With the tailwind of the AI hype, the Advanced Micro Devices (NASDAQ:AMD) share has seen a substantial advance this year. The YTD gain is more than 60%. That’s almost four times as good as the performance of the S&P 500, which grew by about 16% in the same period. But yes, compared to the AI king Nvidia (NVDA) and its tripling, the share price development is slightly less impressive.

Operational development lags behind the Nvidia and its Q2 shock

There are good reasons for this development. While Nvidia more or less pulverized analysts’ expectations and forecasts with its 2Q report, AMD’s operational growth was not so impressive.

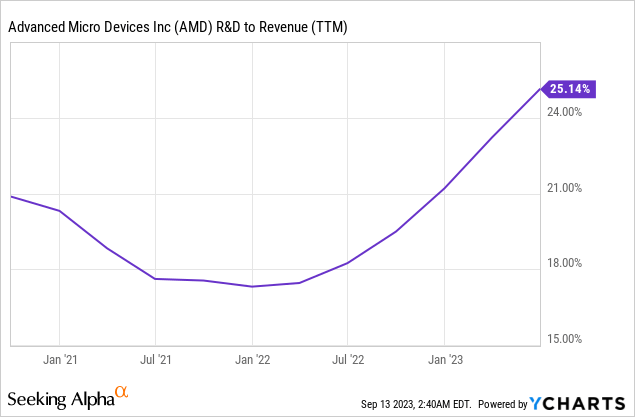

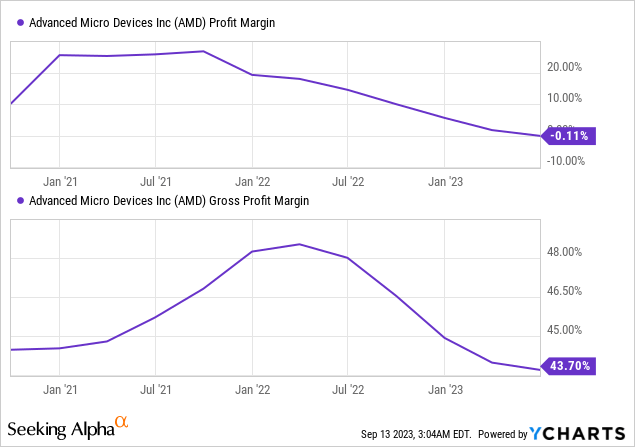

Thus, revenues fell with a view to Q2 but also concerning the first six months of 2023. Instead of $12.4 billion in net revenue, AMD achieved a total of only $10.7 billion in Q1 and Q2. In 2Q alone, revenue fell 18%. Gross profit fell from $5.8 billion to $4.8 billion in the first half year. EPS fell from $0.28 to $0.02 in Q2 YoY and overall in Q1 and Q2 YoY from $0.82 to negative $0.07. To that extent, AMD ended the first six months of 2023 with a net loss of over $100 million. In addition to the decline in sales, the high R&D expenses were the main driver of this performance.

Except for the Embedded segment, all segments reported a decline in sales. The decline was particularly sharp in the Client segment. In the Client segment, revenue in the first six months of YoY fell by more than 50% from $4.2 billion to $1.7 billion. Admittedly, this segment is somewhat seasonal. CEO Lisa Su also expects a better second half of the year here.

We expect our Client segment will grow in the seasonally stronger second-half of the year based on the strength of our product portfolio and increased adoption of our Ryzen 7000 CPUs, including the ramp of our Ryzen 7040 mobile CPUs that deliver leadership performance and energy efficiency, and are the industry’s first x86 processors with a dedicated AI engine.

I was somewhat surprised by how much the Data Center segment weakened, with revenue down $100 million (11% YoY). This is no comparison to Nvidia’s 100% revenue growth in 2Q, fueled by Data Center revenue growth.

What at least stands out positively is the good performance of the Embedded segment. AMD increased the segment’s operating income from $918 million to $2.3 billion in the first six months of 2023. I already pointed out the potential of this segment two years ago. The $35 billion Xilinx acquisition at that time could pay off more and more. In my older article, I wrote:

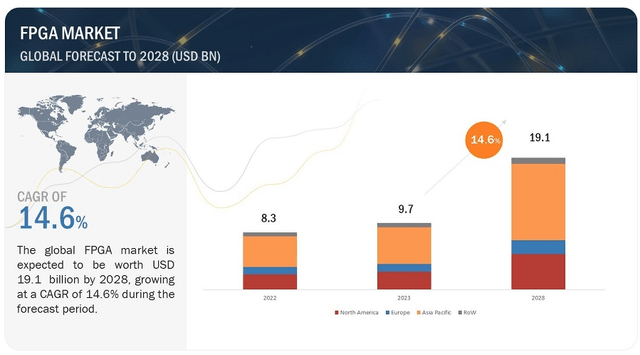

The $35 billion acquisition of Xilinx should help AMD, especially in the market for reprogrammable chips (FPGAs). As I said before, FPGAs have increasingly replaced high-end CPUs and Application Specific Integrated Circuits (ASICs). It is therefore not surprising that the market for FPGAs will grow extremely in the future. The market size was valued at USD 5 billion in 2014 and is expected to grow at a CAGR of 14% from 2017 to 2027.

The current market volume is just under $10 billion. According to analysts, the volume is expected to grow at a CAGR of 14.6% to $19.1 billion by 2028. The current market volume is slightly under $10 billion. According to analysts, the volume is expected to grow at a CAGR of 14.6% to $19.1 billion by 2028.

FPGA Market Global Forecast (MarketsandMarkets)

The prospects are good, but the competition is strong

Overall, the prospects for AMD are promising at first glance. The growth in high-end computing and data centers will continue in the next few years. The development of AI will also massively increase the demand for GPUs and CPUs. Or, as the CEO says:

it is clear that AI represents a multibillion dollar growth opportunity for AMD across cloud, edge and an increasingly diverse number of intelligent endpoints.

In the datacenter alone, we expect the market for AI accelerators to reach over $150 billion by 2027.

Nevertheless, AMD is not the spearhead. The last quarter, in particular, showed that Nvidia has made more progress with the execution of its own AI strategy than AMD. When I read statements like the following, it feels like AMD is a bit late to the party.

Our AI strategy is focused on three areas. First, deliver a broad portfolio and multi-generation roadmap of leadership GPUs, CPUs, and adaptive computing solutions for AI inferencing. Second, extend the open and proven software platform we have established that enables our AI hardware to be deployed broadly and easily. And third, expand the deep and collaborative partnerships we have established across the ecosystem to accelerate deployments of AMD-based AI solutions at scale.

The AI race will not be decided in the first quarters of a journey that will take years or even decades. The market volume and growth prospects are much too good for that. From my point of view, however, AMD is currently more of a follower than a pioneer.

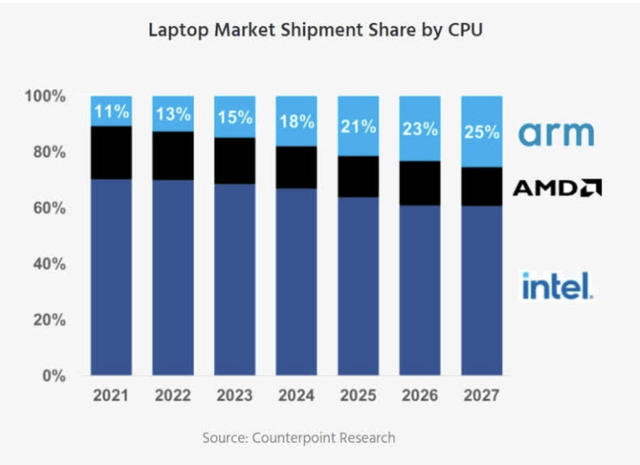

In the Windows computer market, life isn’t getting any easier for AMD, either. Chips based on Arm-Design are in the process of thoroughly shaking up the market. From my point of view, Apple’s (AAPL) Mxy chipsets have shown how strong Arm-Design is in personal computers. And now there are very concrete indications that Qualcomm (QCOM) wants to bring Arm-based chips for Windows computers onto the market. At the beginning of next year, Qualcomm is expected to launch the Snapdragon 8cx Gen 4 chip on an Arm design basis.

AMD could, therefore, be squeezed between Intel (INTC) and other manufacturers of Arm chips in the medium and long term.

Laptop market shipment share by CPU (Counterpoint Research)

Somewhat highly valued from my point of view

The strong competitive pressure will increase rather than decrease in the future as other tech companies will also jump on the AI bandwagon and develop solutions. In this respect, it is fair to say that AMD’s business model has no unconquerable moat.

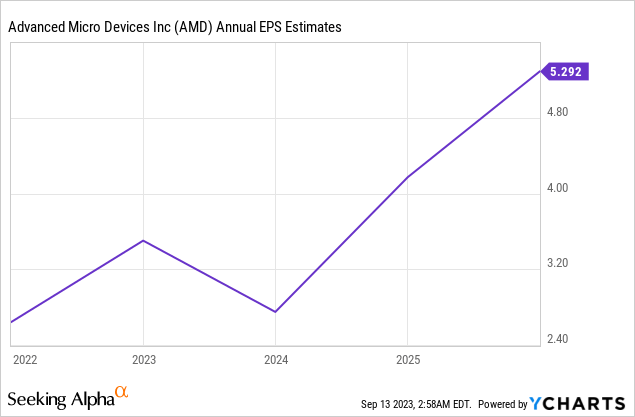

With full-year 2023 EPS expected to be between $2.75 and $2.80, the forward PE ratio at a share price of $105 is over 35. For a company with declining revenues and profits, that’s quite a bit. Of course, the market is pricing in earnings increases in the coming years. Analysts believe that by 2026, EPS could rise to over $5. Based on the current share price, that would be a P/E ratio of only 20x.

From my perspective, the price tag is not attractive at the moment. Currently, the positive outlook has too much influence on the share price while it does not sufficiently reflect the risks. For example, AMD falling further behind Nvidia could eat up more and more market share and drive up R&D spending. We’ve seen this mix eat into margins over the past two quarters. Therefore, that earnings per share will march in such a straight line upward until 2026 is not guaranteed, in my view.

Conclusion

The tailwind that carried Nvidia’s business recently did not catch AMD. At least, however, the share price could pull up in Nvidia’s slipstream. With a YTD performance of over 60%, however, I think the market has priced in more opportunity than risk in the share price. I do not have a crystal ball, but from my point of view, the risk/reward ratio is currently not good enough for a buy. This is perhaps a good time to sell for investors who like to take profits now and then, which is why I give a sell rating.

Read the full article here

Leave a Reply