Analysis of Applied Materials’ Recent Earnings Call

The semiconductor industry is the focus for most of my SA articles, so I’ll address that sector. As reported in Applied Materials’ (NASDAQ:AMAT) fiscal Q4 2023 Earnings Call of November 16, 2023, semiconductor systems revenue declined 3% YoY to $4.88 billion and segment non-GAAP operating margin was flat at 36.9%. For the full year, semiconductor systems grew revenue by 5%.

For fiscal 1Q 2024, consensus is for semiconductor systems to be $4.65 billion, meaning QoQ growth of -4.7%. AMAT did not guide semi revenues for 2024.

Competitive Analysis with Peers

I wrote a September 18, 2023, Seeking Alpha article entitled “ASML To Top WFE Semiconductor Equipment In 2023, Overtaking Applied Materials.” I maintain that contention that ASML (ASML) will overtake Applied Materials as the top WFE (wafer front end) Semiconductor Equipment supplier in 2023, according to my analysis.

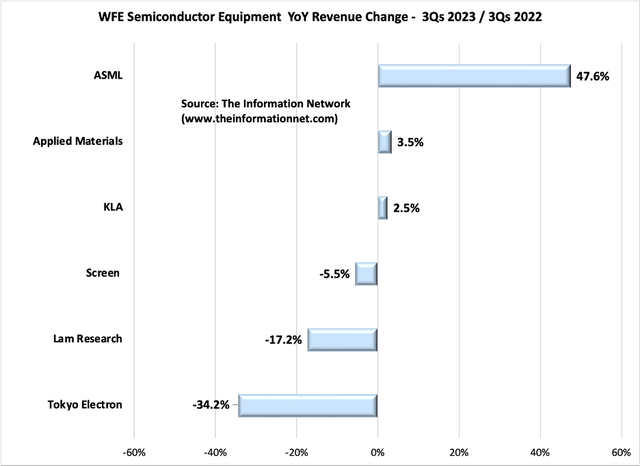

Chart 1 shows revenue for AMAT among the top equipment companies for three quarters 2023 versus three quarters 2022. Revenues are for equipment only, and do not include service or spare parts.

AMAT’s semi equipment revenues are up just 3.5% YoY. With consensus for its 1Q 2024 of -4.7%, it is likely that the company will report flat revenue growth for CY 2023. KLA’s (KLAC) revenues were slightly lower, growing 2.5%. KLA forecast revenue above expectations on growing adoption of AI tools.

But Lam Research (LRCX) was significantly lower than U.S. peers with a YoY growth of -17.2%. The reason for Lam’s revenue drop is its high exposure to memory chips, which I discussed in a June 14, 2023, Seeking Alpha article entitled “Lam Research Earnings: All Eyes On Memory Chip Recovery.”

Japanese equipment companies Screen (OTCPK:DINRF) and Tokyo Electron (OTCPK:TOELY) also fared poorly.

The Information Network

Chart 1

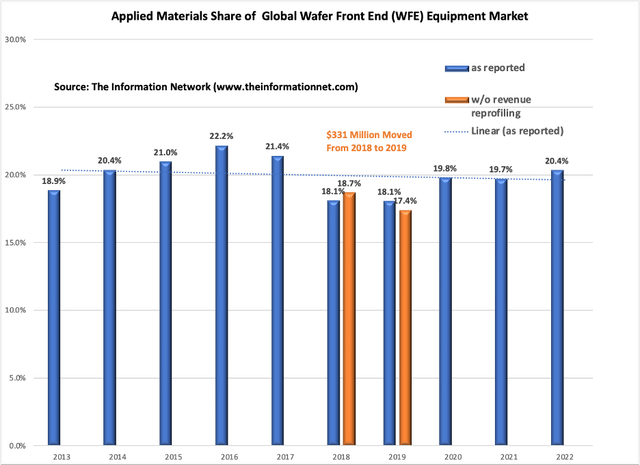

ASML is the dominant equipment company, growing 47.6%, which will vault the company to the #1 WFE company for CY 2023. In CY 2019, ASML was the #1 company despite AMAT moving $331 million from its 2018 revenues into 2019, which I discussed in my August 19, 2019, Seeking Alpha article entitled “Applied Materials: It Was Worse Than It Appears”. This is shown in Chart 2.

AMAT’s share of the WFE market increased slightly in 2022, but the trendline (dotted line) is down between 2013 and 2022, indicating its share of WFE has been dropping, particularly since 2017.

The Information Network

Chart 2

Ironically, AMAT CEO Dickerson made the following comment in the company’s recent earnings call:

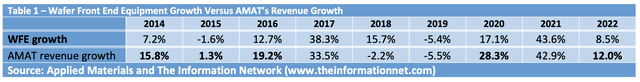

“Our Semiconductor Systems business delivered mid-single digit growth for the fiscal year and remains on track for growth in calendar 2023 which will be the fifth consecutive year that we’ve outperformed the wafer fab equipment market.”

According to Chart 2, AMAT’s share of the global WFE equipment market, AMAT’s share over the past four years from 2019 to 2023 (his fifth consecutive year comment is for 2023), revenue increased in 2019 IF the $331 million from 2018 revenues were added to 2019 (blue bar).

In the nine years of data in Table 1, AMAT outperformed the WFE growth in five years, but only two years in the past four, not five consecutive as stated by Dickerson.

The Information Network

China Affect

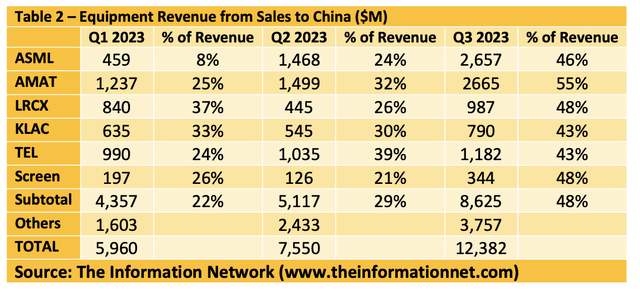

In Table 2, I show the Top 6 Semiconductor equipment companies and their China revenues and percentage of revenues generated from China for Q1-Q3 2023. In Q3, percentage of revenue was nearly the same for each company, indicating that Chinese semiconductor companies are importing equipment irrespective of process equipment type.

The Information Network

Both Chinese semi and foreign equipment companies have taken advantage of loopholes in the U.S. sanctions. With the Commerce Department using the 14nm restriction limit, Importers could easily acquire equipment by claiming its use on an older production line. Limited capacity for end-use inspections makes it challenging to verify that the equipment is not being used to produce more advanced chips.

It is not clear whether new, more restrictive sanctions made in October 2023 will be effective.

Thoughts on Fed Litigation

I must admit I was wrong when I wrote my May 18, 2022 Seeking Alpha article entitled Applied Materials: SMIC Move To 7nm Node Capability Another Headwind. This is the article where I first announced that China’s Semiconductor Manufacturing International Corporation (SMIC) (OTCQX:SIUIF), about three months before the achievement was publicly revealed during a tear down by the company TechInsights.

In my article, I noted that based on the percentage of equipment sales to China, and based on market share percentage for various equipment types, Applied Materials would generate $14 million on sales of equipment to meet SMIC’s 7nm node demand. In contrast, I estimated LRCX would generate nearly $1 billion in sales.

These figures were modeled based on selling equipment through proper licensing channels as dictated by the U.S. Department of Commerce. It didn’t mean that AMAT would go around to the back door and under the table to sell equipment to SMIC and skirt sanctions.

The shipments began after the US Commerce Department added SMIC to its “Entity List” in December 2020, which restricted exports of goods and technology to the company, two of the sources said, and took place in 2021 and 2022, according to Reuters.

Interestingly, according to the same Reuters article:

“Santa Clara, California-based Applied Materials said Thursday it first disclosed in October 2022 that it had received a subpoena from the U.S. Attorney’s Office in Massachusetts for information on certain China customer shipments.” The company is cooperating with the government and remains committed to compliance and global laws, including export controls and trade regulations,” it said in a statement.”

AMAT noted in its Fiscal 2022 10-K on page 18:

“In August 2022, Applied received a subpoena from the U.S. Attorney’s Office for the District of Massachusetts requesting information relating to certain China customer shipments.”

The company produced semiconductor equipment in Massachusetts, then repeatedly shipped the equipment from its plant in Gloucester to a subsidiary in South Korea. From there, the equipment went to SMIC.

Interesting, Gloucester, Mass. is the plant that AMAT’s current upper management, including CEO Gary Dickerson, came from when AMAT acquired Varian Semiconductor Equipment Associates (“VSEA”) in 2011. It appears the equipment shipped to China are ion implant systems.

Read the full article here

Leave a Reply