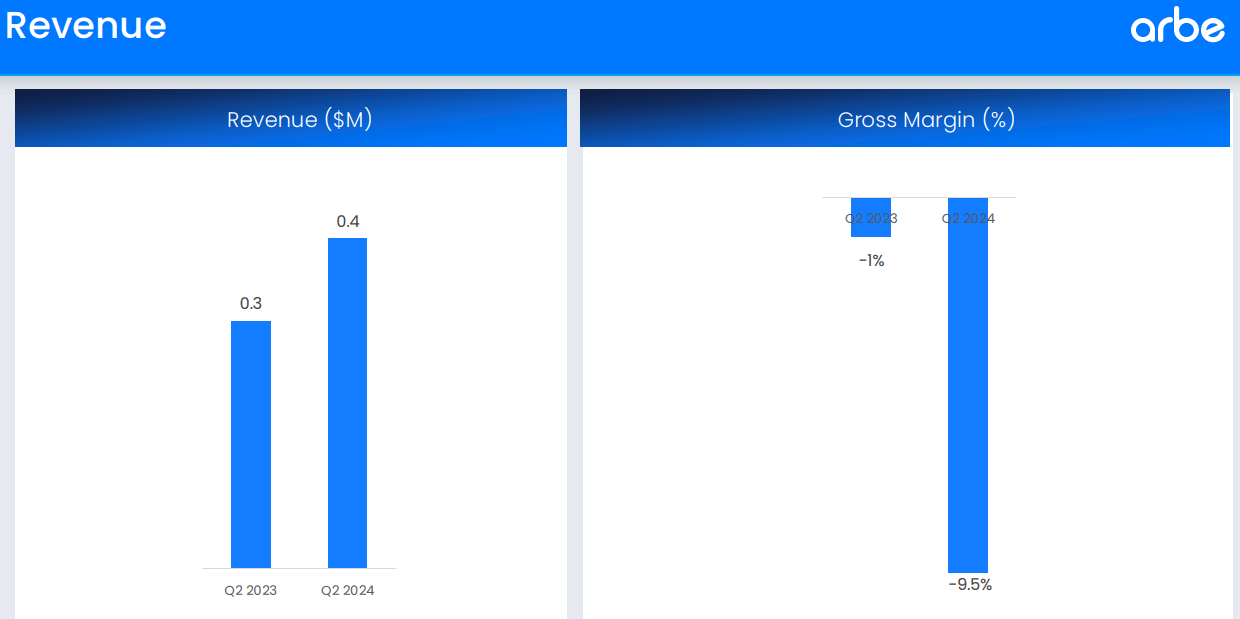

Moreover, ARBE already has a global client base, including Tier-1 suppliers and original equipment manufacturers (OEMs). Its technology seems to be gaining attention in China, Germany, the US, South Korea, Canada, and Israel. ARBE’s website mentions a few notable Tier-1 suppliers, such as Canada’s Magna (MGA), China’s Weifu, and HiRain Technologies. It also lists OEMs such as Hyundai (OTCPK:HYMTF), Beijing Automotive Industry Holding, and advanced mobility technology companies like DiDi (OTCPK:DIDIY), AutoX, and Sensrad. However, so far, the company’s revenues have remained relatively small. For instance, in Q2 2024, ARBE generated just $409.0 thousand in revenues. So, I think the tech is interesting for these entities, but ARBE hasn’t yet obtained meaningful contracts from these larger companies.

Source: ARBE’s Q2 2024 Financial Results.

Nevertheless, I believe one of the most exciting validations of its technology was when ARBE announced a collaboration agreement with a European truck manufacturer. On July 11, 2024, ARBE disclosed its plan to integrate its imaging radar technology to enhance the reliability and safety of large vehicles in challenging conditions. ARBE’s radar chipset was tested in a fleet of trucks during field trials, and the results were positive. As a result, they plan to install ARBE’s chipset in the manufacturer’s next-generation trucks. This radar will enhance their perception and mapping capabilities, especially in complex scenarios such as locating lost cargo and detecting pedestrians at night.

This trucking collaboration is notable because, in April 2024, the US also updated safety regulations. These regulations mandate improved performance requirements for automatic braking systems in new cars sold by September 2029. The National Highway Traffic Safety Administration (NHTSA) stated that these regulations could prevent rear-end and pedestrian collisions, potentially reducing around 40,000 deaths annually. Since ARBE’s offerings have already attracted a European truck manufacturer, it’s likely also compelling for US trucking. After all, ARBE’s high-performance radar systems can detect obstacles and automatically initiate braking, making it ideal for OEMs and Tier-1 entities to comply with these new standards.

Pricing In A Breakthrough: Valuation Analysis

From a valuation perspective, ARBE trades at a market cap of $156.4 million, making it a microcap within its sector. Its balance sheet holds $8.8 million in cash and equivalents, alongside $17.7 million in bank deposits. This amounts to $26.5 million in short-term available liquidity against $30.6 million in financial debt. It’s worth noting that most of that figure comes from $30.0 million in convertible debentures. ARBE’s overall book value stands at $25.5 million, resulting in a P/B multiple of 6.1. This is notably high, especially compared to the sector’s median P/B of 3.2.

Source: Seeking Alpha.

Moreover, I estimate its latest quarterly cash burn at $8.4 million by adding its CFOs and Net CAPEX. This burn rate suggests that ARBE has enough cash runway to last another 3.1 quarters, which is concerning. However, the convertible debentures play a crucial role here. According to the company, these funds are held in escrow and will be accessible once an OEM contract is signed. ARBE has until May 2025 to meet the terms of the debentures, after which the funds would be released. Those additional funds could theoretically extend its cash runway by another 3.6 quarters. Therefore, if ARBE secures that OEM contract, it should have enough cash to operate for 6.7 quarters.

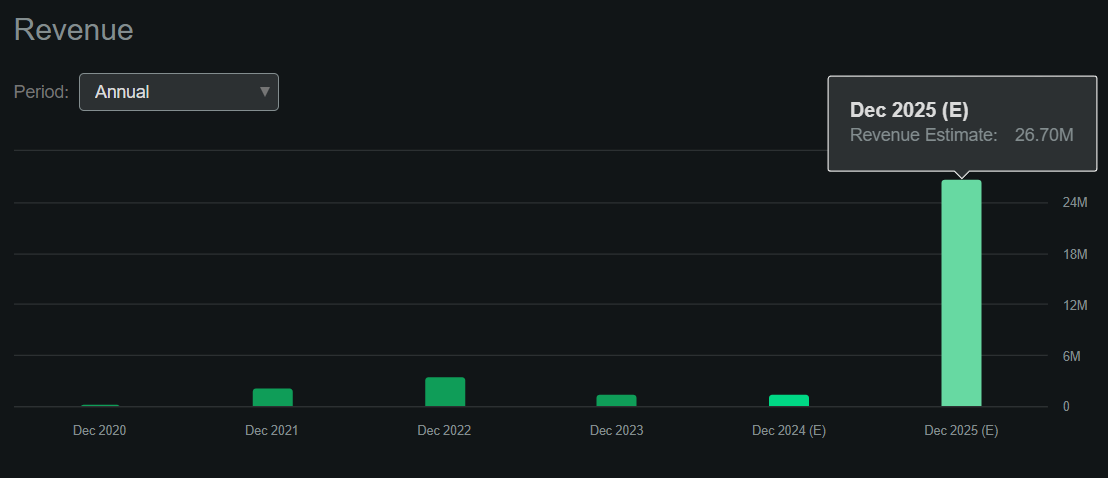

Furthermore, according to Seeking Alpha’s dashboard on ARBE, it’s forecasted to generate $26.7 million in revenues by 2025. I assume this is from the previously mentioned OEM contract management anticipates. If that materializes, it would imply a forward P/S ratio of 5.9. Once again, this is notably higher than its sector’s median forward P/S of just 3.0. So ARBE is evidently trading at a premium in anticipation of that upcoming OEM contract. However, while I accept this would be a pivotal moment for the company, I also see many uncertainties in ARBE’s investment profile.

Many Uncertainties: Risk Analysis

That potential OEM contract’s revenue could provide ARBE with much-needed financial support. However, there’s limited information on the size or timing of this potential contract. It’s not guaranteed that such a contract will materialize, which is a risk investors must consider. I believe ARBE is largely trading in anticipation of this OEM contract. However, if it fails to materialize, I think shareholders would see substantial losses as the company runs out of financing options. On the other hand, securing a large OEM contract could be a major positive turning point for ARBE.

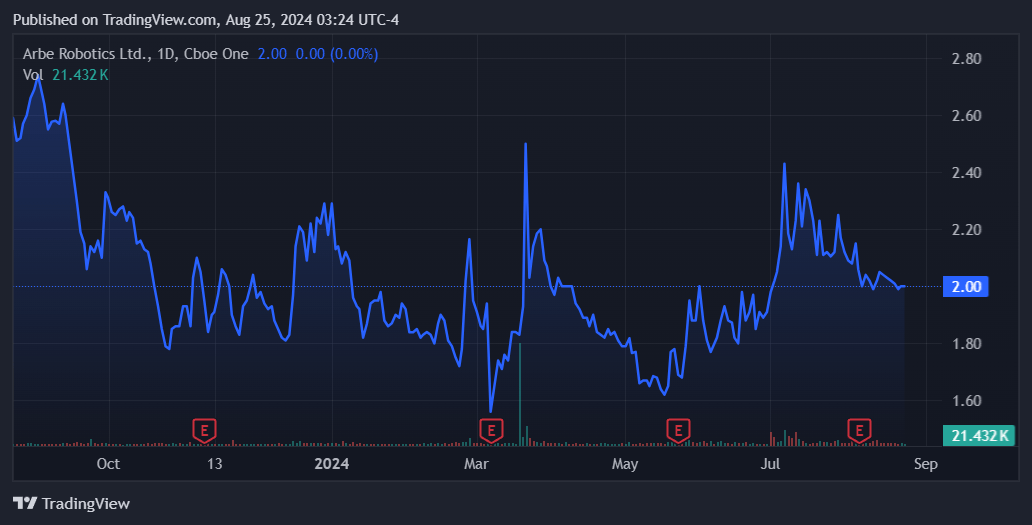

Source: TradingView.

Therefore, I think ARBE is a challenging stock to assess. I reckon its technology appears promising and aligns with industry needs. This is particularly true based on the recent regulatory trends on automation and self-driving. At the same time, the stock is clearly trading at a premium due to speculation around the previously mentioned OEM contract. It also seems to be running low on cash reserves. So, failure to secure the contract could force ARBE into unfavorable financing terms to continue operations. Ultimately, I believe it’s prudent to maintain a neutral stance on the stock for now, so I rate ARBE a “hold” until we get more clarity.

Hold For Now: Conclusion

Overall, I believe ARBE’s technology is promising and addresses the emerging needs of OEMs and Tier 1 suppliers across several industries. However, ARBE’s IP remains largely theoretical at this stage, which is why it’s still essentially a pre-revenue company. Management has hinted at a potentially significant OEM contract that could shift this outlook and transition ARBE into a proven company in its sector. Yet, until that happens, I see a stock trading primarily on speculation about a contract we have limited details on, coupled with a relatively short cash runway. Therefore, I feel it’s reasonable to maintain a neutral stance on the stock until we have more concrete information about the contract and its revenue potential.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply