Investment Rundown

The lithium market has been quite a hot topic the last few years as the EV revolution has set it ablaze. Smaller companies like American Lithium Corp (NASDAQ:AMLI) are trying to get in on the action and capitalize on the growing demand. While there are already major companies in the sector like Albermarle Corporation (ALB) the likelihood of a smaller company like AMLI getting bought out is quite high. This is perhaps the main appeal of buying into the company as well. Production has not yet begun and still seems to be a few years out.

I think that allocating a smaller portion of a portfolio to AMLI won’t be too detrimental in the long term. The fundamental demand and necessity of lithium are going to result in growing revenues and earnings for the business. Rating AMLI a buy now.

Company Segments

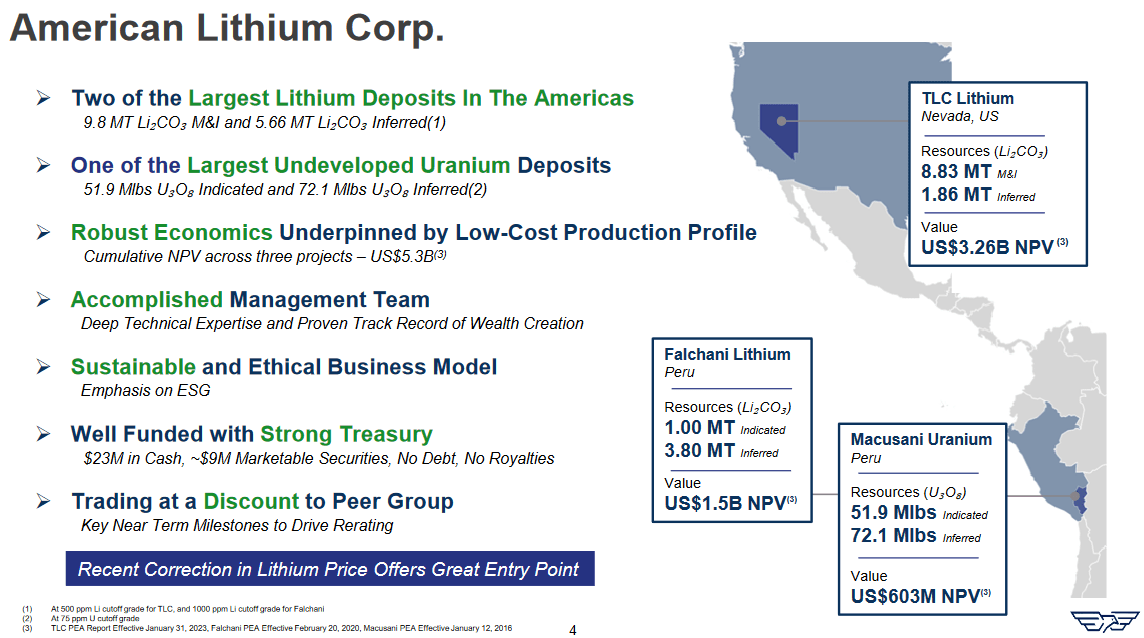

AMLI operates as a Canadian exploration and development firm with a strategic emphasis on advancing its lithium ventures in Nevada. The company’s primary asset, the TLC lithium project, encompasses an expansive 5000-acre area in Nevada. In addition to its Nevada-based operations, AMLI also manages the Falchani Lithium Project and the Macusani Uranium Project, both situated in Puno, Peru. The company is positioned to tap into the growing demand for lithium, a crucial component in batteries for electric vehicles and renewable energy storage. As the world shifts towards cleaner and more sustainable energy solutions, AMLI aims to play a pivotal role in the lithium supply chain.

Company Overview (Investor Presentation)

The investment case for AMLI heavily relies on the company’s ability to establish strong pipelines and asset bases where they can extract and sell lithium. The price for lithium carbonate rose to nearly 60,000 per tonne in November of 2022 but has since retreated to around 18,500 per tonne instead. Given that AMLI is more or less a pure-play lithium company they have seen the share price deliver a similar downward trend over the last few months. The share price seems quite heavily tied to the progress the company is making on its assets and when it can get them online as well. Delays or bad news is likely to send the share price down even lower.

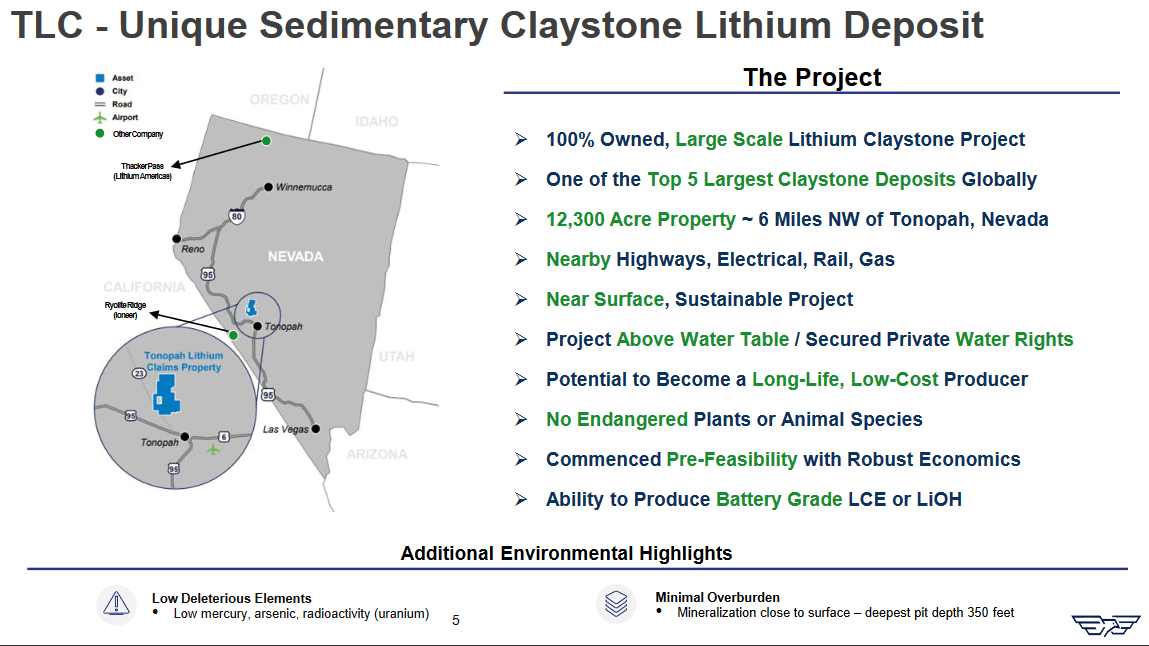

Lithium Deposit (Investor Presentation)

One of the more important assets and sites that AMLI has is TLC a unique and highly accessible site where the company has 100% ownership. The lithium claystone project is in the US and because of this, the transition to manufacturing and industrial facilities are close. AMLI is also able to market itself as a pure-play American lithium option for companies. I think that this is an advantage that should yield them strong domestic sales over the long term. The cut down of transcription is also a significant benefit that customers are getting.

Markets They Are In

Besides the lithium market, ALMI is also engaging in another commodity market that I think has a lot of potential for the long term.

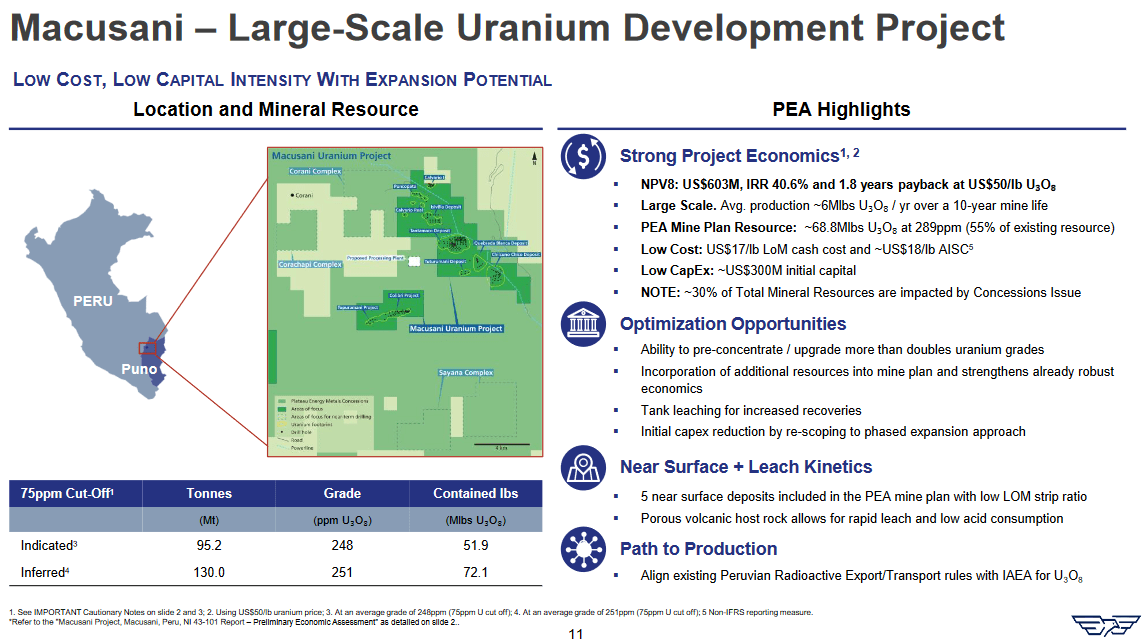

Company Project (Investor Presentation)

In Peru, the company has a site called Macusani where they are developing a large-scale uranium development project which can prove to be incredibly valuable over the long term. Uranium is shown to be one of the best options for generating clean energy with the minimal amount of land used up. There have also been some recent events that have pushed up uranium prices like the coup in Nigeria that is undergoing is making the markets uncertain about the production rate from this country. If there is a lack of uranium on the markets the prices will be pushed up and create more incentives for companies to enter it. I think that ALMI is well suited in diversifying their revenue streams and uranium is an exciting market to enter right now.

Risks

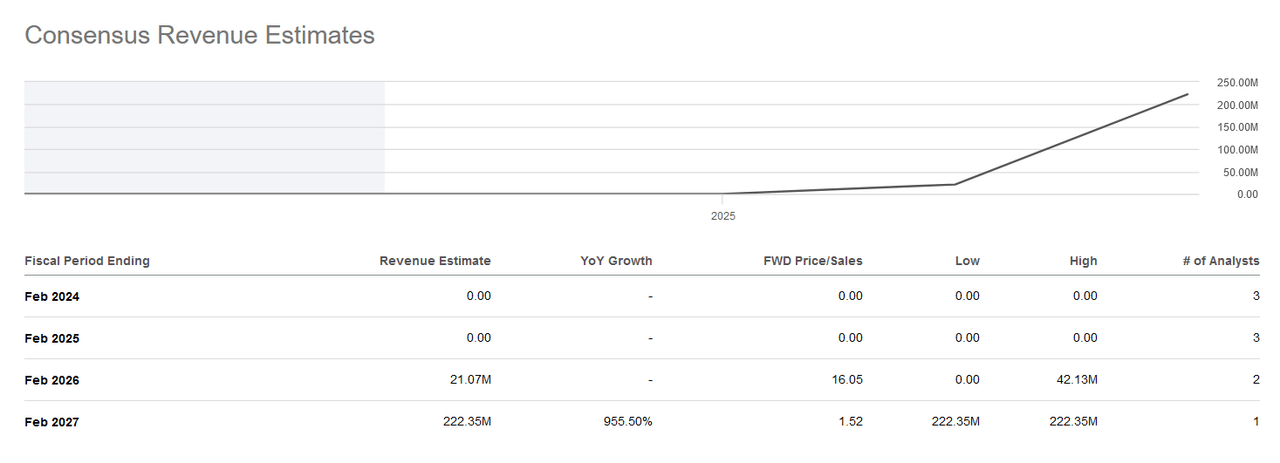

As a rapidly growing company, securing capital is paramount to ensure the sustainability of operations and to facilitate further expansion. To address its financial needs and support critical initiatives, the company has actively engaged in capital-raising endeavors. However, this strategic approach has resulted in a substantial rise in the number of shares outstanding, surging from 66 million to approximately 205 million since 2020. This expansion in shares outstanding reflects the company’s efforts to access the necessary funds for its growth and development endeavors. As production is still some years out I think that the dilution will continue. The first revenues are to be generated in 2026 and the risk of excessive dilution until then is certainly there in my opinion.

Revenue Estimates (Seeking Alpha)

Furthermore, AMLI must also contend with the potential challenges associated with scaling up its lithium extraction operations. As it seeks to expand and establish itself as a prominent player in the lithium market, it will need to invest in infrastructure, equipment, and skilled labor. This expansion comes with its own set of risks, including cost overruns, operational inefficiencies, and delays. Another factor to consider is the competitive landscape in the lithium industry. AMLI will face competition from established players with deep pockets and extensive experience in lithium production. Navigating this competitive environment and gaining market share will be a significant challenge.

Final Words

ALMI is an exciting company right now that is benefiting from the EV revolution as demand for lithium is increasing quite quickly. I think that allocating a smaller portion of a portfolio to ALMI will be quite beneficial over the long term. If anything ALMI is a decent buyout opportunity for larger corporations like ALB. As for allocation size, something under 1% is where I would be comfortable. As a result of this, I am rating AMLI a buy right now. Risks are the volatile pricing environment for lithium, but long-term I remain bullish that the prices will see an uptrend.

Read the full article here

Leave a Reply