In the sprawling landscape of finance, few things stand as solid as a trusted bank. Among them, American National Bankshares Inc. (NASDAQ:AMNB) shines as a beacon in Virginia’s banking sector. With a history dating back to 1909, this institution is much more than a century-old; it’s a symbol of financial stability and community support.

In this article, we dive into the fundamentals, prospects, and the overarching narrative of AMNB, which I believe offers a performance opportunity worth considering.

Unpacking AMNB: A Banking Legacy

American National Bankshares Inc. is the bank holding company for American National Bank and Trust Company. Based in Danville, Virginia, this institution provides a range of financial products and services, covering two essential segments: Community Banking and Wealth Management.

As a community bank, AMNB caters to the needs of both consumers and businesses, offering deposit products such as checking accounts, money market accounts, and time deposits. On the lending side, the bank provides a suite of loan products, including commercial and residential real estate loans, construction and land development loans, mortgage loans, and more.

Moreover, the institution extends its services to wealth management, including estate planning, trust account administration, retail brokerage services, and investment management.

The company’s operations and its well-established presence in Virginia speak to its dedication to serving the local community.

A Bright Recommendation: Buy

This optimistic outlook is rooted in several fundamental strengths, which we believe offer a more compelling investment opportunity compared to many other stocks we cover.

AMNB’s performance shines in several areas. Notably, it exhibits remarkable revenue growth, boasts a solid financial position with conservative debt management, displays attractive valuation levels, demonstrates robust cash flow from operations, and shows a stock price increase over the past year.

These strengths, despite some softness in earnings growth, underline a promising investment case for the bank.

Let’s take a deeper look.

The Fundamental Highlights

AMNB’s revenue growth has been robust, even though it slightly lags behind an average of its peers. Over the past year, revenues have surged by 23.4%. However, this growth in revenue has not translated into a significant increase in earnings per share. As with many banks, this discrepancy may be attributed to a variety of factors as they deal with a sharp rise in interest rates, including operating expenses and provisions for loan losses.

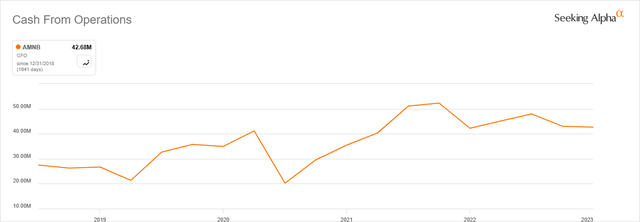

Cash flow from operations is often a strong indicator of a company’s financial health. Here, American National Bankshares shines. Net operating cash flow has significantly increased by an impressive 162.87%, reaching $42.68 million in comparison to the same period last year. This impressive cash flow growth not only showcases the bank’s financial resilience but also substantially surpasses the subsector average cash flow growth rate that is a deficit.

Seeking Alpha

Stock Performance

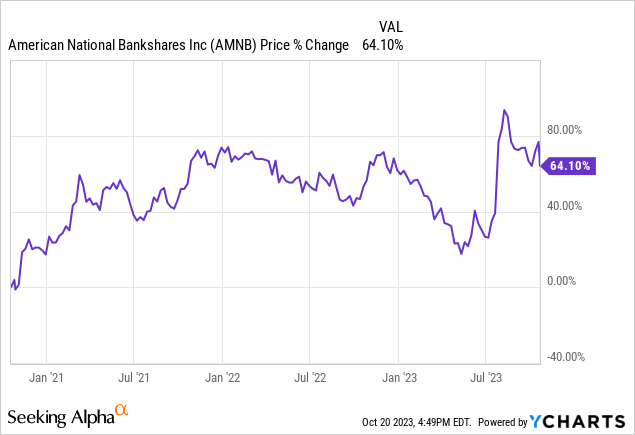

Even with the bank’s less-than-ideal earnings results, the stock is now trading at a higher level than it was a year ago, and shares have climbed 64.1% over the last three years. This upswing is a testament to the stock’s resilience and investor confidence in AMNB. However, it’s important to note that, like any other stock, it can face challenges in a broader market downturn. Nonetheless, in a more stable environment, it still presents considerable upside potential.

Peer Comparisons

The company valuations are undervalued amongst the broader S&P but is more in line with its peers based on the companies listed below.

Seeking Alpha

Let’s break down how American National Bankshares Inc. compares to these five companies.

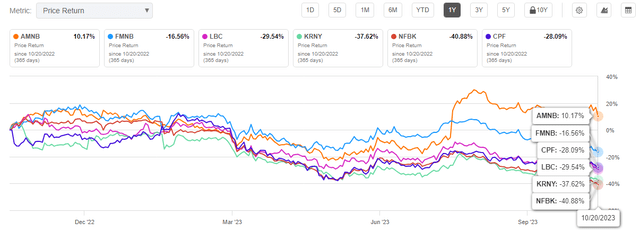

AMNB has outperformed based on share price growth over the past year, with AMNB up 10.17%. This is in contrast to our comparison companies being down for the last twelve months for the other five companies, ranging from -16.56% to -40.88%.

Seeking Alpha

This shows that investors are already seeing some of the strengths we have highlighted today and are rewarding the stock as a result.

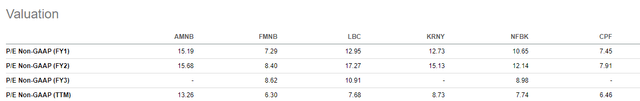

Next, let’s look at the Price-to-Earnings (P/E) Ratio.

The stock’s P/E ratio is lower than the S&P 500 averages, indicating that it is trading at a discount. It is also higher than the peers we selected for comparison, which indicates strength as the P/E ratio is at just 15.19. The P/E ratio can serve as a measure of market sentiment towards the stock.

Seeking Alpha

AMNB’s price-to-book ratio is slightly above its peers, at 1.27, compared to ranges from 0.50 to 1.13 times book for the peers. A low price-to-book can signal an undervalued investment, which AMNB does not qualify for in this case. That doesn’t mean it is overvalued though. As we saw, it’s share price is outpacing the competition, which would result in a higher price-to-book, all else being equal.

While AMNB dishes out a comfortable dividend at 3.06% per share, it is below its peers which range from 5.79% to 6.5%, with one of the banks not paying a dividend at all.

The lower yield from AMNB means you are not buying this stock for the dividend. You are looking at this stock thanks to the sound fundamentals and strong history of growth.

Banking’s Bedrock: The Local Community

Before we conclude, keep in mind American National Bankshares Inc. represents the essence of community banking. It’s a steadfast financial institution rooted in history and committed to serving its local community. The longevity and stability of this bank are testament to its enduring relevance.

With that said, there are many tailwinds and headwinds to highlight that are unique to the current environment we are in.

Tailwinds

Community Banking: The community banking model inherently fosters strong ties with local businesses and consumers, making AMNB an integral part of the communities it serves.

Diverse Services: Beyond traditional banking services, AMNB offers wealth management and investment services, catering to a range of financial needs.

Solid Financials: AMNB’s strong revenue growth, prudent debt management, and robust cash flow underscore its financial stability.

Headwinds

Earnings Growth: While revenue growth has been impressive, the bank has faced challenges in translating this into substantial growth in earnings per share. Addressing this disconnect is a priority.

Market Dependency: Like all financial institutions, AMNB’s performance is closely tied to broader economic conditions. A downturn in the local or national economy could impact its operations.

Competition: The banking sector is competitive, and AMNB faces competition from both traditional banks and online financial institutions thanks to advancements in technology creating new challenges and removing barriers to entry.

In Conclusion

In the bustling world of finance, American National Bankshares Inc. stands out as a steadfast symbol of community banking. With impressive revenue growth, sound financials, and a focus on serving its local communities, AMNB is well-positioned to weather headwinds and harness tailwinds.

While there are challenges to address, the bank’s dedication to community banking and its expanding suite of services make it an intriguing investment opportunity. The story of AMNB is one of enduring commitment to local communities, and it’s a story worth watching for investors seeking a beacon of stability in the banking sector.

Read the full article here

Leave a Reply