Investment Thesis

Apple (NASDAQ:AAPL), an American icon and a darling of Wall Street, is undeniably the most closely watched company here on Seeking Alpha, boasting a massive following of over 2.6 million investors. This company’s track record is nothing short of stellar, having evolved into a tech juggernaut currently valued at a staggering $2.7 trillion and its brand being valued at $297.5 billion just behind Amazon’s (AMZN) and followed by Microsoft (MSFT) and Google (GOOGL,GOOG), making it the single largest player in the S&P 500 index (SPY), where it accounts for over 7% of the index’s weight.

Brand Value (Visual Capitalist)

Given its current premium valuation and uncertain growth prospects in the short term, Seeking Alpha has seen a flurry of activity in the last 30 days, with no fewer than 34 articles dedicated to dissecting the company from every conceivable angle. While these articles vary widely in their perspectives and ultimate conclusions, it’s worth noting that there are currently 9 BUY ratings, 18 HOLD recommendations, and 7 SELL opinions, reflecting the diversity of opinions among investors themselves.

As its September, a month I personally consider the most important one in Apple’s annual cycle, especially with their recent introduction of the 2023/24 iPhones, it becomes imperative to dive into our expectations for these new devices. The critical question at hand is whether the innovations and pricing strategies will indeed be robust enough to re-ignite sales growth and justify the company’s premium valuation.

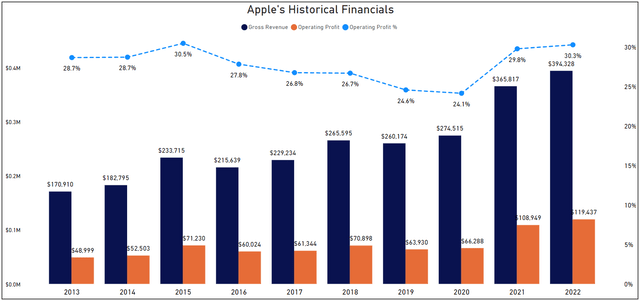

Apple’s historical growth has been strong, but it’s the expanding margins that steal the spotlight

Before delving into the prospects of the new iPhones and their sales potential, let’s take a quick look at Apple’s historical growth and profitability.

Over the past decade, Apple’s revenue has surged with an impressive annualized growth rate of 13%. However, it’s essential to note that a significant portion of this growth occurred between 2021 and 2022, driven partly by increased digital content consumption and device upgrades during the pandemic. However, I lean more toward the view that this growth was significantly influenced by extensive stimulus packages, which often found their way into the coffers of tech giants.

Considering the current landscape of quantitative tightening and interest rates hovering around 5.25%-5.5%, it becomes increasingly likely that replicating the growth experienced during the pandemic may prove challenging. In light of this, I would lean towards working with Apple’s more typical growth levels observed between 2013 and 2020 when Apple consistently achieved around 6% annualized revenue growth.

Even more impressive is the company’s remarkable efficiency, evident in the expansion of its operating margin over the past two years, which has surged by over 600 basis points. Although Apple doesn’t break down margins by product category, this boost is likely a result of the revenue shift toward Apple’s premium offerings, such as the iPhone, which typically carry higher margins.

Moreover, Apple’s decision to utilize in-house chips has played a pivotal role in reducing the COGS. The introduction of the M1 chip into Mac computers, starting in November 2020, has been followed by the release of new models, further contributing to this cost-saving strategy and I expect this trend to continue.

Historical Financials (Author’s Graph (Data SA))

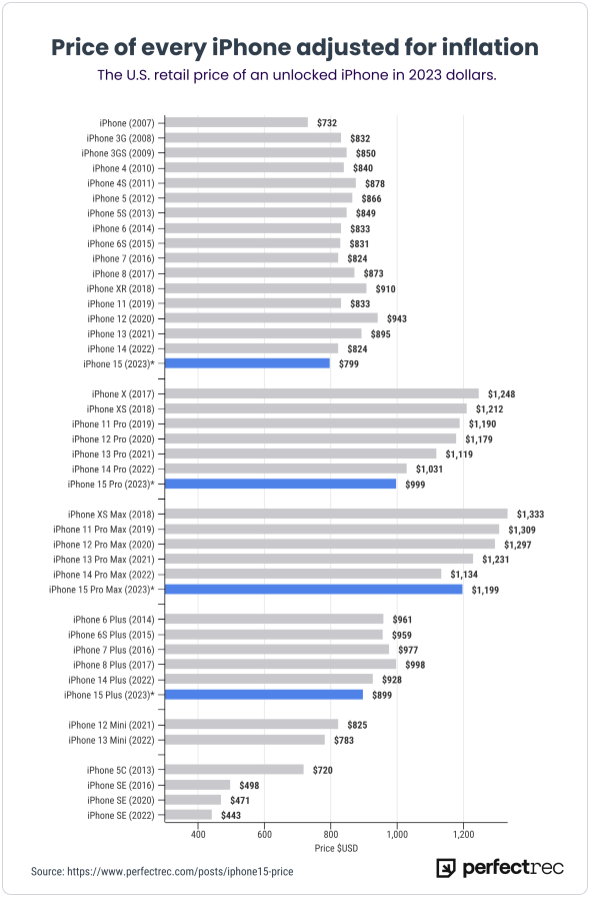

iPhone 15 lineup is second most affordable ever when adjusted for inflation

Every year, tech enthusiasts engage in discussions about whether the latest iPhone release offers enough new features to warrant an upgrade from previous models or even from competitors’ devices. Instead of delving into the specifics of which device has the superior features or why one should or shouldn’t make a purchase, let’s shift our focus to the numbers.

Numerous analysts had anticipated Apple to raise prices across the board for its devices this year, but that expectation did not materialize. The iPhone 15, positioned as the more affordable model below the flagship iPhone 15 Pro, has maintained its price from the previous year. The only notable change is in the Pro Max model, which has seen a $100 price increase, albeit starting with higher storage configuration this year.

In my view, this suggests a slight shift in Apple’s game plan. Instead of purely chasing short-term revenue and profits, the company seems to be embracing a strategy that I’d like to call for a lack of a better word “value proposition.”

Apple appears to be acknowledging the persistent economic uncertainties and is seizing the moment to carve out a larger market share. The underlying philosophy is clear: once you’re in the Apple ecosystem, you’re more likely to stay, and possibly expand your Apple product collection to include items like watches and computers. This, in turn, sets the stage for sustained sales growth and profitability down the road.

Turning our focus back to pricing, I’m genuinely impressed with what the iPhone 15 offers – it’s a substantial upgrade compared to the iPhone 14. In my view, this model will be a significant sales driver for Apple this year, and it’s a sentiment shared by analysts who anticipate a 10%-12% increase in pre-orders compared to the iPhone 14. What’s even more intriguing is that, when we consider inflation, this year’s devices are, for the most part, the second most affordable they’ve ever been since the iPhone’s initial release in 2007. I believe this represents an enticing value proposition for customers seeking a high-end device.

iPhone Price adjusted per Inflation (PerfectRec)

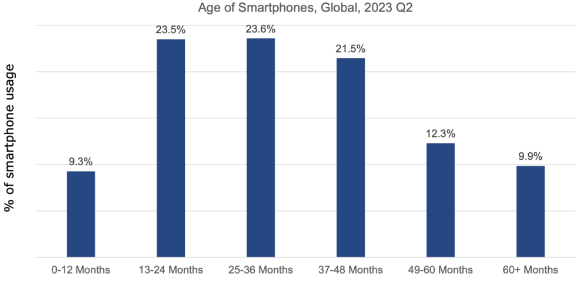

The noticeable surge in pre-orders compared to the previous year undoubtedly indicates strong sales potential for the new devices this year. However, what’s worth acknowledging is the increasing trend of prolonged upgrade cycles, a challenge faced not only by Apple but also by many other smartphone companies.

In recent years, innovation in the smartphone market has largely revolved around camera and chip improvements. This has resulted in devices becoming more powerful and enduring, causing a significant 23.6% of customers to stick with their current phones for longer periods, spanning anywhere from 25 to 36 months. This shift marks a departure from the traditional bi-annual upgrade pattern.

Age of Smartphones (Dazeinfo)

For a rough estimate, let’s take into account the approximately 5.25 billion smartphone users globally, with Apple currently holding a market share of 28%. This implies there are approximately 1.47 billion iPhones in use today. If we assume that 18% of these users decide to upgrade their phones this year, that would translate to approximately 279 million new devices being purchased.

Now, considering that not everyone opts for the latest iPhone model and using the average price of $799, which is the price of the iPhone 15 base model this year, Apple could potentially generate around $222 billion in sales from iPhones. This projection reflects a 8% increase from the $205 billion generated by iPhones at the end of 2022.

Looking ahead, it’s crucial to expand our perspective beyond iPhones as the sole drivers of growth. As of the end of 2022, iPhones accounted for 52% of the company’s revenue. Additionally, as we move forward, Apple will start selling the Vision Pro, a device I believe will find popularity, particularly among businesses rather than individual consumers, despite its hefty price tag.

I’d like to emphasize is the importance of adopting a long-term outlook when looking at a visionary hardware company as Apple is.

The return of Huawei and the ongoing Chinese government risks

I want to briefly address a concerning issue related to the Chinese government, which has recently had a significant impact on Apple, causing a staggering $200 billion drop in the company’s valuation.

China is the third-largest market for Apple, contributing around 17.4% to its overall revenue, trailing only the Americas and Europe in importance. It’s crucial for Apple to maintain a strong presence in this market, especially since most of its devices are still manufactured in China, despite the recent shift towards producing some iPhones in India in 2023.

It’s important to note that China hasn’t officially enacted any laws, regulations, or policies explicitly banning the purchase and use of foreign-brand mobile phones like Apple’s. However, there have been reports, such as those in The Wall Street Journal, suggesting that staff at central government agencies were informally told not to use iPhones for work and were discouraged from bringing them into government offices.

I interpret this situation in the context of the escalating tensions between the U.S. and China, seeing it as a potential response to the U.S. ban on Huawei devices in 2022. It appears that China is flexing its muscles, possibly as a form of retaliation against an American icon like Apple. However, it’s worth considering that Apple’s partnership with Foxconn (OTCPK:FXCOF), a company employing over 200,000 workers in its largest factory dedicated to Apple, adds a layer of complexity to any decision to sever ties, especially in the face of economic challenges in China.

Another aspect that has left analysts pondering is whether Huawei’s new lineup, featuring phones equipped with capable 5G chips, might entice Chinese consumers to switch. However, with the release of the iPhone 15, it seems the Chinese public still leans towards Apple, considering it a symbol of luxury and status.

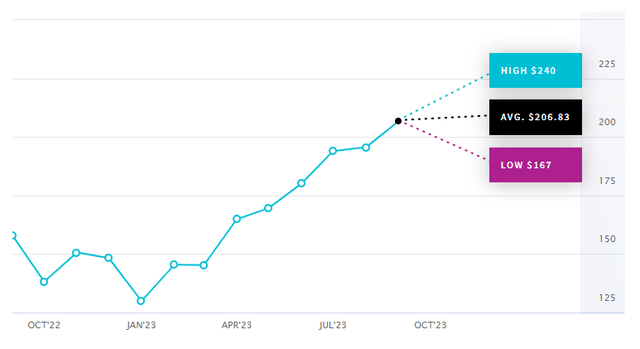

Valuation

Much like the varying opinions found on Seeking Alpha, professional analysts also have a wide range of predictions when it comes to Apple’s price targets. Among the 38 analysts offering 12-month price forecasts, the median target is set at $206.8. Within this range, there’s a high projection of $240.00 and a low estimate of $167.00. It’s noteworthy that the median estimate suggests a notable +14.46% increase from the stock’s most recent price of $174.74.

Price Forecast (NASDAQ)

While it’s valuable to gain insights into what professional analysts anticipate for the stock over the next 12 months, I maintain a degree of skepticism. Their primary role is to encourage investments and attract more capital. Being bullish on a widely favored stock and ending up wrong is generally more socially accepted than adopting a bearish stance and being incorrect.

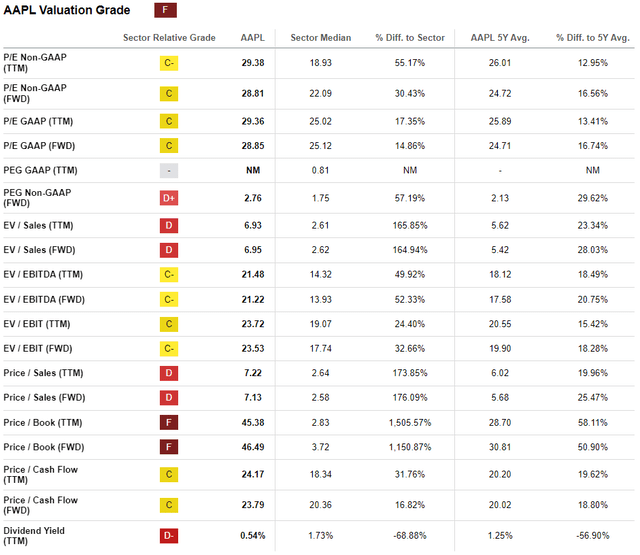

So let’s have a look at some valuation metrics, to understand the valuation of Apple better.

Apple’s current PE ratio stands at 29.38x, which is 12.95% above its 5-year average. Additionally, the Forward PE ratio, currently at 28.81x FY24 earnings, appears to be on the higher side. However, considering the projected EPS growth, it’s expected that the company will trade closer to its 5-year Forward PE ratio by FY26, which is roughly three years from now.

Turning to the EV/EBITDA, it’s clear that Apple is trading at a significant premium. It’s 18.49% higher than its 5-year average and nearly 50% higher than the technology industry average.

All valuation metrics, no matter how we look at it, seem to suggest that Apple is currently trading at a rich valuation, with an overvaluation of nearly 15%. However, it’s important to note that these metrics provide a somewhat short-term perspective and don’t account for the expected expansion in EPS beyond the next FY.

It’s crucial to emphasize that Apple is a high-quality business. Despite economic turbulence, it consistently delivers stable performance and manages to expand its margins. This track record certainly justifies a premium valuation to some extent.

Valuation Scorecard (Seeking Alpha)

Looking ahead, based on its historical growth rates with an anticipated annualized revenue growth rate of around 6% in the years to come (excluding the anomaly of stimulus and pandemic-driven years), Apple seems poised to reach a revenue figure nearing $650 billion by the close of 2032.

Simultaneously, I have expectations of Apple’s EPS growing by approximately 8.3% annually over the next decade. This growth will be driven by factors such as the focus on the more luxurious products, increased in-house chip production, and a continuation of their successful share buyback program, which has seen them repurchase nearly 38% of their outstanding shares in the past decade.

With these insights in mind, it’s likely that the Forward PE ratio will gradually move closer to its 5-year average of 25x, suggesting a potential valuation contraction. Based on this trajectory, I project that Apple’s stock could be trading at around $308 by the conclusion of 2032. This implies an annualized rate of return of 6.7%. When considering the dividend yield of approximately 0.6%, the total rate of return should be approximately 7.5%.

While this projected return falls short of the historical performance of SPY, which has averaged a total return of approximately 10.2% since its inception, it’s crucial to bear in mind the current outlook for SPY returns in the next decade, which is estimated to be in the range of 4.7% to 6.7%. In light of these projections, it’s reasonable to expect that Apple will outperform the broader market.

| Fiscal Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

| Revenue ($b) | 405.9 | 431.5 | 457.4 | 484.8 | 513.9 | 544.7 | 577.4 | 612.1 | 648.8 |

| Revenue Growth | 5.9% | 6.3% | 6.0% | 6.0% | 6.0% | 6.0% | 6.0% | 6.0% | 6.0% |

| EPS | 6.6 | 7.1 | 7.7 | 8.2 | 8.9 | 9.7 | 10.5 | 11.4 | 12.3 |

| EPS Growth | 8.2% | 8.4% | 7.5% | 7.5% | 8.5% | 8.5% | 8.3% | 8.3% | 8.5% |

| Forward PE | 28 | 27 | 26 | 25 | 25 | 25 | 25 | 25 | 25 |

| Stock Price ($) | 184 | 192 | 199 | 206 | 223 | 242 | 262 | 284 | 308 |

In closing, it’s worth recalling the timeless wisdom: “Price is what you pay, value is what you get.” Even with its current elevated valuation, Apple appears to offer compelling value for investors.

Conclusion

Apple stands as one of the tech giants that has seen remarkable growth over the past decade, consistently outperforming the market and earning its place as a symbol of American innovation and pride.

The company’s commitment to innovation and unwavering focus on delivering premium products that resonate with customers worldwide positions it for continued growth in the years ahead. With the introduction of its second most affordable iPhone lineup and the promise of new devices entering the market next year, Apple remains in a strong position for expansion.

While 2023 may not match the explosive growth of 2021 and 2022, which were driven by the unique circumstances of the COVID-19 lockdowns and stimulus packages, the future appears promising. A reasonable expectation is that Apple will achieve an annualized revenue growth of approximately 6% and even faster growth of EPS, estimated at around 8.3%.

Despite its current premium valuation, Apple’s exceptional quality as a business justifies trading at a premium. Considering its quality and growth prospects, I rate the company as a BUY.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply