Introduction

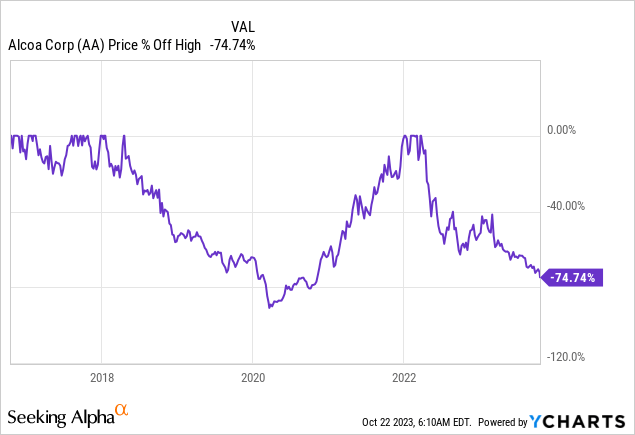

Being early is somewhat the same as being wrong, which means I was wrong about the Alcoa Corporation (NYSE:AA) – at least when it comes to the health of the industry, not necessarily about economic risks.

On July 20, I wrote my most recent article titled Why Alcoa Could Double If Demand Improves.

This is a part of the takeaway:

The outlook for the global aluminum market is positive, with demand growth expected from renewable energy, electric vehicles, and recyclable packaging.

Additionally, Alcoa’s position as a low-carbon primary aluminum producer is an advantage in key regions.

Considering the current valuation and the potential for demand to improve, the risk/reward of Alcoa has become attractive.

However, given the volatile economic environment, caution is advised, and a bottoming-out of economic demand is crucial for a potential rally in the stock price, which could reach the $80 to $90 range.

Unfortunately, economic fears continue to pressure the Pittsburgh-based aluminum giant. After dropping 10% last week, it’s now down almost 50% year-to-date!

This makes it the second-worst sell-off since the company became a pure-play aluminum producer in 2016.

In light of the just-released 3Q23 earnings, I’m taking another look at the risk/reward, as Alcoa has a history of violent rallies after steep sell-offs. Getting the timing even remotely right could result in tremendous gains.

So, let’s get to it!

Cyclical Pricing Weakness

Let’s start with the bad news.

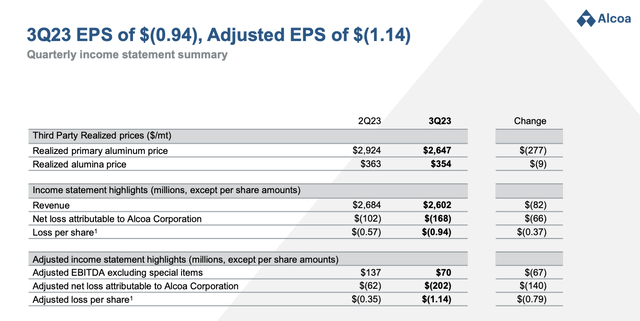

Alcoa reported a third-quarter adjusted net loss of $1.14 per share and $70 million in adjusted EBITDA, attributing the losses to lower realized prices for alumina and aluminum.

Alcoa Corporation

Despite improvements in production and raw material costs, lower prices had a significant impact, which is often the case in this industry or any industry that relies on commodity prices.

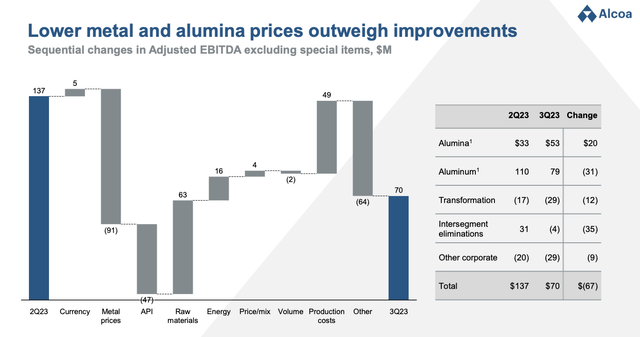

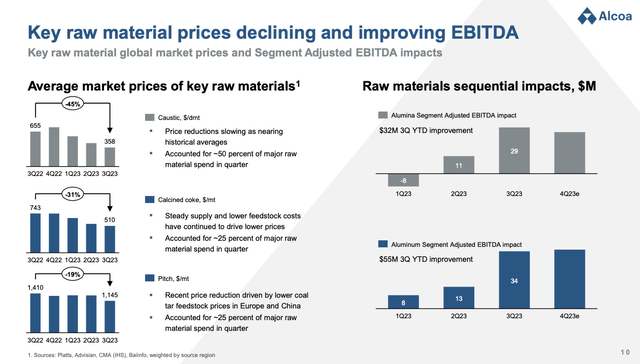

Looking at the overview below, the lower metal and alumina realized prices were partially offset by reduced raw materials, energy, and production costs.

The Alumina segment’s EBITDA, for example, saw an increase of $20 million due to lower raw material costs, primarily in caustic soda, and decreased production costs in Brazil and Spain.

Alcoa Corporation

These gains more than compensated for the lower alumina index prices.

A similar trend was seen in the Aluminum segment, where lower raw materials and production costs, along with energy improvements, still couldn’t fully offset the impact of lower metal prices.

Alcoa Corporation

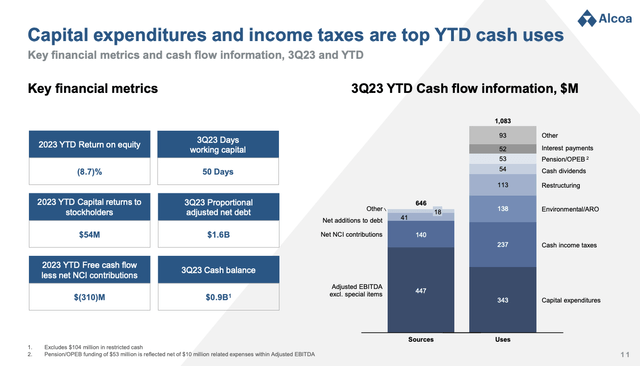

The company also became a bit more efficient, as it managed to improve its days working capital by five days to 50 days in the third quarter, primarily due to lower inventories. Please note that working capital is current assets minus current liabilities.

Lower working capital means that a company has less money tied up in current assets, such as inventory and accounts receivable, and less debt to pay in the short term, such as accounts payable and accrued expenses. This can be a good thing, as it means that the company is more efficient with its resources and has more flexibility to respond to changes in the market.

According to the company, this improvement served as a significant source of cash in the third quarter, entirely offsetting the previous year-to-date working capital cash use.

The cash balance decreased by $64 million in the quarter, with the most substantial cash source coming from a working capital reduction of $183 million, mainly due to lower inventories, followed by EBITDA of $70 million and net NCI contributions of $40 million.

Alcoa Corporation

Expectations are that working capital will continue to be a source of cash in the fourth quarter.

While 3Q23 was a poor quarter, it’s the outlook that matters.

Outlook

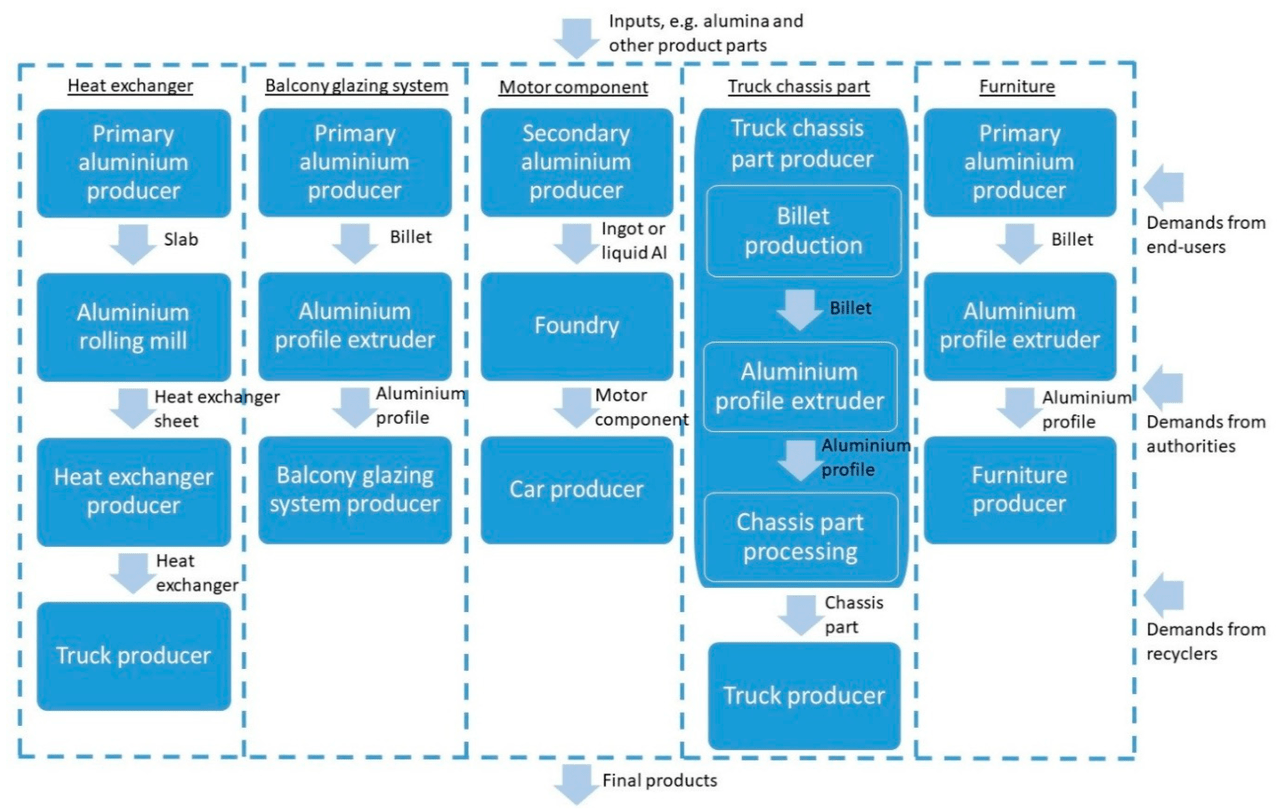

Alcoa’s outlook and comments are always fascinating. Not only because it tells us a lot about the company but also because aluminum is one of the most widespread metals in our modern economy.

As seen in the overview below, aluminum is used in transportation industries (cars, trucks, planes, etc.), home building, furniture, and so much more. Listening to companies far up that supply chain (often) means getting valuable intel.

Linköping University

Regardless of the economic cycle, Alcoa is making progress in its value-adding products.

The company reported that customers are increasingly interested in its Sustana line of products, with sales of EcoLum (low-carbon aluminum) on the rise in Europe and North America.

Global sales volume for EcoLum is expected to increase by approximately 60% in 2023 compared to the previous year.

Alcoa is also expanding its offerings, making its first sale of the non-metallurgical variety of EcoSource, a low-carbon alumina brand.

This expansion allows Alcoa to cater to a wide range of industries, including refractories, sandpaper, and water treatment processes.

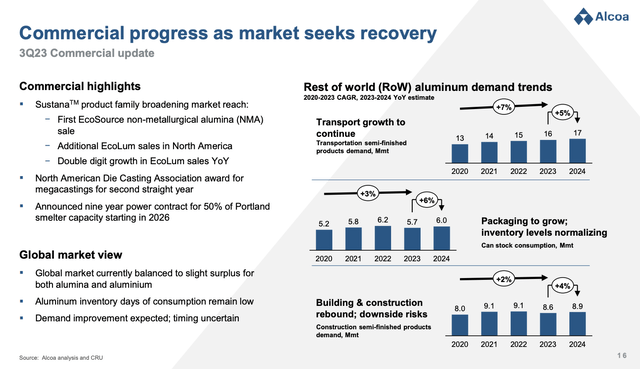

Looking at the bigger picture, the global alumina and aluminum markets are balanced to a slight surplus, and aluminum inventories remain at historically low levels in terms of days of consumption.

Alcoa Corporation

The outlook for 2024 is uncertain due to geopolitical and macroeconomic factors, with a key question revolving around demand outside of China.

- Alcoa anticipates continued growth in transportation, recovery in packaging, and building and construction sectors.

- The automotive market, which drives major trends, is recovering after COVID-related disruptions.

- In building and construction, a relative recovery is expected in 2024, driven by projections of slowing inflation and stabilizing interest rates.

Due to ongoing uncertainty, Alcoa’s ability to mitigate risks is limited, which means it remains focused on issues it can control, like cost, operational improvement, and breakthrough technology programs to ensure a positive future outlook for the company.

In the long term, Alcoa remains bullish on aluminum’s future, driven by megatrends like EV adoption and solar energy demand.

Valuation

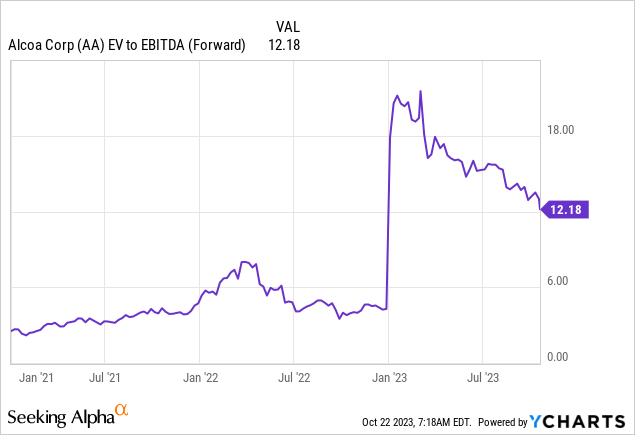

Putting a valuation on a stock that relies on commodity prices (more so than demand) is tricky. Right now, AA is trading at 12x NTM EBITDA. Last year, the company traded close to 6x NTM EBITDA. So, despite losing roughly half of its value this year, AA seems to be more expensive.

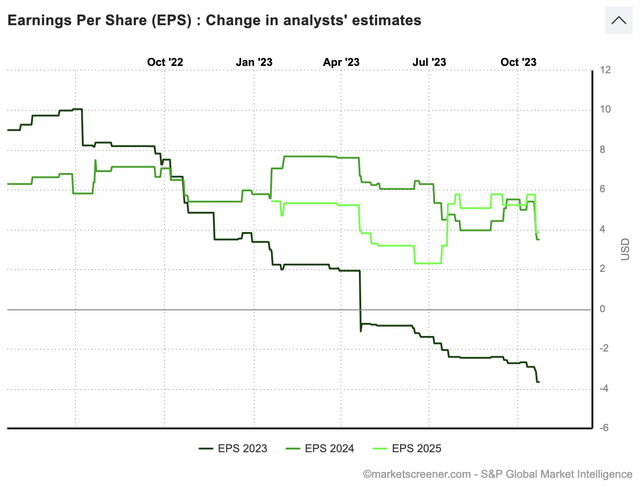

To give you an idea of the massive impact lower aluminum prices have on profitability, analysts expected 2023 EPS to be close to $10 in the second half of 2022. Since then, multiple revisions have led to an expected EPS of almost- $4!

The good news is that 2024 and 2025 estimates are still somewhat unchanged (in a wide and volatile estimates range between $3 and $8.

MarketScreener

I expect that a potential surge in commodity prices, in the event of an economic recovery, could push EPS estimates back to $8 in 2024 or 2025, depending on the timing of the rebound.

When applying a modest 8x multiple for AA, it means that there’s a path to $64 per share. We could see $80 to $90 if supply in Europe remains constrained due to elevated energy prices.

This would imply roughly 170% upside potential in an economic recovery.

The current consensus price target is $37, 55% above the current price.

So, I stick to my bullish outlook.

However, as I said in prior articles, the downside is the tricky part here. If the economy continues to decline, we could see a move below $20. We could even see $15. That’s the risk that comes with commodity stocks that the market doesn’t want when economic demand goes south.

Hence, AA should be treated as a wild card.

If you are bullish on its future, which I am, gradually building a small position is the way to go. Do not go overweight.

I only buy lower-risk cyclical stocks like railroads, machinery producers, and consumer cyclical with both hands. High-volatility cyclical stocks like AA need to be handled with extreme care.

In other words, I’m bullish on the company’s future. I expect to see a $60 stock price over the next 2-3 years, with room to cross $80 per share.

However, we could also see $15 before we get to these levels.

Please be aware of this risk/reward.

Takeaway

Despite a challenging economic environment, there are promising signs for Alcoa’s future. The global aluminum market is poised for growth, driven by renewable energy, electric vehicles, and recyclable packaging. Alcoa’s focus on low-carbon production is a strategic advantage.

While the stock has faced significant setbacks this year, there’s room for a strong rebound.

Although timing is tricky, an economic recovery could lead to substantial gains, potentially pushing the stock price to the $80 to $90 range.

On the flip side, economic downturns can be harsh on commodity stocks like AA, posing the risk of a decline to $15.

Having said that, my outlook for Alcoa remains positive, with the potential for a $60 stock price in the next few years.

However, investors should exercise caution and consider Alcoa a wild card in their portfolio. Gradually building a small position is advisable, but avoiding an overweight allocation is key.

Read the full article here

Leave a Reply