Alibaba (NYSE:BABA) reported good revenue growth numbers in the recent quarter as the company announced 14% YoY growth. However, the real story in the recent quarter was the ability of the management to deliver rapid improvement in EBITA for every single segment. This will make the spinoff process a lot easier for the management. Alibaba is starting the spinoff process by listing logistics unit Cainiao Network in Hong Kong with a stock sale of $1 billion.

Traditionally, the Taobao and Tmall Group segment has contributed most of EBITA for the company. In the recent quarter, the YoY EBITA for this segment increased by 9%. However, the overall YoY EBITA increased by a staggering 24%. This shows that other segments are reporting a better margin expansion compared to Taobao and Tmall Group segment. Rapid growth in international business is also reducing the geographic risk for the company which should improve the bullish sentiment. Recently, Alibaba announced an investment of another $2 billion in its Turkish unit called Trendyol. Strong growth in international commerce is improving the growth runway for the company.

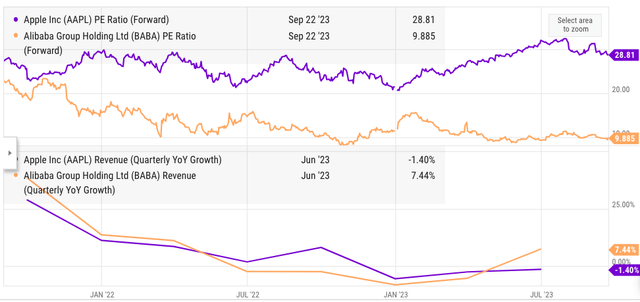

Alibaba is still producing massive cash from operations. In the recent quarter, it reported EBITA of $6.5 billion or close to $25 billion on an annualized basis. The improvement in margin has also reduced the forward PE multiple of the company to less than 10 which is very low for a company showing double-digit growth. It should be noted that some Big Tech companies like Apple (AAPL) have reported a decline in revenue in recent earnings while they are trading at close to 30 times the forward PE. The headwinds due to geopolitical tensions will likely be a challenge for Alibaba stock but the company is in a good financial position to weather the storm and deliver strong fundamental growth.

Smoother spinoff process

One of the key challenges for the management after it announced the spinning off process of the company into six segments was the negative margins in many segments. A negative margin for a new company would make it difficult for it to be self-sufficient. Usually, Alibaba’s Tmall and Taobao Group delivered the bulk of EBITA and this was used to fund new businesses like cloud computing, delivery, Cainiao, international commerce, and others.

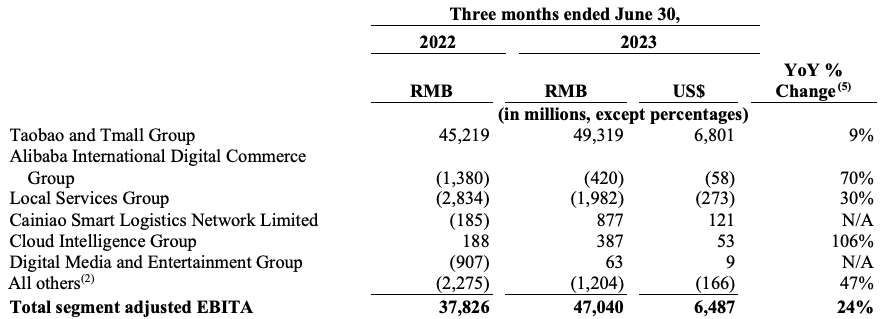

However, if the company is spinning off, the loss-making segments would not be able to rely on Alibaba to fund their growth. This issue has been resolved in the recent quarter. We can see that every single segment has delivered good progress in improving the margins. Segments like Digital Media and Cainiao have moved from negative margins in the year-ago quarter to positive margins.

Alibaba Filings

Figure 1: Improvement in margins for every single segment. Source: Alibaba Filings

In the year-ago quarter, Digital Media reported a loss of RMB 907 million. This has improved to a positive EBITA of RMB 63 million. Similarly, the Cainiao segment went from negative EBITA of RMB 185 million to positive EBITA of RMB 877 million.

The International commerce and Local Services Group which includes food delivery are still in the red. However, their margins have also improved significantly. The International commerce segment has seen its EBITA loss decline by 70% on a YoY basis.

Strong revenue growth

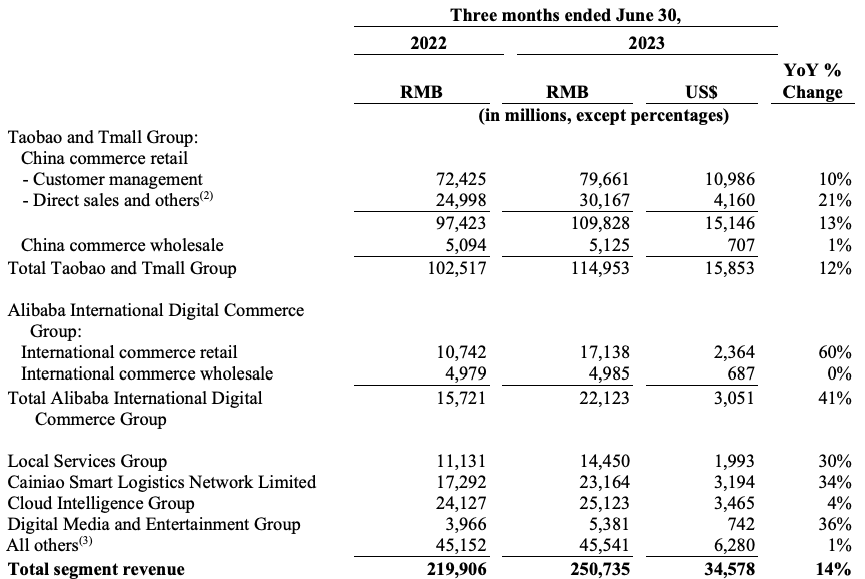

It should be noted that this improvement in margins was delivered while the company showed good revenue growth in all the key segments. The food delivery, Cainiao, Digital Media, and International commerce segments reported YoY revenue growth of over 30%.

Alibaba Filings

Figure 2: Revenue growth in different segments. Source: Alibaba Filings

The improvement in margins and higher revenue growth shows that the company does not need to burn cash in order to deliver growth in key segments. Most of these segments should be able to sustain themselves in an independent fashion which will give them greater freedom to be nimble.

The YoY revenue growth of Alibaba has been higher than almost all other big tech companies like Apple, Microsoft (MSFT), Alphabet (GOOG), Meta (META), and others. This shows that the company has strong fundamentals and can deliver double-digit revenue growth over the long-term.

Headwinds from geopolitical tensions

Alibaba stock has been held back by geopolitical tensions between China and U.S. It is unlikely that Wall Street will become bullish toward the company unless these tensions are reduced. However, as we enter the presidential race, we should expect to see more trade restrictions. A big positive for Alibaba is that its International commerce segment is growing rapidly. This will provide the company with good geographic diversity.

In the recent quarter, International commerce segment reported 41% YoY revenue growth which is the highest for any segment. The revenue share of this segment is now close to 10%. If the current trend continues, the revenue share of International commerce could be more than 25% within the next five years. This would be a big positive for Alibaba and allow investors to hedge some of the geopolitical risks.

Progress within the spinning-off process is also a positive for the stock as it shows that the Chinese regulators are reducing the restrictions on bigger companies. We could see all the individual segments report positive margins by the end of this year which can help in increasing the pace of the spin-off process.

Impact on Alibaba stock

Alibaba stock is trading at less than 10 times the forward PE ratio. This is a massive discount to other stocks like Apple which are trading at close to 30 times their forward PE multiple. At the same time, Apple also receives 20% of its revenue from China which shows that the company is not completely sheltered from geopolitical tensions.

Alibaba’s management is reducing cash burn in many segments and is focusing on efficiency. If Alibaba is able to show further margin improvement, we could see a strong bullish momentum build for the stock.

Ycharts

Figure 3: Comparison between Alibaba and Apple in key metrics. Source: Ycharts

Alibaba’s forward revenue growth projection is higher than Apple. Alibaba will also likely improve its margins in the next few quarters as more focus is given to the profitability of every single segment. Alibaba stock is trading at 65% discount compared to Apple stock when we look at forward PE multiple metric. These factors should help Alibaba deliver better returns over the long term. The geopolitical tensions will continue to be a headwind for the stock but the spinoff process, growth in international commerce, and rock-bottom valuation multiple should help Alibaba stock deliver better returns than other big tech peers.

Investor Takeaway

Alibaba has reported improvement in margin for all the major segments in the recent quarter. Many of the segments have also reached break-even level. This is very important for the company as it tries to spin off the segments into independent companies. It is likely that the two segments with negative EBITA will also turn positive within the next few quarters.

At the same time, the acceleration in revenue growth has improved the forward revenue growth projections for the company. Alibaba stock is trading at a historically low valuation while the company has delivered good progress in key metrics. Longer-term investors who can wait out the current geopolitical tensions should be able to receive better returns from Alibaba stock.

Read the full article here

Leave a Reply