Basic Information

Alibaba is a company based in China that provides e-commerce and technology infrastructure services. It is in the technology sector and the retail industry and currently trades on two exchanges. In the United States, it trades under BABA, and in Hong Kong, it trades as 9988.

The company is a large cap with a market capitalization of $199 billion at $78 per share. The stock exhibits high liquidity, with an average daily trading volume of $12 million over the past month.

I highly recommend considering an investment in Alibaba shares at the current price of $78 per share, as the company appears to be undervalued in the market. My target price for Alibaba shares is set at $300, which represents more than a threefold increase from the current valuation.

I think that the company’s current valuation doesn’t fully reflect its potential due to several reasons: firstly, the promising future of e-commerce; secondly, its various business divisions beyond e-commerce are on the brink of turning profitable; thirdly, the company benefits from significant competitive advantages, such as network effects and economies of scale; fourthly, it holds a commanding and established market leadership position across multiple sectors; fifthly, China, where it operates, is expected to continue growing at rates surpassing those of other developed countries.

Why I’m Impressed with Alibaba’s E-Commerce Platforms

Alibaba has cemented its position as a market leader, achieving a remarkable milestone of over 1 billion transactions in 2022 on its platforms.

Taobao and Tmall boast massive network effects, with buyers and sellers gravitating toward these platforms in a symbiotic relationship. As the platforms grow larger, the barriers to entry become more formidable, reinforcing their dominance.

Moreover, both Tmall and Taobao operate as intermediaries, eliminating the need for inventory management. This capital-light model allows these platforms to scale efficiently without significant additional resources.

Finally, the fact that Taobao is free for users presents an insurmountable advantage. Competing with a free platform is virtually impossible. Sellers only incur fees for advertising their products prominently and appearing in keyword searches, akin to Google’s model.

How Alibaba Outshone eBay in the Chinese Market?

Having delved into Alibaba: The House That Jack Ma Built and Alibaba’s World: How One Remarkable Chinese Company is Revolutionizing Global Business “, I gained insights into Alibaba’s journey and its triumphant struggle against eBay.

The factors below contributed to Alibaba’s victory over eBay:

Cultural Understanding: eBay’s downfall in China can be attributed, in part, to its lack of understanding of Chinese culture and consumer behaviour. eBay’s strict policies, aimed at preventing buyers and sellers from directly interacting to avoid commission circumvention, stifled the personal relationships integral to Chinese commerce.

Encouraging Connections: In contrast, Alibaba actively promoted buyer-seller interaction, encouraging communication and fostering relationships. Alibaba had confidence that even without transaction fees, they would eventually profit from their user base.

User-Centric Approach: Alibaba tailored its platform to cater to Chinese consumers, drawing them in with Taobao’s appealing features. Users found eBay’s new cold, minimalist interface lacking the intangible human touch present in Taobao, which featured cute icons and engaging animations.

Accounting for Technical Challenges: eBay had not adequately accounted for the China firewall, which introduced significant delays in Internet speeds between the United States and China. While e-commerce itself was politically neutral and not subject to censorship, the firewall still hindered access to international websites, making China-based websites, like Alibaba’s, more appealing due to their faster loading times.

Management and Governance

I admire Alibaba’s corporate culture and principles for several compelling reasons:

Customer-Centric Approach: Alibaba places customers at the forefront of their priorities, followed by employees and then shareholders. This strategic focus acknowledges that by nurturing customer satisfaction and retaining talented employees, shareholders will ultimately reap the rewards. Alibaba has consistently emphasized customer satisfaction over concerns about competition.

Consistent Profitability and Robust Growth: Alibaba has consistently delivered profits every year, experiencing substantial growth. Over the past decade, the company has achieved an impressive annual revenue per share increase of 38% and annual profit growth of 24%. These metrics reflect its status as a high-growth company.

Management’s Aligned Interests: Management’s economic interests are closely aligned with those of shareholders, with a 2% ownership stake in the company. While this ownership percentage could be higher, Alibaba is a large company and it signifies some “skin in the game.”

Sensible Share Practices: The company has refrained from repurchasing shares at inflated prices, issuing shares at undervalued levels, or distributing excessive dividends. Alibaba’s decision not to pay a dividend in the past can be viewed as a prudent strategy given the company’s ability to generate high internal rates of return (IRR).

Since March 2021, Alibaba’s management has been proactive in repurchasing shares at prices seemingly well below intrinsic value. Over the past two years, they have bought back 5% of outstanding shares.

Change in Management: The change in management and reintroduction of Joe Tsai as chairman is good news. He speaks Wall Street and I think will be able to better market Alibaba to institutional shareholders than Daniel Zhang could.

In conclusion, Alibaba’s commitment to customer satisfaction, long-term vision, consistent profitability, shareholder alignment, and prudent capital allocation make it a well-run company, capable of delivering sustainable value to its investors.

Additional Favorable Aspects

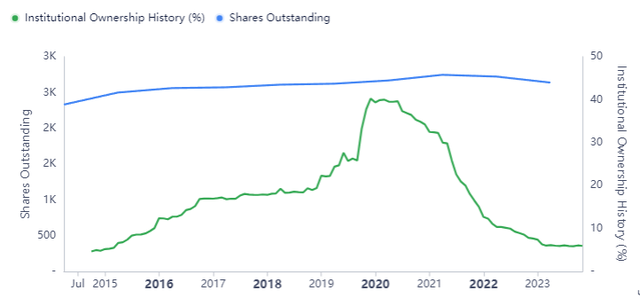

Institutional Ownership: Presently, Alibaba’s institutional ownership stands at just under 6%. This low level of institutional engagement is seen positively in the investment context. The sparse presence of institutional investors opens the door for future participation by these entities. An increase in institutional interest could lead to a surge in demand for shares, potentially catalysing a rise in the share price.

Institutional Ownership (GuruFocus)

Reluctance to Dimmish Technology Sector in China: China has a vested interest in not undermining its tech giants, like Alibaba, on the global stage. These companies are integral to the economy, providing substantial employment and fostering entrepreneurship and trade within China. Alibaba, seen as a contributor to wider societal good, should enjoy a degree of protection from the CCP.

Use of Cash Stockpile: Regarding the strategic use of financial resources, Alibaba has the potential to utilize its substantial cash reserves ($79 billion) to maintain a competitive edge. These strategies could include engaging in predatory pricing to outlast competitors, acquiring emerging competitors (subject to regulatory constraints and approvals), and influencing policy through lobbying efforts. Such lobbying could involve funding academic research and fostering collaborative relationships with government entities.

Buybacks and Dividends: The recent buybacks and dividends are a great move. The cash pile grows every year and because they do not do much with it, people have begun to think that it is not real or fraudulent in some way. As they pay out a dividend and hopefully increase the pace of buybacks, it will become clear this cash very much is real and will be factored into valuations.

Cancellation of IPOs: More recently, the cancellation of the IPOs looks like good news. I was of the view that this was being done to appease the CCP. Now that this is canceled, it looks like the CCP is backing off from attacking Alibaba.

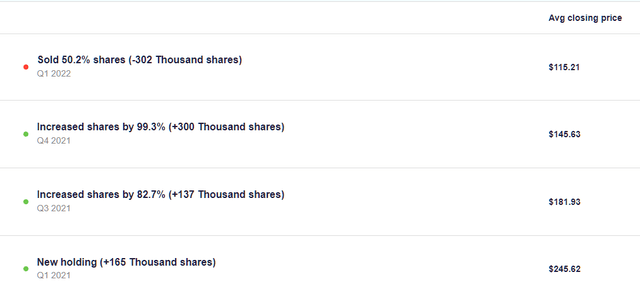

Support by Gurus: Adopting ideas from successful investors, such as Charlie Munger, is frequently lucrative. Moreover, investing at prices merely a third of what they initially paid, offers substantial security for present investors and signals substantial potential gains. As Charlie Munger bought these shares starting in 2021, these purchases remain relevant and provide an esteemed endorsement.

GuruFocus

Charlie Munger Purchases of BABA (GuruFocus)

Macroeconomics of China: China, with its expanding middle class and population of over 1.3 billion, offers a compelling investment landscape for Alibaba. Over the past few decades, China’s economy has seen extraordinary growth, outpacing other global economies. The shift from a predominantly state-controlled economy to one that embraces market principles and encourages private enterprise has been a key driver of this growth.

Also, research suggests that the average intelligence quotient (IQ) in China stands at approximately 105, positioning it among the highest globally. According to The Bell Curve: Intelligence and Class Structure in American Life, IQ is correlated to numerous significant life outcomes.

Furthermore, the Chinese culture’s emphasis on education, strong work ethic, and propensity for saving are traits synonymous with individual success. When a significant portion of a population exhibits such behaviours, it leads to national prosperity.

To conclude, China’s human capital, educational prowess, and cultural values provide a strong foundation for long-term economic success, making it an attractive prospect for investors considering Alibaba and similar entities deeply rooted in China’s growth narrative.

Financial Analysis

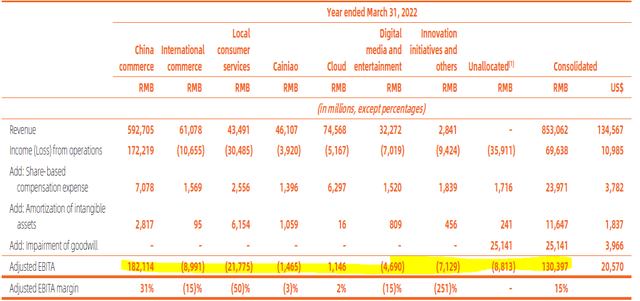

Profits Could Be Higher: The company’s overall profits would be even more substantial if not for the drag on earnings caused by other growing business segments (see the highlighted segments below). As of the year ending March 2022, only the China Commerce and Cloud segments managed to generate a profit, with the Cloud segment breaking even for the first time. I expect that as the company’s non-core segments expand and reach critical mass, a significant number of them will transition into profitable operations.

Segmental Breakdown (Financial Statements 2022)

Future Growth: Several long-term trends are poised to benefit e-commerce: Firstly, as wages increase in China, the value placed on convenience is expected to rise. This shift could make the cost of physical shopping less appealing compared to the cost-effectiveness of online purchasing. Secondly, as the younger generations grow up and the older generations die, the use of online shopping is likely to become more widespread. Thirdly, advancements in internet connectivity, particularly in rural areas, are expected to further bolster e-commerce, offering a more appealing alternative to traditional retail.

However, saying that, there has been a significant increase in domestic e-commerce competition in China. The landscape looks very competitive and since the CCP, rightly, did away with the choose one from two policies, it has hurt Alibaba’s competitive position. To conclude, I expect China’s e-commerce segment to grow steadily in GMV terms but not at the same pace as in pre-pandemic years.

I think international commerce is now a big growth area. Sea Ltd is scaling back, and Lazada is gaining ground. Trendyol is doing well in Turkey, and the other smaller companies like Daraz, etc, are scaling up well. As international commerce grows, this really could become very significant.

Finally, the cloud and logistics segments are both capital-intensive and technology-driven, resulting in significant barriers to entry. As these segments have high fixed costs and low marginal costs, particularly the cloud segment, profits are likely to surge once a certain scale is reached, with economies of scale further deterring new competitors.

Clean Accounting: It’s worth emphasizing that the company has consistently received clean audits without any major reinstatements.

Furthermore, there exists a strong correlation of 0.81 between net income and cash flow from operations from 2014 onwards. This significant correlation suggests that the company is unlikely to be engaged in any financial irregularities or deceptive practices.

Relative Valuation/Ratio Analysis

When it was listed on the stock market in 2014, the company was valued at $220 billion. Fast forward to today, its valuation stands at $199 billion, reflecting a decrease of over $20 billion in nearly a decade. Although interest rates have increased, resulting in decreased equity valuations, this decline in valuation seems paradoxical considering the company’s significant growth during this period:

- Its revenue has surged to fifteen times its original size.

- Profits have quintupled.

- Book value has increased twenty-fivefold.

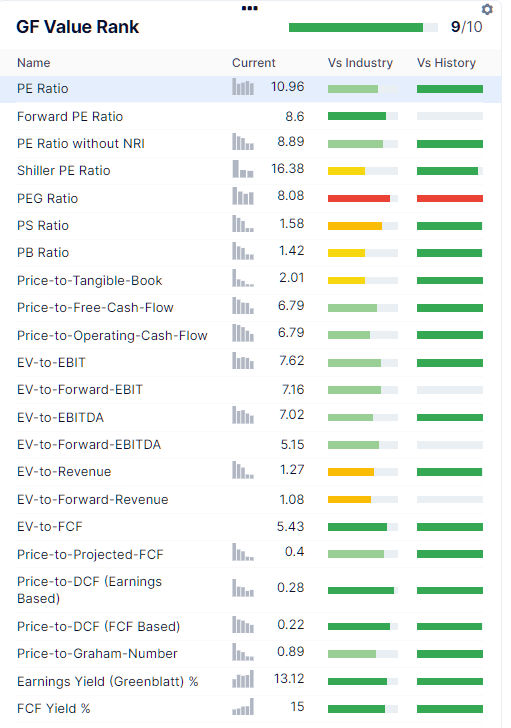

In essence, Alibaba is fundamentally stronger now than it was at its initial listing, yet its market valuation is surprisingly lower. Furthermore, an analysis of the past five years reveals that the company has historically traded at more favourable multiples, suggesting that its current valuation is not reflective of its intrinsic worth. Let’s delve into some key ratios underscoring this perspective:

Ratio Analysis (GuruFocus)

- Price-to-Book (P/B) Ratio: Alibaba’s current P/B ratio is 1.4, significantly lower than the 10-year median of 5.8.

- Price-to-Sales (P/S) Ratio: Currently at 1.6, this ratio indicates that Alibaba’s market valuation relative to its revenue is modest, especially when compared to the 10-year median of 5.8.

- Enterprise Value-to-EBIT Ratio: The present ratio stands at 7.6, a stark contrast to the decade-long median of 24.

- Enterprise Value-to-Free Cash Flow Ratio: This ratio is currently 5.4, compared to a median of 21.5 over the past ten years.

Other investments and holdings in Ant Financial are also a key aspect of the bull case. These investments have had to be written down due to poor performance, but they represent a large cash equivalent that should be factored in. Taking the cash and these into account, it trades mid-single digits enterprise value to earnings.

All things considered, these metrics collectively suggest that Alibaba is trading at levels that are undervalued when benchmarked against historical standards. This discrepancy highlights a potential mismatch between the market perception and the company’s actual financial health, presenting a scenario that investors might want to evaluate closely.

Investment Risks

1. Political Risks: Relations and Potential Conflicts

Ray Dalio, in his book Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail, predicts China’s rise as a global superpower, sharing dominance with the United States. He anticipates some geopolitical friction during this transition, as highlighted in his writings and interviews. However, Dalio believes China is averse to military conflict, preferring to maintain global business relations.

He said recently in an article,

“The Chinese don’t want to go to war. I expect the Chinese side to be very restrained for the time being. In fact, it was said to me a number of times when I was in China that they believe that some Americans are trying to bait them into a trap (a war) that they want to avoid. Still, I think virtually all countries want to stay out of the conflict with China and want to go about business as usual.”

Historically, nuclear powers have avoided direct conflict due to the risk of mutually assured destruction (MAD). Consequently, in the long term, China and the U.S. will likely find a way to coexist and share global power.

The prospect of China invading Taiwan is considered low due to Taiwan’s robust defenses as mentioned in Prisoners of Geography, potential economic repercussions, and lessons drawn from Russia’s Ukraine invasion. Additionally, China is very likely to explore non-military options for influencing Taiwan before considering military action.

Alibaba, generating approximately 95% of its revenue domestically in China, is relatively insulated from these international tensions.

Investing in Alibaba is a long-term commitment. Investors need to exercise patience and become comfortable with political uncertainty to realize potential returns.

2. Confiscation Risks

While there’s a remote possibility of the Chinese government confiscating foreign investments, it’s unlikely given the country’s embrace of capitalism and economic growth.

3. Potential Delisting and Market Maneuvers

U.S. market regulators are cautious about alienating Chinese companies due to the financial benefits of IPOs. There is a mutual interest among the U.S., China, and companies like Alibaba in maintaining their presence in U.S. markets.

If Alibaba were to delist from the U.S. market, investors could transfer their shares to the Hong Kong market, although this might involve some costs and potential discounts on the shares. At present, this conversion costs £500 with interactive brokers.

4. Variable Interest Entity Structure and Currency Fluctuations

The ownership structure through a VIE is not seen as a significant risk, with options available to transfer holdings to the Hong Kong exchange if necessary.

As an investment quoted in USD, currency fluctuations, particularly a weaker dollar, can impact returns for investors holding different currencies.

5. Emerging Market Integrity Challenges

China’s approach to capitalism is relatively nascent, somewhat reminiscent of the early, unregulated days of the American Wild West. This stage of economic development often sees less stringent regulatory frameworks and enforcement, leading to practices like insider trading that can erode trust in public markets. However, these issues are expected to diminish over time as the market matures.

6. Excessive Market Volatility

The Chinese inclination towards speculative trading could contribute to heightened share price volatility. This environment, while challenging for the average investor, can present more opportunities for disciplined value investors focused on fundamental analysis.

7. Educational System Limitations

The Chinese educational system, noted for its strong test scores, tends to emphasize rote learning over critical thinking and creativity. This educational approach might limit the development of innovative thinking, which is crucial in the rapidly evolving global economy.

8. Decline of a Meritocracy

Capitalism has led to increased inequality and established rigid social hierarchies, challenging the notion of a meritocracy.

9. Potential Friction Between Jack Ma and the CCP

Concerns about the relationship between Jack Ma and the Chinese Communist Party have been noted. It is believed that Ma has gained valuable insights from past interactions with the CCP, and any existing tensions are likely to ease over time. The resolution of these issues will be important for maintaining investor confidence in Alibaba and its leadership.

10. Demographics

Given the one-child policy and low birth rate, it seems like China is going to run into some issues, especially given that there is not much immigration to China. This doesn’t affect the investment in the short term but might impact the very long-term picture.

11. Cloud Business Slowing Down

It looks like growth has collapsed here, and given the internal reshuffles and concern around chips, I do not think we can expect much over the next year at least. Beyond this, the expected uptake from China’s domestic business may happen but is not a certainty.

In summary, there are various risks associated with investing in a company like Alibaba, particularly amidst the complex geopolitical and economic landscape, investors must be aware of these dynamics and consider them in their investment decisions.

Valuation

My valuation methodology for Alibaba involves a weighted average of several potential scenarios. Recognizing the unpredictability of the future, I’ve outlined possible outcomes, each with its probability estimate:

1. The Optimistic Scenario (40% Probability)

- In this scenario, cloud computing becomes a major, profitable segment for Alibaba. The overall market in the cloud is expected to be three times the size of the current market by 2025. Alibaba is well positioned to capitalize on this as they are the largest provider in Asia and the third largest in the world.

- E-commerce operations continue to excel, bolstered by network effects and economies of scale

- Other business segments turn profitable as they reach critical mass.

- Alibaba’s investments in AI and other technologies yield profitable returns.

- Alibaba’s management successfully executes share buybacks at below intrinsic value, enhancing shareholder value.

- The Chinese government relaxes its stance on technology firms.

- Tensions between Jack Ma and the CCP diminish over time

- The U.S. and China find a harmonious way to coexist, enhancing global stability and attracting institutional investors back to the stock.

- The company avoids significant fines in the future, which have depressed the most recent earnings and biased projections and valuations downward.

- With a profit growth projection of slightly above 15% annually for the next decade and trading at a P/E ratio of 25, the estimated market capitalization in ten years stands at $1.5 trillion. It’s worth noting that while past growth doesn’t guarantee future growth, there exists a correlation between the two, rendering past data somewhat predictive. Given the company’s profit growth rate of over 24% in the last decade, a 15% growth estimate seems conservative, especially considering the above factors. I also think a P/E of 25 is not unreasonable when sentiment has improved. At a discount rate of 5%, the present value amounts to $920 billion today.

- I’ve assigned a probability of 40% to this scenario, reflecting my belief that these projections are likely to materialize over the long term.

2. The Moderate Scenario (40% Probability)

- Alibaba grows steadily, though at a slower pace. Earnings improve by 10% per annum.

- Alibaba dividing itself into multiple separate entities unlocks hidden value, as the combined worth of the individual parts is perceived as greater than that of the consolidated entity.

- Estimated 10-year market capitalization: $1 trillion. Present value at a 5% discount rate: $614 billion.

3. The Pessimistic Scenario (15% Probability)

- Escalating tensions between China and the U.S. lead to a new Cold War. Alibaba delists from U.S. exchanges, necessitating a shift to the Hong Kong exchange, accompanied by a conversion fee and reduced market demand.

- Despite these challenges, Alibaba’s strong fundamentals and domestic focus provide resilience.

- Estimated 10-year market capitalization: $400 billion. Present value at a 5% discount rate: $245 billion.

4. The Worst-Case Scenario (5% Probability)

- Complete loss of investment. The CCP seizes everything and reverts to communism. Estimated 10-year market capitalization: Zero.

- I’ve attributed a low probability to this scenario due to the transformative impact that free markets have had on China’s development and prosperity. The CCP is keenly aware of what strategies are effective, and I don’t foresee them reverting to previous models that may hinder progress.

Conclusion

The weighted average valuation based on these scenarios is $650 billion, significantly higher than the current market capitalization of $199 billion. This disparity suggests a considerable margin of safety, indicating that even with potential setbacks, the investment should remain profitable.

This investment represents a high-reward opportunity with a long-term horizon. It offers the potential to participate in the growth of a leading company within what may become the world’s next superpower.

Read the full article here

Leave a Reply