Apple (NASDAQ:AAPL) announced a $110 billion stock buyback after the bell on Thursday along with its Q1 results. This is the biggest stock repurchase program in history and helped the stock gain some six percent in trading on Friday. While the repurchase plan should buoy EPS on the margin, it is probably not the wisest way to utilize that massive amount of cash. We will also get into why this historic buyback program is unlikely to move the needle over the long-term for Apple shareholders. However, first here are three more effective uses for that largess in my opinion.

Buy Short-Term Treasuries:

Let me be clear I am not a big fan of stock buybacks in general. They cover for the shareholder dilution caused by the stock and option compensation company leadership receives and do nothing for increasing free cash flow at the firm. They do boost EPS, which can be positive for capital appreciation, but that also enhances executive compensation as EPS is almost always a core part of the criteria for doling out performance bonuses and option grants to management.

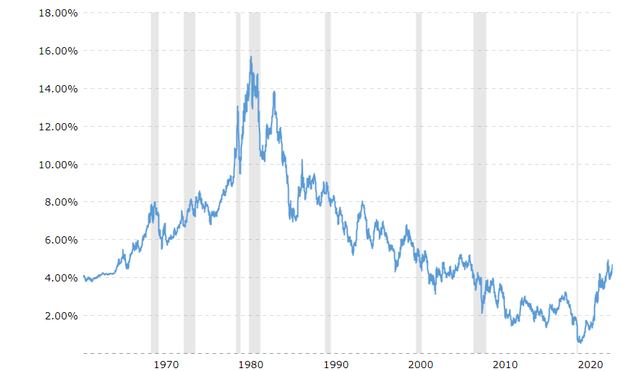

10-Year Treasury Yield (Macro Trends)

That said, there are times when stock repurchases are more than warranted and in the best interest of shareholders and management. Back when I was applauding Apple’s stock buyback efforts in 2014, the stock sold for roughly 10 times forward earnings, had a ton of cash on its balance sheet and the yield on the 10-Year Treasury was around 2.5%. Today AAPL trades at roughly 28 times forward earnings and the yield on the 10-Year Treasury is just over 4.5%. With AAPL’s inverse earnings yield being slightly less than 3.6% when short term treasuries pay nearly 5.4%, one could make the argument the company and its shareholders would get a better return by buying short term treasuries even after paying corporate taxes on the income.

Increase Dividend Payout:

The company could also substantially increase its quarterly dividend payout and/or execute a substantial ‘special dividend‘. Currently AAPL has an absolutely paltry yield of .55% and a payout ratio of approximately 15%. Given the mature state of Apple’s business that payout ratio could easily be raised to 40% to 50%. Yes, corporate dividends amount to ‘double taxation‘, one of many glitches in the U.S. tax system that should be fixed. However, dividends have appeal to investors, even tech shareholders. One reason that Alphabet (GOOG) just announced it was going to start issuing quarterly dividends for the first time in its history.

It also should be noted that stock buybacks are coming under increasing congressional scrutiny. A one percent tax on stock repurchases was introduced in 2023 and already the administration wants to quadruple that tax in the coming budget year.

A Generational Investment In Generative AI:

Apple has become a $2.8 trillion market cap concern. The company has gotten so large it is akin to trying to turn a supertanker. Very few new markets have the ability to substantially boost growth. One of these, however, is artificial intelligence or AI. The emergence of generative AI has already changed the fortunes of name like NVIDIA Corporation (NVDA), Super Micro Computer (SMCI) as well as for other tech companies.

The emergence of AI could be a paradigm shift that has not been seen since the birth of the internet in the 90s. This is why Meta Platforms (META) just announced a $5 billion increase to its AI investment plans even after pouring tens of billions of dollars into building out the Metaverse, with little to show for that investment to date.

The consensus among analysts is that Apple is playing ‘catch up‘ in the AI space compared to its large rivals, and many are frustrated that management has not announced major investment plans. What if Apple had announced that it would invest a substantial amount of the money now geared towards stock buybacks into a major AI buildout? That is something investors can only ponder, but in the long run I think shareholders would have been better off if management would have targeted the AI space rather than a massive stock repurchase program.

Conclusion

Apple made $6.13 a share on $383.3 billion in sales in FY2023. The current analyst firm consensus has the company making $6.53 a share in FY2024 as revenues right slightly to $385.8 billion. They project profits moving to $7.13 a share in FY2025 on six to seven percent sales growth. For this relatively paltry level of earnings growth, investors are paying just north of 28 times forward earnings and over seven times forward sales. To put in perspective, on a forward P/E basis Apple is being valued like Microsoft (MSFT) that is experiencing much faster sales and earnings growth. MSFT even has a slightly higher dividend yield (.75%).

The $110 billion stock buyback announcement is the largest in U.S. history, and it should lead to EPS estimates being taken up slightly in the coming weeks. That said, Apple is still a low growth stock being priced in the market as a fast-growing enterprise. This is maybe why Warren Buffett’s Berkshire Hathaway (BRK.A) reduced its huge stake in Apple by slightly over 20% in the first quarter. Also of note, Berkshire boosted its holdings of T-bills by $24 billion to $153 billion during the quarter.

In addition, as large as $110 billion sounds (more than the market caps of over 400 S&P 500 companies), it amounts to just under four percent of the outstanding float of the stock. In addition, Berkshire still held just over $135 billion of Apple stock at the end of the first quarter, which it appears to be reducing.

The stock got a nice one-day boost on Friday from the stock buyback news. However, I don’t think that announcement will have a major longer-term impact on the stock and the shares appear range bound in a best-case scenario given their valuation.

Read the full article here

Leave a Reply