Thesis

In an era of rapidly evolving technology and e-commerce, Amazon.com, Inc. (NASDAQ:AMZN) stands as a prominent figure. This article delves into the financial intricacies of Amazon, examining its recent growth trends, risk factors, and competitive strengths. Through a meticulous evaluation of the company’s performance, this analysis aims to provide investors with a balanced perspective on Amazon’s future. Consequently from the three valuations, we can conclude that Amazon may have a fair value target price of $127.9 which makes the stock a “hold”, mainly because of how low the upside is and how optimistic the growth should be in order to achieve an annual return of 15%.

Overview

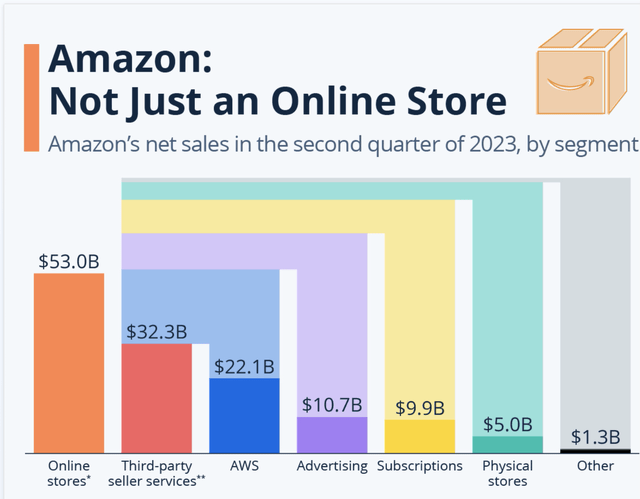

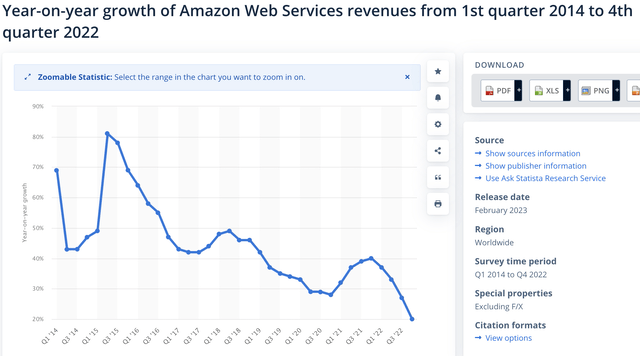

Amazon, as suggested by the image from Statista below, is not just an online store; it encompasses various operations across different segments. In my opinion, the one with the most potential is Amazon Web Services, currently the world’s largest cloud operation. Additionally, the e-commerce segment has displayed profitability fluctuations over the years due to its capital-intensive nature, primarily attributable to Amazon’s extensive delivery network that employs thousands of drivers, aiming to deliver parcels in less than two days.

Statista

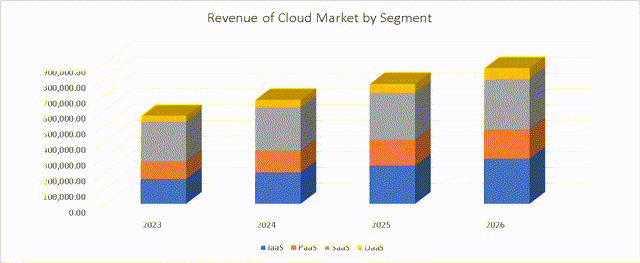

The cloud market is expected to experience a growth rate of 16.3% throughout 2026. However, for the purpose of this discussion on upside potential, I am inclined to be more optimistic and assume that the market could sustain this growth until 2028.

Author’s Calculations

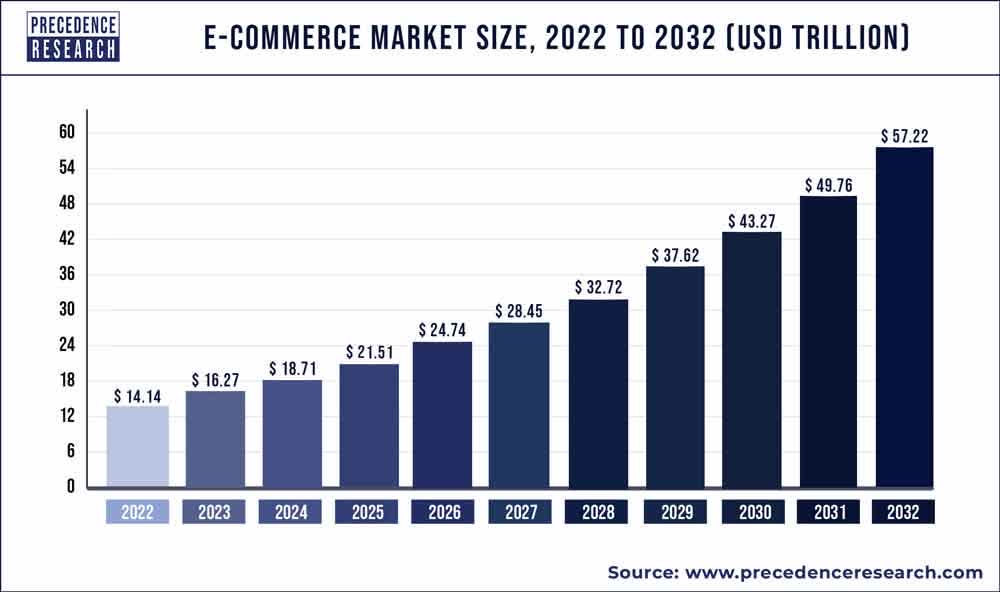

Meanwhile, the e-commerce segment, encompassing Amazon’s Online Stores and Third-party seller services, is not lagging behind in terms of growth. It is expected that the global e-commerce market will grow at a rate of approximately 15% throughout 2032.

Precedence Research

What we can glean from this analysis is that Amazon’s most crucial segments, the first and third, are operating in double-digit growth markets.

Financials

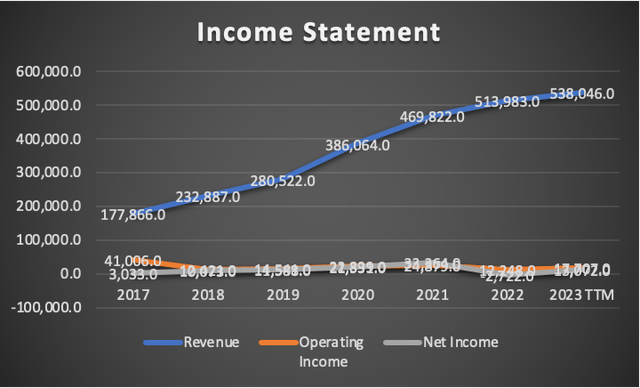

Amazon’s revenue has experienced substantial growth, yet it has recently stagnated. If you examine the graph below, you will notice that from 2021 to the present, Amazon’s revenue has increased by 4.9% annually, a rate significantly lower than the 32.9% annual growth it achieved from 2017 to 2021.

Author’s Calculations

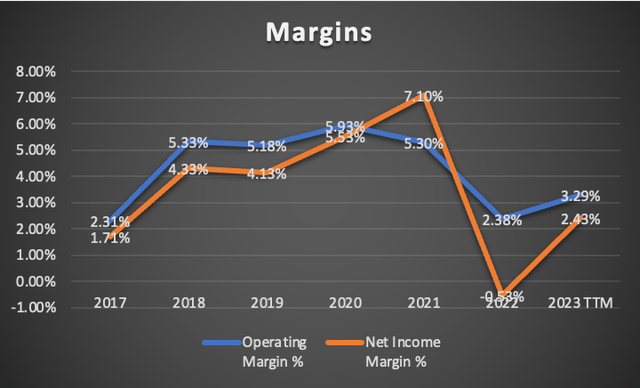

Amazon’s margins, both net income margin and operating margin, have consistently remained below the 10% threshold throughout the 2017-2023 period. This may, however, be attributed to Amazon’s competitive advantage, as these seemingly small percentages translate into billions of dollars. Smaller competitors would struggle to operate at such narrow margins and amass sufficient capital to expand their businesses, leaving them at a distinct disadvantage when competing with Amazon.

Author’s Calculations

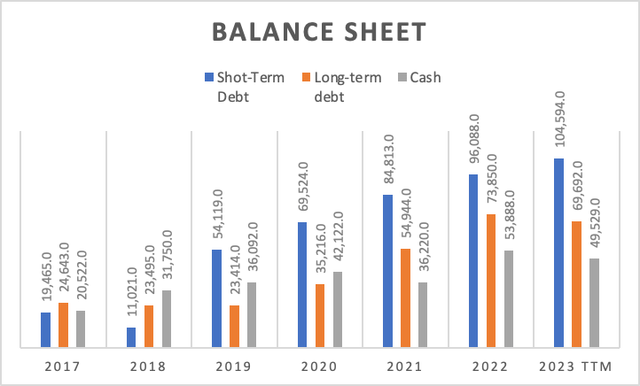

Amazon’s balance sheet, while not dire, does raise concerns. Holding $104 billion in short-term debt means they may need to issue further debt to service existing obligations, incurring higher costs due to prevailing high interest rates. With $34.9 billion in accounts receivable, it’s apparent that their current liquidity may not suffice.

Author’s Calculations

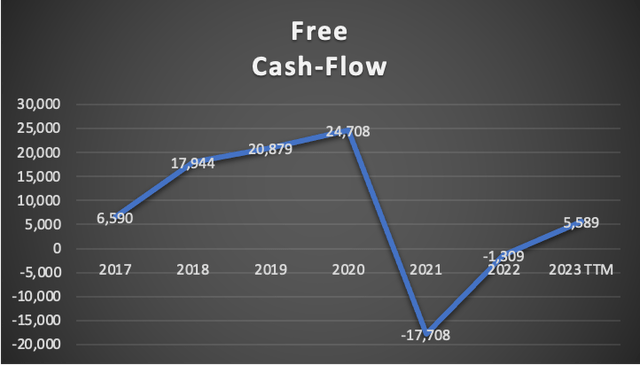

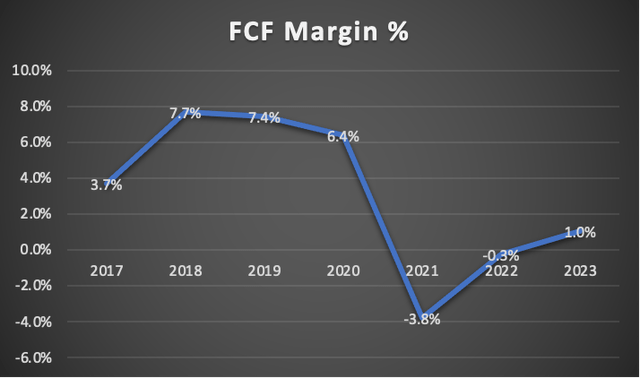

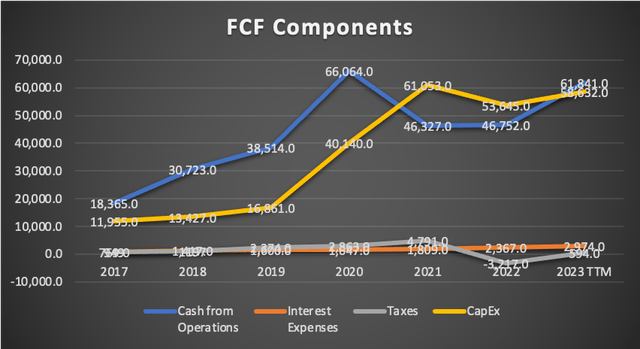

Amazon’s free cash flow has taken a significant dive, declining from its peak of $24.7 billion in 2020 to $5.5 billion in 2023. This results in a current FCF margin of just 1%. Notably, Amazon increased its capital expenditures by approximately $20 billion from 2020 to 2021, which is the primary factor contributing to the sharp drop in cash flow. Given that CapEx is the driving force behind this decline, Amazon has the capacity to reduce these expenditures if they so choose.

Author’s Calculations

Author’s Calculations

Author’s Calculations

Valuation

In this valuation, I will present two models. The first model assumes that Amazon can achieve the expected revenue growth rate of 10.65% and a net income growth rate of 38.49%. The second model, on the other hand, focuses on safeguarding AWS and e-commerce revenue by aligning them with the average expected growth rates of the cloud computing market (16.3%) and the worldwide e-commerce market (15%).

The table of assumptions below, which is filled with all the current financial data available on Amazon, projects interest expenses, depreciation and amortization (D&A), and capital expenditures (CapEx) based on margins linked to revenue. This approach is intended to estimate how much Amazon would need to increase these factors to support its revenue growth.

| Table Of Assumptions | |

| (Current data) | |

| Assumptions Part 1 | |

| Equity Value | 168,602.00 |

| Debt Value | 174,286.00 |

| Cost of Debt | 1.71% |

| Tax Rate | 4.35% |

| 10y Treasury | 4.80% |

| Beta | 1.11 |

| Market Return | 10.50% |

| Cost of Equity | 11.13% |

| Assumptions Part 2 | |

| EBIT | |

| Tax | 594.00 |

| D&A | 45,724.00 |

| CapEx | 58,632.00 |

| CapEx Margin | 10.90% |

| Assumption Part 3 | |

| Net Income | 13,072.00 |

| Interest | 2,974.00 |

| Tax | 594.00 |

| D&A | 45,724.00 |

| Ebitda | 62,364.00 |

| D&A Margin | 8.50% |

| Interest Expense Margin | 0.55% |

| Revenue | 538,046.0 |

Analysts’ Estimates Scenario

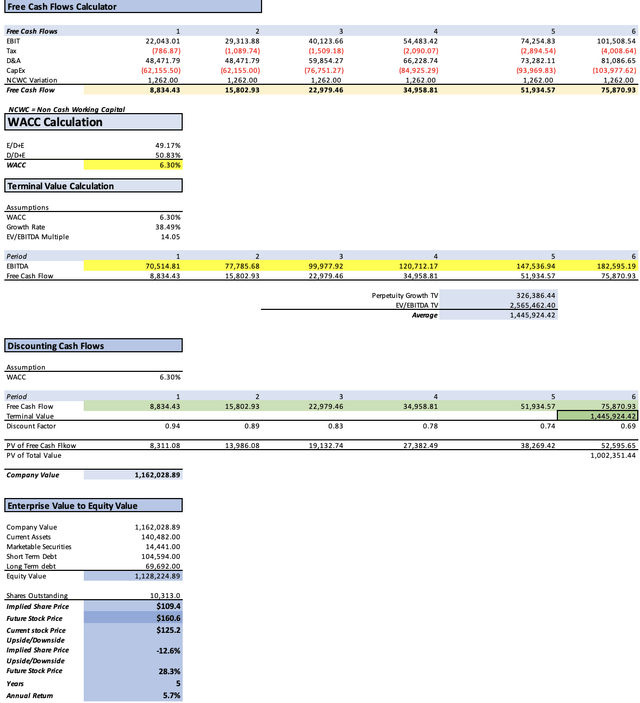

In the first model, I will assess the fair value of Amazon by assuming it can achieve the expected revenue growth rate of 10.65% and a net income growth rate of 38.49%.

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | $570,380.0 | $18,103.41 | $18,890.29 | $67,362.08 | $70,514.81 |

| 2024 | $636,530.0 | $25,071.42 | $26,161.16 | $74,632.95 | $77,785.68 |

| 2025 | $704,320.4 | $34,721.40 | $36,230.59 | $96,084.85 | $99,977.92 |

| 2026 | $779,330.6 | $48,085.67 | $50,175.74 | $116,404.49 | $120,712.17 |

| 2027 | $862,329.3 | $66,593.85 | $69,488.39 | $142,770.49 | $147,536.94 |

| 2028 | $954,167.3 | $92,225.82 | $96,234.47 | $177,321.12 | $182,595.19 |

| ^Final EBITA^ |

Author’s Calculations

As displayed, the present fair value of $109.4 reflects a 12.6% downside from the current stock price of $125.2. Additionally, the model suggests a future stock price of $160.6, equivalent to a 5.7% annual return.

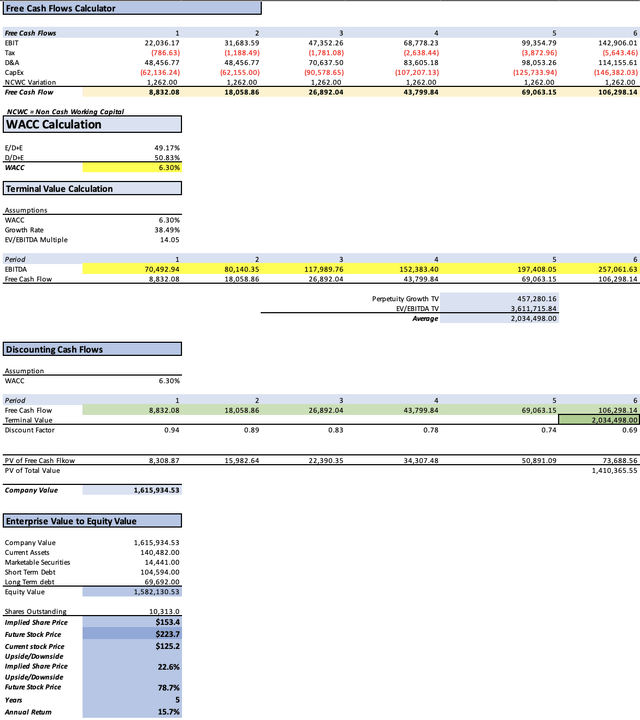

My Estimates

In this second model, I will determine the potential fair value of Amazon if its cloud revenue can grow at the market’s rate of 16.3% and if e-commerce can expand at the market’s rate of 15%. Achieving these revenue growth rates would necessitate an annual increase of 33.37%. The net income margin remains the same as in the previous model.

| Net Income Margin | |

| 2023 | 3.2% |

| 2024 | 3.9% |

| 2025 | 4.9% |

| 2026 | 6.2% |

| 2027 | 7.7% |

| 2028 | 9.7% |

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | $570,203.2 | $18,097.80 | $18,884.43 | $67,341.20 | $70,492.94 |

| 2024 | $694,211.2 | $27,343.35 | $28,531.84 | $76,988.61 | $80,140.35 |

| 2025 | $831,209.5 | $40,976.75 | $42,757.82 | $113,395.33 | $117,989.76 |

| 2026 | $983,803.5 | $60,701.90 | $63,340.34 | $146,945.52 | $152,383.40 |

| 2027 | $1,153,817.8 | $89,104.21 | $92,977.17 | $191,030.43 | $197,408.05 |

| 2028 | $1,343,298.3 | $129,837.59 | $135,481.05 | $249,636.67 | $257,061.63 |

| ^Final EBITA^ |

| E-Commerce | AWS | The Other Things | |

| 2023 | $362,271.15 | $93,856.0 | $114,076.0 |

| 2024 | $457,750.65 | $109,154.6 | $127,306.0 |

| 2025 | $563,398.71 | $126,946.8 | $140,864.1 |

| 2026 | $680,298.30 | $147,639.1 | $155,866.1 |

| 2027 | $809,647.70 | $171,704.2 | $172,465.9 |

| 2028 | $952,772.79 | $199,692.0 | $190,833.5 |

Author’s Calculations

As you can see the present fair value of $109.4 represents a 12.6% downside from the current stock price of $125.2. Then the model also suggests a future stock price of $160.6 which is the equivalent to a 15.7% annual return.

Risks

Amazon’s cloud service, AWS, stands out as one of the most cost-effective cloud options for businesses. Moreover, businesses typically diversify their cloud providers, reducing reliance on a single source. Therefore, I believe that AWS is likely to maintain its dominance in the market, unless it faces recurring hacker attacks and data leaks, which could severely impact its performance.

While AWS’s revenue growth has declined, it’s still above 20%, a robust figure compared to the 16.3% growth rate I used. The risks associated with Amazon’s e-commerce business appear limited, except for its seasonality, which can lead to fluctuations in sales during periods like pre and post-Christmas.

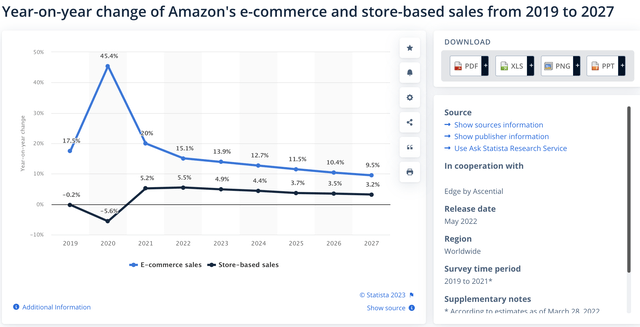

Statista

However, in the table below, you’ll notice that the projected growth rates for Amazon’s e-commerce segment fall significantly below the 15% rate I utilized. Sales from physical stores were also overestimated, with a growth rate of 10.65%. If these adjustments are made in the model, the fair value of the second scenario drops to $127.9, representing only a 2.2% upside from the current stock price of $125.2. The future stock price would then be $187.1, resulting in an annual return of 9.9%.

Statista

These factors, though, pose more risks to Amazon than to my bearish thesis. The main risk to my thesis is the possibility of Amazon surprising us with substantial revenue growth that necessitates upward adjustments to all forecasts. This could push the fair price, perhaps approaching that of the more optimistic second scenario. Nevertheless, a 15.7% annual return is still relatively lower compared to potential returns from other stocks.

So what?

In conclusion, I find that Amazon is fairly valued. I’m assigning it a target price of $127.9, as previously mentioned, indicating a modest 2.2% upside from the current stock price of $125.2. The projected future value of $181.1 reflects an annual return of 9.9% over a five-year period.

Considering the risks outlined in the preceding section, which primarily revolve around Amazon’s challenges in achieving growth unless it experiences a significant and unforeseen surge in revenue, bringing its growth forecasts in line with the previously mentioned figures of 15% for e-commerce, 16.3% for cloud, and 10.65% for other segments. Even under these conditions, Amazon’s potential annual revenue growth would only reach 15.7%, which may not provide a sufficient margin of safety. Therefore, I rate Amazon as a “hold.”

Conclusion

In conclusion, the evaluation of Amazon’s financial prospects reveals a nuanced outlook. While the company faces certain challenges, including a deceleration in revenue growth and concerns about its e-commerce and cloud segments, it remains a formidable force in the market. Amazon’s dominance in cloud services, AWS, its cost-effective offerings, and its diversified customer base provide a substantial competitive advantage. Nevertheless, uncertainties surrounding its e-commerce performance and the need for substantial revenue growth to support optimistic valuations present potential risks. Ultimately, the fair value of Amazon, when accounting for these dynamics, points to a target price of $127.9, offering a modest 2.2% upside from the current stock price of $125.2. The projected future value of $181.1 indicates an annual return of 9.9% over a five-year period. Given these factors, the recommendation for Amazon falls under a “hold” rating.

Read the full article here

Leave a Reply