At this point of winter, nearly everyone knows we have an El Nino winter and they are supposed to be warm. As I mentioned before, those things are not as dependable as many commenters believe. Sure enough, Kinder Morgan (KMI) management just mentioned in the latest conference call how they made up a significant portion of their guidance (which normally includes a cold spell) after a record warm December that had them worried. One of the very few companies that has unusual flexibility to send natural gas production to different places is Antero Resources Corporation (NYSE:AR). If any company benefitted from the recent cold spell that raised prices somewhat for a while, it was this company.

As I noted in a previous article back in fiscal year 2021, this company capitalized big time on storm Uri, which led to several previous years of profits all at one time. These cold air leaks as well as polar vortex events often mean that commodity industries like this one make their money “all at one time.” But many managements commit to sell their production in basin with zero flexibility for an event like 2021. The latest event was far smaller in nature. But any time you can get higher prices, that pricing difference goes straight to the bottom line with only minor cost changes because the costs were paid for before the pricing rise (for the most part). Companies like Antero pay for that flexibility with extra profits many times over.

Expected First Quarter Update- Rig Count

I have so many comments about production not falling even though rig count is dropping. What is not understood is that rig count will continue to drop until production and supply come back into balance. It actually usually leads to the next industry profit peak because demand often continues to grow to produce a shortage.

At the same time, it takes months or even a year for a well to be drilled, completed, and then cleanup for production. Therefore, current production reporting has to really go back to when the well was drilled (and everything else). It is therefore no surprise that production rises when the rig count begins to drop as there is a lag between rig count decline and production decline.

But the same commenters that know production is not falling currently also “know” that prices will remain “high forever.” Therefore, there is no hope for these stocks.

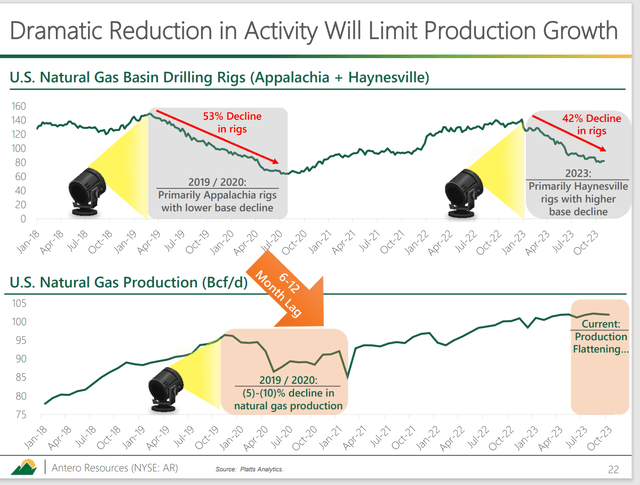

Antero Resources History Of Rig Count And Production (Antero Resources Investor Presentation November 2023)

The one thing that will not change since this slide was presented is that weak prices mean the rig count will continue to drop. In fact, rigs will continue to be idled in excess of any production improvements. The fact that current production is flattening in the eyes of management (as shown above) means that the declining rig count is having an effect. A quick look at the graphical history quickly demonstrates that rig count needed to fall very roughly for a year before production began to decline.

Also note that once production began to decline in the past, the rig count kept falling probably because prices remained weak. That means a warm winter just means that the rig count will continue to fall (just like last time) until supply balances demand and natural gas prices begin to recover. The warmer winter is, the more the rig count will drop, and the lower production will be.

Notice that at the time of the slide, the rig count had already dropped more than 40% and it only dropped a total of more than 50% in the last natural gas oversupply situation. Therefore, most of the rig drop is already done. High-cost operators will also shut-in production until the cash flow becomes adequate to justify production. This part of the production decline is somewhat of a wild-card as higher cost production can fluctuate both in cost and quantity.

But the key is that because production is not currently dropping does not mean that production will not begin to drop as many investors currently assume. Furthermore, there is no guarantee that there will not be another cold snap as there is still a lot of time left to the current winter.

The last part of this is that this El Nino is expected to peak soon if it has not already. That is pretty typical for El Nino. Many weather people are looking for a La Nina summer. If that happens, La Nina summers are known to be hot.

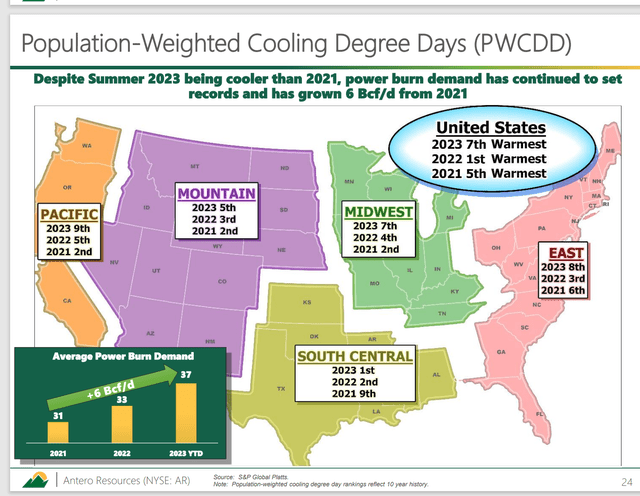

Antero Resources Summer Weather Compared To Natural Gas Usage For Electricity (Antero Resources Corporate Presentation November 2023)

One thing about cheap natural gas prices is that it displaces other energy sources in increasing amounts during times of cheap pricing. That means that usage climbs as shown above.

When this is combined with the dropping rig count shown before, that means that not only does supply come into balance with demand. But that supply amount often keeps dropping until natural gas prices are sufficient.

The same lag shown above from the time of rig count drops until production drops also happens on the other side. Not only does supply drop, but it drops to a level too low as a general rule. Anything like a cold winter or a hot summer simply magnifies the cycle. A La Nina that weather people believe usually follows an El Nino is very likely to provide that cold winter or hot summer.

What This Means

Timing is always tough when the weather is involved because the weather is a very low future visibility item. That makes natural gas price forecasting far less accurate than many of the comments on my articles would indicate. After all, no one forecast the latest cold spell, or the volume progress Kinder Morgan management stated was made to make up for that warm December.

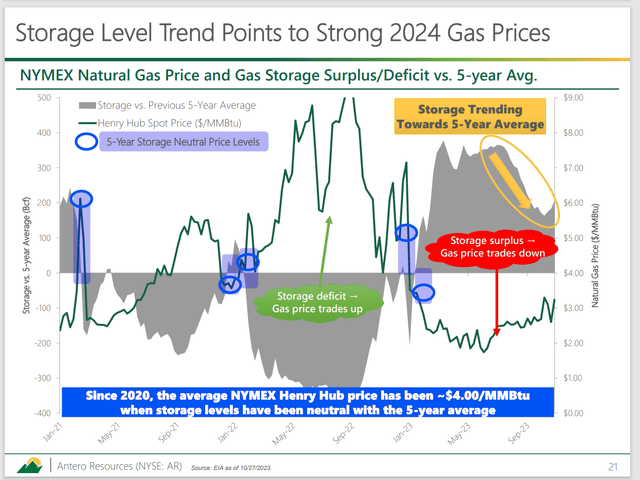

Antero Resources Comparison Of Natural Gas Prices To Storage Levels (Antero Resources Corporate Presentation November 2023)

Many focused on the high absolute levels of storage. But the key focus as several producers have pointed out (in several of my previous articles) should be the days of usage in storage because usage has grown. That days of use has not been out of line with history.

Therefore, the recent cold spell may mean that several industry sources will report a below average day of use when they report the fourth quarter results. For many, those reports will come towards the end of winter. Similarly, the recent cold spell may well mean that the first quarter (to some extent) offset the warmer than average December. In addition, winter still has quite a few days left that could surprise investors with a cold spell.

Even if the recent warm spell lasts through the end of winter, the declining rig count is clearly getting to the point where it is significant enough and long enough to begin to affect production. The rig count will decline until you see the storage levels on the graph above become low enough that natural gas prices rise to a level that the rig count slowly begins to rise.

“Buy straw hats in January” applies here. Natural gas stocks are often a good buy when the company has a strong balance sheet, and the market is sure that the oversupply will “last forever.”

Despite the fact that weather and politics are low visibility activities, many feel they can forecast natural gas oversupply to at least 2025. Sometimes it works. But usually, when the market is this pessimistic, good natural gas companies like this one are a strong buy on an eventual cyclical recovery. Another cold spell, which cannot be forecast long term (as the one we just went through also was not forecast until about 2 weeks before it happened), is definitely not out of the question.

The Polar Vortex is in bad shape. That is very unusual for an El Nino. But it is what we have to deal with. A flexible company like Antero Resources with a lot of choices about where to send natural gas can take advantage of those unforecastable cold spells. The typically large profits from such an event will benefit shareholders one way or another.

For me, that makes Antero Resources a strong buy. I buy good management when that good management is cheap, and the market is down on the whole industry prospects because I know the bad is priced in but not the potential recovery and maybe even a shortage.

Read the full article here

Leave a Reply