This article is an update after my previous article on Airtel Africa (OTCPK:AARTY) (OTCPK:AAFRF) in July, warning about the impact of the Nigerian Naira devaluation. I discussed the 50% crash of the Naira that happened in June, and I predicted a strong negative impact on Airtel Africa’s FY2024 earnings in USD that is now materializing. If you want more background information, please go back and read my previous article on the company and the foreign currency risk (FX).

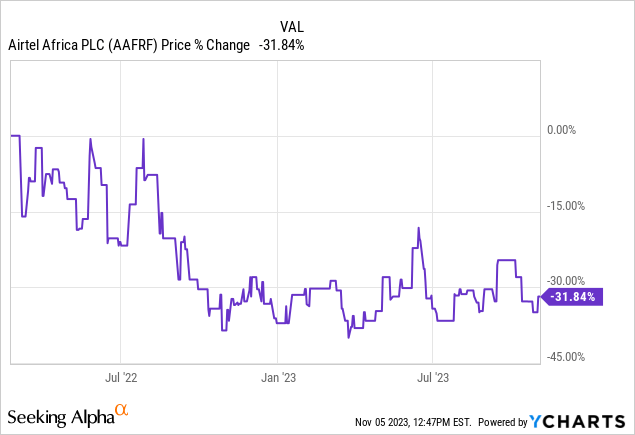

The company has recently reported its Q2 2024 earnings, and its Q1 2024 earnings on the 27th of July right after the Naira crash that happened in June. These recent earnings reports give us the opportunity to assess the actual impact of FX on their earnings. These earnings were received relatively well by the market and the stock gained a few percentage points since July, probably because the FX impact has already been priced in and the company provided more information about it which reduced investors’ uncertainty. That being said, the stock is still down over 30% from its peak from last year in July.

We will examine the results, and assess the actual impact of the currency devaluation. We confirm that the company has a large and negative impact of FX on USD reported earnings and revenue in FY2024. Moreover, we argue that last years’ and this years’ results are inflated, because they are reported under more favorable exchange rates than the actual >800 Naira/USD rate.

Overall, we confirm that the company is troubled with structural FX headwinds and we identify new geopolitical risks. These findings result in a downgrade from a sell recommendation to a strong sell recommendation.

A short recap of the current FX situation

One of the biggest financial risks for Airtel Africa is the exchange rate of the Nigerian Naira versus the USD. As the CEO himself said in the FY2023 press release:

Our largest exposure is to the Nigerian naira, for which a 1% devaluation would have a negative impact of $22 million on revenues, $12 million on EBITDA and $7m on finance costs (excluding derivatives).

Airtel Africa collects revenue in various local African currencies, but reports its earnings in USD so this introduces significant foreign currency risks. Over the past year, the Nigerian Naira’s exchange rate has crashed from 450 Naira/USD to over 750 Naira/USD. This year was a very bad currency devaluation of over 66%. Following their own calculation, I estimated that a 66% devaluation of the Naira ((750-450) / 450 = 0.66), translates to a negative impact of $1.45 billion on Airtel Africa’s revenue (66%*$22m = $1.45b).

While some investors argued that this devaluation is one-time transitory event, looking at some historical data suggests it’s unfortunately not a short-term issue. The Naira has consistently lost its value vs. the USD over the past decade (~400% devaluation from 2013 to 2023) and it will probably keep doing so going forward because of structural issues in the economy.

Long-term Naira exchange rate (XE, 2023)

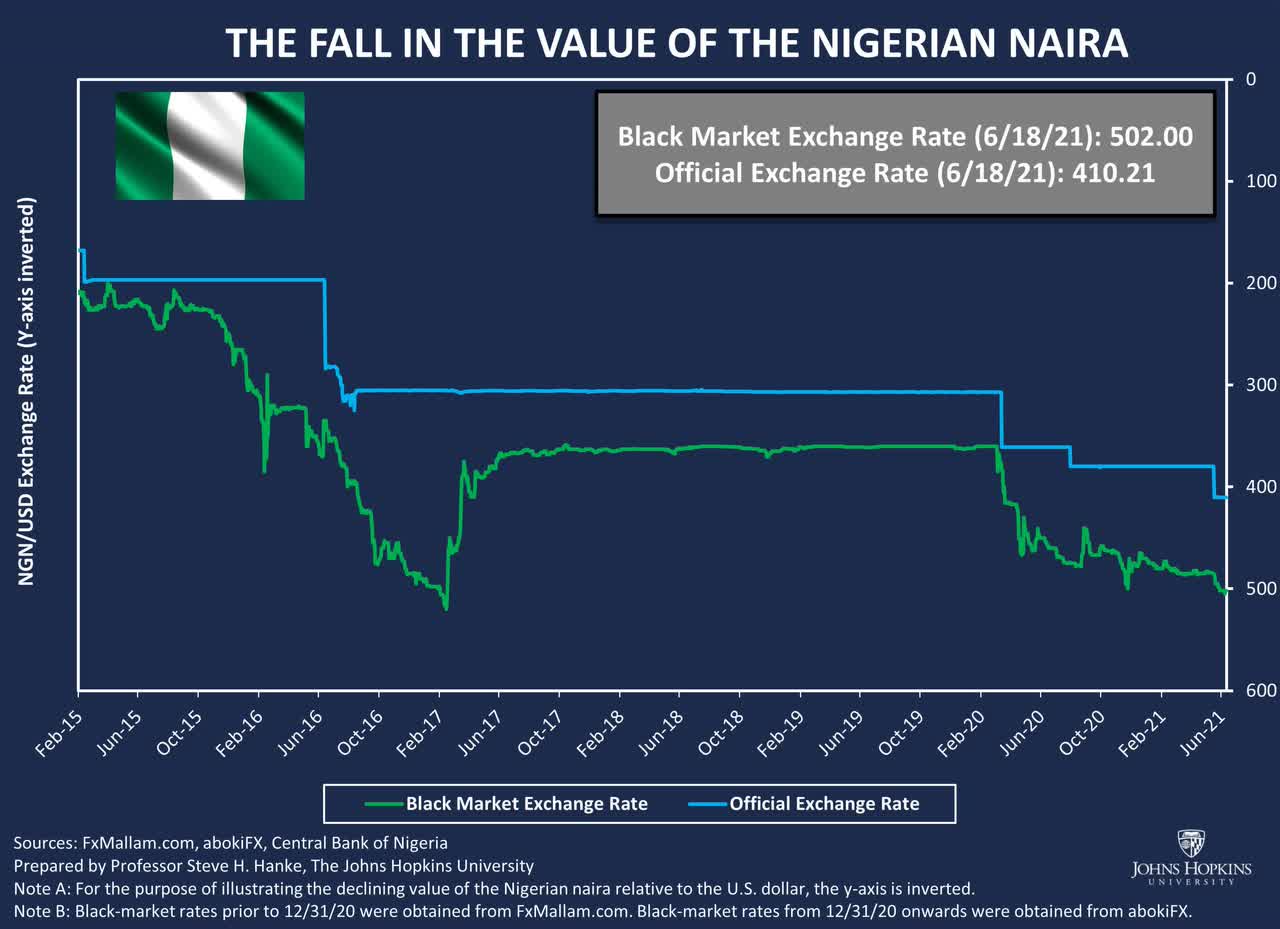

An important thing to note is the fact that the Nigerian currency trades at two different rates, namely the unofficial “black market” rate and the official rate set by the Nigerian central bank. Historically, the official rate set by Nigerian central bank has followed the black market rate with a lag. The rigid “breaking” moments of devaluations in the chart above are instances of the Nigerian central bank setting a new fixed exchange rate, following the black market exchange rate after the spreads became too wide. The figure below shows an example of the black market rate over time, as the free floating green line, and the official rate following it as the rigid blue line.

Naira/USD exchange rate (Steve Hanke, 2021)

Looking forward, the central bank has allowed the Naira to trade freely on the open market instead of setting a rigid exchange rate. Some hope that this will reduce volatility and make the currency more stable. However, the parallel black market has been functioning this way for decades and still showed significant devaluation over time. So while free float might reduce the risk of large spreads between black market rates and official rates, there is a little reason to believe why switching to a free floating rate would stop the Nigerian currency from devaluating like it has done over the past decade.

The Economist Intelligence Unit has predicted that the Naira will trade at over 800 Naira/USD next year and over 1000 Naira/USD in 2027. However, others disagree: JP Morgan has predicted that the Naira will appreciate back to 600 Naira/USD. In the end, there is no way to know for sure what the currency will do in the future, but in any case FX presents a persistent headache and financial risk for Airtel Africa. It seems more likely to me that the Naira will keep depreciating because of these historical trends and little to no fundamental changes that will reverse devaluation. However, when relying on predictions from the Economist Intelligence Unit, the prospect of moving to 1000 Naira/USD in 2027 is a reasonably manageable ~8% annual devaluation than what we are seeing this year with a record 66% devaluation.

The CEO’s comments about the FX risk

The CEO addressed this FX problem in his comments on the Q1 earnings report. He said:

Despite the strong operating performance, our results have been impacted by foreign exchange headwinds. This quarter saw the announcement of the change to the FX market in Nigeria which resulted in a significant naira devaluation. We have welcomed this reform [moving to free float] as very positive for the medium and long-term development of our business in Nigeria, our largest market. The country offers significant untapped growth potential, […]. This has supported and sustained a strong operating performance which has seen a five-year revenue and EBITDA CAGR of 23.5% and 27.3% in constant currency, respectively.

We expect the FX reforms to improve liquidity over time, thereby alleviating the challenges faced by international businesses over the last few years associated with accessing US dollars and thus hindering accelerated growth. However, in the reporting period the devaluation has had a material impact on our results. (Airtel Africa, Q1 2024 earnings report)

While he acknowledges the negative impact of FX, his comments seem to downplay the FX impact somewhat touting high growth numbers at the end. Furthermore, he says that he sees the changes to the FX market (i.e., moving to a free floating rate) as very positive for the company long-term, but there is no reason to believe why this will stop currency devaluations. The benefits of a free floating rate for the company are unclear to me. Most importantly, he still did not share a viable long-term strategy to deal with depreciating local currencies apart from trying to outgrow the devaluations.

The CEO provided some insights into his long-term strategy (or lack thereof):

Over the last few years, we have actively reduced our FX exposure across the Group, and this will continue to be a focus area in the future to limit the impact of any future devaluation. Our focus remains on areas which we can control: the provision of reliable telecom and mobile money services, at affordable rates across our 14 sub-Saharan markets in Africa where demand for these services remains significant. The excellent operating performance over the last quarter highlights this success, and we are well positioned to deliver against the growth opportunities these markets offer, with a continued focus on margin resilience.’ (Airtel Africa, Q1 2024 earnings report)

To me, this is not very convincing. While he mentions reducing FX exposure somehow, it is not explained how he intends to achieve this and what this will amount to in terms of financial results. For the most part, he intends to continue like he has done over the past years in order to keep outgrowing the currency devaluations. It’s simply the only option he has. Sooner or later, the growth will inevitably slow down and the company’s earnings will go backward in USD terms, e.g., assuming a 5% terminal growth rate and a negative impact of 10% currency devaluations annually. From my perspective, simply maintaining high-growth numbers is not a viable long-term strategy; the company is outrunning something that will inevitably catch up to them.

The reported financial impact of FX in Q1 2024

In the Q1 2024 earnings report, we can already see the negative impact of FX reducing earnings and revenue growth numbers in USD. However, the impact of this seemed less severe than I estimated in my previous article, which followed Airtel Africa’s own devaluation sensitivity analysis. After accounting for currency devaluations, the company still grew its reported revenue by almost 10%. So, why does this deviate from their own sensitivity analysis?

Importantly, the company has reported its earnings at a more favorable exchange rate (500 Naira/USD) than the official exchange rate (750 Naira/USD), so the results look a lot better than they should be. Some context around this decision regarding the reporting was given in the earnings report:

Due to the timing of the Nigerian naira devaluation, the weighted average NGN/USD rate used to consolidate the Group results in the current period was 503 NGN/USD as opposed to the closing rate of 752 NGN/USD. As a result, the impact of the Nigerian naira devaluation on reported revenue and EBITDA in Q1’24 has been minimal, $45m and $24m, respectively.

If the closing rate of 752 NGN/USD were to be used to consolidate the results of the Group for the three months ended 30 June 2023, reported revenues would have declined by 4.4% to $1,202m, as opposed to 9.6% growth which was reported, and reported EBITDA would have declined by 3.5% to $592m, as opposed to the 11.1% growth reported. (Airtel Africa, Q1 2024 press release)

Hence, their decision to report the results at this weighted average exchange rate improved their Q1 2024 results in USD terms. While they reported over 10% EBITDA growth in Q1, the actual USD EBITDA declined year-over-year using the (in my opinion correct) 750 Naira/USD exchange rate by over 30%.

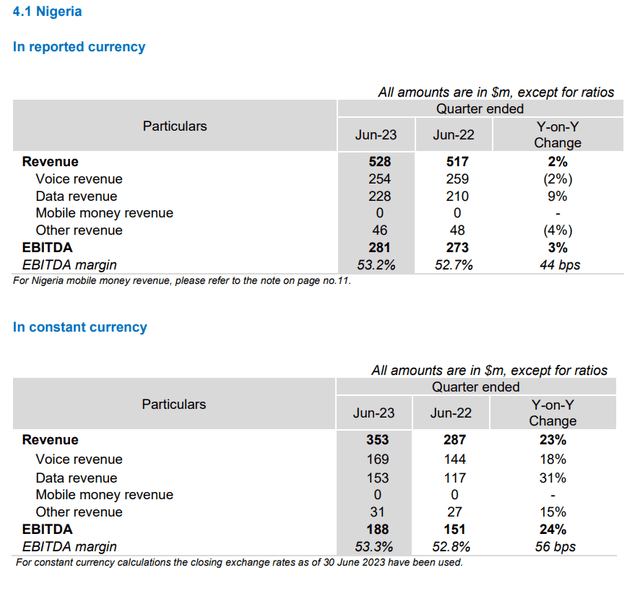

To prove this point, you can find Airtel Africa’s revenue from Nigeria as reported under different exchange rates in their Q1 2024 IR pack below.

Revenue from Nigeria (Airtel Africa IR pack Q1 2024)

In the little subtitle under the second table showing “constant currency”, you can read that they used June 30 exchange rate for this table (i.e., 750 Naira/USD), while they used a weighted average for the “reported currency” table. The weighted average was 500 Naira/USD for Q1 2024 and 450 Naira/USD for Q1 2023. The reported Q1 Nigerian revenue looks relatively flat with 2% growth, and in constant currency there is big growth of > 20%.

Importantly, however, when using the official exchange rates, we find a 30% decline in USD revenue YoY from Nigeria. More specifically, we are using the 750 Naira/USD exchange rate of June 30th for June 2023 revenue ($353m) and the reported revenue for June 2022 at 450 Naira/USD ($517m), which is in line with what I predicted in my previous article. Close to what I predicted, Nigeria dropped from being the largest revenue sources close to being to the smallest. Now, East-Africa is the largest revenue source ($391m).

Moreover, the actual revenue from Nigeria for June 2022 was less than half of what was reported when using the black market at that time of 750 naira/USD ($287m) exchange rate versus the official rate of 450 Naira/USD ($517m). Hence, backward-looking ratios using last years’ earnings (e.g., P/E) look a lot more positive than they should be and should be adjusted to lower earnings.

Obviously, this decision to use a weighted average 500 Naira/USD rate inflates the reported earnings. When using the actual exchange rate of 750 Naira/USD, their revenue from Nigeria in Q1 2024 was $353m instead of the $528m which was reported. This is a significant difference of almost $200m in revenue.

The reported financial impact of FX in Q2 2024

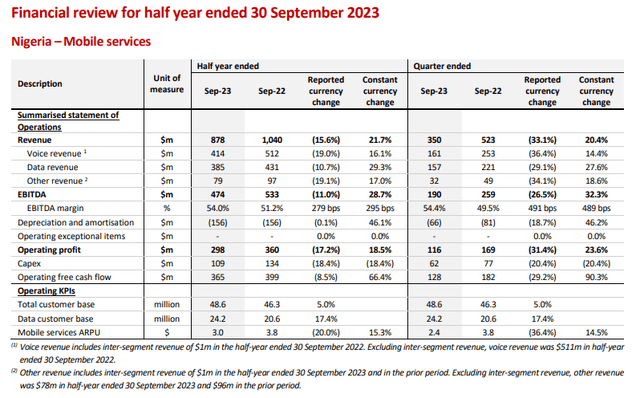

In Q2 2024, the company finally did report its earnings at 750 Naira/USD and now indeed reported currency earnings shows a big decline. While constant currency revenue was up by 20%, the actual revenue in US dollars was down by 5% on a group level over all regions. In Nigeria specifically, reported revenue was down by over 30% because of the currency devaluation.

Revenue in constant currency grew by 19.7%, with reported currency revenues up by 2.3% to $2,623m. In Q2’24, reported currency revenues declined by 4.7% reflecting a full quarter’s impact of the Nigerian naira devaluation in June 2023. Q2’24 constant currency revenues increased by 19.0%. (Airtel Africa, Q2 2024 press release)

In addition to declining revenues in US dollars, the company reported a net loss, which shows the impact of the FX risk that I noted about half a year ago.

Loss after tax was $13m driven largely by a foreign exchange loss of $471m recorded in finance cost before tax and $317m after tax because of the devaluation of the Nigerian naira in June 2023. This impact has been classified as an exceptional item. (Airtel Africa, Q2 2024 press release)

These results are not great, but they are still better than using the most recent official exchange rates of 806 Naira to USD at this time of writing. While reported revenues were up by 2% YoY, they were actually down over 5% when using the most an exchange rate of 777 NGN/USD. This is still too positive because we have had another 5% Naira devaluation just in the past month.

If the closing rate of 777 NGN/USD were to be used to consolidate the results of the Group for the half year ended 30 September 2023, reported revenues would have declined by 5.1% to $2,434m, as opposed to 2.3% growth which was reported. (Airtel Africa, Q2 2024 press release)

As expected, these declines in revenue and profits were mostly due to Nigeria. Now we do see the >30% decline in revenue from this region under the reported currency change, while revenue in constant currency is up by 20%.

Financial Results Nigeria (Airtel Africa, Q2 2024 press release)

As I predicted the Nigerian region went from being their largest source of revenue to being the smallest source when using actual exchange rates that should push revenue under the $340m revenue mark reported for their Francophone Africa region. This is a big setback for the company.

In summary, we see a strong and negative impact of FX on Airtel Africa’s financial results. Importantly, however, we see that the earnings and revenue numbers in USD vary a lot depending on the exchange rates that are used, often the numbers that are reported are more positive (inflated) than the numbers using the latest exchange rates. So, overall, it seems that the situation is considerably worse than what is being reported by the company.

Looking ahead to FY 2024 and beyond

In my previous article, I estimated total FY2024 impact of the Naira devaluation over $1.4bn based on Airtel Africa’s own sensitivity analysis. The company, by contrast, provides a lower estimate of this FX impact:

The expected annualised translation impact of the devaluation in Nigeria incurred in June 2023 is expected to be between $900m and $950m on annualised revenues, and between $450m and $500m on annualised EBITDA. (Airtel Africa, Q2 2024 press release)

While Airtel Africa expects a negative revenue impact of almost 1 billion USD, I believe this impact is still understated because the Q1 results were based on a weighted average of 500 Naira/USD instead of the actual exchange rates of 750 Naira/USD. Taken together, the negative revenue impact should be closer to the estimate that I gave in my previous article at $1.4bn for FY2024. Moreover, the impact should be even higher than my original estimate because with further devaluations we have already passed the 800 Naira/USD mark at this point, which should further negatively impact earnings and revenue.

With respect to currency devaluation sensitivity, on a 12-month basis, a further 1% USD appreciation across all currencies in our OpCos would have a negative impact of $49m on revenues, $24m on EBITDA and $19m on finance costs (excluding derivatives). Our largest exposure is to the Nigerian naira, for which a further 1% USD appreciation would have a negative impact of $14m on revenues, $8m on EBITDA and $7m on finance costs (excluding derivatives). This sensitivity analysis assumes the USD appreciation occurs at the beginning of the period. (Airtel Africa, Q2 2024 press release)

Using their own sensitivity analysis again, another potential 10% devaluation of the Naira from 750 Naira/USD to 825 Naira/USD at the end of the year gives another $140m negative impact on revenues bringing the total impact over $1.5bn. This only accounts for the Naira while other African Currencies are also losing value and this should be accounted for. Total impact of all currency devaluations on revenue for this year alone could be north of $2bn.

Overall, we find multiple instances of financial reporting decisions that make the results look better than they actually are, which is a major red flag for me as an investor and lead me to downgrade my sell recommendation to a strong sell. Because previous earnings were reported at 450 Naira/USD, earlier valuation models based on these more favorable exchange rates should be reconsidered. In most cases, this means that the company is worth less. Correcting for these aspects, the company trades at a forward P/E of substantially over 15, which puts it in a similar ballpark in terms of valuation as some US-based companies with much less risk and uncertainty.

Additional risks to consider

Next to the devaluation of the Naira, other local African currencies are also losing value against the US dollar. For example, the Kenyan Shilling also continues to have weak performance. This therefore represents a structural headwind for the company. As noted by the company:

The gap in constant and reported currency revenue growth of 17.4% in H1’24 is primarily due to the impact of average currency devaluations between the periods, mainly in the Nigerian naira (51.7%), the Zambian kwacha (14.9%), the Kenyan shilling (19.3%), the Malawi kwacha (10.6%), the Madagascar ariary (8.8%) and the Tanzania shilling (4.0%), in turn, partially offset by appreciation in the Central African franc (4.9%). (Airtel Africa, Q2 2024 press release)

While some argue that the Naira devaluation was a one-time occurrence, it has happened multiple times before and it will probably keep losing value against the USD going forward. Next to simply reducing the value of the company’s earnings for US or EU based investors, these developments also hurt the SSA population and reduce their discretionary income. This escalating cost of living crisis puts a brake on the future growth potential for Airtel Africa. Local consumers might prioritize food and fuel, instead of discretionary spending on mobile phones and data services.

In addition to currency devaluations, Sub-Saharan Africa (SSA) is generally a very risky environment to do business in. Recently, there was a surge of violence in the D.R. Congo. Moreover, the recent coup in Niger could destabilize the whole region and brings new geopolitical risks. Although Niger is a relative small market for Airtel Africa, the entire Francophone region of Airtel Africa could become unstable because the ECOWAS (including Chad, Nigeria etc.) has hinted at military interventions in Niger. This adds another source of uncertainty and risks in the region. There are also reports of the Russians being involved in Niger. Estimating the exact financial impact of these events is an impossible task, but it certainly makes the investment case for long-term infrastructure projects and doing business in Africa less appealing.

Mohamed Toumba at a Niger Coup Demonstration (Foreign Policy, August 2023)

Conclusions

The current article confirms earlier expectations about negative impact of Naira devaluation. We note a 30% decrease in revenue from the company’s largest market and highlight the reported net loss in Q2. Moreover, I conclude that the impact of FX is worse than what is being reported, which is a red flag for me as an investor because it makes me lose trust in the reported numbers.

Previous valuation models or P/E ratios based on inflated earnings reports should be reconsidered. Factoring in more unfavorable exchange rates would decrease last years’ earnings and increase backward-looking P/E ratios thereby making the valuations less appealing than some investors might think. For this year, growth has slowed down like I expected and the company is going backwards in terms to USD earnings and revenues.

In addition to significant and structural FX headwinds there are many additional risks and uncertainties in SSA. For example, the recent coup in Niger adds to the already high level of uncertainty and risks in the region.

While the valuation might not be very demanding and the company still has substantial room to grow, there is not enough margin of safety to warrant such a risky investment in an unstable environment such as SSA in my opinion. Currently, there is a possible war brewing in the region and a currency crisis going on, so I’ll put it on the “too hard pile” and invest my money elsewhere. We downgrade this business from a sell, to a strong sell recommendation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply