The Apple Inc. (NASDAQ:AAPL) Services segment reported 8% YoY growth, which is seen as a major silver lining in the recent fiscal Q3 earnings report. In the previous quarter, this growth rate was only 5%, which shows that there is an acceleration in this metric. However, we should also look at the margins of Services business. The main reason behind Apple’s higher valuation multiple in the last few years is the high margin reported by Services business. If the margins of Services business start to shrink, we could see an increase in bearish calls for Apple stock. The decline in provision for income tax in the recent quarter has helped the company improve the margins, but we could see a fall in overall margins if the profitability of Services segments shrinks.

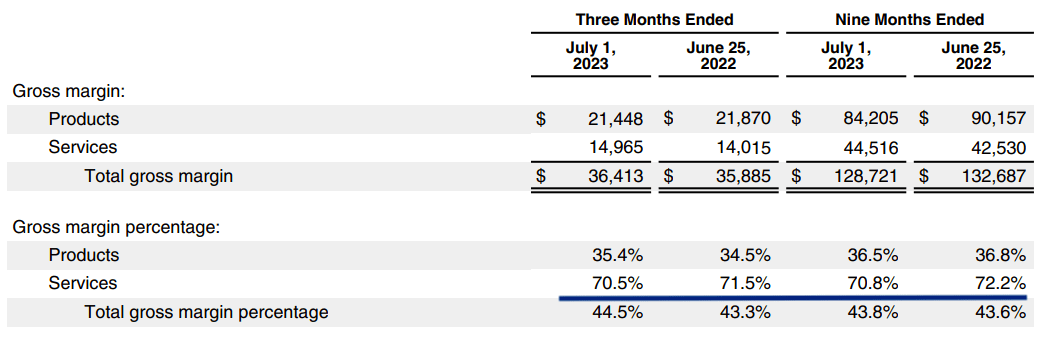

In the recent quarter, the Services segment reported 70.5% gross margin, which is 1 percentage point less than the 71.5% gross margin reported in the year-ago quarter. Similarly, over the last nine months, the gross margin dipped from 72.2% to 70.8%. This is a 1.4 percentage point decline. Apple has entered a number of low-margin businesses like Apple TV+ which will cause the company to report a further decline in overall gross margin within Services segment. The company is already facing a declining revenue base. A decline in Services margin can hurt the valuation multiple of the stock and lead to a bigger correction in Apple stock.

Another dip in Services margin

The margin of Services segment has been declining for some quarters. The management usually announces the positive aspect. In this quarter, CFO Luca Maestri made a special mention of the 8% YoY revenue growth in Services and the fact that it was an acceleration from the year-ago quarter. This is true, however, we should also look at the overall margins for Services.

Company Filings

Figure 1: Decline in Services margin in the recent quarter. Source: Company Filings.

Due to the decline in gross margin percentage, the growth in gross margin income for Services was only 6.7% in the recent quarter. Similarly, over the last nine months, the increase in gross margin income came to only 4.7% compared to a 6.8% increase in revenue for Services segment.

This trend will accelerate

The trend of declining Services margin can continue or even increase as new low-margin businesses are added to this segment. Apple adds all different services in a single metric. The Services segment includes very high margins from licensing revenue and App Store commissions. It also includes the wafer-thin margins in Apple Music and the very low margins of Apple TV+. The management is planning to heavily spend on Apple TV+ in order to increase subscriptions. This can cause a further decline in the margins.

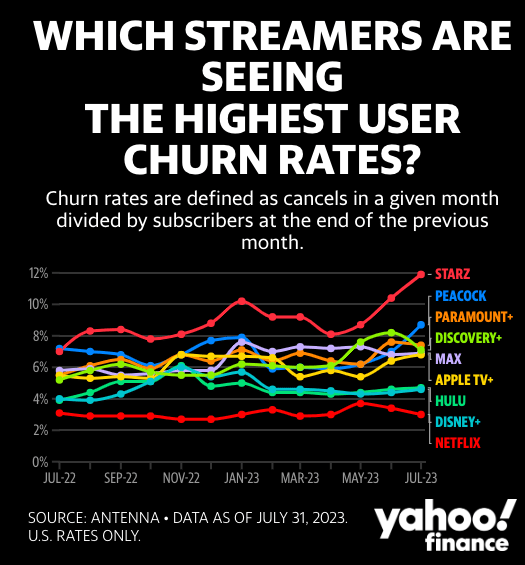

Antenna, Yahoo Finance

Figure 2: Churn rates of major streaming players. Source: Antenna, Yahoo Finance.

The churn rate of Apple TV+ is especially high. Recent numbers reported by Antenna showed that Apple TV+ has a monthly churn rate of 6.5% compared to only 3% for Netflix (NFLX). The only way to build a more loyal subscriber base is to increase spending on original content. This would require massive investment as we have seen from other streaming players. The investment could easily reach billions of dollars annually or even over $10 billion. At this level, the impact on Services margin could be severe. It should be noted that the Apple TV+ subscribers will still increase Services revenue growth rate. However, most of this revenue has very low margins.

Unless Apple is able to deliver another high-margin service like licensing revenue or App Store commissions, we should expect the declining margin trend to intensify.

Headwinds for EPS growth

Apple has managed to report a 5% YoY growth in EPS in the recent quarter. This seems like a very good number when we look at the revenue growth which came at negative 1%. However, most of this EPS growth was due to a decline in provision for income tax and massive buybacks. The decline in provision for taxes is a one-time tailwind that might not be available next year. The company is also reaching cash neutral position which will limit the ability to have massive buybacks while the net income is declining.

We could easily see a 5 to 10 percentage point decline in Services gross margin rate over the next few quarters. This will hit Apple’s bottom line and also impact the forward EPS growth projection. Most analysts have forecasted that Apple would still be able to deliver double-digit EPS growth for the remaining decade. This is one of the reasons behind the high valuation multiple. Any major dip in Services margin can lead to instant correction in forward EPS growth and build a bearish sentiment towards the stock.

Impact on Apple stock

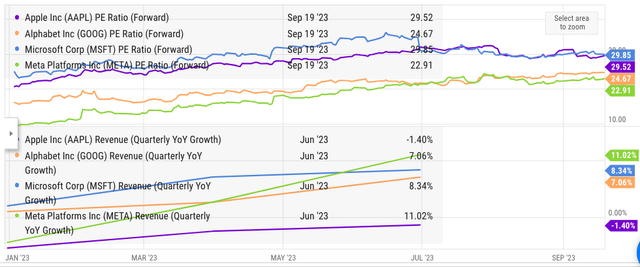

Investors would need to look beyond the headline Services revenue growth number in the future. As the gross margin percentage decreases in Services segment, it will lead to a bigger impact on Apple’s bottom line. Apple is still one of the most pricey companies in terms of forward P/E ratio. This ratio will become untenable when we look at the declining revenue base, decline in Services margin, and lack of high-growth segments.

Ycharts

Figure 3: Comparison of Apple with other big tech peers. Source: Ycharts.

When we look at the bull run in 2023, it can clearly be seen that Apple has been able to get a higher forward PE multiple compared to other Big Tech companies like Microsoft (MSFT), Alphabet (GOOG), and Meta (META). At the same time, the revenue growth of Apple has been the lowest among the group. When we add the prospect of shrinking margins in Apple, it is likely that Wall Street will cause a bigger correction in Apple stock over the next few months.

Investor Takeaway

Apple’s Services revenue has increased by 8% YoY. However, its gross margin has further dipped to 70.5% showing a 1 percentage decline compared to the year-ago quarter. This trend could increase as more revenue is received from low-margin businesses like Apple TV+. The only way to stem this decline is if there is a new service with much higher margins.

Under the current revenue and margin trend, it is unlikely that Apple will be able to retain a forward P/E multiple higher than other tech peers. Prior to the pandemic, Apple’s average P/E ratio was close to 15. Hence, we can see that Apple stock is trading at historically elevated levels which can cause a major correction in the near term.

Read the full article here

Leave a Reply