In my previous article, I highlighted the Alerian Energy Infrastructure ETF (ENFR) as a great way to gain exposure to the energy infrastructure sector. While ENFR’s 5.6% yield is nice, it’s not top of the charts. It is lower than what dividend investors typically get with MLPs. Those looking for higher yields might want to sidestep to the InfraCap MLP ETF (NYSEARCA:AMZA) – a contender that could pack a more powerful punch.

The InfraCap MLP ETF comes with a high expense ratio. But is the higher fee worth paying? This is what I am going to explore in the article, by putting this ETF up against the industry’s benchmark fund. And here’s a little heads-up: I’m leaning towards ‘yes it is.’ Why? Because AMZA is not just another fund on the block; it has a couple of aces up its sleeve that might just position it to trump the competition.

Active Management

The InfraCap MLP ETF, or AMZA, is an actively managed exchange-traded fund designed to provide investors with access to a portfolio of around 25 to 35 energy infrastructure companies, primarily master limited partnerships [MLP]. The fund employs leverage – approximately 20% to 30% – to potentially enhance returns for investors. Holding $326.6 million in assets, AMZA is a moderate-sized ETF dedicated to MLPs. However, being an actively managed fund that also uses leverage and invests solely in MLPs, it is fundamentally different than some of the largest funds that give investors exposure to energy infrastructure companies.

Take ENFR as a contrast, which holds both energy infrastructure C-corporations and MLPs, capturing a wider scope of the sector. This broad reach allows investors to gain access to major energy infrastructure companies that are often omitted by MLP-focused ETFs such as AMZA or the Alerian MLP ETF (AMLP). In my view, for those who aim for comprehensive exposure to the energy infrastructure arena, ENFR is worthy of consideration. However, note that C-corporations – many of which are some of the prominent components of ENFR – tend to have lower yields compared to MLPs, which may diminish ENFR’s appeal to yield-seeking investors. On the other hand, AMZA’s focus on MLPs allows it to provide a yield of 9.26% (30-day SEC yield) and may present as a more attractive option for those prioritizing income.

AMZA stands out in the realm of energy infrastructure ETFs due to its active management style. This is in contrast with the sector’s heavyweights like AMLP, which has over $7 billion in assets and serves as a benchmark for MLPs, operating on a passive management approach. These funds track a set index, and for AMLP, it is the Alerian MLP Infrastructure Index, a leading index within the MLP industry. Consequently, AMLP’s performance is a direct reflection of the index it tracks.

In contrast, while AMZA also uses the Alerian MLP Infrastructure Index as its performance benchmark, it doesn’t simply mimic the index. Instead, its portfolio managers, led by Chief Investment Officer Jay Hatfield and Chief Operating Officer Edward Ryan since 2014, strive to maximize shareholder returns. Rather than being bound by market cap rankings, AMZA’s managers conduct a fundamental analysis of each stock, followed by a technical analysis. This process enables them to select investments based on their intrinsic strength, rather than size alone. Hence, even smaller MLPs with solid fundamentals may be given prominent positions within AMZA’s portfolio, reflecting the nuanced approach of its managers in stock selection.

Seeking Outperformance

Actively managed funds often have higher fees than passive ones, reflecting their additional research and management costs. These funds may also employ leverage and options to boost returns. AMZA’s expense ratio stands at 1.64%, including management fees of 0.95%, and employs modest levels of leverage between 20% and 30%. In contrast, AMLP’s expense ratio is lower at 0.85% and it does not use leverage.

In my view, investors may justify AMZA’s higher fees with its potential for greater returns, underscored by its significant dividend yield of 9.26% compared to AMLP’s 5.60%. Additionally, AMZA’s management team has a track record of outperforming other MLP-focused ETFs.

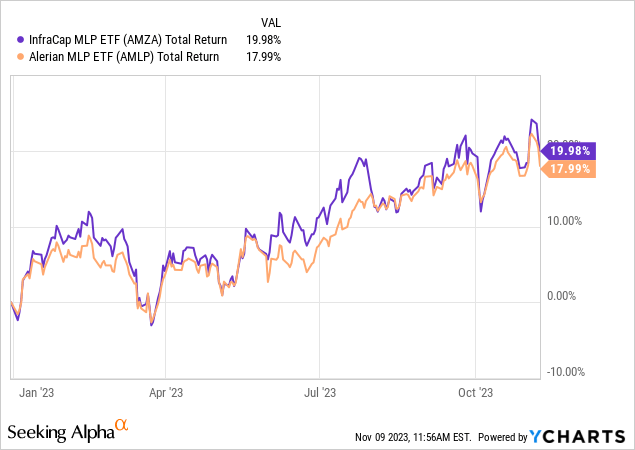

Both AMZA and AMLP draw from the Alerian MLP Infrastructure Index. Thus, comparing AMZA’s performance with AMLP’s can show the value of active management. This year, AMZA has outshined with a return of 20% against AMLP’s 18%, inclusive of dividends.

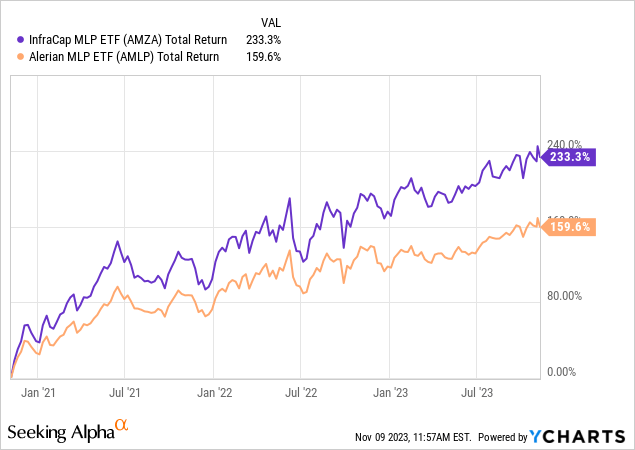

Looking at the past three years, AMZA has significantly outperformed AMLP, yielding returns of 233% compared to AMLP’s 160%. This substantial lead can be attributed to AMZA’s consistent performance, with strong annual results contributing to this trend. In 2022, AMZA’s returns reached 51%, surpassing AMLP’s 39%. The previous year, AMZA continued to outpace AMLP by gaining 33% against AMLP’s 26%. AMZA’s sustained success over multiple years demonstrates that its achievements extend beyond short-term gains, marking a pattern of reliable market outperformance and long-term value creation.

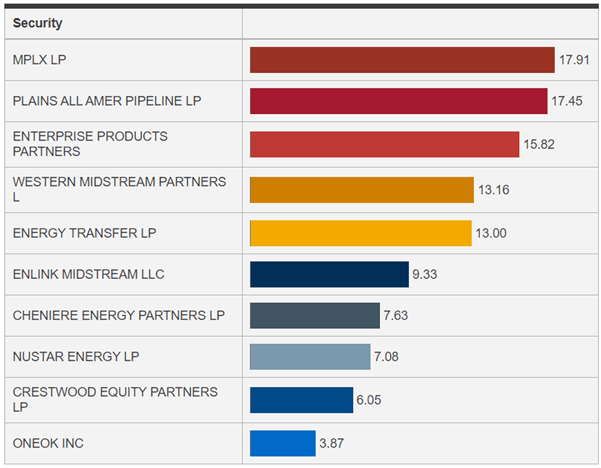

I appreciate how AMZA’s portfolio strategy includes a focus on providing exposure to some of the leading, well-established MLPs, without unnecessary emphasis on smaller, riskier entities. Looking at its portfolio composition, the names that emerge are some of the sector’s most reputable. Leading AMZA’s investments are MPLX LP (MPLX), Plains All American Pipeline (PAA), Enterprise Products Partners (EPD), Western Midstream Partners (WES), and Energy Transfer (ET) – each a major player with extensive energy infrastructure holdings across the United States.

MPLX LP, AMZA’s top holding, owns a vast portfolio of crude oil and refined petroleum products transportation, logistics, and storage assets as well as natural gas gathering and processing systems. The company has interest in 16,000 miles of pipelines, 35 million barrels of terminal storage capacity as well as 12 billion cf of natural gas processing and 10.4 billion cf of natural gas gathering capacity. It also owns interest in 852,000 bpd of NGL fractionation capacity and its marine business has stakes in more than 300 vessels and barges, ensuring a diverse and robust portfolio encompassing various segments of the energy infrastructure sector.

But what I like most about MPLX is its ability to consistently grow its distributable cash flows [DCF], with a compounded annual growth rate [CAGR] surpassing 6% since 2019. This has allowed it to lift shareholder returns by increasing distributions. And I think this positive trend will likely continue in the future.

MPLX’s growth trajectory will be propelled by a raft of expansion projects. It has outlined five projects within its Logistics & Storage and four within its Gathering & Processing segment, all expected to be commissioned by 2025. These strategic projects will likely sustain MPLX’s upward DCF trend, directly translating into progressive distribution increases for shareholders. This should have a positive impact on AMZA’s performance as well.

AMZA Holdings (AMZA)

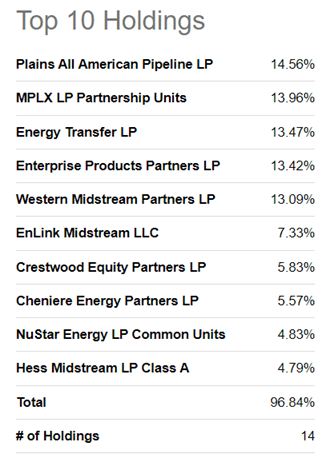

Most MLP-focused ETFs, including AMLP, feature a familiar line-up of leading companies at the top of their holdings lists. For example, AMLP’s top holdings include Plains All American Pipeline, MPLX LP, Energy Transfer, Enterprise Products Partners, and Western Midstream Partners. Although their respective weights vary between AMZA and AMLP, there’s a common thread in the overweight positioning of these industry stalwarts.

AMLP Holdings (Seeking Alpha)

The question then arises: What is the key difference that drives AMZA’s consistent outperformance over AMLP? In my view, it’s not just the nuances in holdings and weightings that contribute but rather AMZA’s active management of portfolio and the strategic use of leverage that provide it with a competitive advantage. Unlike AMLP, which is constrained to the rigid composition of the market-cap weighted Alerian MLP Infrastructure Index, AMZA has the flexibility to adjust its portfolio in response to valuation shifts. If a high-quality stock becomes overvalued and another similarly quality stock looks undervalued, then AMZA’s managers have the latitude to recalibrate the fund’s holdings to capitalize on the latter’s potential for higher returns. This is something that the passively managed AMLP can’t do.

Leverage is yet another tool that AMZA utilizes effectively. It can amplify exposure to promising picks, a move that AMLP’s passive strategy doesn’t permit. AMZA can strategically borrow funds to invest in opportunities that have the potential to enhance returns for their investors. AMZA’s portfolio managers use leverage to give investors outsized exposure to high-quality names. Subsequently, the returns also get magnified. This proactive financial maneuvering is one of the critical tactics that enable AMZA to outpace AMLP in performance metrics.

Takeaway & Risks

In short, AMZA looks poised for success, buoyed by the solid performance of its constituents. Companies within its fold, such as MPLX, are well positioned to grow their earnings, DCF, and distributions. This bodes well for AMZA’s potential to generate investor returns. Its active management and leverage use distinguish it from passive peers, equipping it to potentially outshine competitors like AMLP, the largest industry ETF. Moreover, AMZA’s above-average dividend yield of more than 9%, despite its higher fee, adds to its appeal as a worthwhile consideration for ETF investors.

AMZA’s valuation presents an enticing picture. Close to half of its holdings score a Seeking Alpha valuation grade of ‘B-‘ or better, indicating their attractiveness. Additionally, 38% hold neutral ‘C-‘ to ‘C+’ grades. The ETF’s top three holdings – MPLX, Energy Transfer, and Plains All American – which together constitute nearly 55% of its weight, each bear an appealing ‘B’ valuation grade. Only three of its stocks can be deemed expensive, with valuation of D to F, cumulatively accounting for a mere 13% of its weight. Given that its heavy-weight holdings are attractively valued, I would rate this ETF as a buy at the current price.

However, readers should also note that investing in AMZA involves inherent risks. While it has outshined similar ETFs historically, past performance is not a fool-proof indicator of future results. Adverse shifts in the business climate, akin to what was experienced during the pandemic, could challenge the fund’s active strategy. Additionally, leverage can potentially become a double-edged sword in a high interest rate environment and may not favor investors during market downturns. Should energy demand weaken, the amplified exposure due to leverage could exacerbate losses, turning what is currently an advantage into a liability. Investors should weigh these risks when considering AMZA as part of their investment strategy.

Read the full article here

Leave a Reply