Some investments, particularly those in high quality companies, can pay off rather fast. As an example, I need only look at a well-known REIT called Alexandria Real Estate Equities, Inc. (NYSE:ARE). This is a very specific type of REIT because it specializes in owning real estate dedicated to the life sciences space. Unlike the office space which is plagued with vacancies, and other assets that can see some degree of volatility throughout the economic cycle, the life sciences market continues to grow year after year and that trend is unlikely to stop any time soon.

Although every investment that I look upon favorably, with a few exceptions, are ones in which I don’t expect near-term results from, Alexandria Real Estate Equities has done remarkably well. In early October 2023, I wrote a bullish article about the company, acknowledging that while shares were a bit pricey, that the company offered an attractive upside for investors. In that article, I lauded the company’s attractive growth and believed that the trend would likely continue even in a rather volatile market. I ultimately rated the company a ‘buy’ and the performance of it since then has been remarkable. While the S&P 500 is up 11.6%, shares of Alexandria Real Estate Equities have seen an upside of 29.9%. Given where we are at now, I would say that the easy money has been made. But I still believe that there is some potential left. So although I do think that there might be better opportunities elsewhere, I have decided to keep the company rated a soft ‘buy’ at this time.

Great growth during the great upside

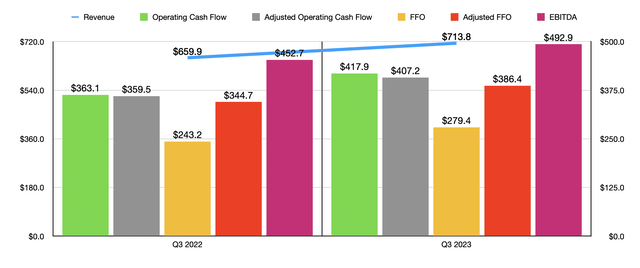

Fundamentally speaking, things are going quite well for Alexandria Real Estate Equities. As an example, let’s look at the most recent data provided by management, which covers the third quarter of the 2023 fiscal year. Revenue for that time came in at $713.8 million. That represents A sizable increase over the $659.9 million reported one year earlier. The largest improvement for the business during this window of time came from new properties in its portfolio. When it came to rental revenue, for instance, properties that are not included as ‘same properties’ reported a 21.6% rise in revenue from $83.8 million to $101.9 million. This was associated with 2.1 million rentable square feet of development and redevelopment projects that were placed into service after July 1st of 2022 and also thanks to 1.7 million square feet worth of space, spread across 14 different operating properties, acquired since that same time. When it comes to the same properties, the 2.9% increase in revenue, or $12.1 million, was driven largely by rental rate increases on lease renewals and the re-leasing of certain spaces.

Author – SEC EDGAR Data

With the rise in revenue came improved profitability. Operating cash flow, for instance, popped from $363.1 million in the third quarter of 2022 to $417.9 million at the same time in the 2023 fiscal year. If we adjust for changes in working capital, we would get an increase from $359.5 million to $407.2 million. There are, of course, other important profitability metrics to look at. One of them would be FFO or funds from operations. This metric grew from $243.2 million to $279.4 million, while the adjusted equivalent of this expanded from $344.7 million to $380.4 million. And lastly, EBITDA for the company expanded from $452.7 million to $492.9 million.

Author – SEC EDGAR Data

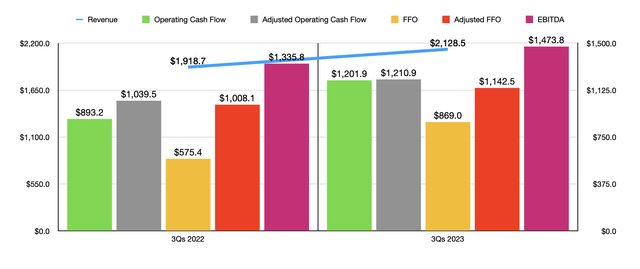

Consistent growth is not new for Alexandria Real Estate Equities. In the chart above, for instance, you can see financial results covering the first nine months of 2023 in the entirety compared to the same window of time of the 2022 fiscal year. And as I covered in my prior article on the firm, growth over time has been achieved by management. But this doesn’t mean that the company is afraid to sell off certain assets. In fact, for the 2023 fiscal year, management had forecasted asset sales totaling between $1.55 billion and $1.75 billion. As of the end of the most recent quarter, management had already completed $875.4 million worth of asset sales. However, they had another $699.3 million worth that was pending or under-executed letters of intent or purchase and sale agreements. That brings the amount up to $1.57 billion. By comparison, asset purchases during the first nine months of 2023 totaled less than $251 million. But the good news is that management has been actively investing in organic growth. The current objective is to use between $2.79 billion and $3.09 billion on construction projects.

Author – SEC EDGAR Data

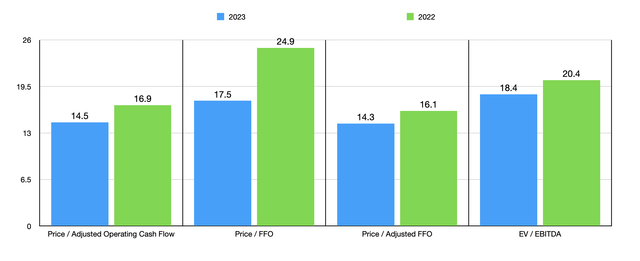

In spite of this, we do have only limited guidance when it comes to 2023 in its entirety. FFO per share, for instance, is forecasted to be around $7.30 at the midpoint, while the adjusted figure for this should be $8.98. This should result in $1.25 billion of FFO and $1.53 billion of adjusted FFO. Following a similar trajectory for these on a year-over-year basis, we would get an adjusted operating cash flow of $1.51 billion and EBITDA of somewhere around $1.98 billion. In the chart above, you can see how shares are priced on an absolute basis. Looking at the forward estimates, the stock is not terribly bad. But it’s not a great prospect either from that perspective. I then compared it to five similar companies. On a price-to-operating cash flow basis, four of the five companies ended up being cheaper than it. That number drops slightly to three of the five if we use the EV-to-EBITDA approach instead.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Alexandria Real Estate Equities | 14.5 | 18.4 |

| Boston Properties, Inc. (BXP) | 8.6 | 16.5 |

| Vornado Realty Trust (VNO) | 7.8 | 32.4 |

| Kilroy Realty Corporation (KRC) | 7.9 | 12.7 |

| Cousins Properties Incorporated (CUZ) | 9.9 | 12.1 |

| SL Green Realty Corp. (SLG) | 14.7 | 33.4 |

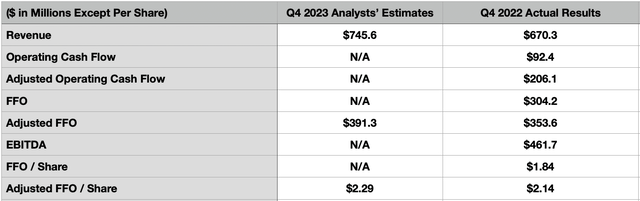

Of course, that picture can change. And in all likelihood, it would be the better. Take, as an example, what analysts are forecasting. The kind of structural growth that we already discussed, combined with higher rents associated with the same property sales, should push revenue up to $745.6 million for the final quarter of the company’s 2024 fiscal year. This is what management is expected to report, at least, when they come out with financial results on January 29th after the market closes. Adjusted FFO per share, meanwhile, is expected to be around $2.29, which would actually be a nice increase over the $2.14 per share that the company reported at the same time last year. This would imply an adjusted FFO of $391.3 million compared to the $353.6 million reported for the final quarter of 2022. In the chart below, you can also see some other financial metrics that investors should be paying attention to when the company reports results. These particular metrics are for the final quarter of 2022, so in all likelihood, they should be higher this year when management reports.

Author – SEC EDGAR Data

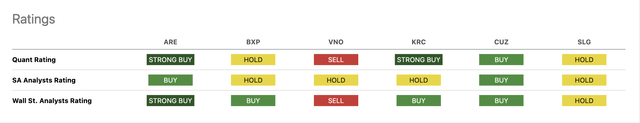

The adjusted FFO for the year that management is expected to report, according to analysts, matches the midpoint of guidance that management has provided. So unless the firm significantly exceeds expectations, it’s likely that shares will continue to be a bit on the pricey end of the spectrum compared to similar enterprises. However, an argument could be made that the stock deserves to trade at this kind of premium. In the image below, you can see certain data provided by Seeking Alpha, including the Quant Rating, that shows just how bullish matters for the company look relative to similar firms.

Seeking Alpha

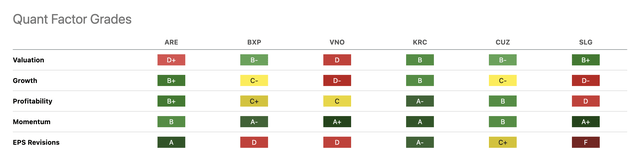

Both the analysts’ ratings from Seeking Alpha contributors and from the Wall Street crowd are fairly self-explanatory. But we should dig a bit deeper into the Quant picture. As you can see in the image below, there are five different metrics that go into the Quant Rating system. And in four of those five, the company does either quite well or very well. In most respects, it handily outperforms its peer group. The one exception is valuation. And this is where I might disagree with the system a bit. Why do you think the valuation is far from ideal, and I do have weighted heavily relative to some other metrics shown in the Quant Rating system. Given where the stock stands today, I personally would rate Valuation closer to a C+ or B-, though because I assign it a heavier weight than any of the other metrics, I believe that the soft ‘buy’ rating I mentioned giving the stock in the introduction to this article is still appropriate.

Seeking Alpha

Takeaway

As things stand, Alexandria Real Estate Equities is a really solid company that has done really well for itself. Although I do not own shares of the business and do not plan to buy the stock for the foreseeable future, the company is very attractive from a fundamental perspective. Because of how pricey the stock is, I do think that a more modest rating is appropriate. And that is why the soft ‘buy’ rating is what I am sticking with at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply