Investing in stocks doesn’t have to be a popularity contest, as there is plenty of value to be had in underfollowed names. For one reason or another, these names may not share the limelight with their better-known counterparts, and that’s not a bad thing, since that creates opportunities as one can buy their overlooked assets at a discount.

This brings me to American Assets Trust (NYSE:AAT), which is a diversified REIT with high quality assets across the U.S. As shown below, AAT’s stock price has declined by 22% over the past 12 months, bringing its forward P/FFO below 10. In this piece, I discuss why AAT currently represents good value for income and potential capital appreciation, so let’s get started!

AAT Stock (Investor Presentation)

Why AAT?

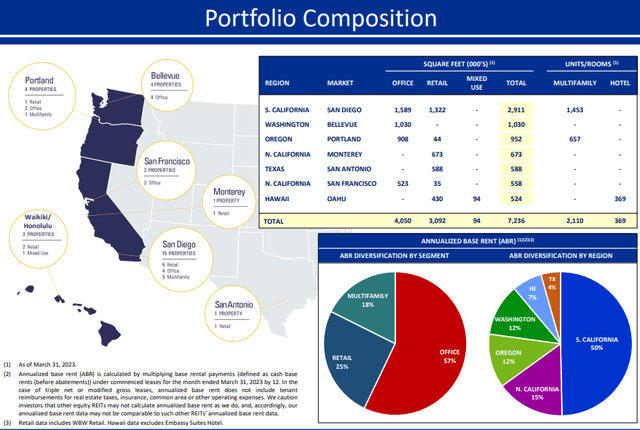

American Assets Trust is a diversified REIT that’s been around for 55 years (publicly traded since 2011). It’s headquartered in San Diego, California and owns a collection of premier office, retail, and residential properties in high barrier-to-entry markets in California, Washington, Oregon, Texas, and Hawaii. As shown below, AAT’s properties are located in metropolitan cities. Most of its rent (57%) is derived from office properties, followed by retail (25%), and multifamily (18%).

Investor Presentation

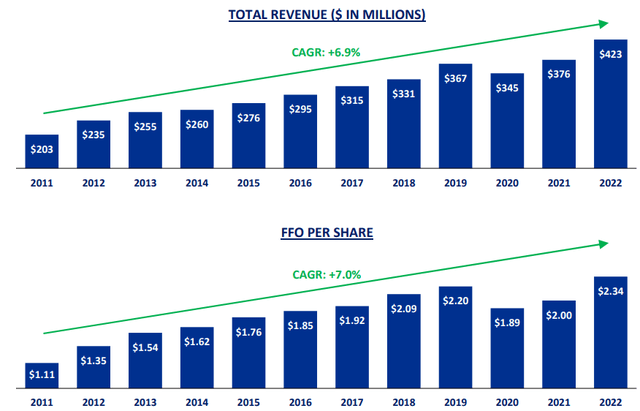

Importantly, AAT has a solid track record of growing both its top and bottom lines over the past decade. This includes both revenue and FFO/share CAGR of 7% over this timeframe. As shown below, both of these metrics have recovered since hitting a trough in 2020, and are above their pre-pandemic levels.

Investor Presentation

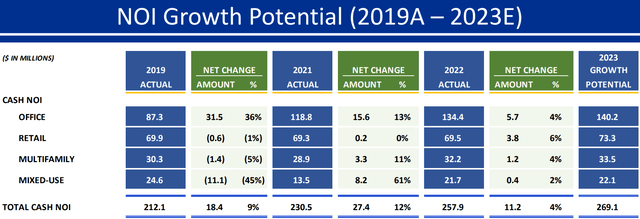

Encouragingly, AAT has also seen near-term growth amidst headline risks around office properties. This includes same-property NOI growing by 7.7% and 7.0% YoY for the 3 months and 6 months ended on June 30, 2023. This was driven by an increase in AAT’s retail segment related to new tenant leases, an increase in revenue at its Waikiki Beach Walk – Embassy Suites, and an increase in revenue and average monthly base rents in the multifamily segment. For the full year, management is conservatively guiding for 4% Cash NOI growth, led by retail, as shown below.

Investor Presentation

Concerns around AAT include its exposure to office properties, which has garnered plenty of headlines over the past months due to uncertainties around return to office. However, the office portfolio remains overall healthy with a 90.3% same-property leased rate. AAT did appear to give concessions on office rent, as cash rents on new leases declined by 4%, although that would be made up with annual rent escalators, as GAAP straight-line rents on said leases grew by 5%.

Moreover, office utilization rates are growing across AAT’s key markets. This is likely driven by a growing number of return to office mandates, with the most publicized ones being Meta’s (META) and Amazon’s (AMZN) requirements that employees return to the office 3 days a week, and even teleconferencing giant Zoom Video (ZM) is requiring employees return 2 days a week. From a space requirement perspective, it doesn’t really matter whether an employee is in the office 2 days a week versus 5, as the same amount of space needs to be set aside for that person.

Like most all REITs, AAT is also facing higher interest rates, and this affects the bottom line, as reflected by the 2% YoY FFO/share growth in the last reported quarter, sitting below the aforementioned 7.7% same-property NOI growth. However, AAT is well-positioned to benefit should interest rates stabilize, as it’s supported by $485 million of liquidity.

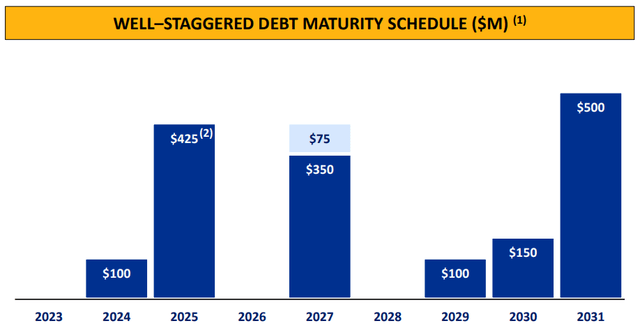

AAT also carries investment-grade credit ratings (BBB- from S&P, and BBB from Fitch). While net debt to EBITDA is somewhat elevated at 6.6x, management plans to lower it to 5.5x, and interest coverage ratio is at a healthy 3.5x. As shown below, AAT has no remaining debt maturities and just $100 million of maturing debt next year.

Investor Presentation

Importantly, AAT’s 3.1% dividend yield is well-protected by a 53% payout ratio, leaving plenty of retained capital to pay down debt and/or opportunistically fund development and acquisitions.

The stock also appears to be undervalued at the current price of $21.54 with a forward P/FFO of 9.4. At the current valuation, the market is baking in low expectations for the company, despite its quality asset base in high barrier-to-entry markets. New supply could also be muted in the near term due to higher interest rates, making AAT’s properties more attractive to tenants. As such, I see potential for AAT to reach a P/FFO in the 11-14x range in the near to medium term (1-5 years) with stabilizing rates and continued growth in same property NOI.

Investor Takeaway

American Assets Trust represents an attractive opportunity for income and potential capital appreciation at the current price. It has a diversified portfolio of high quality office, retail, and residential properties in high barrier-to-entry markets, and is well-positioned to weather potential headwinds from higher interest rates due to overall portfolio rent growth. Meanwhile, investors get to collect a well-covered dividend while waiting for a potential rebound in price if and when the market chooses to revalue the stock.

Read the full article here

Leave a Reply