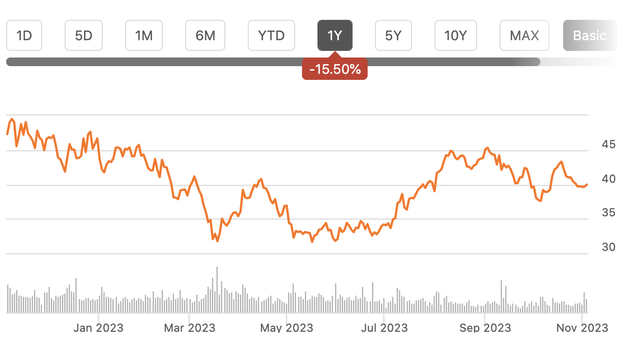

Shares of APA Corporation (NASDAQ:APA), formerly known as Apache, have been a poor performer over the past year, down about 15%, though they have rallied over 20% from their summer lows. In the oil sector, I believe investors want to focus on shareholder returns, and on this metric, APA is not particularly compelling. I view shares broadly at fair value and would invest elsewhere.

Seeking Alpha

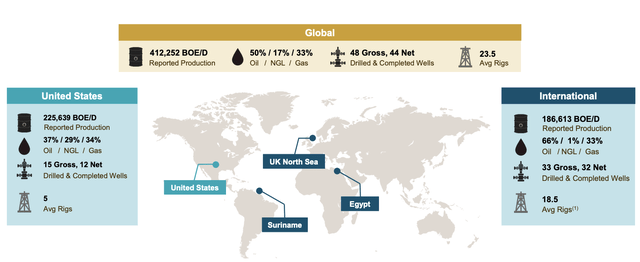

In the company’s third quarter, APA earned $1.33, beating estimates by $0.27 as production came in better than expected. APA is among the smaller “global” exploration and production companies with operations spanning the Permian, Egypt, and North Sea as well as a prospect in Suriname. It is not a “pure-play” shale company like Pioneer Natural Resources (PXD). Given the fact the US accounts for just 55% of production, I view APA as unlikely to be a target in the recent wave of oil sector consolidation, instead staying an independent stand-alone entity.

APA Corp

In the third quarter, APA produced 412mboed (thousands of barrels of oil equivalents per day), up 8% from 382mboed last year. This came in at the high end of expectations as well productivity has continued to improve. Because some of its production in Egypt is shared with tax authorities and with minority partners, its share of production was 340mboed.

Despite higher production, APA’s $1.06 billion in operating income was down from $1.36 billion last year. This decline in operating income is consistent across the sector, just given lower commodity prices. Realizations were down by $11.50 for oil, down by 40% for natural gas, and about a third for natural gas liquids. Additionally, given increased production, operating expenses rose in-line by $30 million or 8% while gathering, process, and transmission costs fell by 10% to $89 million as some bottleneck issues last year have been worked through.

Reflecting its geographic diversity, pre-tax operating income was $510 million in Egypt, $183 million in the North Sea, and $375 million in the US, though free cash flow is driven more by the US than Egypt given different taxing regimes.

In the US, oil production rose about 16% from last year, which was a strong result, aided by continued improvement in rig productivity. It is adding a sixth rig to the Permian this month thanks to strong results in an effort to support continued production growth. One consequence of this decision is that cap-ex will rise sequentially to $500 million from $475 million. Production in the US will be flat as it takes time for this increased cap-ex to translate into more production, but this should support H1 2024 production growth.

In Egypt, gross oil production rose 8% from last year to 138mbo/d though it only retains about half of this due to taxes and noncontrolling interests. Here, APA also saw a 13% improvement in rig efficiency, getting more wells drilled per rig in operation. Thus far, there has been no impact from the Israeli-Gaza conflict. I would not expect there to be a meaningful impact on the company’s operations, though the Middle East can be a volatile region. Still, it would take a very significant expansion of the conflict for this to impact APA’s results. APA has also operated in Egypt for several decades with experience operating successfully through past crises, like the Arab Spring last decade.

In the North Sea, production was surprisingly strong 48mboe/d at the high end of guidance and up sequentially despite no ongoing development activity. While it has more recoverable oil in its fields, UK tax policy makes increasing production economically unattractive relative to operations elsewhere. Consequently, there are no working rigs there. APA is not unique in this assessment with Noble (NE) having called out the North Sea as an area of weakness. APA is essentially reallocating capital budget from here to the Permian.

Aside from areas with existing production, APA continues to be in appraisal process for its Suriname holdings where it estimates there are 700 million barrels of recoverable oil. A final investment decision will be made next year. This project involves Total and Staatsolie with APA receiving ~40% of eventual revenue. The efforts here have been arduous with the company drilling several dry holes, which have raised questions about how much oil will eventually be recovered here, though it has viewed recent appraisal efforts as more successful. Ultimately, any pay-off here is likely to be several years down the road.

Given these results in the quarter, APA generated $1.4 billion of adjusted EBITDA and spent $474 million on upstream cap-ex, resulting in $307 million of free cash flow. Management is committed to returning 60% of free cash flow to shareholders via dividends and buybacks while also seeking “further progress on debt reduction.” Thus far this year, APA has generated $673 million in free cash flow and should do about $1 billion for the full year, down from $1.4 billion last year, given lower commodity prices.

The company has $5.6 billion of long-term debt, which is down $3.2 billion from the end of 2020. Its balance sheet has strengthened, but I would expect de-leveraging to remain a capital allocation priority until it has debt to EBITDA of about 1.0x, requiring about $1.4 billion of further debt reduction over time.

Because of debt needs and its large cap-ex budget of about $2 billion, APA’s capital allocation framework is on the lighter end. While its share count is down 7.5% from last year, as oil prices have reduced free cash flow, buybacks have slowed meaningfully to just $20 million in stock purchases during the quarter and $188 million this year. As noted, APA seeks to return 60% of free cash flow. By comparison, ConocoPhillips (COP) seeks to return about half of operating cash flow to investors. APA is prioritizing capital spending over shareholder returns while other oil firms have put them on a more equal footing.

In this current oil price environment, APA has about $1-1.1 billion in free cash flow capacity. That gives share an ~8% free cash flow yield, and just a ~5% capital return yield, given its allocation policy. Given companies like Conoco or Marathon Oil (MRO) trade at 8+% capital return policies, APA shares look relatively unattractive and are likely factoring in significant Suriname returns which are unlikely to materialize in a material way for several years, if they do.

As such, I believe investors should re-allocate to firms further along their de-leveraging and now able to prioritize shareholder returns in a more meaningful way than APA is. At an 8% free cash flow yield, I see little upside, barring a significant surge in oil (which would also benefit firms like COP and MRO) and expect shares to remain around current levels over the coming months, creating better opportunities elsewhere.

Read the full article here

Leave a Reply