Editor’s note: Seeking Alpha is proud to welcome Alemkhan Serikov as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Introduction To AMTD Digital’s Rise And Questions About Valuation

In the vibrant tapestry of fintech, few names have ascended as swiftly as AMTD Digital (NYSE:HKD). With a slew of strategic partnerships, impressive technological rollouts, and a firm grip on the pulse of digital finance, AMTD Digital’s stock has captured the attention and wallets of investors worldwide. However, as its stock charts depict a tale of meteoric rise, financial experts can’t help but wonder: Is this just the beginning of a legendary ascent, or are we witnessing a company touching its zenith, teetering on the brink of overvaluation? Our analysis makes us bearish AMTD.

The Reddit-Driven Price Spike And Questions That Follow

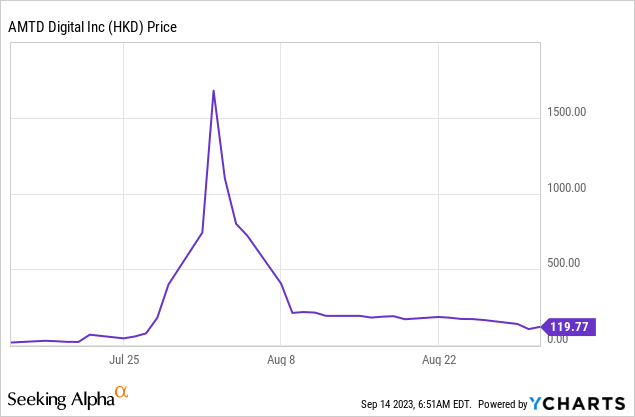

About a year ago, AMTD Digital was relatively obscure to the general masses but found itself thrust into the limelight. On July 11th, 2022, its stock stood at $16.5; by August 1st, it skyrocketed to a staggering $721. This wasn’t merely the result of robust company performance or groundbreaking announcements. Instead, it bore the hallmarks of the GameStop (GME) saga—a cadre of Reddit users rallying together, propelling the stock to stratospheric valuations. As the dust begins to settle, a pressing question emerges: Was this rapid ascent a mere blip, an aberration driven by internet-fueled frenzy, or does AMTD Digital genuinely command such lofty heights in the fintech space? To answer this, it’s pivotal to delve deep into AMTD Digital’s valuation, deciphering the real from the ephemeral.

Exhibit 1: Stock price in mid-2022

Background

Originating from Hong Kong, AMTD Digital stands as a beacon in the fintech world. Operating under the umbrella of Hong Kong’s renowned financial powerhouse, AMTD Group, the firm etched its name in financial chronicles in August 2022. Merely weeks post its IPO in July, its stock witnessed an unprecedented surge of 21,000%, catapulting its market cap beyond $310 billion. This ascent didn’t just make headlines—it positioned AMTD Digital as the 14th most valuable company globally.

AMTD Digital: A Synopsis

Core Offering: AMTD Digital operates as the heart of the ‘AMTD SpiderNet ecosystem’, presenting itself as an expansive digital solutions platform in Asia. Its multifaceted approach covers a broad spectrum:

Digital Solutions – Financial Services: This primary revenue driver offers financial digital solutions, underlining the company’s deep roots in the fintech sector.

Digital Solutions – Non-Financial Services: Launched in December 2017, this segment represents a strategic expansion beyond just financial offerings, showcasing adaptability and broad market outreach.

Digital Media, Content, & Marketing Services: AMTD Digital’s foray into media and content indicates its commitment to comprehensive digital presence and monetization.

AMTD Assets and Hospitality: With the acquisition of AMTD Assets in February 2023, the company diversifies its revenue streams, tapping into premium real estate holdings and hospitality services.

Financials

AMTD Digital: An Overview of Revenue Streams and Market Position

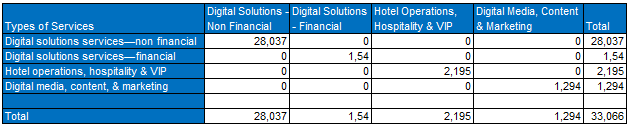

Looking at AMTD Digital’s earnings, it’s clear they’ve spread their wings across different areas. Their biggest chunk comes from non-financial digital solutions, bringing in a hefty US$ 28,037, which is almost 84.7% of what they earn. This shows they’re really good at helping businesses with digital stuff and making custom tech tools. They’ve also stepped into the fintech world, making US$ 1,540, which is about 4.6% of their total. Even though it’s a smaller part, it shows they know their way around finance tech too. They’ve tried their hand at hospitality too, earning US$ 2,195, which is 6.6% of their income. Maybe they’re mixing tech with hotel services in a cool way. They’re also into digital media and marketing, making US$ 1,294 or 3.9% of their total. This means they’re helping businesses get noticed online. In the end, with a total of US$ 33,066, AMTD Digital seems to be doing a lot and doing it well in the digital world.

Exhibit 2: Revenue streams of AMTD Digital

HKD’s Revenue Streams (20-F | Annual and Transition Report)

Source: 20-F | Annual and Transition Report

Unique Market Position

In examining AMTD Digital’s financial profile, I believe their diversified revenue streams paint a picture of a company that’s not putting all its eggs in one basket. Their strong emphasis on non-financial digital solutions catches my eye. It doesn’t just point to where the bulk of their earnings come from, but in my opinion, it also hints at their capability to dominate this niche. While at first glance, their footprint in the fintech world might seem modest, I’d argue that this could be strategic. Perhaps they’re not trying to be everything to everyone. Instead, I believe they could be focusing on offering bespoke solutions that set them apart from rivals who might just be sticking to the beaten path with more run-of-the-mill offerings.

Then there’s their foray into hotel operations and digital media. Now, that’s an interesting move. It’s not every day that tech ventures rub shoulders with the traditional world of hospitality. But in my view, this indicates an adaptable and forward-thinking business strategy. They seem to recognize the potential of infusing tech into sectors that historically didn’t rely heavily on it. I think they’re aiming to create a blend where tech amplifies the strengths of these more traditional areas.

To sum it up, from where I stand, AMTD Digital appears to be charting its own unique path in the market, blending core strengths with innovation, and that’s truly commendable.

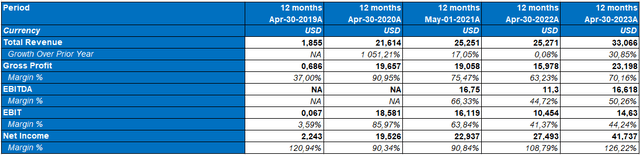

Author’s calculation using data from CapitalIQ

Over the past five years, AMTD Digital has witnessed a transformative surge in revenue, most notably a staggering 1,051.21% growth from 2019 to 2020. While gross profit margins peaked in 2020 and subsequently declined, they made a comeback in 2023, indicating sustained business robustness. Although EBIT margins suggest rising operational costs, the consistent upward trajectory of net income, especially the remarkable net margin exceeding 100% in recent years, showcases the company’s strong financial performance. However, these extraordinary net margins necessitate a deeper examination to discern underlying factors, as they might be influenced by one-time gains, tax benefits, or specific accounting practices.

Strategic Position In The Fintech Sphere

In my view, AMTD Digital is making some strategically sound decisions in the fintech landscape. Their diverse services have not only enabled them to bond strongly with clients but have also presented golden chances for cross-selling. A notable move, in my opinion, is the expansion of the AMTD SpiderNet ecosystem. This not only bolsters their standing in the fintech domain but also underscores their ambition for a more global reach, which I believe is further highlighted by their switch from HK$ to US$ for financial presentation. The consistent growth in net profits over the years is an unmistakable indicator of their strong financial footing. Rising from US$22.1 million in 2021 to a commendable US$40.1 million by 2023, it’s clear that they’re doing more than a few things right. The acquisition of AMTD Assets in 2023 is, in my perspective, a testament to their ability to see beyond the horizon, tapping into the real estate and hospitality sectors.

Industry trends, like the growing reliance on digital platforms post-pandemic, put AMTD Digital at a considerable advantage. Considering the fintech boom in Asia, especially Southeast Asia, I believe they’re sitting at a pivotal position ready to harness this momentum. The sharp increase in their stock in mid-2022 might have been influenced by the Reddit-driven market movements we’ve seen with stocks like GameStop. This is merely my speculation, but it’s plausible given the unexpected ways online forums can sway stock prices. Many investors, including myself, are optimistic about fintech’s trajectory, and it seems AMTD Digital is riding this wave of positive sentiment. The change in their currency presentation, in my view, is a smart external move. It broadcasts a more global ambition, likely making them more attractive to international investors. Given the current market dynamics, AMTD Digital’s valuation, compared to other fintech contemporaries, feels justified, boosting investor confidence.

Valuation Model

Key Metrics And Figures Considered

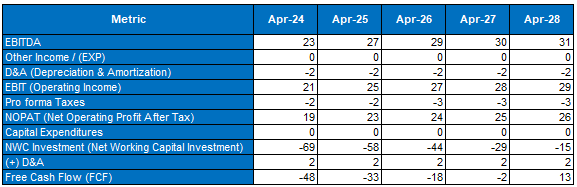

EBITDA Projections: An essential metric for evaluating a company’s operational profitability, our model forecasts a steady increase from 23 million in Apr-24 to 31 million by Apr-28.

Net Operating Profit After Tax (NOPAT): A consistent growth from 19 million in Apr-24 to 26 million in Apr-28, highlighting the company’s potential to generate after-tax profit from its operations.

Free Cash Flow (FCF): This began at a negative 48 million in Apr-24, gradually improving to a positive 13 million by Apr-28. It’s vital to highlight the transition from a negative to a positive FCF, indicating the potential for increased profitability.

Author’s calculation using data from CapitalIQ

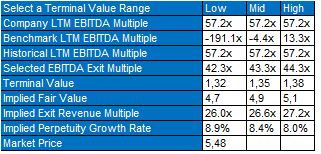

Terminal Value based on EBITDA Exit Multiple: The valuation model proposed an Implied Fair Value for AMTD Digital between $4.70 to $5.10, contrasted against the current Market Price of $5.52.

Author’s calculation using data from CapitalIQ

Findings And Overvaluation Indication

Our valuation model, based on the Terminal Value approach and Free Cash Flow Forecast, suggests a potential overvaluation of AMTD Digital:

The Free Cash Flow is projected to transition from a significant negative in Apr-24 to a positive by Apr-28, indicating a shift towards profitability. However, the overall figures still raise questions about whether the company can sustain the high valuation it currently enjoys. When juxtaposing the Terminal Value’s Implied Fair Value range against the current market price, it’s evident that AMTD Digital’s current valuation exceeds our model’s projections. Specifically, the market price of $5.52 overshadows the derived Implied Fair Value of $4.70 to $5.10, suggesting a potential overvaluation.

In essence, while AMTD Digital’s future potential and improving financial metrics are undeniable, the current market price appears to outpace its value as estimated by our model.

The stock price is overvalued for 10.6%.

Multiples Comparison: AMTD Digital vs. Industry Peers

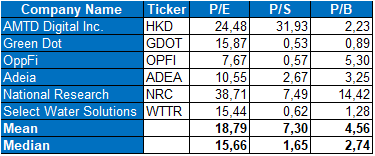

Below is a comparative table that showcases the Price-to-Earnings (P/E), Price-to-Sales (P/S), and Price-to-Book (P/B) ratios of AMTD Digital and its peers in the fintech sector.

Author’s calculation using data from CapitalIQ

When I delve into the numbers, AMTD Digital’s Price-to-Earnings (P/E) ratio catches my attention. Sitting at 24.48, it’s comfortably above the industry’s average of 18.79 and even surpasses the median which stands at 15.66. To me, this feels like the market’s nod of approval. It seems investors are inclined to pay a little extra for every dollar of earnings that AMTD Digital churns out. Maybe it’s their confidence in the company or just the general buzz around fintech, but something’s clearly setting AMTD apart from the crowd.

Turning to the Price-to-Sales (P/S) metric, things get even more interesting. AMTD Digital boasts a P/S ratio of 31.93, which is, in my opinion, a soaring figure, especially when stacked against the sector’s average of 7.30 and a median of a mere 1.65. Now, this could be read in a couple of ways: there’s the optimistic view that the market sees a bright future for AMTD Digital and expects some robust growth. On the flip side, the skeptic in me wonders if the stock is getting a tad overvalued, especially when juxtaposed with its peers.

The Price-to-Book (P/B) ratio, on the other hand, offers a different narrative. At 2.23, it doesn’t tower above the industry average, which hovers around 4.56. In fact, it’s more in line with the industry median of 2.74. My takeaway from this? Perhaps, when we look at the book value alone, AMTD Digital’s stock seems fairly grounded. It doesn’t come across as overly pricey, nor does it seem like a steal – it feels just about right.

In all, while numbers provide a foundation, the true essence lies in interpretation. And in my view, AMTD Digital seems to be walking a tightrope, with some metrics suggesting a bullish outlook, while others urge caution

Concluding Thoughts

When assessing AMTD Digital’s valuation multiples in comparison to its peers, it appears that the market has strong growth expectations for the company, especially when observing the P/S ratio. While its P/E ratio also suggests a premium valuation, its P/B ratio is more in line with industry standards. Investors should consider these factors alongside other qualitative and quantitative information to determine the intrinsic value of AMTD Digital.

Risk Analysis for AMTD Digital

Investing in any company involves inherent risks. It’s essential to fully understand the specific challenges and uncertainties that a company like AMTD Digital faces. Below, we dive into some of the most pressing concerns potential investors should consider.

Regulatory and Operational Risks in China

Government Intervention: The PRC government’s pronounced authority over operations in mainland China could hamper AMTD Digital’s ability to manage its cash flow and overall operations effectively, which could depress the ADS value.

Legal Uncertainties: The ever-evolving landscape of mainland China’s legal system brings with it a certain unpredictability. This could manifest in the form of unexpected interpretations of laws or sudden regulatory shifts, which might negatively impact AMTD Digital’s operational strategy and reputation.

Audit Inspection Concerns: The PCAOB has historically been unable to conduct thorough audits of AMTD Digital’s auditors. Such limitations might erode investor confidence, potentially dampening the value of ADS.

Potential ADS Trading Prohibition: If the PCAOB continues to face limitations in its oversight, there’s a looming risk that ADS trading in the US could be halted, severely affecting its market value.

Regulatory Changes: The ever-shifting regulations concerning data and cyberspace security in China could impose significant challenges for AMTD Digital’s business model, with the potential to disrupt operations.

Regulatory Sanctions: Any misinterpretation of permissions or unexpected legal shifts could expose AMTD Digital to sanctions or fines, which would naturally impact its financial performance and market perception.

Industry and Business-related Risks

Competitive Landscape: The digital financial services sector is fiercely competitive. AMTD Digital’s ability to remain profitable hinges on its capacity to continually innovate and outpace competitors.

Operational History: Given its limited track record in domains like digital solutions services and digital banking in Asia, it can be challenging to make accurate predictions about AMTD Digital’s future performance.

Regulatory Hurdles: Compliance is key. Changes in regulations or any non-compliance can have a ripple effect, potentially causing operational hiccups and financial setbacks.

Diverse Ventures: AMTD Digital’s interests in the film, entertainment, and hospitality sectors introduce a new set of challenges. These industries are known for their competitive nature and rapid evolution, factors that can influence revenues and growth trajectories.

Holding Company Considerations: Being incorporated in the Cayman Islands and operating as a holding company introduces specific liquidity concerns. These could affect AMTD Digital’s ability to distribute dividends to its shareholders consistently.

Concerns Related to the Controlling Shareholder

AMTD Digital’s transition to a public company has been relatively recent. Coupled with its dependence on its Controlling Shareholder, this might introduce an element of financial unpredictability.

Risks Surrounding the ADSs

Price Volatility: The fluctuating trading price of the ADSs poses a risk to investors looking for stable returns.

Market Dynamics: The absence of a robust public trading platform for the ADSs on the NYSE could limit selling opportunities for investors.

Legal Enforcements: For investors looking to enforce foreign judgments or take legal actions based on foreign regulations, the process might prove to be particularly challenging against AMTD Digital or its executive members.

Closing Thoughts

It’s imperative for potential investors to weigh these risks carefully against AMTD Digital’s growth prospects and industry positioning. A well-informed decision is always the best route to ensuring a sound investment strategy.

Conclusion: A Closer Look at AMTD Digital’s Valuation and Path Ahead

After meticulously analyzing AMTD Digital’s operational landscape, regulatory hurdles, and market positioning, a clearer picture emerges regarding its current valuation. According to our model, there’s a noticeable overvaluation. However, the stock market, by nature, is rife with complexities, and past performance isn’t always indicative of future results.

There are a few potential trajectories that AMTD Digital could follow:

Self-Correction: Historically, overvalued stocks often see a correction phase. If the market senses that the valuation isn’t reflective of AMTD Digital’s intrinsic value or future growth potential, we might witness a recalibration in its stock price.

Growth Trajectory: On the flip side, even with a high valuation, there’s a possibility for further growth. The digital financial services sector is booming, and as AMTD Digital continues to innovate and expand its offerings, it could carve out a larger market share, potentially justifying its current valuation.

However, it’s essential to remember that stock market movements are notoriously difficult to predict. Several external factors, from geopolitical events to global economic shifts, can influence stock prices. Additionally, given AMTD Digital’s diverse interests in sectors like entertainment and hospitality, it exposes itself to a set of unique challenges and opportunities, making its stock trajectory even more intriguing.

In conclusion, while our model suggests an overvaluation for AMTD Digital, the future remains uncertain. It’s crucial for investors to keep a close eye on the company’s strategic moves, industry trends, and broader market dynamics. Balancing optimism with caution, being adaptive to new information, and keeping a diversified portfolio are always the best strategies in such unpredictable times.

Read the full article here

Leave a Reply