Electric car sales continue to grow and become a movement within countries to adopt a cleaner form of transportation. This movement has a positive impact on Albemarle Corporation’s (NYSE:ALB) highest revenue product, lithium material for batteries. This increased demand for electric vehicles has seen Albemarle stock surge in recent years since the rise of Tesla and the electric movement. Not only are car sales on the rise, but the electric ecosystem of additional investment in battery storage continues to add another layer of growth opportunity for the company.

The overall market for Lithium needs has been growing, but the supply of lithium continues to grow as well. New competitors and price pressure have sunk some of the revenue and profit Albemarle saw during the rise in electric vehicle demand in the last few years. Combined with this price pressure is the falling demand for electric vehicles as the macroeconomic environment remains uncertain. These two headwinds pose major challenges to the corporation’s main product. Navigating these challenges in the short term will be critical to remain a dominant player when demand returns in the long term as the shift to electric vehicles continues.

Albemarle continues to maintain great margins and maintain efficiency within its manufacturing process. Guidance for the company has remained strong even in the uncertain environment. The company continues to effectively minimize costs to maintain its advantage as a cost leader in the space. Recent news did break on the pivot against acquiring Liontown Resources. While the impact of this is not fully known at this time, the strategy for Albemarle will remain to invest heavily in its high-return organic and inorganic growth while maintaining its strong balance sheet. Overall, much of the news and guidance for the company seems to be neutral or positive, which is surprising given the current stock price decline.

When considering these current stories about Albemarle Corporation, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. Albemarle Corporation is sitting in a strong position in a growing market. As electric vehicles continue to displace combustion engines, lithium becomes an ever-vital source needed to fuel that adoption. This will allow the company to continue to grow along with optimizing its processes to maintain cost leadership against its competitors. Albemarle does have some challenges with demand for electric vehicles falling and price pressure due to an oversupply of lithium, but the growth of the market should outpace these pressures and provide success in the long term.

While current news stories, good or bad, can sway our opinion about investing in a company, it’s good to analyze the fundamentals of the company and to see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if Albemarle Corporation is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

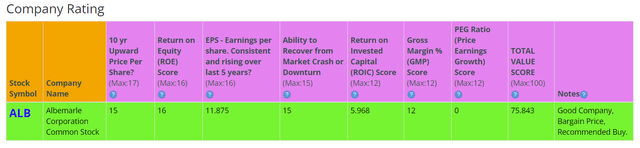

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. Albemarle Corporation shows a rating score of 75.8 out of 100. In summary, Albemarle Corporation has better than average fundamentals.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer )

Fundamentals

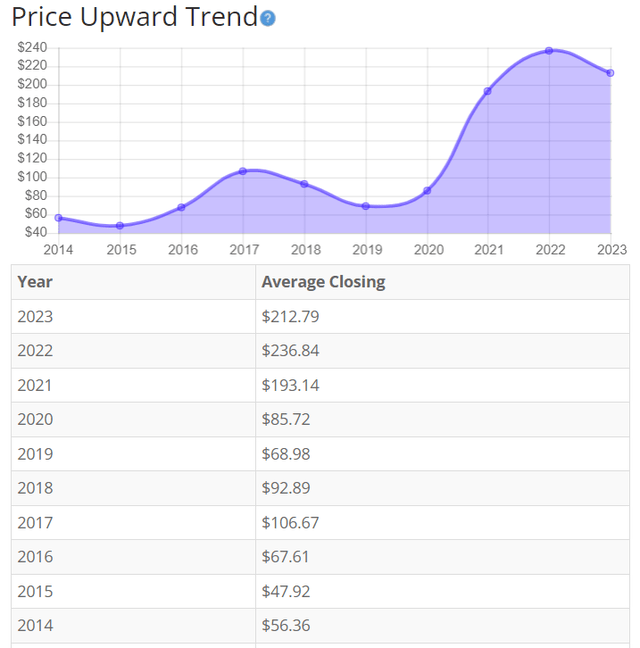

The story of this company’s share price shows an adoption of electric vehicles growing the share price with a decline seen during the COVID-19 pandemic. Before the pandemic, Tesla was beginning to gain steam and generate buzz for electric vehicles impacting the stock price for Albemarle. During COVID-19, Demand fell, and production was halted as the world shut down. The surge after Covid falls in line with the continued market growth of the EV battery space. Recently the stock price has fallen due to concern over increased price pressure due to the oversupply of lithium. I expect a continued decline until a plateau with a resurgence once demand for EV batteries begins to rise again. Overall, the share price average has grown by about 277.55% over the past 10 years, or a Compound Annual Growth Rate of 14.2%. This is an impressive return.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Price Per Share History)

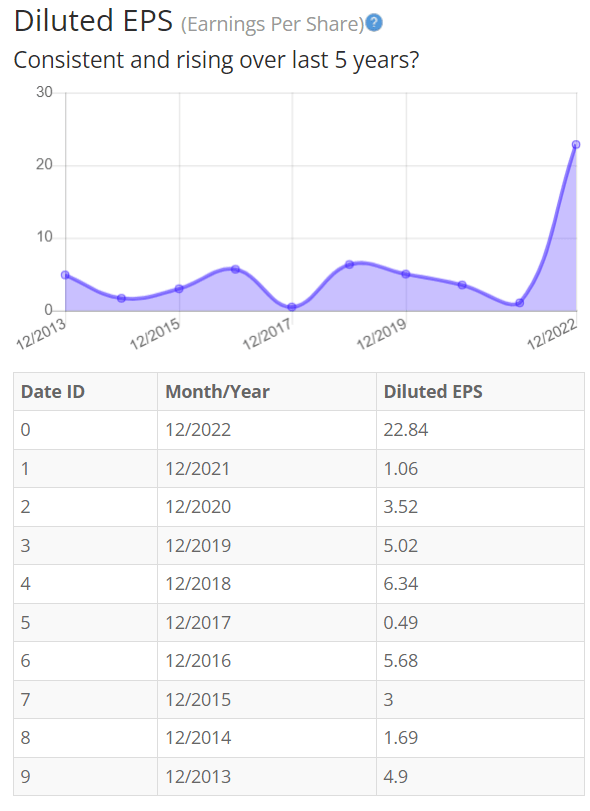

Earnings

The recent 2022 earnings have risen to record-setting levels. However, the past 10 years of earnings history paint a different picture. The earnings history is worrisome. The company has displayed inconsistent and volatile earnings over most of the past 10 years. The peaks and valleys of the chart below help us to visually understand the inconsistent nature of Albemarle’s earnings.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – EPS History)

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

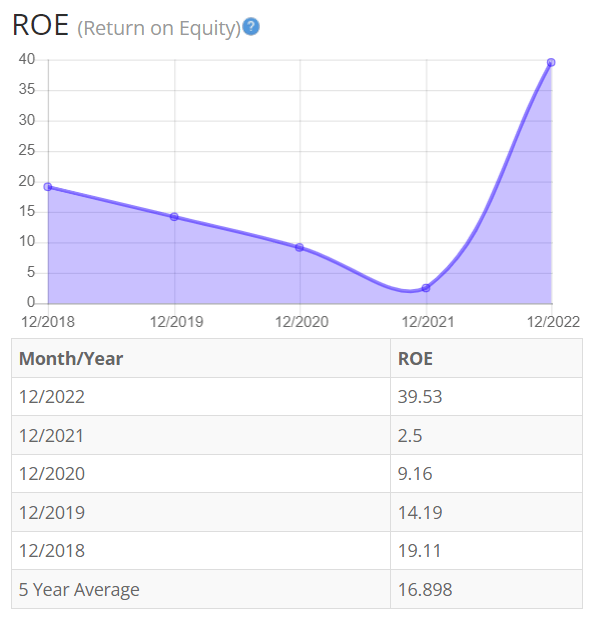

Return on Equity

The return on equity follows a similar path to the earnings per share discussed previously. The overall increase can be attributed to the large rise in net income in 2022 compared to many of the previous years. Before 2022 there was a contraction in prices due to lithium oversupply. This saw the continued reduction in return on equity even with the 2021 outlier further reduced due to extra income expenses impacting the ROE. Then the Inflation Reduction Act and the increased demand for EVs caused a surge in new growth and revenue contributing to the recent rise. For return on equity (ROE), I look for a 5-year average of 16% or more. So, Albemarle Corporation exceeds this requirement.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – ROE History)

Let’s compare the ROE of this company to its industry. The average ROE of 76 Chemical Specialty companies is 11.43%.

Therefore, Albemarle Corporation’s 5-year average of 16.898% is above its industry peers.

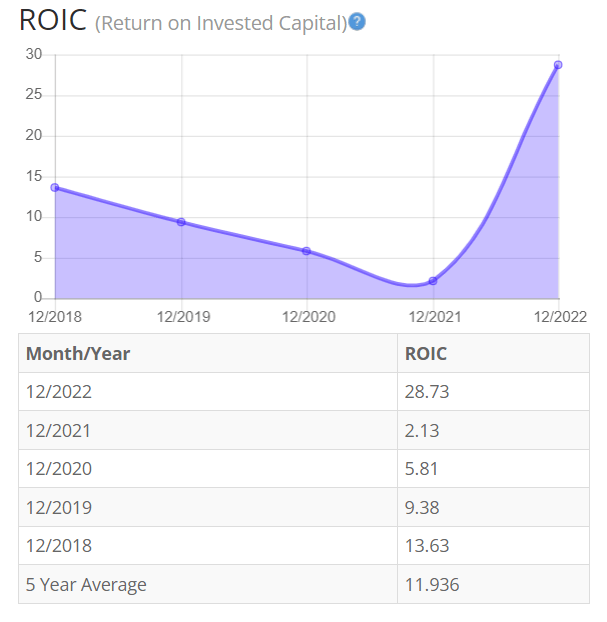

Return on Invested Capital

The return on invested capital again follows similar trends we have seen before. The company has maintained relatively stable capital expenditure but has seen some rise in recent years. The strategic objective for Albemarle tends to be to continue expansion in improved capacity to meet new demand. Overall, we see a diminished return for this strategy until the Inflation Reduction Act and a large increase in EV demand. For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. So, Albemarle Corporation does not exceed this.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Return on Invested Capital History)

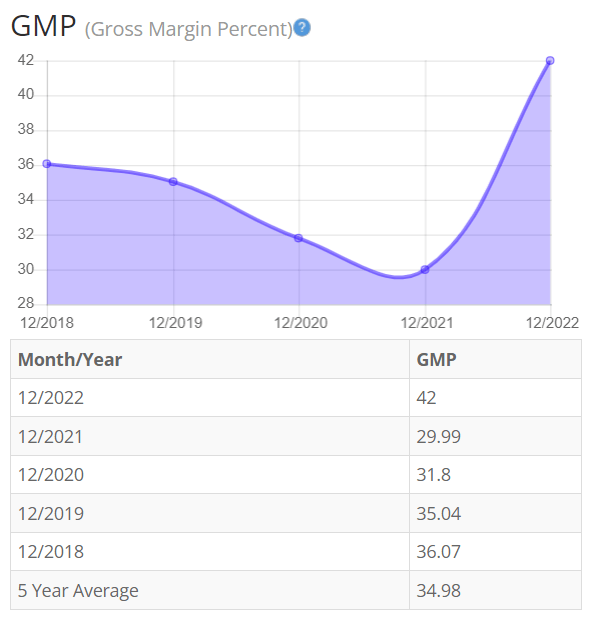

Gross Margin Percent

The gross margin percentage (GMP) shows a decreasing trend due to price pressure on lithium with a resurgence in 2022. This trend directly follows the other charts with have looked at. Overall, the gross margin may continue to see improvement as demand and the Inflation Reduction Act continue to pour money into the sector for improvements. I typically look for companies with gross margin percent consistently above 30%. So, Albemarle Corporation makes the cut.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Gross Margin Percent History)

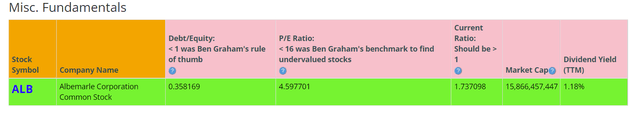

Financial Stability

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is less than one. This is a good indicator that Albemarle Corporation is not overleveraged now and can take additional debt if needed.

Albemarle Company’s Current Ratio of 1.73 indicates it can pay off short-term debt with its current assets.

Ideally, we’d want to see a Current Ratio of more than 1, so Albemarle Corporation exceeds this amount.

Albemarle Corporation is in great financial health from a balance sheet perspective. The company currently has low debt compared to its industry peers in a highly capital-intensive industry. The company has seen a resurgence in capital investment returns in 2022 and could leverage additional capital if needed because of the influx of cash into the industry. Albemarle is set up well to maintain its leadership in the industry and capitalize on the growth in the sector.

Albemarle Corporation does pay a regular dividend.

BTMA Stock Analyzer

(Source: BTMA Stock Analyzer – Misc. Fundamentals)

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

The company’s Price-Earnings Ratio of 4.59 indicates that Albemarle Corporation is underpriced with its current growth when comparing Albemarle Corporation Ratio to a long-term market average PE Ratio of 15.

The 10-year and 5-year average PE Ratio of ALB has typically been 23.8 and 19.8, respectively. This indicates that ALB could be currently trading at a low price when comparing to its average historical PE Ratio range.

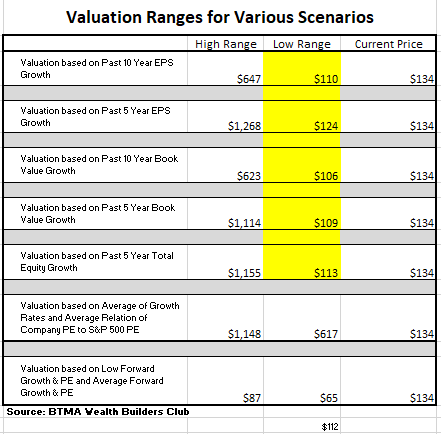

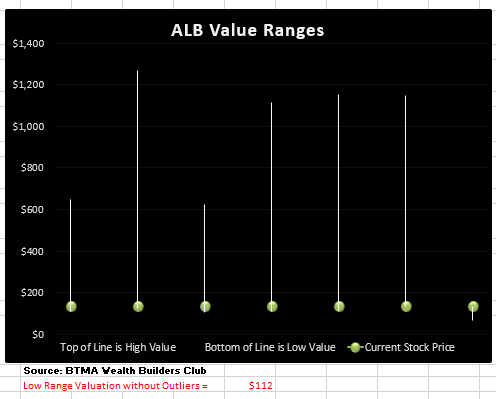

For more detailed valuation purposes, I will be using a diluted EPS of 22.84. I’ve used various past averages of growth rates and PE Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare growth rates of EPS, Book Value, and Total Equity.

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this would show an overvalued stock.

BTMA Wealth Builders Club

BTMA Wealth Builders Club

When considering the low range valuations and removing the outlier valuations, ALB has an estimated valuation of $112 versus a current price of $134.

Therefore, ALB is considered to be overpriced.

Summarizing the Fundamentals

The company is healthy financially with a solid balance sheet. Earnings history is inconsistent and volatile. ROE and GPM are satisfactory, but not consistently increasing. ROIC is subpar.

The current earnings seem very inflated with a high possibility of a continued fall in earnings because of an oversupply of lithium battery raw materials.

Some sources estimate that lithium battery demand will catch up to the oversupply around 2025 or later. But that remains to be determined.

In terms of valuation, my analysis shows that the stock is overpriced.

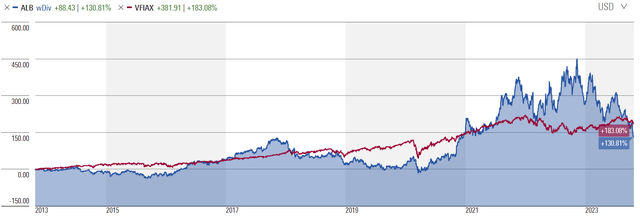

Albemarle Corporation Vs. The S&P 500

Now, let’s see how Albemarle Corporation compares versus the US stock market benchmark S&P 500 over the past 10 years. From the chart below, we can see that Albemarle Corporation has historically performed worse than the market and was more inconsistent than the benchmark.

Only since 2021, has ALB shown some outperformance versus the benchmark. Although, this outperformance has been volatile.

The overall inconsistent performance and mostly underwhelming historical performance of ALB tell me that my money would be better invested in a low fee S&P 500 index fund rather than the less diversified, more volatile ALB.

Morningstar

Forward-Looking Conclusion

Over the next five years, the analysts that follow this company are expecting it to grow earnings at an average annual rate of 12.63%.

Does Albemarle Corporation Pass My Checklist?

- Company Rating 70+ out of 100? Yes (75)

- Share Price Compound Annual Growth Rate > 12%? Yes (14.2%)

- Earnings history mostly increasing? No

- ROE (5-year average 16% or greater)? Yes (16%)

- ROIC (5-year average 16% or greater)? No (11.9%)

- Gross Margin % (5-year average > 30%)? Yes (35%)

- Debt-to-Equity (less than 1)? Yes

- Current Ratio (greater than 1)? Yes

- Outperformed S&P 500 during most of the past 10 years? No

- Do I think this company will continue to successfully sell their same main product/service for the next 10 years? Yes

Albemarle Corporation scored 7/10 or 70%. Therefore, Albemarle shows some potential, but after more detailed analysis, it seems that the company needs much improvement before I would consider as a solid investment.

Is Albemarle Corporation Currently Selling at a Bargain Price?

- Price Earnings less than 16? Yes (4.6)

- Estimated Value greater than the Current Stock Price? No (Value $112 >$134 Stock Price)

Albemarle Corporation has seen fantastic growth of earnings in 2022 due to the Inflation Reduction Act and increased support for electric products in the markets around the world.

On the downside competition within the industry will continue to grow. Also, there is currently an oversupply of raw materials for lithium batteries. This could continue to cause pressure on Albemarle, eating into its profit margins. Non-lithium technology could also have breakthroughs that could harm the key product of the company.

The company has decent fundamentals, but requires a great deal of improvement until I would consider it to be a solid investment. The company’s inconsistent and volatile earnings’ history is worrisome. I will pass on Albemarle at this time.

Read the full article here

Leave a Reply