Editor’s note: Seeking Alpha is proud to welcome Ben Short as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

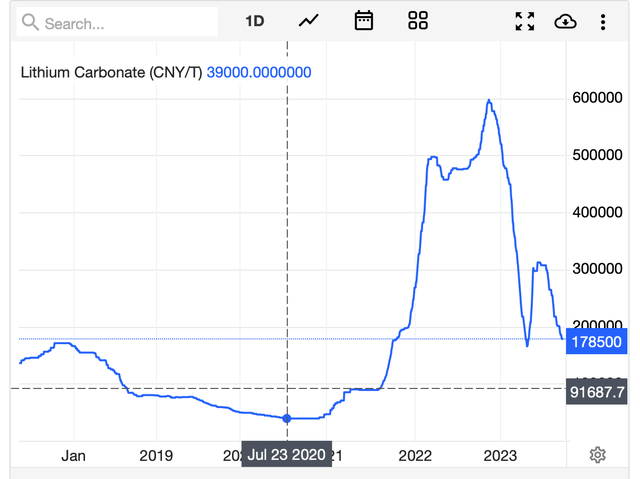

There has been a lot of attention on the lithium investment theme in the last while, and rightly so. Lithium prices have been extremely volatile, soaring to the unbelievable highs of ~$80/kg for lithium carbonate and then coming crashing back down to about $25-30/kg. This price volatility has led to equity volatility, with opportunities to make and lose money.

I have been doing a deep dive into this subject for some time and think it is time to start writing. I have found that there are several poorly understood concepts in the lithium space. I plan to cover a number of the key companies and also reveal some of the promising developer-producer companies. I hope to discuss some big concepts required to get a handle on the lithium market as I go.

In my first article, I want to speak to the largest lithium company by market cap, Albemarle (NYSE:ALB). This company has received a lot of coverage in the news and here on Seeking Alpha. Many of the articles have an argument about Albemarle that goes like this: lithium prices will go up; Albemarle makes a lot of lithium; the share price is low; buy. Let’s call this the basic bull case for Albemarle.

While I agree with this basic argument, Albemarle is a complex company with several particularities worth understanding. Just because they are the biggest lithium company does not mean they are the most profitable nor the best deal out there. There may be reasons for you to look elsewhere for better opportunities in the lithium space. I am more attracted to simpler companies like Pilbara (OTCPK:PILBF). All they do (for now) is make spodumene concentrate, and a heck of a lot of it. In this article, I will discuss Albemarle as a business and four weaknesses and five strengths to keep in mind when comparing this business to other lithium businesses.

To be clear, I am a lithium bull and think that you can make money with Albemarle, especially at the current price. It is a great company with massive tailwinds, and I rate it a buy. However, it is worth understanding the complexities and inner workings before investing.

In this article, I will not make the bull case for lithium. I will touch briefly on this, but throughout the article, I will be assuming that there is a long-term shortage of lithium relative to the coming EV-related demand. I hope to make this case throughout other articles.

Albemarle Is A Vertically Integrated Chemical Producer

A quick summary of the company. Albemarle is more than a lithium miner. They have lithium mining assets that they operate (more on this later). They mine hard rock spodumene and lithium brines from Chile. They are also important bromine assets.

Beyond mining, they are a chemical producer. They take the lithium from the hard rock and process it into the lithium hydroxide which is needed to make some of the batteries that go into EV. They have other specialty chemicals they make, both from lithium and bromine.

The lithium tailwind is making Albemarle an exciting company. Lithium has many industrial applications and Albemarle has been making various forms of lithium for these different applications for many years if you include the history before their Rockwood acquisition. The EV boom is driving the need for lithium, especially two chemicals: lithium carbonate and lithium hydroxide. The demand for these two chemicals has far outstripped all other lithium demand in the last five years, and the lithium market is seeing massive demand.

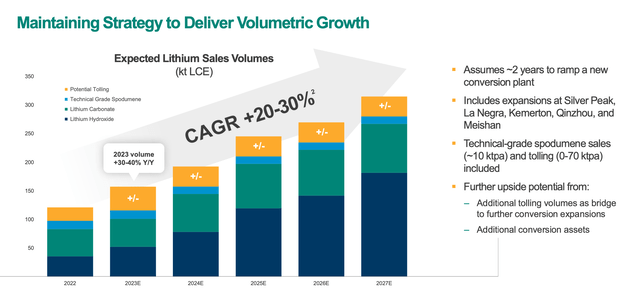

Between 2013 and 2018 Albemarle’s annual revenue was between $2.2B and $3.3B growing at a consistent rate, a CAGR of 8.4%. In 2022 their revenue grew a staggering 97% and it is continuing to grow, though, not at that pace. The company is predicting a 20% CAGR through 2027.

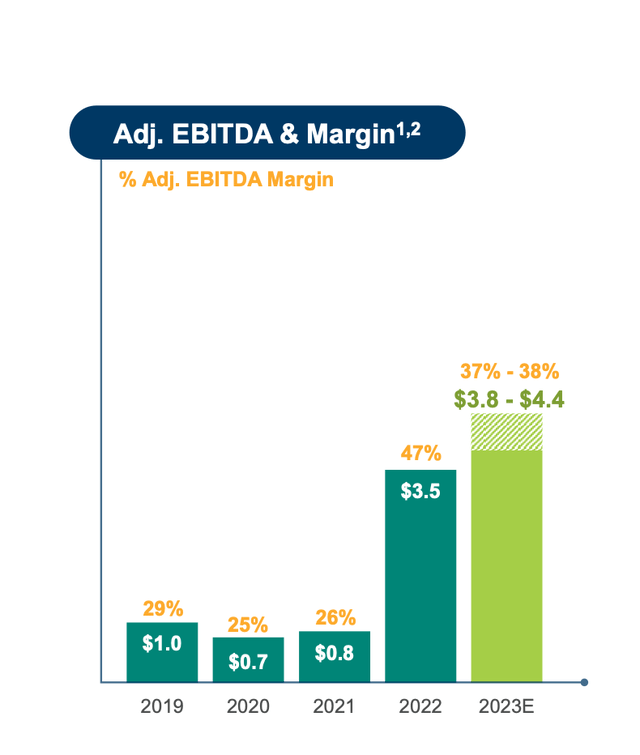

Importantly, in this explosive revenue growth, their margins increased not decreased. In the graph below you can see their 2021 EBITDA margins were 21% and their 2022 margins were 47%. This revenue growth with margin expansion is a direct result of the increasing lithium prices.

Albemarle Margin Growth (Albemarle Investor Presentation)

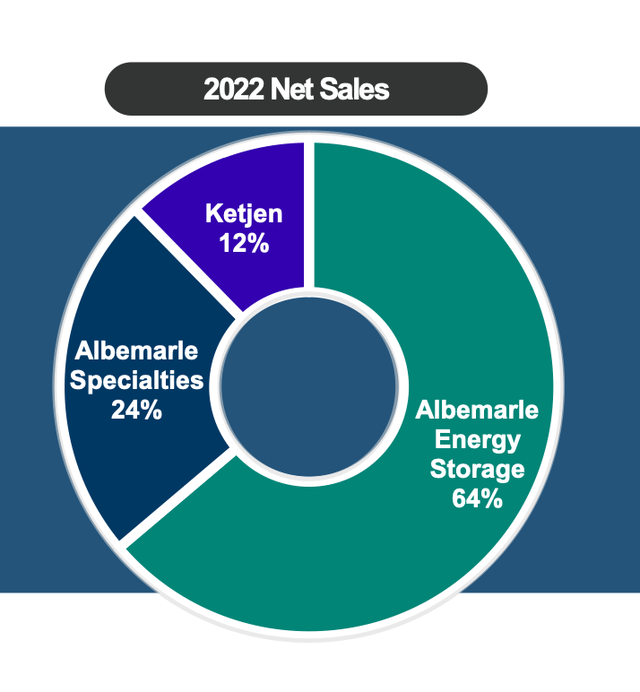

Up to 2022, they reported revenue under three segments, which were Lithium, Bromine, and Catalysts. They have restructured this and now report under three different segments: Energy Storage, Specialties, and Ketjen. The Energy Storage business is where they make the lithium carbonate and lithium hydroxide that go into batteries. This portion of the business was up 120% YoY in Q2. In the Specialties business, they make lithium and bromine into several industrial applications Ketjen is the new name for catalysts.

Albemarle’s Revenue by Reporting Segment (Albemarle’s Investor Presentation)

That’s a snapshot of the company. Now, onto four weaknesses you need to be aware of.

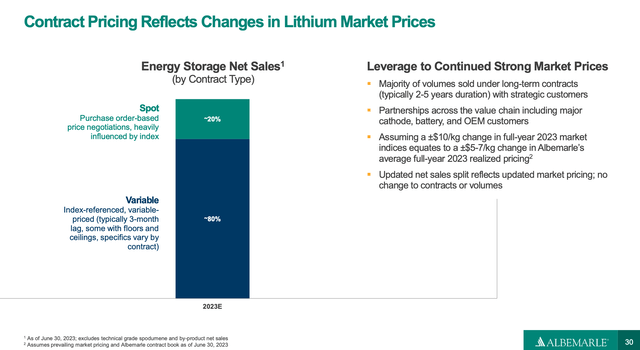

Weakness 1: Long-term Contracts With Ceilings

Albemarle has been quite clear that in all their sales they make long-term contracts, typically 2-5 years, and these contracts have floors and ceilings. Here is a quote from Albemarle CFO Scott Tozier from their Q1 earnings call:

We expect our Energy Storage sales to be about 10% on spot, and 90% on index reference variable price contracts. These contracts are typically two to five years and in duration, and are designed to ensure security of supply for our customers as well as to make our sales more predictable. These strategic customers include partnerships across the value chain, including major cathode, battery, and automotive OEM customers. We are more weighted towards the market than we have been in the past. However, we will still have less volatility than a true spot business. Because of the index reference structure of these contracts. They typically have a three-month lag and have some of them have caps and floors.”

So, most of their contracts have an index reference that is somewhat tied to the market and may have a floor and cap. We don’t know what portion has caps, but a portion of their contracts do. Lithium pricing was a completely different world 3-5 years ago. The Chinese lithium carbonate spot price bottomed out around $12.5/kg, which is about half what the lowest price is now ~ $25/kg. And, this is the bottom of the trough, the average price in the last year is more like $40/kg and I expect that to be the average price going forwards for at least two years.

Albemarle Contracts Details (Albemarle Investor Presentation)

Four years ago $40/kg was inconceivable in the industry; today it is standard. The Albemarle contract philosophy has taken a safer route to revenue smoothly and with great foresight. However, they certainly lost out on a large part of the possible revenue in the last few years. Other companies like SQM (SQM), Pilbara, and Allkem (OTCPK:OROCF) have pricing contract structures that are more closely tied to market price.

Five-Year View of China Lithium Carbonate Spot Price (Trading Economics)

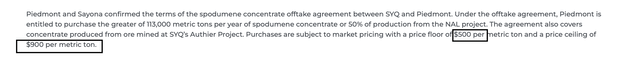

While the details of these contracts are not public, we can take as an illustration the case of the Piedmont/Sayona offtake agreement. Sayona (OTCQB:SYAXF) has a lithium mine in Canada that has just come into production with the help of an investment from Piedmont (PLL). Piedmont got an amazing deal. They will purchase spodumene concentrate from Sayona in a range of $500-900/ton. These days spodumene is selling in a range of $3000-5000/ton.

The Devil is in the Details (Piedmont Announcement)

Albemarle mentioned in that quoted section that they will be seeking to align their contract structures closer to the market, which I see as a good thing, even if it brings volatility.

The only upside of this point is that going forward Albemarle will be able to realize higher prices on their contracts as they roll over. There is pricing upside potential for their lithium sales even if prices stay at the new low of $25/kg.

There is a connected point to make here, which is that Albemarle is more opaque in its reporting than some other companies. In particular, Albemarle does not publish the price of its lithium sales. SQM, Allkem, and Pilbara all do, which is just lovely when it comes to grappling with a company.

Weakness 2: Operations At Arm’s Length

On to weakness number two. Compared to some of the other large lithium companies Albemarle is not an outstanding operator. Of the top four lithium companies, the three others have better operational skills. This may come as a surprise to many, so I need to justify this point. I mean this in particular to mining and not chemical production.

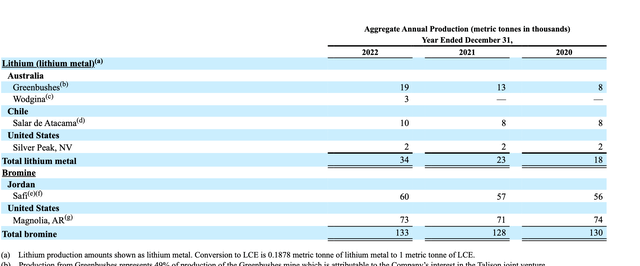

Albemarle Lithium Production (Albemarle Annual Report)

Firstly, let’s examine their lithium mining assets. They have two brine mines, Salar de Atacama in Chile which produced about 50,000 t LCE in 2022, and Silver Peaks which produced about 10,000 t LCE in 2022. They also have two hard rock assets in Australia, Greenbushes which produced a humungous 101,000 t LCE in 2022, and Wodgina, which has just come online and produced 16,000 t LCE.

The Greenbushes Mine (Talison Lithium Website)

Now, the key point is this: Albemarle operates neither Greenbushes nor Wodgina. They have a 49% JV interest in Talison which operates the Greenbushes mine. The 51% is jointly owned by IGO and the Chinese lithium giant. Talison is the company mining the spodumene concentrate, Albemarle just owns it. Similarly, Albemarle has had a JV interest in Wodgina with Mineral Resources (OTCPK:MALRF). Mineral Resources has been the one bringing the mine through ramp-up and production. It looks like they may be divesting this stake in Wodgina soon.

It is an excellent boon to Albemarle that they have an ownership stake in Greenbushes in particular. My point here is that at present the largest lithium company in the world is not operating a spodumene mine.

When we look at the brine operations the point here is that they have both been in operation for a long time. Neither of the operations have had significant expansions in a long time and teams at Albemarle (or the historically related companies) have not brought something into production since the early 80’s. The Silver Peaks mine has been in production since 1966 and was handed between a few companies until it was acquired by Rockwood. The Atacama has been in production since the 80s.

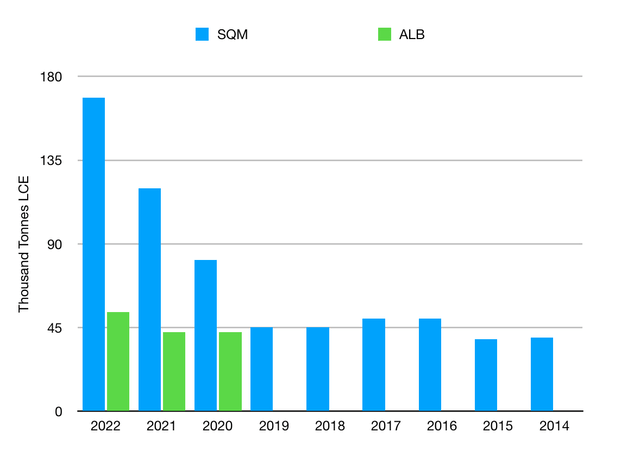

This point comes into focus when we compare SQM’s Atacama operations to Albemarle’s. I have charted out SQM’s LCE output since 2014. You can see that they have significantly grown their lithium production to a major operation of 168 kt LCE. All the lithium companies have been seeing the massive growing demand that is coming down the pipeline. SQM has done an amazing job at expanding its operations at the Atacama in response to this growing demand.

SQM and Albemarle production at Atacama (Author’s Own Chart)

Unfortunately, Albemarle has not been publicly releasing their LCE productions from Atacama until recently, so the chart is not complete. Albemarle has slightly increased its output from its Atacama brines in the last year, but it is still just 50 kt LCE. SQM has done an amazing job in comparison.

In summary, Albemarle has no current experience in mining rock, and their brine operations have been stable but unimpressive. They have been building and ramping up more chemical production facilities, including lithium hydroxide capacity at Kemerton near Greenbushes and in multiple locations in China. However, it is the mining side that will prove to be the most difficult and most lucrative in the future, and it is in mining they are untested.

As they seek to build a new mine in America at Kings Mountain we will see how they go. The Kings Mountain deposit has 45.6 Mt deposits at an unimpressive 0.7% LiO2. This is a lower grade than many of the mines currently operating and will make concentrating the spodumene difficult. You need a high enough grade to be able to turn the concentrate into chemicals.

If they make the Liontown acquisition (see below) they will in the process pick up some needed mining experience.

Weakness 3: A Possible Future Feedstock Issue

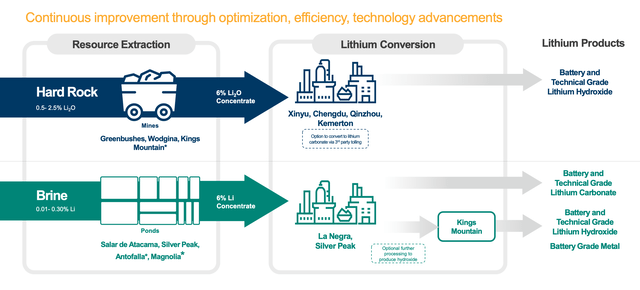

Albemarle is an integrated lithium producer, which means that it both mines raw lithium and proceeds the chemicals that go into batteries, lithium carbonate, and lithium hydroxide. These are two separate competencies, and we have covered their mining operations above.

Up to this point they have had an excess of lithium feedstock. They take the lithium from all their mining sources and turn them into the chemicals in their plants. Whenever they have had an excess of spodumene they can sell that on the open spot market, for which there has been great demand in recent years.

Albemarle is currently aggressively expanding its chemical operations. They are upgrading their plants in China and they are building at Kemerton. These plants will create lithium hydroxide. They are not expanding their mining capacity. They are in the process of divesting Wodgina to Mineral Resources, and soon they may need to buy spodumene or lithium carbonate on the open market to run the factories at nameplate capacity.

Feedstock Flowsheet (Albemarle Investor Presentation)

The problem is that in this market the real margins are going to the miners, not the chemical producers. As Chris Ellison CEO of Mineral Resources says, “If you own your own rock, you’re God”. In a world where there is a shortage of good quality feedstock, chemical producers will need to pay premium prices. Chemical producers will still make a profit if the EV boom happens, but the real margins will be with the miners.

Albemarle has attempted to hedge against this in a few ways. They are expanding Silver Peaks and they are trying to build Kings Mountain. Together, these expansions won’t meet the loss of Wodgina and its new chemical-making capacity.

Therefore, Albemarle is also trying to add feedstock through acquisition. They have made a bid to buy Liontown. Liontown is a high-quality mine in construction in Western Australia. It seems they have excellent operations and would be a boon for Albemarle to pick up. In March Albemarle made a generous bid at USD 3.2 billion which was turned down. They have now made a larger bid at $4.3 billion. Liontown has indicated publicly (in their annual report) that they want their shareholders to accept this offer if it passes due diligence.

You can hear an excellent interview with the CEO of Liontown on the Global Lithium podcast.

If they manage to acquire this mine, I would feel happier about their future.

Weakness 4: Not All Assets IRA-Compliant

This point isn’t a big deal, but it’s worth clarifying. Though Albemarle is a US company many of their operations do not happen in America. Their Chilean brines and their Chinese chemical factories are a large part of their revenue streams and will not fall under any IRA provisions. The IRA cares about where the chemicals are made and manufactured.

Well. After those points, you might think I’m against Albemarle! As a matter of fact, I think they are a great company. I have four strengths of Albemarle: two are company-specific and two are general industry trends.

Strength 1: The Best Assets In The World

Greenbushes Mine (ABC)

Albemarle has the two best lithium assets in the world, by far. The are many spodumene mines out there but there is only one Greenbushes. They have a resource of about 360 Mt at a lithium grade of around 1.5% LiO2, which is incredible. The mine is massive and extremely lithium-rich. Other lithium mines have grades between 1.0-1.3%. For example, the Pilbara Pilgangoora mine has 305 Mt at 1.01% LiO2. The amazing Patriot (OTCQX:PMETF) deposit in Canada is very exciting. They have 109 Mt at 1.4% LiO2, and people are very excited. Greenbushes have a massive of amazing quality lithium.

Many other mines have started to let their spodumene concrete slip a bit. Most are selling 5.5% lithium or even 5.3%, to produce more volume. Only Greenbushes continues to produce the full 6.0% and produce it at scale. This is the best lithium asset in both size and quality, and it is being operated by an amazing team. It dwarfs all other spodumene mines

Lithium Brines (Albemarle Website)

Similar to the Atacama. There are many brine operations around the world, in the US, Argentina, and China, but there is only one Atacama. Wikipedia says 27% of the world’s reserves are there. The Atacama is extremely lithium-rich and only two companies have access to these brines (SQM and Albemarle).

These two assets mean that going forward Albemarle will have a durable competitive advantage. They will be able to produce low-cost, high-quality lithium units at scale.

Strength 2: Lithium Chemical Optionality

A few years ago the lithium world was focused on lithium hydroxide because this is the chemical that goes into nickel-based NCM batteries. However, recently LFP has burst onto the stage and taken much of the spotlight. LFP uses lithium carbonate instead of hydroxide. Going forward, there will probably be a mix of battery chemistries and so there will be demand for both lithium hydroxide and carbonate.

Albemarle is making both of these chemicals. Their spodumene is turned into lithium hydroxide at their various chemical plants. They produce the lithium carbonate from the brines in the Atacama. Having both these products available to the market will be important for Albemarle’s strong position in the lithium value chain in the future.

Strength 3: Albemarle Has A Great Financial Position And Is Investing In The Future

Albemarle has about $1.6 billion cash on hand and $3.4 billion in debt. They have made $2.6 billion in cash from operation in the TTM and spent $1.7 billion in Capex. They are making a lot of money and spending it to expand their operations. They are also seeking to spend $4.3 billion on the Liontown acquisition.

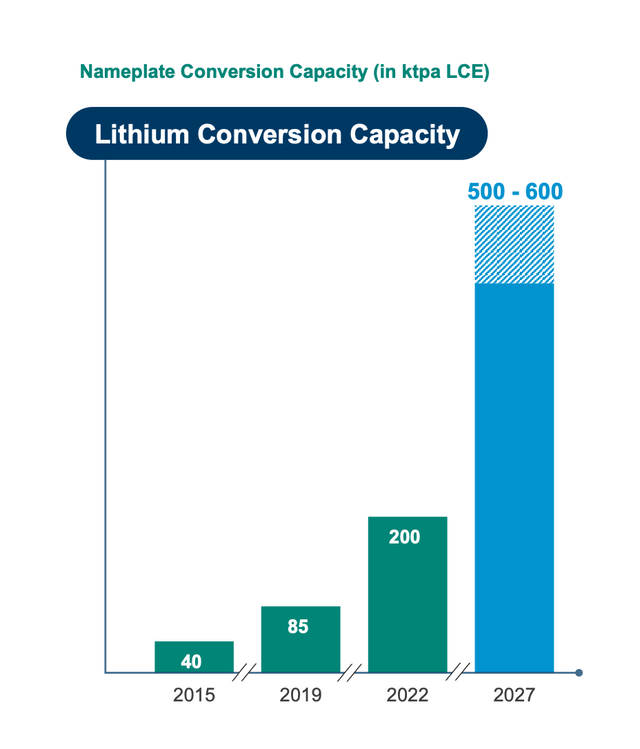

All this says to me, they are a cash-positive company with a mindset to grow. In their presentations, they predict they will grow their lithium capacity from 200 kt LCE in 2022 to 600-700 kt LCE representing 20-30% CAGR. So long as lithium prices hold, they will continue to print money.

They use some of their free cash flow to support a modest dividend, but right now they are more focused on investing for the future.

Albemarle Lithium Capacity Growth (Albemarle Investor Presentation)

2027 Conversion Capacity (Albemarle Investor Presentation)

Strength 4: The Lithium Tailwind

This has been a long article, and I said that I wouldn’t make a general lithium bull case. I give a brief thesis here and make the case more carefully in later articles.

In the big picture, the price of lithium will be driven up by the gap in demand and supply. Demand is being driven by the EV revolution as well as the growing energy storage world. According to Albemarle In 2022 EV sales grew 64% YoY and will see another 40% YoY growth this year, despite the recession in China. This demand will continue to grow for some years.

On the supply side, many lithium companies are seeking to come online. The supply problem is that mining is difficult. Bringing lithium mines takes time; a lot of it. Some delays happen due to permitting issues, financial issues, and construction issues. Mine took around ten years to bring online.

There will come a day when there is a great lithium oversupply, but that day is far away. Lithium mining companies put up predictions about when they will come into production. All the industry insiders say that these numbers never come true.

There will be a growing lithium demand that will be sustained. Unless there is much more investment in this space there will be a growing relative lack of supply. This bodes well for the long-term lithium price.

Strength 5: Some Of Their Assets Are IRA-compliant

This is just worth mentioning. Albemarle does have IRA-compliant assets. They have just become one of the first two mines to receive actual IRA investment. Their Kings Mountain project is located in the US and has now revised a $90 million investment from the DOD. Until now all the investments have been in the chemical-producing step.

Valuation

It’s always good to have some concrete valuations.

I have generally used the ‘back of the envelope’ type as taught by Rule Number One guru Phil Town. There are three ways of looking at valuation from Rule One, I’ll give you two here. We assume a future earnings growth rate of 16%, which is less than the ~25% volume growth rate. I assume for these calculations that lithium prices will stay even from here, which I think is a conservative assumption.

The first is called the margin of safety method, which is a kind of simple DCF model. The current EPS is $33.25. If they grow these earnings at a conservative 16% that would be an EPS of $146.68 in ten years. If we sell the shares at a PE of 30 (within the historical range) then we’d sell them at $4400.41. Discounting these shares at a rate of 15% to the present we get an insane present value of $1087. Phil recommends a MOS of half, so a safe entry buy price is $543. Well above the current price.

The second valuation is called payback time. Taking the free cash flow, over how many years will we need to wait to be paid back? This year they have $977 million in free cash flow TTM. If this grows at 16% next year it will be $1,144.4 million and then $1,314.6 million and so on. As the ‘owner’ of the business I am entitled to receive that cash flow. After how many years do I get my money back?

| Year | FCF that Year | Cumulative FCF |

|

1 |

1,133.4 |

1,133.4 |

|

2 |

1,314.8 |

2,448.2 |

|

3 |

1,525.2 |

3,973.4 |

|

4 |

1,769.2 |

5,742.5 |

|

5 |

2,052.2 |

7,794.8 |

|

6 |

2,380.6 |

10,175.4 |

|

7 |

2,761.5 |

12,936.9 |

|

8 |

3,203.3 |

16,140.2 |

|

9 |

3,715.9 |

19,856.1 |

The answer here is nine years, as Albemarle has a market cap of around $19 billion. Phil Town recommends looking for an investment that is 8 years, so on a free cash flow basis the current is a little expensive.

Comparing these two methods, we might say on an income basis Albemarle looks very cheap, but on a free cash flow basis it looks only a little cheap. This makes sense as they are spending a lot on capital expansion for growth.

Putting this together I am happy to give this company a buy rating.

Why Is It So Cheap?

When buying a company, if you think it is a good deal you should always be able to ask the question, “Why is this on sale?” or “Why I am smarter than the market? What can I see that the market is missing?”

In this case, the answer is quite simple. There is a fight out there between lithium bulls and lithium bears. Many of the large investment banks as well as major Chinese battery makers are putting out a lithium bear case that is based on the coming ‘flood’ of supply.

Recently the price of lithium has dropped from the stupid high price of $80/kg, and this is spooking people.

I am a firm believer that this bear case grossly misunderstands the nature of the lithium market. I hope to explain this in greater detail later ;). Lithium prices will rebound.

I do not know when they will rebound. It is very possible that this is not the bottom, either for lithium prices or for Albemarle’s share price. Charlie Munger says you need to buy a company at a price that makes sense, not at the very best possible price. I think the current price is wonderful.

I would consider selling puts right now. I see Nov 17 puts at 140 selling for about $2.37 right now. Getting ALB shares at $140 would be an amazing deal.

Summary

Hopefully, this article gives you a better feel for Albemarle as a company. They are the largest lithium company out there, but they have several complexities that are worth understanding to be able to take a clearer view of their future. It is worth knowing about their contract problems and their operational weaknesses as compared to other companies.

Fundamentally, though they have some weaknesses, I am thrilled at their drive to invest in the future from here. They have competency in making lithium chemicals and access to the two greatest lithium assets in the world. They will continue to grow and I think they will continue to generate growing revenue with high margins for many years. They are a great company that will harness the lithium tailwind.

Other companies offer different exposure to the lithium space. For example, Pilbara is a pure play spodumene company which I love. So you might want to look at other opportunities.

Read the full article here

Leave a Reply