“If all Altria shareholders quit smoking, the company cuts its dividend and we are right back to square one on our finances.”

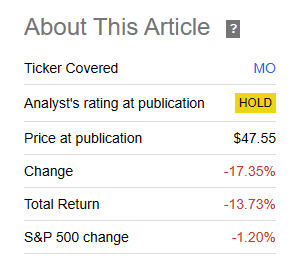

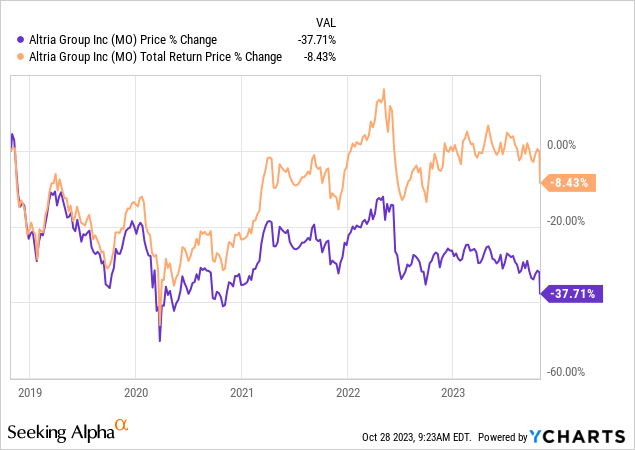

A little while back, we suggested that Altria Group Inc. (NYSE:MO) investors were in for a declining royalty type of investors and that total returns would be rather poor. Our conclusion also included a price target,

You have a range of outcomes here with a higher probability of significant downside. If the Marlboro category joins the discount category in having a 25% year over year decline, you can bet your bottom dollar that Altria won’t be able to hike prices enough to offset. If they did, then that would only further accelerate the vortex. We rate the stock a hold and see it as an oil royalty kind of play with terminal value of zero. As such, we need to assess whether the expected value of the dividends we would get over time would exceed the current price. That leads to our “buy under” of about $35 and that is the most we would pay for this.

Source: NJOY The Dividends As You Won’t Get Price Appreciation

That is playing out as expected.

Seeking Alpha

We look at the Q3-2023 results and tell you why the selloff was completely justified.

Q3-2023

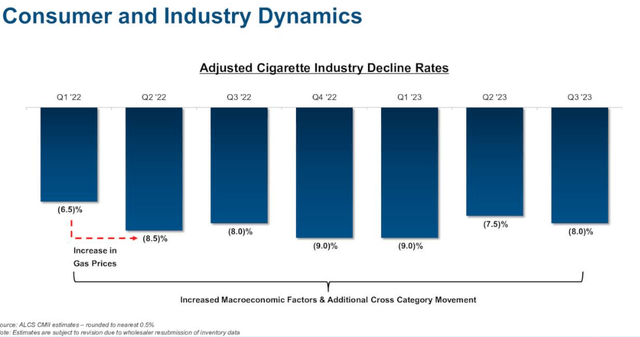

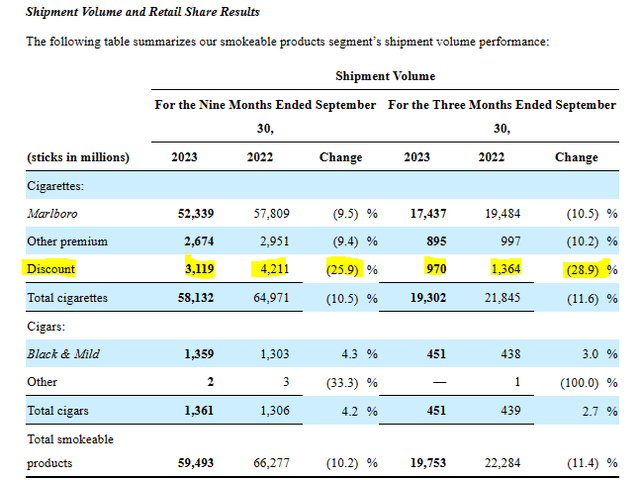

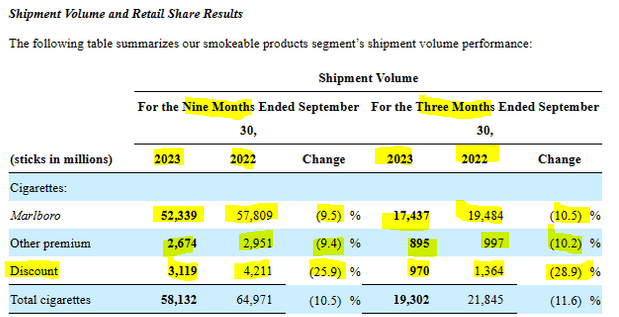

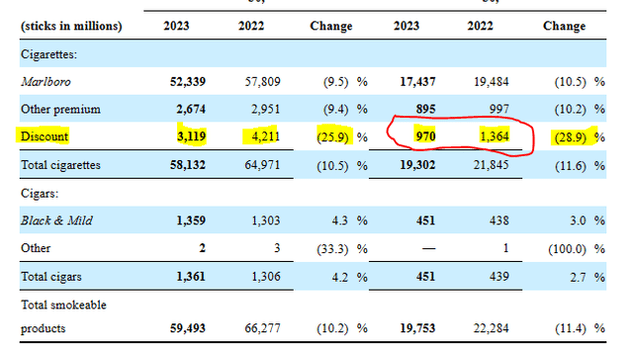

Altria had a rare double miss with both revenues and earnings per share falling short of expectations. The misses were not large but come on the back of modest expectations from the sell side community. The problem? The industry decline rates show zero signs of abating. In fact, from Q2-2023 to Q3-2023, the decline rates accelerated once again.

Altria Q3-2023 Presentation

Altria tries and breaks down the causes of the decline and this is always a very interesting exercise to watch. According to the company, there is a secular decline rate of just 2.5%.

Altria Q3-2023 Presentation

Cigarette price elasticity, which refers to the revulsion smokers have to price hikes. So quitting becomes an economic reason rather than one to preserve one’s health. That here is tabled at near 2%. Altria deliciously lumps a whole host of other factors which are currently leading to a 4% annual decline rate.

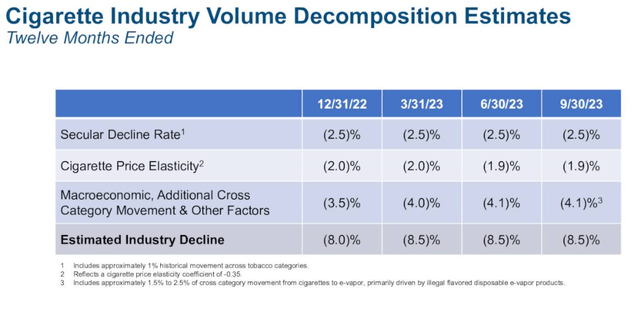

Here is where it gets more interesting. Altria continues to underperform these industry decline rates quarter after quarter.

Altria Q3-2023 Presentation

In the discount segment, Altria is getting annihilated. The declines were a shocking 28.9%.

Altria Q3-2023 Presentation

The other categories were not much to write about but the discount side is the one that might become a footnote first. Seeing these results, we were not at all surprised at the magnitude of the decline. In fact, we think the market has underreacted to the news. We need to go to $35 and fast to make this back to fair value.

Outlook

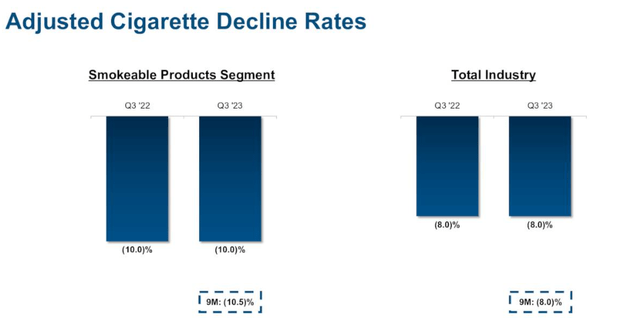

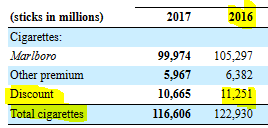

Denial is not a river in Egypt. But here on the Altria bull board, everyone seems to avoid the basic math that the company presents quarter after quarter after quarter. Here is the reminder from our side though. In 2015, discount segment shipped 11.251 billion sticks.

Altria 10-K

In Q3-2023, the company shipped 0.97 billion sticks for an annualized run-rate of 3.88 billion. In other words, stick volume has dropped over 65% in less than 7 years. One thing to note here is that volume drop off the that original 2016 base appears to be going at a steady rate. We are losing about 1 billion sticks a year. But because the base is getting lower and lower, the percentages drops are increasing. This is a very different dynamic than one where percentage drops remain constant so numerical drops reduce over time. The latter is what we see in declining oil and gas wells. Here we are making a beeline to zero.

Of course discount segment is small and the other two make up a ton more money. They don’t look any prettier though. Marlboro segment shipped 105.297 billion sticks in 2016. The Q3-2023 annualized rate was 69.748 million. A 34% total drop. This drop is accelerating if we examine the 2020-2023 timeframe, versus the 4 year prior to that. In fact, even when you look at the third quarter, every category is worse when you look at nine month run-rates.

Altria Q3-2023 10-Q

So come January 1, 2024 we will be resetting this clock and Altria will have to decide whether it wants to hike prices by a large amount to offset these declines. It likely will go ahead with the decision. It has no other playbook. Those prices hikes will again take a further toll. There is only so much of chronic price hikes one can tolerate to get chronic emphysema. Exactly how much remains a mystery but we think numerical declines will average at least as much as we saw in 2023. So percentage declines (as these are off a smaller base) will be higher. We are not giving much weightage to Ozempic use and abuse adding more heft to the decline rates, but it remains a distinct possibility that Altria will pull guidance at some point in 2024.

Verdict

The stock always looks cheap and the dividend yield has gotten more people hooked than the actual product. The stock returns also look fantastic from the rear-view mirror, though one has had to go back further and further in recent years to justify that claim. For example, over the last 5 years, investors have not even broken even after those big dividends.

The numbers are right in front of you and by that we mean for the decline rates. We always saw the smoking as a social activity. The smoke breaks were a way to get away from work and chat with fellow smokers. As people quit, the remaining become increasingly viewed as pariahs. The asymmetric downside risk is still that we go to a virtual zero cigarette volume in less than 10 years. This is hardly a fantastical thought as the discount segment appears to be aiming for it in less than 4 at current decline rates.

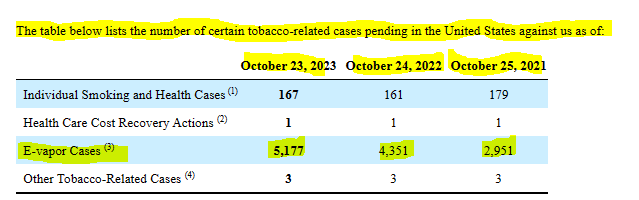

Altria Q3-2023 10-Q

From the longer term bull perspective, the lower price is good as it improves effectiveness of buybacks. If all those adjunct IQOS and NJOY growth stories are to work out, then at least the buybacks in this timeframe can be done when the stock price is low. But those growth stories remain a poor reason to invest as IQOS timeline is really far off and NJOY margins are a laughable comparative to the main cigarette segment. The only real growth that Altria will get in the e-vapor category is how much it pays its lawyers.

Altria Q3-2023 10-Q

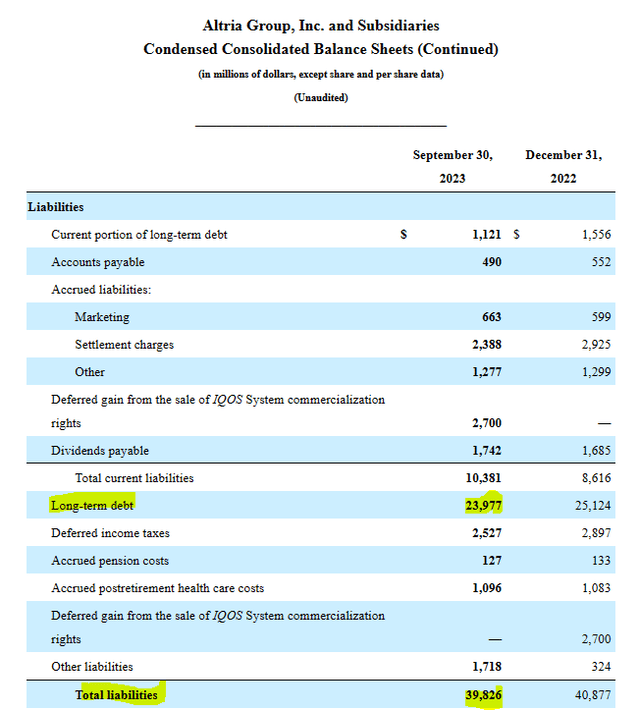

Investors also seem to be perpetually attached to Altria’s equity investments as a reason to buy the stock. Those equity investments are worth about $10 billion and the company has total liabilities near $40 billion.

Altria Q3-2023 10-Q

We generally don’t address that it is obvious knowledge to anyone doing a cursory glance through the balance sheet but we are making an exception here as this keeps coming up in the comments section.

Last time our “fair value” for Altria was $35 and we are now lowering it to $32.50. That represents the maximum price we would pay for Altria stock as it stands today. It also represents a price where discounted cash flow analysis gives it a positive value. Since we use “Sell” ratings only for a short selling opportunity, we continue to rate this as a “hold/neutral.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here

Leave a Reply