On May 2nd, I published “Alto Ingredients Growth Story Temporarily Lost In A ‘Maize'” when Alto (NASDAQ:ALTO) was priced at $1.27. In the article, I highlighted how everything that could have possibly went wrong in 2022… did go wrong. Furthermore, I highlighted how it was extremely unlikely that these events would repeat and that the market’s concern over ALTO’s liquidity was wildly misplaced.

As of market close on October 6th, ALTO has risen over 200% to $3.98, but still remains significantly undervalued, trading roughly equal to tangible book value, with multiple short-term as well as long-term catalysts.

Q3 Earnings Will At Least Double Analyst Estimates

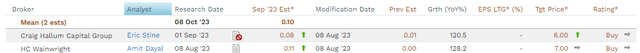

There are currently two analysts that cover ALTO and the mean estimate has ALTO reporting Q3 EPS of $0.10 at the beginning of November.

ALTO EPS Estimates (FactSet)

These analyst estimates almost certainly significantly underestimate ALTO’s likely earnings in the third quarter.

As I explained in my last article, anyone can track ALTO’s daily Pekin corn bids (including basis) on their website and compare it to the price of Chicago ethanol to estimate ALTO’s daily crush margin where the majority of their ethanol production exists. ALTO management does not believe in hedging the price of corn, and it’s very difficult to lock-in both corn as well as renewable fuel ethanol much past a few days; therefore, tracking the daily crush margin is an incredibly accurate method to measure profitability on a daily basis.

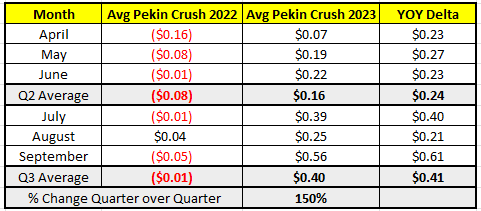

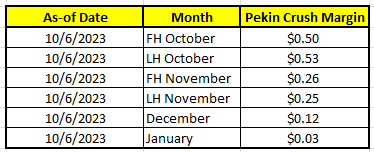

ALTO Crush Margins (DOMO Capital Management, LLC)

As one can see from the above table, the operating environment has completely changed year over year. Furthermore, the average daily crush margin for ALTO has risen 150% in Q3 versus Q2! However, the current analyst mean estimate for $0.10 per share is exactly equal to what ALTO reported in Q2 of 2023.

If we want to be super conservative we can reasonably assume that at the very least ALTO will report $0.20 per share of earnings; however, I think it’s much more likely that ALTO puts up a figure close to $0.30 per share for a variety of reasons that extend well beyond just the crush margin at Pekin. In fact, earnings of $0.30 or more, a 200% beat compared to FactSet’s mean estimate, is probable.

Not only has the average crush margin rose 150% quarter over quarter, but corn oil prices in Illinois have risen from an average of $0.56 in Q2 to $0.68 in Q3 (an increase of >20%) based on data from Iowa State. This increase in corn oil prices (which occurred nationally, not just in IL) combined with ALTO’s Magic Valley facility fully ramped-up with the CoPromax technology will result in a material increase to essential ingredient revenues. The Magic Valley facility is also likely to have benefited from protein sales from the technology as well even though we shouldn’t expect that part of the system to be fully ramped until Q4.

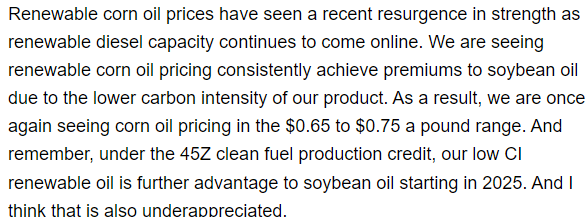

Need another source? On Green Plains’ (GPRE) earnings call on August 4th they stated:

GPRE Corn Oil Commentary (Seeking Alpha GPRE Earnings Transcript)

Based off of the crush margin as well as the corn oil pricing, it is easy to see why ALTO will easily earn much more than the $0.10 per share that they earned in the second quarter; however, it gets even better.

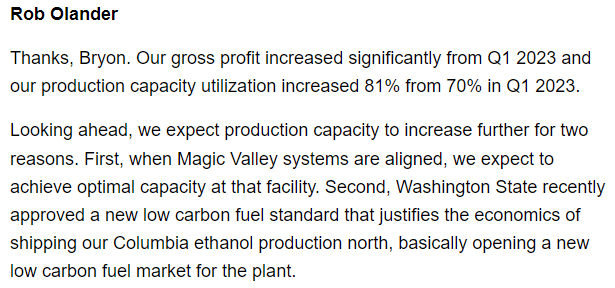

While perhaps not clearly communicated, the Columbia facility still had curtailed production in Q2 and was not running at full capacity due to demand constraints. From the Q2 financials, we can see that ALTO only produced 70.5M gallons of ethanol in Q2 vs 77.0M gallons in Q2 of 2022 (a 7% decline in capacity utilization). We should expect a huge increase in capacity utilization in Q3, because not only should all of the facilities have been fully operating for the entire quarter, but the Columbia facility also had a new market as Rob, the CFO, indicated on the last earnings call:

CFO Comments on Columbia plant (Seeking Alpha ALTO Q2 Earnings Transcript)

In short – not only will ALTO benefit from having the Western plants fully ramped, high crush margins, and high corn oil prices – ALTO will also benefit from being able to sell ethanol into the Washington State market at even higher ethanol prices due to the newly passed state legislation!

Forward Guidance

What about forward looking guidance though? What if the market looks beyond Q3 and instead focuses on Q4? Fear not:

Current ALTO Crush Margins (DOMO Capital Management, LLC)

The table above shows that as of the close of market on October 6th, ALTO’s current crush margin is still over $0.50! Remember, we shouldn’t expect ALTO to lock in future months; therefore, there is still uncertainty about what actual crush margins will be for the rest of October as well as November and December. However, as this forward-looking curve is the only tool available to management to provide any sort of opinion about the fourth quarter, it would be impossible to come to any other conclusion than an extremely enthusiastic and optimistic forward guidance.

It should also be noted that specialty alcohol sales tend to pick up in the last half of the year and also tend to be higher-margin sales into the pharmaceutical market.

Why is the renewable fuel crush margin so good? Is it sustainable?

In essence, the demand for renewable fuel in the US has stabilized year over year, supporting the price of ethanol, while the price of corn (as well as corn basis) has materially fallen. The price of corn has fallen for a variety of reasons.

First, Ukraine has found multiple workarounds (via both train as well as different water routes such as the Danube river) to get their corn harvest into international markets as the Russian/Ukraine war has dragged on an additional year.

Secondly, Brazil had a record harvest and is exporting a record amount of corn internationally. This has both increased world stocks of corn while also making it more difficult for US farmers to find buyers in the international markets for their corn.

Thirdly, despite drought risk at some points during the year, the US corn crop was able to get timely rains when they were most needed. The timely rains combined with a huge increase in the number of planted acres of corn has resulted in a fantastic domestic corn harvest. However, since cheaper Brazilian corn is flooding the international markets, there has been a massive decrease (a decline of over 30%) in exports of US corn year over year.

Summarizing, ALTO is benefiting from both a decline in the price of corn due to a huge increase in world corn stocks as well as benefiting by the inability for local farmers to export corn internationally which is decreasing the basis (cash cost) that ALTO has to pay to have the corn delivered.

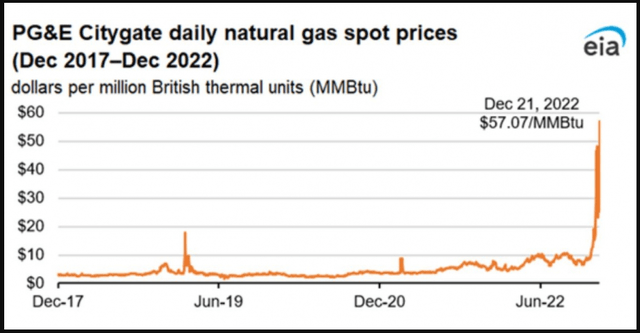

The largest cost for ALTO outside of corn is natural gas. In the second quarter, natural gas prices were down about 54% YOY at Pekin, and in the third quarter, natural gas prices were down over 60% YOY! The trend has continued into the fourth quarter with October down 60% YOY as well.

ALTO management recently indicated at the LD Micro Main Event that they were locking-up a winter strip for natural gas pricing. Therefore, we shouldn’t expect a repeat of the 4th quarter last year where ALTO was unhedged and hit by natural gas prices in the Western United States spiking from under $10/MMBtus to around $60/MMBtus!

December 2022 Natural Gas Spike (EIA)

Sustainable Aviation Fuel

Clearly, Q3 earnings is a very near short-term catalyst for ALTO. However, there is the potential for additional short-term (as well as long-term) catalysts for ALTO in regards to Sustainable Aviation Fuel. The market clearly has not yet caught onto this segment of the market, but when they do, ethanol companies may begin to be materially re-rated as full-comprehension begins to take hold.

The “Inflation Reduction Act” not only created huge benefits for ethanol companies to sequester carbon dioxide, but it also created huge benefits for the production of Sustainable Aviation Fuel for both producers as well as consumers (the airlines).

Sustainable Aviation Fuel (SAF) is simply aviation fuel that is made from non-petroleum feedstocks such as used cooking oil or ethanol. The feedstocks are required to have extremely low carbon intensity scores; therefore, there is currently some uncertainty on the subject as it relates to ethanol. There is currently no definitive ruling from the Treasury / IRS on what calculation will be used to determine the carbon intensity scores for SAF feedstock. Per this Reuters article:

CORSIA is more likely than GREET to exclude ethanol-based SAF from the subsidy program because of the way it evaluates the emissions of so-called indirect land-use change, the displacement of existing farmland or natural vegetation to grow crops.

I do not share the concerns or fears of the market that ethanol will be excluded. First of all, SAF demand is expected to reach 7 billion gallons by 2030 (5% of global jet fuel demand) and then grow over 26% annually through 2050. There is simply no way to meet this demand without ethanol as the supply capacity of verifiable used cooking oil as well as other potential feedstocks is extremely low. It would, quite frankly, be impossible to meet any SAF goals without ethanol as a feedstock. Last week, on October 3rd, a DOE official confirmed that ethanol would be part of SAF:

The biofuel and airline industries continue to wait on the Treasury Department to issue some critical guidance that will determine which feedstocks can qualify for a new tax credit for sustainable aviation fuel. But an Energy Department official confirmed that the GREET model favored by the biofuel industry will be one of the options.

Speaking at an SAF conference Houston on Monday, DOE’s Jim Spaeth said the industry will have an option of the GREET model and a model developed by the International Civil Aviation Organization that is considered less favorable to agriculture.

“Both models will be options to use, whichever works best for your particular pathway,” said Spaeth, manager of the System Development and Integration Program in DOE’s Bioenergy Technologies Office.

This should have been huge news for the ethanol industry, but simply finding those comments from the DOE official was a difficult process. Therefore, the market is unlikely to begin taking this into consideration until it officially comes from the Treasury in an official statement. Therefore, a statement from the Treasury is an important short-term catalyst, and it is likely that the final ruling from the Treasury will be officially released by the end of October (perhaps mid-October).

Why would the market begin to re-rate the entire ethanol industry based on this news?

It takes about 1.9 gallons of ethanol to make a single gallon of SAF!

Think about that… if SAF demand reaches 7 billion gallons by 2030 (just 5% of global jet fuel demand), it would take over 13 billion gallons of ethanol to meet that demand. According to the EIA, the total ethanol plant capacity in the United States was about 17.6 billion gallons, in theory, (as plants would never run at full capacity on an annual basis). In actuality, the annual US capacity is likely closer to 16 billion gallons. The EPA currently requires ethanol blending levels of 15 billion gallons for 2023, 2024, and 2025.

Do you see where this is going? How can 15 billion gallons of ethanol out of 16 to 18 billion gallons of ethanol capacity go into renewable fuel if meeting just 5% of global jet fuel demand with SAF would take an additional 13 billion gallons of ethanol? Global ethanol capacity is only 28 billion and the international plants will not have the benefits of being a low carbon intensity product as they do not have the same geological abilities to sequester carbon underground.

Ethanol producers will instantly go from a commodity price-taker position into a price-maker position as demand for ethanol will skyrocket with zero possibility of possibly meeting the demand requirements for both SAF and renewable fuel.

Therefore, not only will the ruling immediately benefit those ethanol producers that are instantly ready to provide low carbon intensity ethanol as feedstock into the SAF market due to having carbon sequestration, natural gas bypass, and co-generation already in place – It will benefit the entire industry as gallons are moved out of supplying renewable fuel.

In fact, at the Wainwright conference in mid-September, Bryon McGregor (around the 14 or 15 minute mark), talked about how Archer-Daniels-Midland (ADM) has already announced that they are converting two ethanol plants into SAF facilities over the next couple of years which will represent a 700M gallon decline of ethanol supply available for renewable fuel.

The rising tide will lift all boats. The price for renewable fuel ethanol will likely experience an exponential increase by the end of the decade as there will simply not be enough ethanol to meet the demands of both renewable fuel as well as SAF and the market just simply has not fully comprehended this yet.

If you listen to the comments at the Wainwright conference (again around the 14-minute mark), you’ll also hear management comments about how not only will the government provide $85 per metric ton of sequestered carbon (via the 45Q), but that product can currently be sold into California and Oregon at $85 to $135 per metric ton on top of that subsidy!

Risks

The biggest risk facing ALTO would be another period of sustained negative crush margins. This could potentially be brought about by some sort of black swan event like COVID where everyone essentially stopped driving for months.

The market may still have some lingering concerns over ALTO’s ability to fund all of their growth initiatives, but two consecutive quarters (Q3 and Q4) of strong net income will go a long way towards dispelling these concerns. Additionally, ALTO management has consistently hinted towards some sort of funding mechanism for carbon sequestration that includes potential final customers of the low carbon intensity product. This could, for example, be some sort of partnership with an airline with a future need for SAF.

Furthermore, something that many may have overlooked, is the ability to obtain grants for several of the projects. While management has not yet commented on this, there are plenty of sources that show that funding for things such as co-generation could partly be paid-for through Federal or State grants. If ALTO were to win one of these grants it would further reduce their cash needs to fund their growth initiatives.

Finally, there is also a risk that something could happen at one of ALTO’s facilities that results in the facility being unable to produce ethanol for a sustained period of time.

Conclusion

In conclusion, ALTO has several near-term catalysts coming up that make it a strong buy for both the short-term as well as the long-term. ALTO may beat the FactSet mean consensus earnings estimate by over 200%! Any concerns over the ability of the company to fund their upcoming growth projects should be completely non-existent after what is likely to be two consecutive quarters of strong, positive earnings.

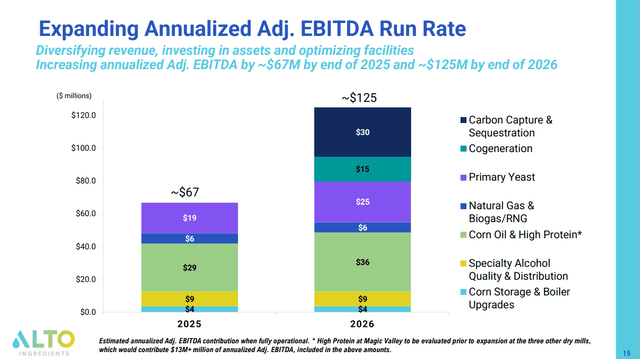

ALTO Future EBIDA Run Rate Expansions (Alto Ingredients)

ALTO still trades right around tangible book value while GPRE trades at well over double their tangible book value. I expect that ALTO will narrow this valuation GAP with GPRE soon.

An official ruling from the Treasury and IRS on the ability to use the GREET methodology to calculate SAF subsidies should begin to open the market’s eyes to this incredible opportunity that will change the ethanol industry for decades and decades to come.

It is clear that it will take an incredible expansion of ethanol capacity to meet the future demands for renewable fuel and SAF. Therefore, it is almost certain that the ethanol producers will become price-makers for decades upon decades until the market can find a balance. While not previously mentioned (perhaps anywhere), through my discussions with management I’ve been told that the Pekin facility could be expanded by hundreds of millions of gallons from the current 250M annual production capacity. Therefore, the future earnings potential of ALTO is materially higher than the $40M average EBITDA over the last several years, and my projections that the shares should be valued at $10+ to $20+ by 2026/2027 in a worse-case/base-case scenario with a 10x EBITDA multiple may now be too conservative.

Read the full article here

Leave a Reply