Dear readers/followers,

My portfolio has a lot of “moving parts”. Part of the parts, so to speak, is owning both investments that I hold for yield and investments that I hold for an upside. Other investments, I hold knowing the yield is relatively low, but my reason for holding is the unerring stability and safety of the underlying operations that the company offers.

This is the case with Ahold Delhaize (OTCQX:ADRNY). The company has plenty of overall upside on a theoretical basis, but even if this upside was to not materialize as expected, then the company still has plenty to make it a “BUY”. In this case, I’m talking about the safety of owning a grocer/FMCG company with some great additions.

So, since it’s been a few months since my last coverage of the company, I thought now would be a good time to update how my position is doing and where I am expecting it to go on a forward basis.

Let’s look at the recent set of news for, and where Ahold Delhaize may be going.

Ahold Delhaize – Plenty to like at a good valuation

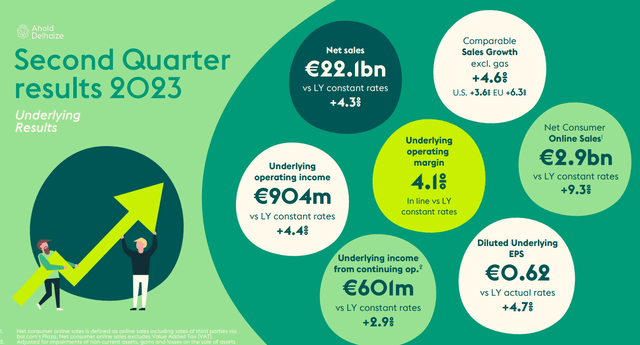

So, the latest set of results we have for the company are 2Q results. The company is an FMCG, which means that any improvements are usually going to be small, due to razor-thin margins and a usually extremely mature market with strong incumbents. Ahold Delhaize is one of those incumbents.

The company’s net sales for the latest quarter were up at a 2.9% rate based on the actual exchange rate. Online sales were up far more – 9.3% at constant exchange, with an underlying operating margin of 4.1%, which is in line with prior-year results.

IFRS operating income was over €720M for the quarter, with a diluted EPS of just south of €0.5/share. The company, as such, did well. Ahold Delhaize now expects a full-year FCF of upwards of €2.2B, with an interim dividend of €0.49/share based on the company’s dividend policy. That’s an interim increase of 3 euro cents based on the previous, and 6 euro cents for the year.

Ahold Delhaize IR

In a word, the company is “staying the course”, adjusting pricing where it needs to and can do so based on macro trends. The company is in the midst of a transformation to a healthy and sustainable food system, and the overall growth rates we’re seeing for Ahold Delhaize are, in the end, very solid.

Ahold Delhaize IR

Also, as a note, the Giant Company, part of Ahold, recently celebrated its 100 years of business. While these sorts of records don’t make or break a company thesis, just look at how many of the companies that were around 100 years ago still exist in their form today – it’s always an advantage being able to point to a company that has been around for a very long time.

The company has several attractive vectors – including its Food Lion brand, where omnichannel sales models are delivering very solid results, and where Ahold is investing in remodeling.

Also, as a non-irrelevant note for the brand, Food Lion’s 2Q23 celebrated 43 consecutive quarters of comparative sales growth. Not many companies on earth can claim this.

With regards to Albert Heijn, one of the larger brands of the company, the company started its own AI startup, Gen AI Labs, and its own GPT platform. I’m not personally a fan of “AI” for everything – it seems to be a buzzword or thing that companies need to go into at default – but I see it as a very minor risk when compared to the company’s overall scale.

Bol.com is more interesting to me, as it’s a full-fledged and profitable Amazon (AMZN) peer, albeit with a much smaller footprint. However, it’s growing – and it’s growing by double digits, in this quarter at 10.5%, with advertising revenues up 73% on a YoY basis.

Ahold Delhaize IR

While this is not part of this article, I believe Amazon is proving my initial expectation quite well, which was that secondary markets are something Amazon will eventually have to leave behind in terms of retail. Europe, including Germany, France and probably the UK is on that list, as I see it. Smaller markets like Belgium are definitely on that list as well. I believe the future there is for local, or at the very largest continental/trans-national players with a home market advantage, which Amazon does not have in Europe. But we’ll see, of course. For now, Bol.com is doing very well.

Ahold’s USA segment meanwhile, is doing quite well, back to comparative sales growth at 3.6% exclusive of gas sales, and overall sales over €13.5B for the quarter, with a solid underlying EBIT margin of 4.6%. This is well within reason for a company like this, and the company’s brands, including ADUSA, Stop & Shop, Giant, and PDL are doing well. Despite being an originally European company, the company’s USA sales are significantly higher than the European sales – though growth in Europe is higher than in the US due to pricing trends.

To conclude and summarize, AD’s strategy at this juncture includes a focus on the shift to omnichannel strategies for all of its brands – and it’s moving forward well. The company does have pushes to go more towards “ESG” and the like, I can mention in passing that Albert Heijn is now 100% electric in its home deliveries in more than one city across its operating geography.

The clear message from the company is also that inflation has now passed its overall peak – and while there is a rise in social and socioeconomic tensions across the company’s geographies and a rise in abnormal weather patterns requiring adjustments, the company is still working well.

Dividend safety for AD is paramount and clear – AD doesn’t pay out more than 40-50% of its earnings, and for the year, CapEx is estimated at around €2B – this amount of CapEx is also likely part of the reason why we’re currently seeing some slight trading down for this company.

Things to look at?

Not much, from a company-specific perspective. AD, due to its size is a play on inflation and macro. Where it goes, the company will go. Structural pressures from inflation, pricing, and sourcing are what we want to look at. Worth mentioning is that there is a significant variance between food price inflation in the EU and the US. It’s 4.5% in the US, but 11% in the EU. While the number is coming down, it’s obviously coming down at different rates. If Sweden had the USA’s CPI and inflation numbers, I’m fairly sure our FED would be very happy – but instead, we’re still close to double digits in September.

Some of these trends are product-specific and have to do with sourcing, but others have more to do with ingredients. Eggs aren’t inflated as high in the US anymore, because there is no avian flu – but beef prices are going up USA-wise, and those are commodity-related.

So, you see it’s almost a mix from product category to product category. In the end, an FMCG like this is a solid play from the perspective of several different approaches – and in the end, even if a company like AD was to decline massively, that would only mean a significant entry from my side, expecting superb returns.

I’m moving to a valuation with this company with the following stance.

Valuation for Ahold Delhaize – still an upside, and a good one

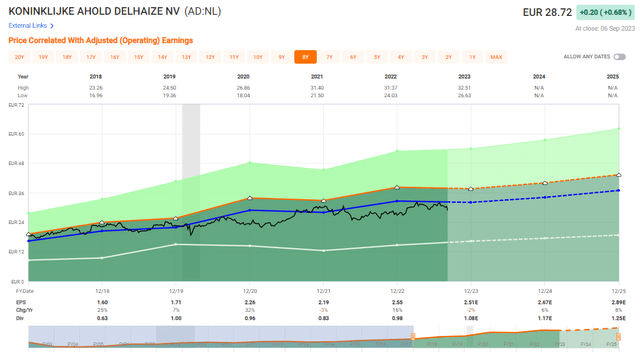

The fact is that consumer goods companies are rarely “cheap”, but that is exactly how I consider Ahold Delhaize to be approaching her. The company’s current valuation is an attractive 11.38x P/E, and this is despite a double-digit 8-year EPS growth rate.

F.A.S.T. Graphs AD Upside

So it’s not at an all-time low, but at this time we’re at a meaningful discount to its longer-term EPS trend.

While some of this is justified given the significantly slowing growth rate, this of course does not influence the safety or incumbency status of the company, with its BBB+ rating, over 3.5% yield, and the SWAN quality of knowing you own one of the best grocers on the block.

The conservative upside even just to an 11-13x P/E range on a 2025E basis is an annualized rate of return of 15.2% for 13x P/E, which is where I consider this company to be fairly valued.

That means AD as of this article fulfills the underlying attractive RoR potential of a high-conviction “BUY” for my portfolio. What I want for those companies is a 15% annualized RoR.

While S&P global analysts and some other analysts covering the stock are somewhat more mellow on the potential of AD, I continue to believe that €35/share PT is the least we should expect for AD. The fact that it’s now below €29/share does not change this for me, because that thesis and those calculations already included the potential impacts of inflation and somewhat dilutive discounting that the company is currently doing.

This is a good example where I believe I’ve made a superb price target that accurately reflects what the company is worth, and where it could go. This is how I try and calculate my targets. I combine peer averages, historicals, sector trends, forecasts, and fundamentals, and use valuation models like DCF to arrive not only at a PT that I consider to be in the ballpark but long-term indicative.

The longer-term indicative target for this company to me is very clear, and I go against the grain compared to some of the analysts here, still considering it a “buy“.

Questions or concerns about the latest set of results that you feel I haven’t covered?

Let me know!

Thesis

My thesis for Ahold Delhaize is the following:

- The company is one of the more appealing EU/US grocery retailers that is trading at what I consider to be a significant discount to conservative multiples. This discount has gone down since my last article.

- I’m keeping my PT and sticking to my “buy“. Despite inflation and SCM issues, I believe the company is one of the best in the entire market to stick to during these troubles, and I believe 4Q22 and what we expect in 1Q23 to be even further proof of just how well the company is managing.

- As of this latest article and set of earnings, the trends have markedly improved, and I’m now ready to even call this company “cheap”.

- My PT is €35, and I’m at a “buy” here.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative and well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I can say that this company is a “buy“, and I can once again call it “cheap”. This is as high as I would “buy” the company, and I’m starting to look at other potentials here, as there is a lot of value in the market at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here

Leave a Reply