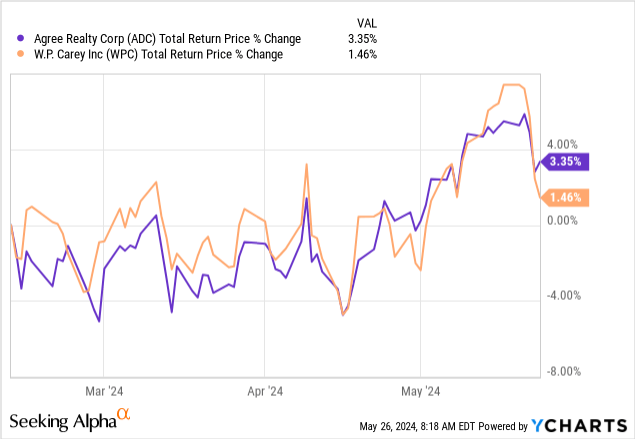

On our previous coverage of Agree Realty Corporation (NYSE:ADC) we compared it to WP Carey (WPC). WPC was the one that ultimately made it higher on our priority list.

Those income investors are going to come back to this, probably in the early 2030s. WPC is likely to be in the penalty box, and valuation expansion won’t be happening anytime soon. That said, objectively, if we can get past the misstep, WPC does have a splendid portfolio and one that could really do well if we enter a secular inflation era. We are declaring this a tie at this point and will consider adding WPC should it get below $50.00.

Source: Hell Hath No Fury Like An Income Investor Scorned

There was not much to choose between the two since then.

We review the recent results for ADC, the price action, and tell you where we stand.

Q1-2024

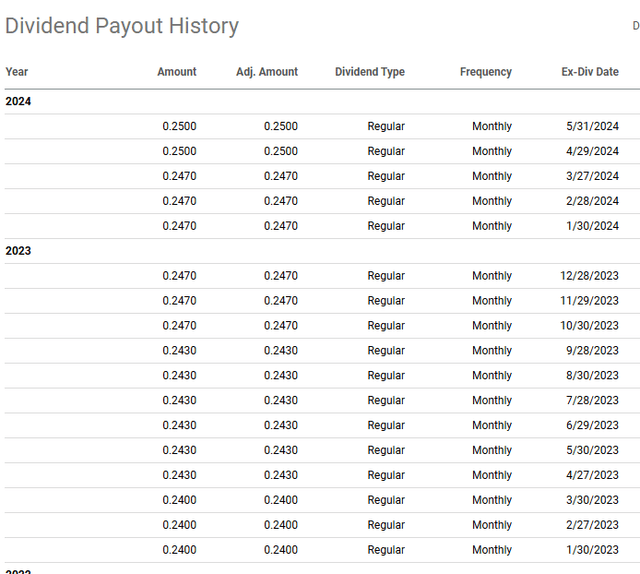

ADC reported a 3.5% increase in core funds from operations (FFO) and an even larger (4.5%) increase in adjusted FFO (AFFO) for Q1-2024. The REIT rewarded investors with a 2.9% year over year increase in the dividend in April 2024. The dividend increases have been small, but about in line with the growth in the FFO over time.

Seeking Alpha

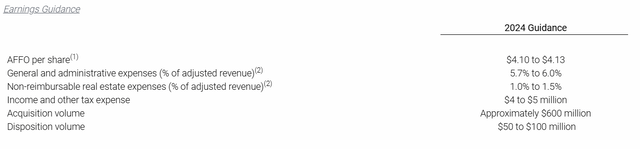

2024 guidance was set between $4.10-$4.13 for AFFO and the REIT expects about $525 million net of acquisition volume.

ADC Q1-2024 Press Release

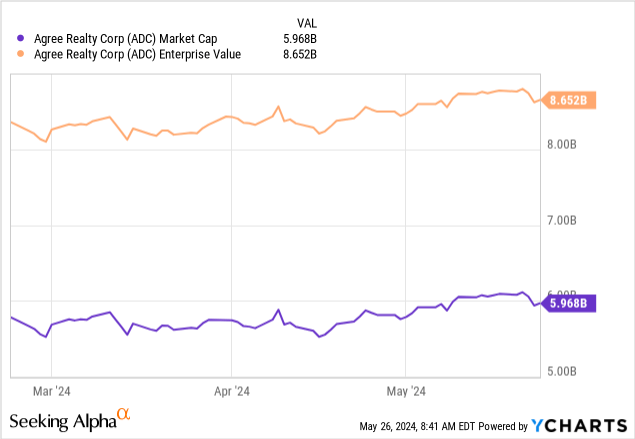

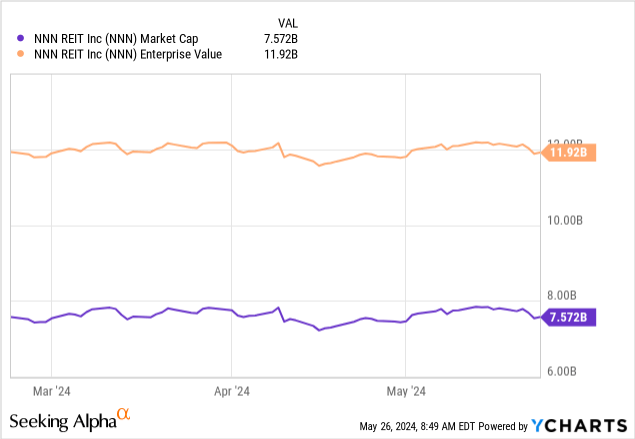

That is a fairly substantial volume of properties in relation to ADC’s market cap and enterprise value.

So we are looking at close to 8.75% of the market cap being acquired (NET) in 1 year. For comparison NNN REIT (NNN) is guiding for about $350 million net in acquisitions in 2024.

That is about 4.62% of its current market capitalization. So far, ADC has shown good ability to grow quickly without compromising quality but we will have to see if this volume rate holds.

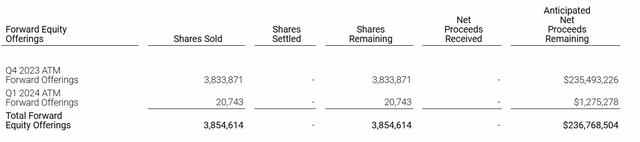

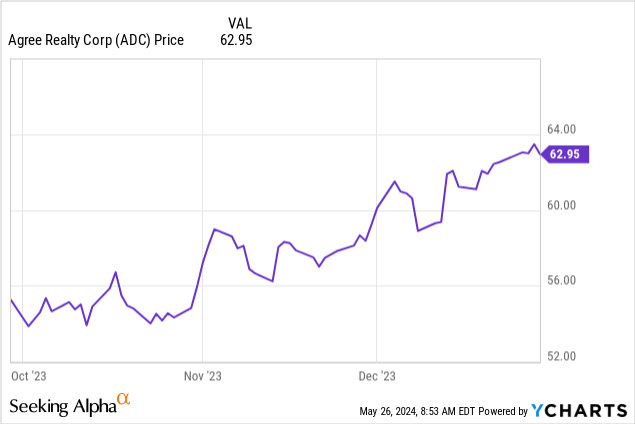

To finance this growth, ADC accelerated its ATM equity offering Q4-2023. These shares were sold at average price of $61.42.

ADC Q1-2024 Press Release

That’s fairly good timing as the shares were sold at the high end of the range, and also at the point where the rally was about to fizzle out.

Outlook

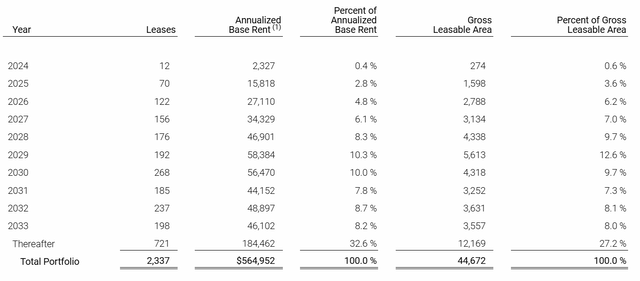

With triple nets, you have an extremely high degree of predictability. With ADC, your predictability goes a notch further. The reason is that it uses less debt than the standard triple net and the odds of a negative surprise are low. We can add to that ADC’s lease maturity profile. The numbers are virtually negligible for 2024 and 2025.

ADC Q1-2024 Press Release

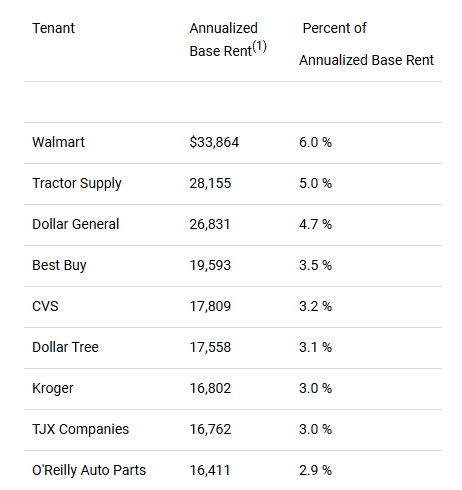

The top tenants are top notch, so you have that additional safety as well.

ADC Q1-2024 Press Release

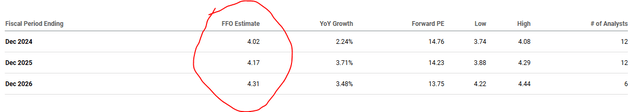

So those estimates below are very likely close to being accurate.

Seeking Alpha

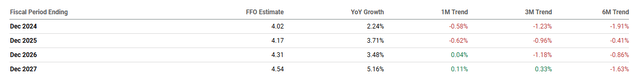

This will hold true even in a mild recession. It is interesting that even that massive acquisition volume is not pushing the FFO levels up faster. This likely comes from the higher equity and debt cost relative to what we saw historically. Despite the torrid pace of acquisitions, FFO estimates have actually moved a bit lower than 6 months back.

Seeking Alpha

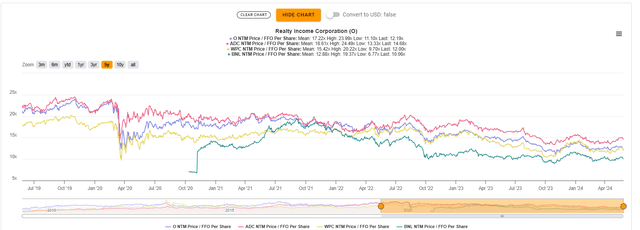

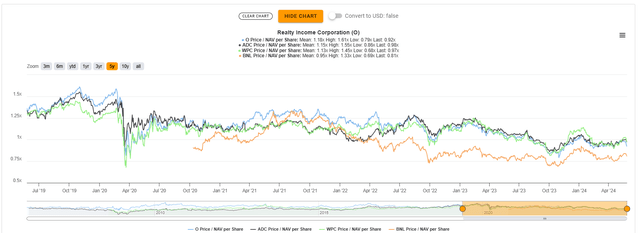

Some of this likely comes from analysts slowly pricing out interest rate cuts that were a popular theme in late 2023. Higher rates over the longer run means lower FFO, all other things being equal. At present, ADC is still trading a premium FFO multiple relative WPC and even relative to Realty Income (O) and Broadstone Net Lease (BNL).

TIKR

This difference though, is a positive side effect of using less leverage. That is why on a price to NAV basis, ADC appears to hold a similar valuation to WPC and O. We will note here that BNL continues to look heavily discounted relative to everyone else.

TIKR

Unfortunately though, the risk remains high in our opinion that ADC will get to the same price to FFO multiple as the rest. That lower leverage and NAV valuation will likely not protect the company from a potential lower valuation (on price to FFO0 in a broad based selloff. So that extra 2-3 multiples of FFO, just does not seem worth it at this point. The good news for investors is that the bubble valuations of 2019, where ADC traded at close to 25X trailing FFO, are now long gone. From these levels, your 10 year forward returns are likely to be quite decent. But on a relative basis, we don’t see the current setup as the most appealing. We own WPC and BNL, both with covered calls. The high implied volatility plus the lower multiple gave us enough of a buffer to create lower risk-entries. With ADC we might get interested in initiating the same around $52.50.

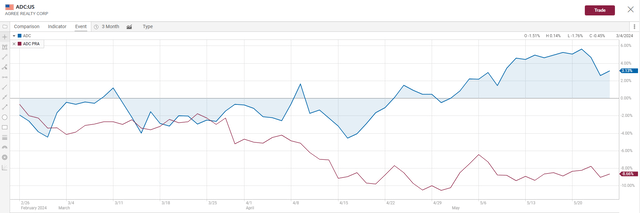

Agree Realty Corporation 4.250% DEP PFD A (NYSE:NYSE:ADC.PR.A)

One interesting new development has been just how the pricing has moved on the preferred shares relative to the common shares. Back in February, our thinking was that the preferreds offered an extremely poor setup relative to the common shares.

You are getting just a 0.47% premium for the preferred shares relative to the common shares. Using historical growth rates, ADC’s common dividend, at this price, should outpace the preferred within 5 years. Investors can also easily add 1%-2% in “yield” by selling way out of the money call options on ADC. For example, you could sell the July 2024, $70 strike calls for 25-30 cents and if you do that twice a year, there is your extra 1% yield. The preferreds make a poor investment case here.

Source: Hell Hath No Fury Like An Income Investor Scorned

But things are looking a lot better today with the preferred shares dropping and the common going up.

CIBC

At this point, the preferreds offer an extremely safe 6.23% yield (1.17% more than common) and have an interesting duration play for those that believe that interest cuts are around the corner. That is not our thinking of course, but we might buy this as well, if we get a 6.5% plus yield.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Read the full article here

Leave a Reply