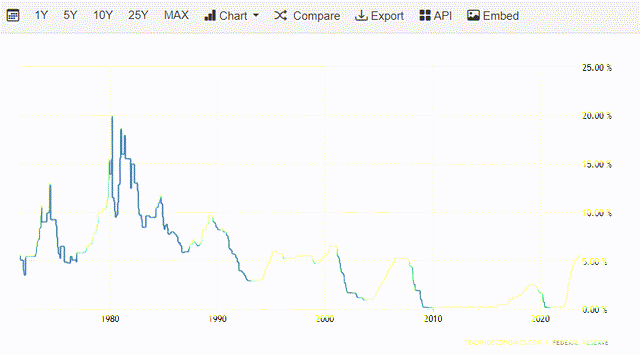

2023 has been a challenging year for dividend stocks as the Fed tightening cycle pushed interest rates well past 5%. It’s now the most lucrative time in over a decade to allocate capital toward risk-free investments as the 2-year treasury has a yield exceeding 5% and the 10-year yields 4.68%. There were many exciting proxies when the 2-year had a sub-2 % yield from the fall of 2013 to the beginning of 2018 and again in the yield-starved environment where the 2-year yielded less than half a percent from March of 2020 to the fall of 2021. As the Fed increased rates at the quickest pace since the 1980s, not only did dividend stocks get hammered, but bonds crashed as well. Many Dividend Aristocrats and Dividend Kings that acted as proxies for yield couldn’t keep their appeal as rates traveled higher. Many investors found themselves piling into CDs and treasuries because they were able to get a 4-5% return on their capital with no exposure to risk. Altria Group (NYSE:MO) hasn’t been immune to the higher for longer rate environment as its shares have declined -8.66% YTD. Altria is rapidly approaching a long-term resistance level of $40 per share. Altria is the king of the Dividend Kings, as its yield exceeds 9%. While Altria faces several challenges, including regulatory and consumers becoming more health-conscious, this could be the best time in a decade to start a position of dollar cost average into Altria. For me, the positives outweigh the risks, and I have been adding to my position in Altria as I am excited to grab more shares as they fall closer to $40.

Seeking Alpha

Following up on my expanding thesis for Altria Group

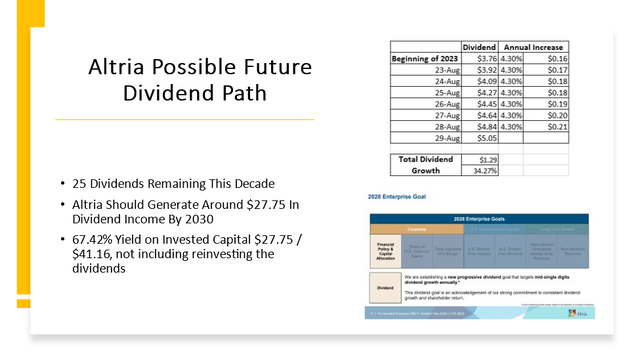

At the end of August, I wrote an article on Altria Group (which can be read here). In that article, I discussed Altria’s recent dividend increase and how their methodology on dividend increases would change into the future. Altria had introduced a new methodology that would move away from a percentage of EPS being paid toward the dividend and will now look to raise the dividend annually by a mid-single-digit percentage boost. I had concluded that my outlook was still bullish as investors were getting paid to wait with a growing dividend from a company that was a cash cow.

As shares of Altria continued to retrace they have come extremely close to a large level of resistance. In this article, I am updating my thesis to include how Altria has traded over the past decade when it approaches the $40 level. I also wanted to explore how Altria is valued compared to the next 9 largest Dividend Kings to see if there was a value proposition at its current share price in addition to looking at several potential catalysts. The Senate has been working toward cannabis legislation and there could be some investors who are overlooking that Altria has a large investment in the space. I also looked at how the rate environment looks to be in a higher for longer camp and what the impacts could be for dividend stocks. Ultimately I am more bullish than before despite the external risks that Altria could face.

Altria Group is the King of the Dividend Kings not just in yield but also in being undervalued

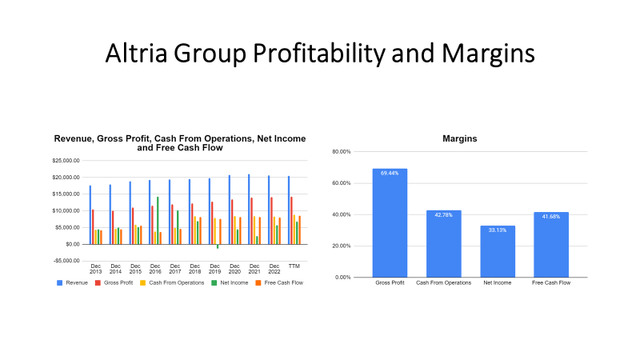

Numbers don’t lie, and the financial statements for Altria are impressive. In the trailing twelve months [TTM] Altria has generated $20.58 billion in revenue. They have produced $14.29 billion in gross profit, placing them at a 69.44% margin. On an actual profitability level, Altria has generated $6.82 billion in net income, a 33.13% margin, and $8.58 billion in free cash flow [FCF], an FCF yield of 41.68%. While Altria hasn’t grown its topline revenue since 2021, it’s a cash cow with limited debt. Altria has $26.32 billion in net debt on its balance sheet, of which $24.07 billion is long-term debt. Their current net debt to EBITDA ratio is 2.15x, as Altria generates roughly $12.24 billion in EBITDA.

Steven Fiorillo, Seeking Alpha

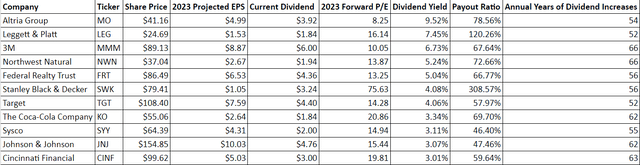

Altria Group has provided investors with 58 dividend increases over the past 54 years. They are currently the highest-yielding Dividend King with a 9.52% yield. Altria has a 5.85% CAGR over the past 5 years, and its dividend has a 78.56% payout ratio based on 2023 forward EPS. Altria is interesting because they have increased the dividend annually for over 5 decades and have done an incredible job at forecasting and predicting its business trends. Altria recently increased its quarterly dividend by 4.3% to mark its 54th annual dividend increase. At the investor day conference, Altria announced that they were moving away from a specific payout ratio and would increase their dividend at a mid-single-digit annual dividend growth as part of their 2028 Enterprise Plan.

Steven Fiorillo, Seeking Alpha

Based on a 4.3% annual dividend growth rate to replicate what Altria just delivered, they are on track to increase their annualized dividend by 34.27% through the rest of the decade. The dividend could grow to $5.05 by the end of 2029 from $3.76 at the beginning of 2023. With 25 remaining dividends this decade, shares of Altria could generate $27.75 in dividend income based on these projections, which is a 67.42% yield on capital at the current share price. Altria isn’t just the King of Dividend Kings in yield, but it also has a large runway of growth ahead of it.

Steven Fiorillo, Altria Group

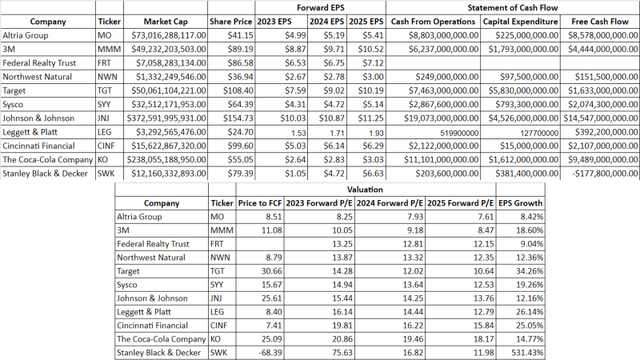

I looked at the top-10 yielding Dividend Kings forward EPS estimates and current FCF metrics. Altria Group is trading at the lowest forward EPS levels in 2023 through 2025. Based on the forward estimates, Altria trades at 8.25x 2023 earnings, 7.93x 2024 earnings, and 7.61x 2025 earnings. Altria is also trading at 8.51x their FCF, the 3rd lowest in the group. From a valuation standpoint, Altria Group is trading at an attractive valuation considering the amount of earnings and FCF they generate. They are also expected to grow their EPS by 8.42% through 20205. While the high-single-digit growth may not be exciting to some, Altria is still able to grow its EPS, which will support the growing dividend.

Steven Fiorillo, Seeking Alpha

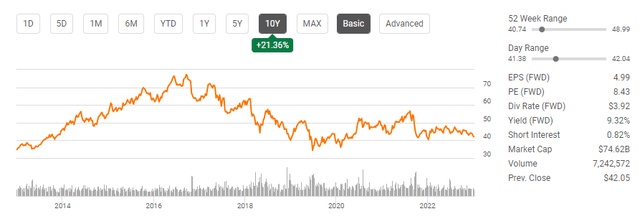

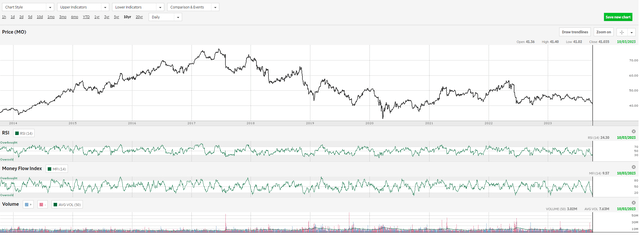

Altria Group is facing a long-term level of resistance

Altria Group is facing a long-term level of resistance since crossing over the $40 level back in 2014. In 2019, shares of Altria touched the $40 level and rebounded; excluding the pandemic crash, shares have not breached the $40 level. In 2022, shares of Altria flirted with the $40 level but trended higher. Recently, shares of Altria have consolidated to the downside as the $50 level has not been retested. Based on the RSI and Money Flow Index measures, Altria is oversold, and we are once again testing the $40 long-term resistance level.

The rising rate environment has put tremendous pressure on the markets, and the $40 resistance level is critical. If Altria holds the line, then I could see shares rebounding to the mid $40s once again. If the $40 level is broken and shares don’t imminently revert, then this level of resistance will be shattered, and Altria could end up forming a new level somewhere in the $30s. If this occurs, it will not be bullish for Altria and put additional pressure on its shares. I am eagerly waiting to see what occurs as shares are getting closer and closer to $40.

Steven Fiorillo, Ameritrade

3 external catalysts could help Altria in 2024 and 2025

Outside of Altria Group’s profitability, achievable enterprise goals, low valuation, and remarkable yield, I see 3 external catalysts that could help shares move higher in the future. In recent years, environmental, social, and governance (ESG) investing has become popular. ESG investors would allocate capital toward companies that strived to improve their performance in these areas. While profits were still important, ESG scores became a significant factor in the investment process. For many, ESG investing transcended the acronym, and investors looked at how companies served their stakeholders, workers, communities, customers, shareholders, and the environment. Recently Silla Brush from Bloomberg reported that BlackRock (BLK), State Street (STT), and other money managers are closing ESG funds. As ESG investment products disappear, it could be positive for Altria Group, as being in the tobacco industry doesn’t necessarily align with an ESG narrative. This could also cause some funds that had a loose guideline for ESG to add Altria Group to its holdings and cause larger institutional ownership in the company.

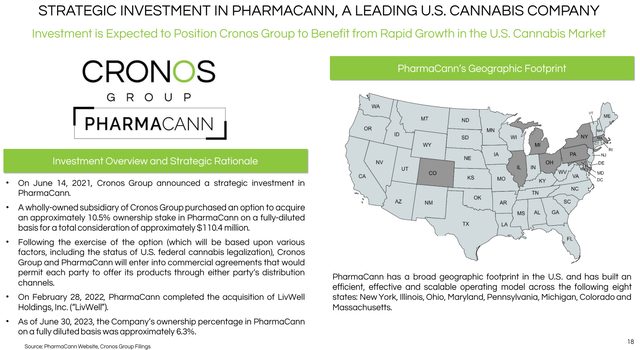

Altria still owns 43.5% of Cronos Group (CRON), which has a 10.5% ownership stake in PharmaCann, which has a geographic footprint and operating model in New York, Illinois, Ohio, Maryland, Pennsylvania, Michigan, Colorado, and Massachusetts. The Senate Banking Committee recently approved The Secure and Fair Enforcement Regulation (SAFER) Banking Act. This looks to resolve a financial debacle that forced cannabis-related companies to operate using only cash. The bill will make its way toward the Senate floor. If the bill passes, the cannabis industry will take a giant step forward toward legitimizing the industry and creating a framework for a regulated operating environment. There is no way to know what will come of this, but if several things fall into place, including obtaining banking regulation and federal legalization, it could be a huge catalyst. Altria has the manufacturing and distribution network to help scale its investments into the U.S. market, which could provide a windfall of revenue and earnings in the future. Much is uncertain, and this could go nowhere, but there is substantial potential for Altria to benefit from cannabis in the future.

Cronos Group

The current economic environment has worked against dividend stocks as the Fed continues to push rates higher. We have lived through a period where the Fed raised rates at a pace not seen since the early 1980s. The rapid rise in rates has caused the 2-year treasury to yield 5.13%, and the 10-year treasury reached a yield of 4.75%. This has impacted the attractiveness of dividend stocks as investors are less willing to take on single-stock equity risk to generate income when they can get a risk-free rate of return that exceeds 5% on a 2-year note and 4.5% on a 10-year note.

Trading Economics

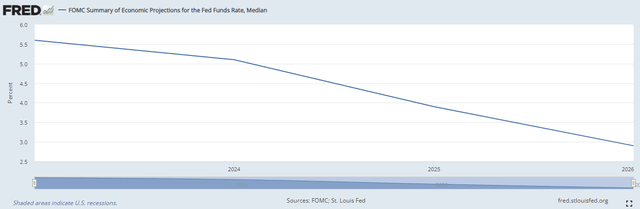

The CME group has projected that there is an 18.3% chance that the Fed will raise rates to 550-575 in November, and a 31.4% chance that rates will go to 550-575 in December. The St. Louis Fed has adjusted its economic projections on interest rates to reflect the latest sentiment coming from the Fed. The updated outlook consists of higher rates for longer but declining in 2024. The St. Louis Fed is pricing in one more rate hike, then declining from 5.6% to 5.1% in 2024, with rates falling to 3.9% in 2025 and 2.9% in 2026. I feel that this is positive news for dividend stocks. As the risk-free rate of return declines, investors will once again look for proxies to generate yield. Depending on when existing investments mature, these investors may be less inclined to lock up capital in risk-free assets in a falling-rate environment as a more attractive yield can be found in the equity markets.

St. Louis Fed

Investing in Altria doesn’t come without risks, and they should be considered

Unlike other companies, Altria Group’s largest risks fall outside of their control. The threat of competition is minimal as new companies are unlikely to emerge in the tobacco industry. The true threats to their business lay in the hands of regulators and the general public. While it may be unlikely, tobacco could be outlawed, or regulators could pass new legislation that increases taxes on tobacco or imposes stricter regulations. Tobacco products could also face further scrutiny as to where they can be sold. Today’s general public is much more health conscious than in the 80s and 90s. More people are concerned with wellness and implementing a clean lifestyle. This is a problem for Altria even as they shift to a smokeless product because a growing segment of the population is turning away from tobacco and alcohol products. This should be considered before investing in Altria because external threats can seriously impact their revenue streams. I can’t predict the future, but it’s entirely possible that the operating environment will get tighter for Altria.

Conclusion

I don’t invest on a short-term basis and feel that Altria, yielding over 9.5% presents a strong opportunity to dollar cost average into an existing position or start a long-term position in the company. Investing in Altria comes with unknown risks as nobody can predict human nature regarding healthy lifestyles or what new regulations will get passed on a state or federal level. For me, the business prospects outweigh the risks as Altria is extremely profitable, has a low net debt to EBITDA level, is buying back shares, continues to grow its large dividend, and has several catalysts on the horizon. I do believe the Fed will be forced to pivot in 2024, and an easing rate environment should make taking equity risk to generate yield more acceptable as the yields found in risk-free assets decline. Shares of Atria could be under pressure for longer than I like, but I am getting paid a large yield to wait and dollar cost average into my position. I think that, ultimately, capital will flow back into dividend stocks, and Altria will become very attractive for income investors again as this Dividend King continues to grow the dividend when yields are falling in risk-free assets.

Read the full article here

Leave a Reply