Investment Thesis

Applied Industrial Technologies (NYSE:AIT) financials are outstanding and are exhibiting an uptrend, however, with the lack of revenue growth and little margin improvement going forward, the company is slightly expensive for a new investor’s portfolio and would like to see a pullback sometime in the future.

Briefly on the company

AIT distributes industrial motion, power, control, and automation technology solutions. The core focus of the company is industrial bearings, power transmission products, fluid power components, and advanced factory automation. The company has two reportable revenue segments: Service Center-Based Distribution, which accounted for 66% of FY23 revenues, and Engineered Solutions, which accounted for the remainder. Service center-based distribution provides products for the maintenance of motion control infrastructure, while Engineered solutions provide expertise in repairing, designing, engineering, and distributing of hydraulic and pneumatic fluid technologies.

Financials

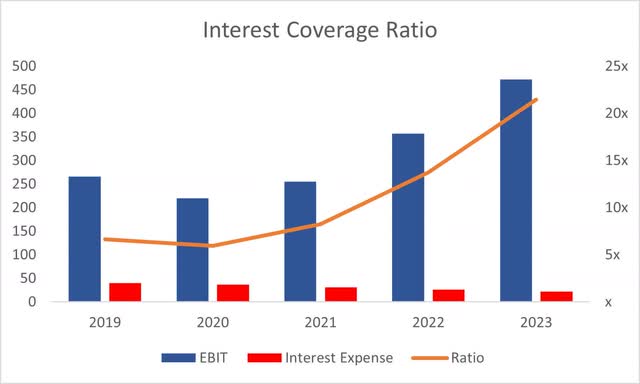

As of FY23, the company had $344m in cash and equivalents against $597 in long-term debt, which was reduced by around $54m y/y. It is good to see that the company is paying it down, which will in turn reduce its annual interest burden on debt. Speaking of which, the interest expense on debt stood at around $25m for the year. Is that manageable for the company? Well, EBIT stood at around $473m, which meant that the interest coverage ratio was over 18x, meaning EBIT could pay off annual interest on debt over 18 times. For reference, many analysts consider an interest coverage ratio of 2 to be sufficient and healthy. On the other hand, I consider anything over 5x to be acceptable. So, it is safe to say the company is at no risk of insolvency any time soon.

Coverage Ratio (Author)

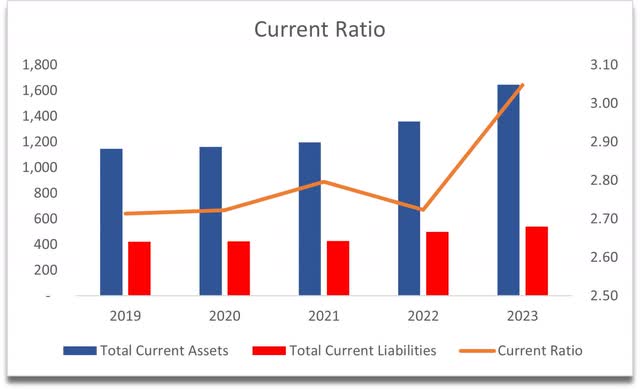

In terms of the working capital ratio, it is very strong, which makes it a little bit inefficient in my opinion. An inefficient current ratio, I consider to be anything substantially over 2. The good thing about such a ratio is that it has no problem paying off its short-term obligations, but a bad thing because the company’s assets aren’t being utilized efficiently, for example, the company could use its substantial cash pile for more of an aggressive expansion initiative, rather than hoarding the cash. The current ratio has been well above 2.0 for at least 5 years and it doesn’t look like it’s going to change any time soon.

Current Ratio (Author)

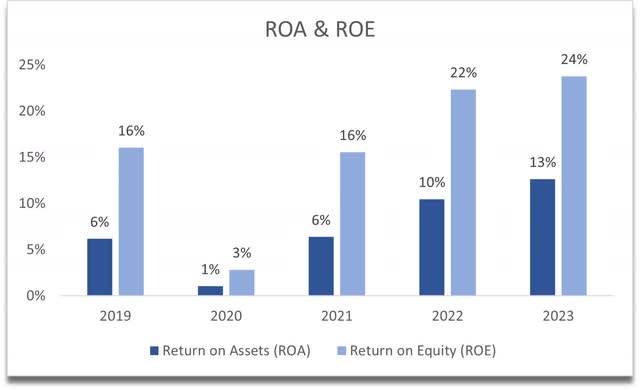

Looking at the company’s profitability and efficiency ratios, we can see that the ROA and ROE have exhibited an upward trend since the pandemic lows of ’20. This is what I like to see. ROA is above my minimum of 5% and ROE above my 10% threshold, which makes it much more attractive as an investment. This tells us that the management is utilizing the company’s assets and shareholder capital efficiently enough. ROA would have been higher if the current ratio was a lot more efficient.

ROA and ROE (Author)

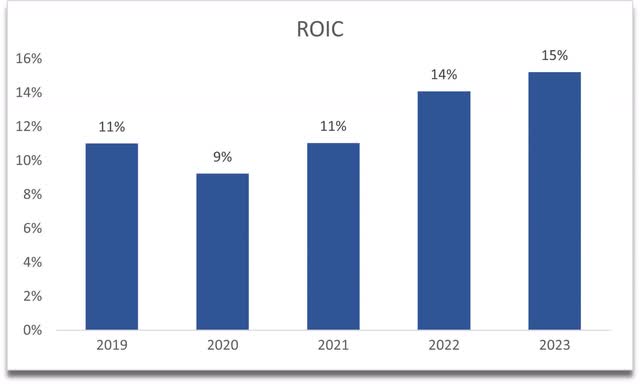

The same story can be observed in the company’s return on invested capital or ROIC. It’s on an upward trajectory since the pandemic lows (even though it wasn’t even that low). It is also higher than what I usually look for in an investment, which is at least a 10% return. This tells me that the company has some sort of competitive advantage and a moat since it can retain such returns and even increase them over time.

ROIC (Author)

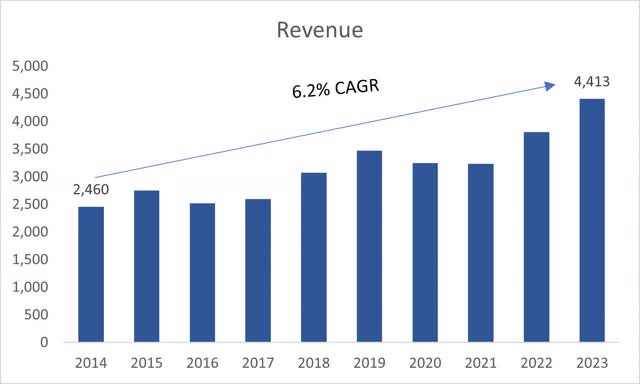

In terms of revenue growth, for a company that is 100 years old, I would say an average CAGR of 6.7% is more than decent. This will provide me with an anchor for my valuation analysis. The last two years showed an above-average growth rate of around 17%, which I don’t think is sustainable, so in the long term, I believe the company will return to its historical average, or slightly lower. Two analysts are estimating that the company will see a 2.29% revenue growth next year, while one analyst estimates around 4% growth for the year after that. Since the company is not very well covered by the mainstream media, we’ll have to come up with some reasonable assumptions for the valuation in the next section.

Revenue (Author)

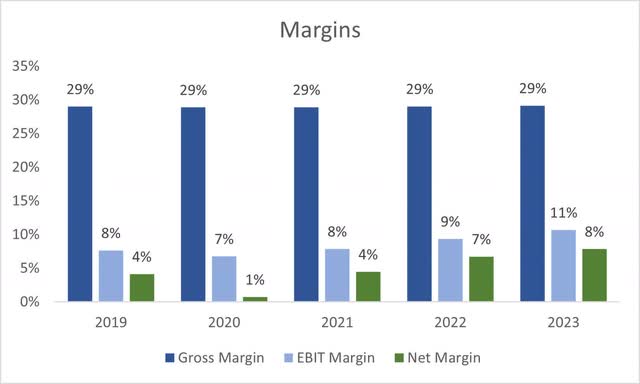

I also like how the margins have developed over the last 5 years. Gross margins have stayed relatively stable over the years, while the company managed to improve efficiency and profitability, as EBIT and net margins have improved dramatically since FY20. Can these improve any more? I’ll assume they can but only slightly more.

Margins (Author)

Overall, I like the direction the company’s going in. All the metrics that I look for in an investment exhibited some sort of an uptrend, which is what I like to see. This and stable metrics are also good in my opinion, while seeing as few downward metrics as possible. This will call for a small margin of safety in the next section.

Valuation

As I mentioned earlier, we will have to come up with some reasonable assumptions for the valuation because the analysts are far between.

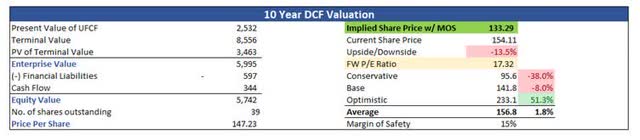

So, for the base case scenario for revenues, I went with a slightly conservative outlook of around 4.5% CAGR for the next decade. For the optimistic case, I went with a 6.5% CAGR, while for the conservative case, I went with a 2.5% CAGR to give me a range of possible outcomes.

For the margins, since the company has been able to achieve stable gross margins throughout, I went with about 180bps of improvement over the next decade, while for operating margins, I went with only around 50bps of improvement over the same period. I don’t think there is much improvement to be had going forward. I do see some further improvements because I would like to account for technological advancements slightly.

On top of these estimates, I decided to add a little extra margin of safety of 15%. This is on the lower end that I give to companies with decent balance sheets and other financial metrics. With that said, AIT’s intrinsic value is $133.29 a share, which implies that the company is currently trading at a slight premium to its fair value.

Intrinsic Value (Author)

Closing Comments

With these types of estimates, which are very close to its historical average, the company does not trade at an enticing risk/reward in my opinion. The company was at the intrinsic value above sometime in June, which means I may have missed it already. If that is the case, I don’t mind it, to be honest, I will find another company that will meet my criteria in the future. For now, all I can do is set a price alert and see what happens in the future. If it hits my PT, I will reassess the company’s situation and see if it’s going to be a good investment.

I’m not sure if we are out of the woods yet in terms of macroeconomic headwinds, which means that the company may see further volatility along the way that may present a good entry point if investors are vigilant enough.

Read the full article here

Leave a Reply