Whether you love the company or hate it, e-commerce and cloud giant Amazon (NASDAQ:AMZN) is one of the largest companies on the planet with a market capitalization of over $1.3 trillion. Historically speaking, betting against the company has not gone well. In the past decade, for instance, the market value of the company has shot up by a multiple of seven. And it’s up by a multiple of almost 62 compared to where it was 20 years ago.

Given broader economic concerns, particularly with the Federal Reserve keeping interest rates high in an attempt to drive inflation down, I can understand why investors might be hesitant to own shares of the business. Even earlier this year, I wrote an article granting the company a ‘hold’ rating because of profitability issues. In addition to seeing weakness in both its North American and International segments, the company’s profit margins when it came to AWS were also on the decline. Fast forward to today, and shares have risen slightly more than the broader market has. So you might think that I would be even less optimistic about its prospects as a result. But actually, my own sentiment in the company is improving markedly.

The fact of the matter is that while AWS has experienced a bit of pain recently, the other two operating segments of the company are doing really well. In addition to seeing revenue grow nicely year over year, the company has benefited from cost cutting initiatives that have helped to push up bottom line results in those two segments. This is not to say that the enterprise cannot or will not experience some downside when, not if, the Federal Reserve is successful in forcing the economy to weaken. It is highly probable that shares could fall at that time as the state of the economy is reflected in the company’s top and bottom lines. But with management successful in proving that the company can become more efficient, I would say that the long-term outlook for the company is now positive.

Recent results are encouraging

When analyzing Amazon, it’s best to really think about the company in a segmented manner based on its operating segments. As I mentioned already, these are the North American, International, and AWS segments. In the article that I wrote about the business back in May of this year, I pointed out that while revenue in the North American segment was growing nicely, profits had been on the decline because of higher fulfillment and shipping costs, as well as other factors like increased investments that the company was making. Revenue had more or less flatlined when it came to the International segment. But over the prior three years, the company went from generating a modest amount of profit to incurring some rather sizable losses.

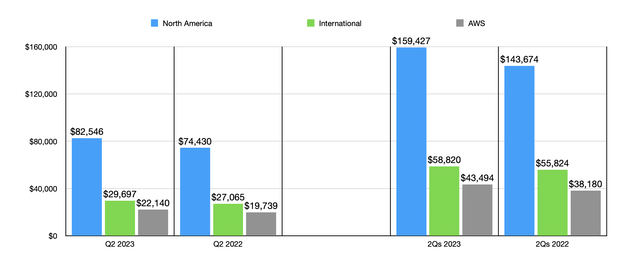

Revenue

Author – SEC EDGAR Data

Since then, additional data has come out that I would describe as being encouraging. Consider, for instance, the most recent quarter for which data is available. This is the second quarter of the 2023 fiscal year. Revenue during that time came in at $134.38 billion. That represents an increase of 10.8% over the $121.23 billion reported one year earlier. All three of the company’s operating segments performed well during this time. The North American segment, for instance, saw revenue jump by 10.9% from $74.43 billion to $82.55 billion. Management chalked this growth up to increased unit sales, mostly associated with third-party sellers, as well as higher advertising revenue and subscription services. The International segment, meanwhile, saw revenue grow by 9.7% from $27.07 billion to $29.70 billion. The exact same things that benefited the North American segment benefited this one as well. Increased customer usage was instrumental in pushing up AWS revenue by 12.2% from $19.74 billion to $22.14 billion. Interestingly, the picture would have been even more appealing for this segment had it not been for long-term customer contracts bringing effective pricing down.

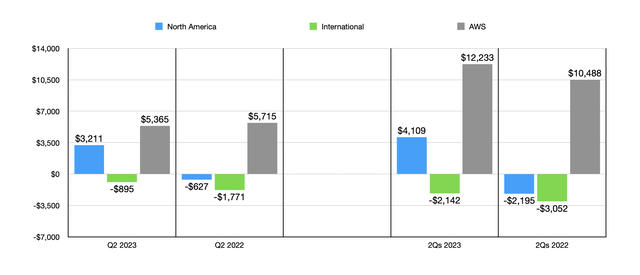

It’s always great to see revenue rise. But it’s not revenue that determines the value of a company. What truly determines value is profitability. As you can see in the first chart of this article, net profits, operating cash flow, adjusted operating cash flow, and EBITDA increased for Amazon rather significantly year over year. What’s really exciting for shareholders is that this improvement occurred across some of the most challenged parts of the company. The North American segment went from generating a loss of $627 million in the second quarter of 2022 to generating a gain of $3.21 billion at the same time this year. Higher unit sales helped the company spread its fixed costs across a greater volume of revenue, while high-margin advertising revenue helped the company’s bottom line as well. The International segment went from generating a loss of $1.77 billion to generating a loss of only $895 million. Once again, the same factors that helped out the North American segment helped out this one as well.

Profits

Author – SEC EDGAR Data

Unfortunately, not everything was great for the business. The AWS segment actually saw profits decline from $5.72 billion to $5.37 billion over the same window of time. Despite the increase in sales and the fact that AWS has historically been a cash cow, the firm’s bottom line was negatively affected by higher payroll and related expenses, as well as increased spending on technology infrastructure. The good news, according to management, is that this seems to have been voluntary spending aimed at growing the company more in the long run. This is an example of what I would call a good cost increase.

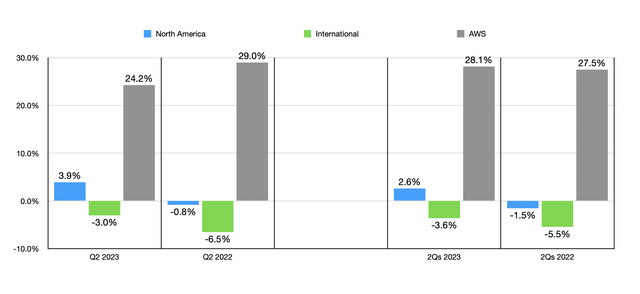

I could go on and talk about how the results for the first half of the year very closely mirror the second quarter on its own on a year over year basis. But instead of diving into those details, I will refer you to the charts in this section because they also include that data in them. What is interesting about all of this, however, is that it’s showing margin improvement across the board for both the second quarter on its own and the first half of the year for both of the non-AWS segments. And even for the first half of this year, as you can see in the chart below, AWS margins are up.

Margins

Author – SEC EDGAR Data

The improvements are unlikely to stop here

Over the past couple of quarters, the management team at Amazon has clearly demonstrated that they can cut costs. After seeing shares of the company pummeled last year because of the aforementioned profitability issues, the firm’s CEO, Andy Jassy, took a hatchet to many parts of the business. He ended up eliminating 27,000 jobs and either cut or reduced the company’s dedication to certain lines of business that might be much longer-term plays than investors were willing to wait for.

One example of this cost-cutting included implementing small charges on some return items. Back in 2022, the company began charging to have a return done by means of a UPS truck picking up their return items. In April of this year, they even began charging $1 to return items by dropping them off at a UPS store. The company famously and controversially raised the price of Amazon Prime last year and put a limit on how many years an individual with a student email address could get the service for half off.

In an effort to boost margins, the company began, in late February of this year, charging differently for Amazon Fresh grocery delivery. Previously, delivery was free for online orders greater than $35, with some places like New York City coming in a bit higher at $50. Anything below these thresholds would incur a $4.99 delivery fee. Effective February 28th, the company began charging between $3.95 and $9.95 for orders greater than $35 but no more than $150, with orders in excess of that being delivered for free. But in a sign that not all initiatives are going as well with customers as the company would hope, a leaked memo indicated that the company will no longer be charging a fee for orders more than $100. This is an area where the company does have some competition. Mega retailer Walmart (WMT) currently offers delivery as part of a program called Walmart+. As of the end of the 2022 fiscal year, the company offered grocery pickup options at roughly 8,100 locations and delivery options for 7,000 locations across the globe. 4,600 and 3,900 of these, respectively, fall within the U.S. market. If there’s any company in the world that can compete with Amazon, it’s Walmart.

While the company’s decision to backtrack on delivery charges might have some impact on the bottom line, it’s also true that the enterprise is continuing with its cost cutting crusade. Just this month, the company said that it was ‘killing’ its live-streaming app, Amp, in order to cut down on costs. This was a relatively new platform, launched in March of last year, that gave users the ability to play the role of disc jockey for their own live radio shows. It even launched with some high-profile creators such as Nicki Minaj. And completely separate from this endeavor, the company recently revealed that it is cutting over 5% of the staff at its communications division at Amazon Studios, with Prime Video and Music being impacted. Although unfortunate for the employees, this maneuver should help boost margins even more.

A solid buying opportunity

In the middle of September of this year, shares of Amazon hit a fresh 52 week high of $145.86. Since then, the stock has dropped about 13.6%. I have no doubt that broader economic concerns are weighing on the stock to some extent. But it’s almost certain that the larger contributor to this pain was the rather sudden and unexpected lawsuit that the company picked up from the FTC, as well as 17 different states. The charges sent her around the idea that the company is a monopolist in the e-commerce space and that it has historically used anti-competitive strategies to keep this monopoly power.

The purpose of this article is not necessarily to delve on that particular matter. But it is one that has the potential to impact the company significantly. The only reason I’m not digging into it is because I don’t have much insight to give that hasn’t already been made publicly available. It’s also very early in that process and it could take years before any true resolution is arrived at. In the meantime, the company is going to continue growing and generating strong cash flows. Not only does it have traditional levers of growth to benefit from. It also has new catalysts such as AI. Earlier this year, I wrote an article about Google (GOOG) (GOOGL) and how AI might prove particularly bullish for it because of its cloud operations. My sentiment is the same when it comes to a company like Amazon.

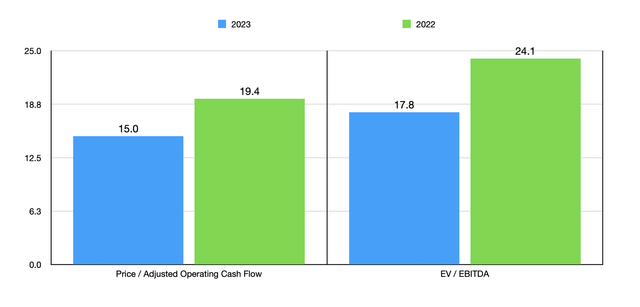

Author – SEC EDGAR Data

In terms of valuing the company, what I did was annualize the financial performance achieved during the first half of this year. Following this approach, I was able to create the chart above. On a forward basis, the company is trading at a price to adjusted operating cash flow multiple of 15 and at a forward EV to EBITDA multiple of 17.8. These are both lower than what we get using data from 2022. While this is not exactly in value territory, it’s a decent price for a high-quality company that is almost certain to continue growing for the foreseeable future.

Takeaway

Based on the data that I have covered in this article, I would argue that Amazon truly is showing signs of improvement. Yes, the company does have some headwinds to worry about, such as the FTC lawsuit and the prospect of a weakening economy. The former could take years to resolve, while the latter should truly be temporary. At the same time, shareholders are benefiting from major cost cutting initiatives and the company has continued growth prospects to benefit from. All combined, this leads me to rate the business a soft ‘buy’ at this time.

Read the full article here

Leave a Reply