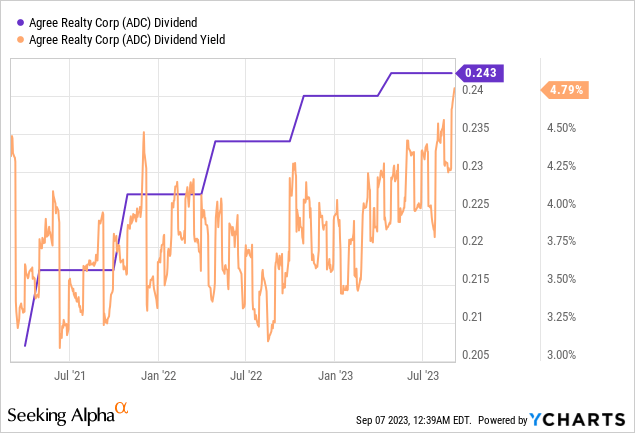

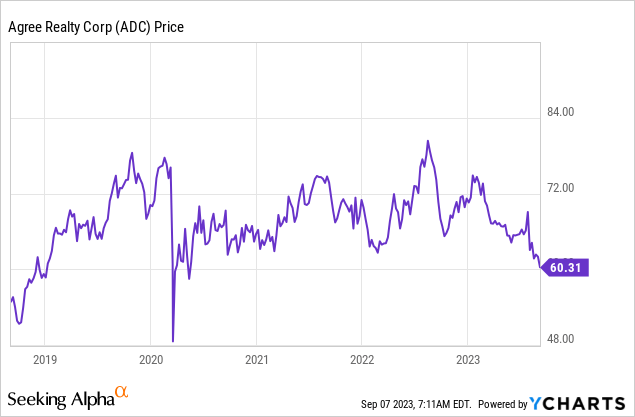

The 2023 pullback of REITs has been one of the defining themes of a year that has seen the Fed funds rate hiked to a 22-year high as the battle to get inflation back to its 2% target rate looks set to move into a third year. Agree Realty (NYSE:ADC) is down 21% over the last 1 year against this backdrop, sitting on 52-week lows as the Fed’s higher for longer mantra and what could still be a further 25 basis points rate hike in 2023 weigh down on sentiment. The REIT last declared a monthly cash dividend of $0.243 per share, in line with its prior payment and for a 4.84% annualized forward yield. The income is the prize and Agree Realty has hiked its dividend payouts by a 7.28% 3-year compound annual growth rate, markedly higher than its peer group median.

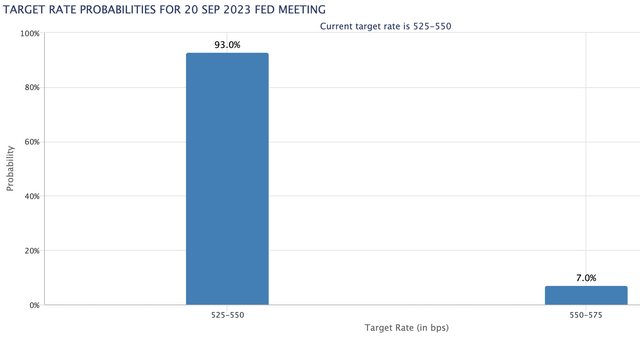

Hence, the current dip has left the common shares trading hands for a 15.26x price to forward funds from operations and with a PE ratio that now sits at its lowest level since 2020. There are some reasons to be cautious though and bears, who form the 2.69% short interest, would be right to flag that the age of prosperity for REITs is over with near-zero rates that fueled years of incredible growth solidly in the rearview mirror. The market is currently pricing in a 93% chance that the Fed will keep rates unchanged at its upcoming September 20 FOMC meeting. I think the July rate hike was likely the final for this hiking cycle and we’re about to enter the post-rate hike period still set to be characterized by rates staying high for longer than REITs would like.

CME FedWatch Tool

Book Value And Debt Maturities As Revenue Surges

Bloomfield Hills, Michigan-based Agree Realty reported revenue of $129.9 million, up 23.9% over its year-ago comp but roughly in line with consensus estimates. The REIT purchased 92 retail net lease properties, with a weighted average lease term of approximately 9.9 years, for $307 million during the quarter. This was a ramp-down from its year-ago period when it purchased 99 retail net lease properties for $423.7 million. Agree Realty has year-to-date purchased 158 retail net lease properties, across 35 states and with a weighted average lease term of 11.5 years for $610.8 million.

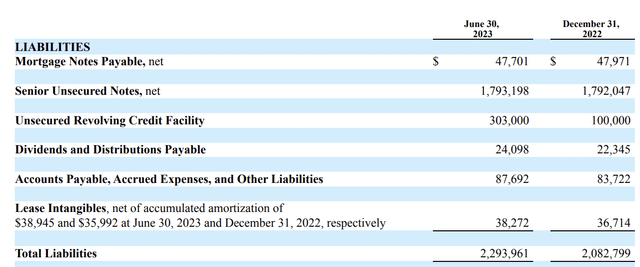

Agree Realty Corporation Fiscal 2023 Second Quarter Form 10-Q

The $5.78 billion market cap REIT held total liabilities of $2.29 billion as of the end of its second quarter, mainly comprised of $1.79 billion in senior unsecured notes and a $303 million on its $1 billion unsecured revolving credit facility which accrues interest based on a pricing grid with a range of 72.5 to 140 basis points over SOFR plus a SOFR adjustment of 10 basis points over the initial LIBOR pricing. Agree Realty also now expects to invest at least $1.3 billion through 2023 in new properties, upping its prior guidance by $100 million

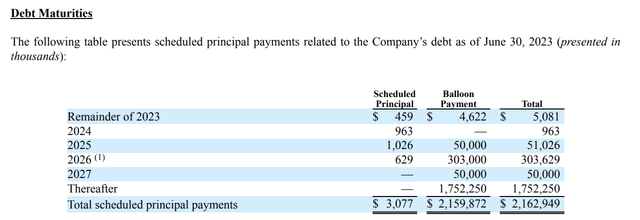

Agree Realty Corporation Fiscal 2023 Second Quarter Form 10-Q

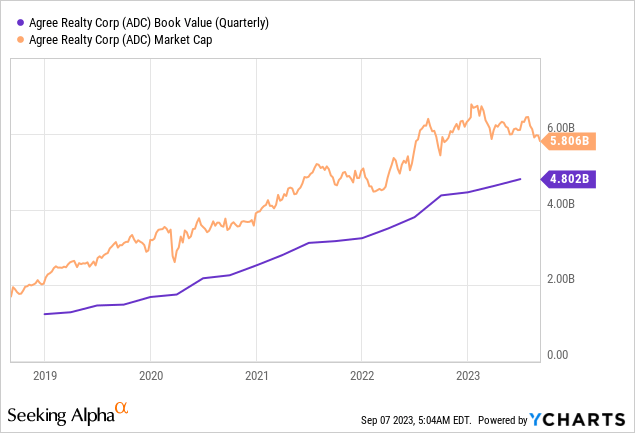

This came as its portfolio reached 2,004 properties, roughly 41.7 million square feet of gross leasable area, as of the end of the second quarter. The portfolio was 99.7% leased, generated 67.9% of annualized base rents from investment-grade retail tenants, and had a weighted average remaining lease term of 8.6 years. Hence, buying the Agree Realty dip comes with resiliency against the specter of recession as high interest rates reverberate through the economy. This defensive positioning is heightened by an extremely favorable debt maturity profile which will only see $5 million of principal repayments made through the remainder of 2023 and just under $1 million in repayments in 2024. Agree Realty has been able to consistently grow its book value which came in at $4.80 billion as of the end of the second quarter.

Healthy Dividend Coverage

The REIT bought in second-quarter net income of $39 million, up 14.3% over its year-ago period. Core FFO was $91.4 million, up 22.7% year-over-year and around $0.98 per share. Core FFO was in line with its year-ago comp on the back of an increase in its weighted average number of common shares outstanding to 93,134,385 from 75,570,089. With core FFO covering the dividend by 134%, Agree Realty could very well hike its payout on the back of its aggressive investments and an expansion of FFO.

Sentiment on the common shares could also invert higher on the back of a number of positive macroeconomic developments. Firstly, the Fed actually has to follow through with pauses through its next three FOMC meetings to close out 2023. Further, the US has to realize a Goldilocks economic scenario where it stages a soft landing with inflation coming back to the Fed’s 2% target. Recession expectations for next year have been pulled back with Goldman Sachs recently cutting the chances of a recession next year to 20% from 25%. The current pullback is significant as Agree Realty continues to build its portfolio and against an extremely favorable debt maturity profile. The common shares are a buy against this.

Read the full article here

Leave a Reply